Adoption by Accumulation

The Bitcoin rally gathers credibility.

Since April 10th, Bitcoin has surged over 50%, briefly trading just below $112,000 on Thursday, a new local high that surpasses the January peak.

But beneath the surface, this rally stands apart. From a cross-asset perspective, it doesn’t fit the same playbook as the momentum-driven bursts we saw in February or last November. This move feels more structural and more reflexive.

In this note, we explore the mechanics behind the move, the shifting market architecture supporting it, and what that might signal for the path ahead.

Short-Term Drivers

Stablecoin Act

A pivotal factor in Bitcoin’s recent ascent is the US Senate’s progress on the GENIUS Act, a bipartisan bill aimed at establishing a regulatory framework for stablecoins.

The act mandates that stablecoin issuers obtain licenses and be subject to supervision by federal or state regulators. This includes banks, credit unions, and approved nonbank entities. Put another way, the supervision provides credibility for stablecoins and the crypto industry as a result.

Earlier this week, the Senate voted 66-32 to advance the bill, overcoming previous bipartisan opposition and moving it closer to final passage. The industry-backed regulatory bill is now set for debate on the Senate floor over the next week, with the potential for it to be passed just as quickly.

This was a source of strength for BTC bulls. After all, the passage of the GENIUS Act would provide much-needed regulatory clarity for stablecoin issuers and users, potentially encouraging greater institutional participation and innovation in the crypto space.

However, some concerns remain regarding the potential for conflicts of interest, particularly given President Trump’s family’s involvement in the stablecoin market through World Liberty Financial. You might think that the provision in the act to prevent executive branch officials from launching their own stablecoins is a smart move. Funnily enough, it notably excludes the president and vice president from this restriction…

Corporate Buzz

Last month, we wrote about the public launch of Twenty One Capital through a business combination with Cantor Equity Partners, the SPAC arm of Cantor Fitzgerald.

Twenty One represents a structural evolution in public market Bitcoin vehicles. Unlike legacy corporates that retrofitted Bitcoin into traditional business models (like MSTR did), Twenty One has been engineered from inception with Bitcoin accumulation as its core mandate.

There are a host of similar copycat firms in the woodwork that we expect will hit the public markets later this year in the same way. Yet Twenty One’s launch signals a pivot point. Bitcoin has moved beyond its early role as an opportunistic balance sheet asset. It’s not just this likely pending higher rate of adoption that’s helped to drive the price higher, but rather the fact that retail investors are aware of this shift and jumping onboard.

Previous Bull Runs

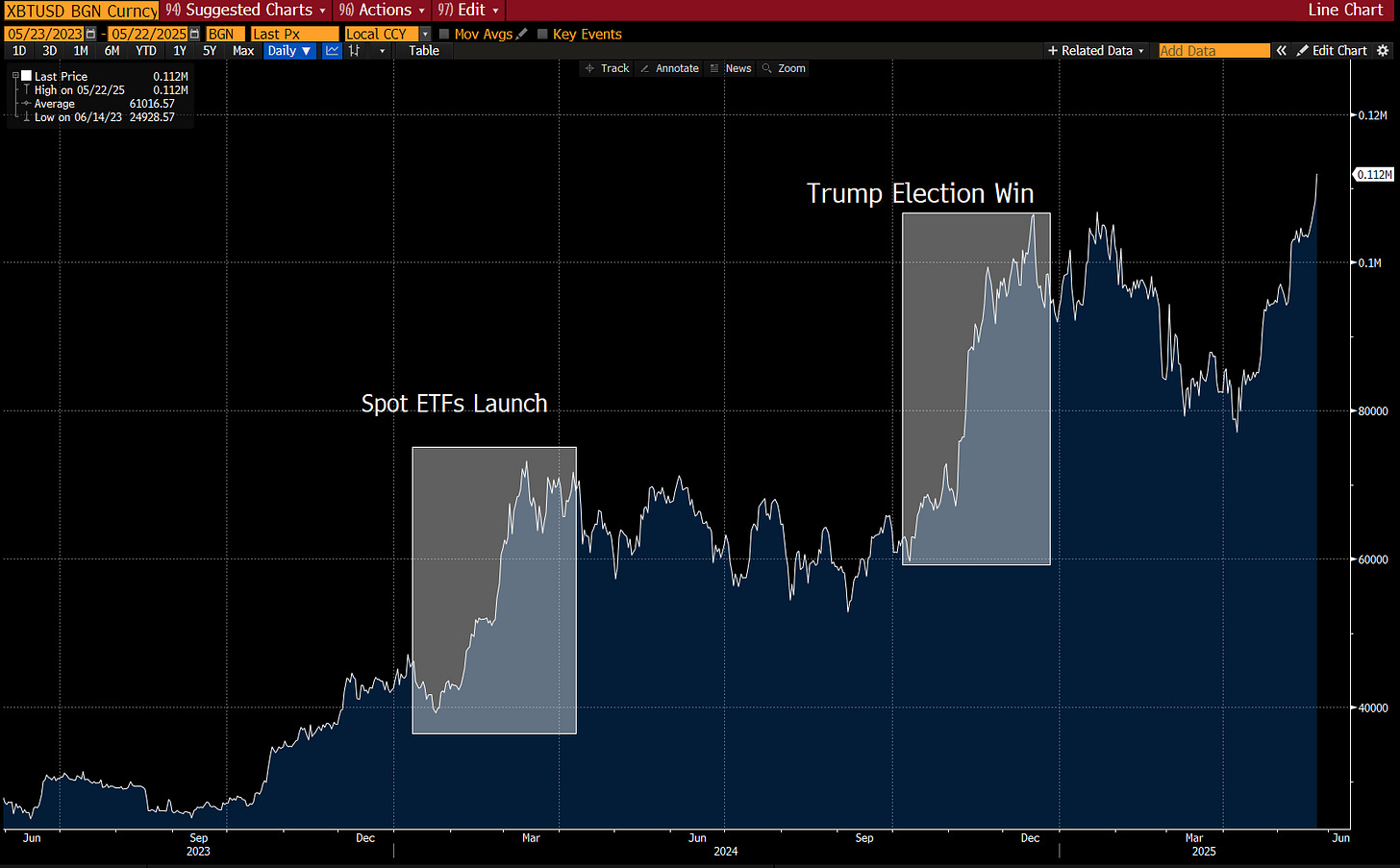

Let’s contrast this run over the past month to what we’ve seen in the past.

Q1 2024

In the first quarter of 2024, Bitcoin experienced a significant rally, with its price increasing from approximately $42,300 to over $71,000, marking a 67% rise and reaching a new all-time high of $73,800 in March.

A primary catalyst was the SEC’s approval of spot Bitcoin ETFs in January 2024. This development allowed investors to gain exposure to Bitcoin through traditional financial markets without the complexities of direct cryptocurrency ownership. Major financial institutions, including BlackRock and Fidelity, launched these ETFs, leading to substantial inflows and increased market legitimacy.