When Bitcoin Becomes the Balance Sheet

Cantor, Twenty One and the corporate Bitcoin race.

The architecture of corporate Bitcoin strategy is shifting. What began as opportunistic balance sheet allocation by early adopters is evolving into full-scale financial engineering, and the public markets are responding with fresh capital and a new valuation framework.

The launch of Twenty One Capital, in partnership with Cantor Fitzgerald, marks a significant inflexion point: Bitcoin is no longer simply an asset held by corporations. It is becoming the foundation on which new corporations can be built.

This shift comes at a critical moment. Bitcoin’s behaviour is changing as traditional markets struggle with tightening liquidity, rising political volatility, and fractured fiscal credibility.

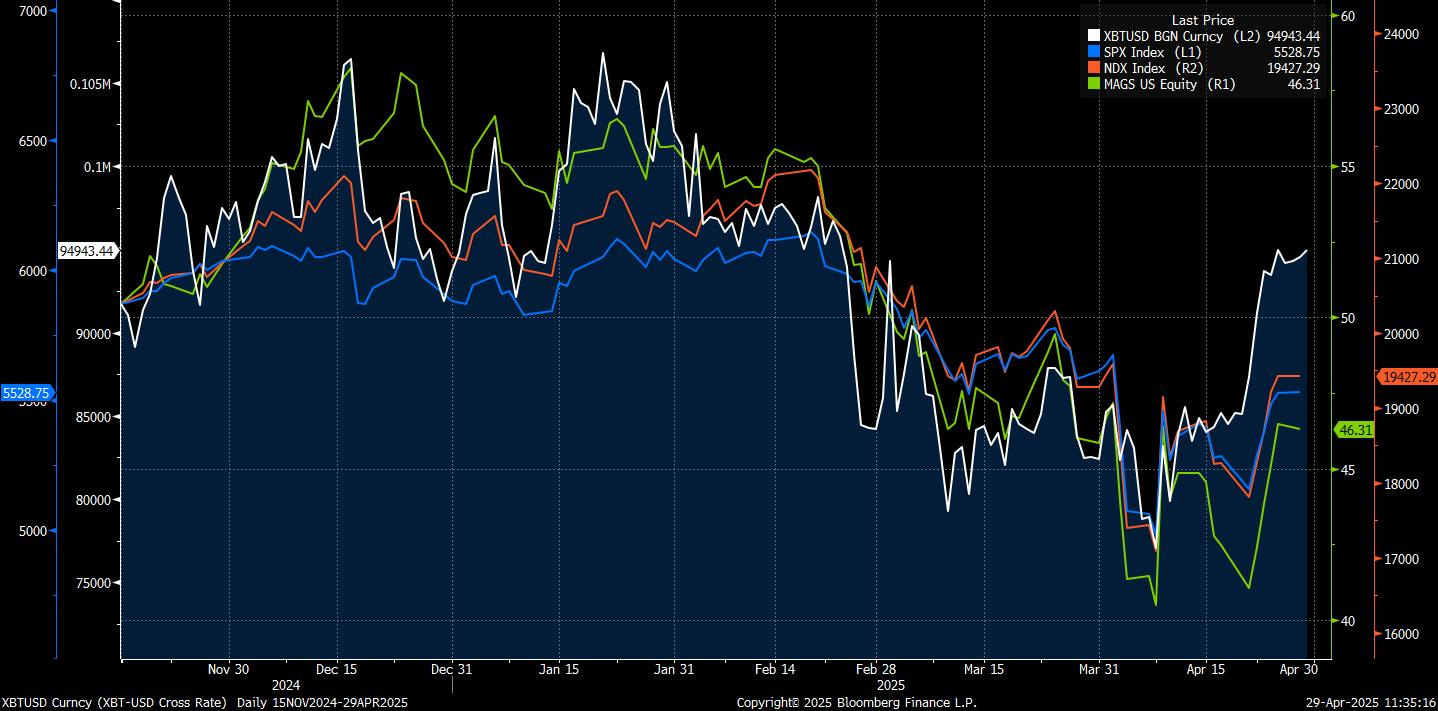

Once dismissed as a high-beta risk proxy, Bitcoin is beginning to show signs of safe-haven dynamics, preserving value even as conventional assets falter. As demonstrated by the chart below, Bitcoin is the only asset above mid-November levels (between BTC, NQ, and Mag7).

The out-performance is even more pronounced if we include the “animal spirits” rally directly after the election. Even gold hasn’t outperformed.

Capital is moving not only into Bitcoin itself, but into corporate vehicles purpose-built to accumulate and compound Bitcoin ownership over time. Today, we wanted to examine the structure and implications of the Twenty One deal, compare its strategy with earlier Bitcoin corporates like Michael Saylor’s Strategy, and assess the emerging role of Bitcoin as a financial reserve asset.

In a market increasingly defined by scarcity of trust and abundance of risk, Bitcoin’s gravitational pull is growing, and the public markets are starting to reprice accordingly.

Bitcoin Strategy for the Public Markets

Twenty One Capital has entered the public sphere through a business combination with Cantor Equity Partners, the SPAC arm of Cantor Fitzgerald. The deal is notable not only for its scale, capitalised with $585mn in new financing alongside the merger, but for the strategic architecture underpinning the venture.

Upon closing, Twenty One will be majority-owned by Tether and Bitfinex, with SoftBank as a significant minority shareholder. The capitalisation includes $385mn in convertible senior secured notes and a $200mn PIPE (private investments in public equity), with net proceeds earmarked for direct Bitcoin acquisition. At launch, Twenty One is expected to hold over 42,000 Bitcoins, placing it among the largest corporate treasuries globally. For comparison, Strategy owns 553,555 Bitcoins, while El Salvador owns 6,161.

But size alone is not the story. Twenty One represents a structural evolution in public market Bitcoin vehicles. Unlike legacy corporates that retrofitted Bitcoin into traditional business models (like MSTR did), Twenty One has been engineered from inception with Bitcoin accumulation as its core mandate.

Its framework is Bitcoin-native: success will be measured not by fiat profits or earnings multiples, but by two bespoke metrics, Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR). Shareholder value will be defined by growth in Bitcoin ownership per share, not dollar earnings.

Jack Mallers, a long-time advocate for Bitcoin’s institutional adoption and CEO of Strike, will lead the company. Mallers’ stated ambition is explicit: to build the definitive public-market Bitcoin vehicle, constructed “by Bitcoiners, for Bitcoiners,” and to extend Bitcoin’s architecture into the realm of capital markets, native lending, and corporate finance.

Twenty One’s launch signals a pivot point. Bitcoin has moved beyond its early role as an opportunistic balance sheet asset. It is becoming the foundational architecture for a new class of corporate entities—capitalised by Wall Street, but grounded in Bitcoin’s decentralisation thesis.

The market is not merely adopting Bitcoin anymore. It is beginning to reconstruct itself around it.

A Public Bitcoin Proxy, at a Premium

The market’s reaction to the Twenty One deal has been immediate and emphatic. Since the announcement, shares of Cantor Equity Partners have rallied nearly 200%, implying a fully diluted market capitalisation of approximately $12bn, roughly 3x the estimated value of the Bitcoin Twenty One is expected to hold at launch. Once again for comparison, MSTR trades at about a 2x premium.

This premium underscores the growing appetite among both retail and institutional investors for publicly traded vehicles that offer Bitcoin exposure with operational leverage. The surge reflects demand for proxy investment vehicles—companies that can accumulate Bitcoin accretively and offer shareholders an amplified exposure to Bitcoin’s secular adoption.

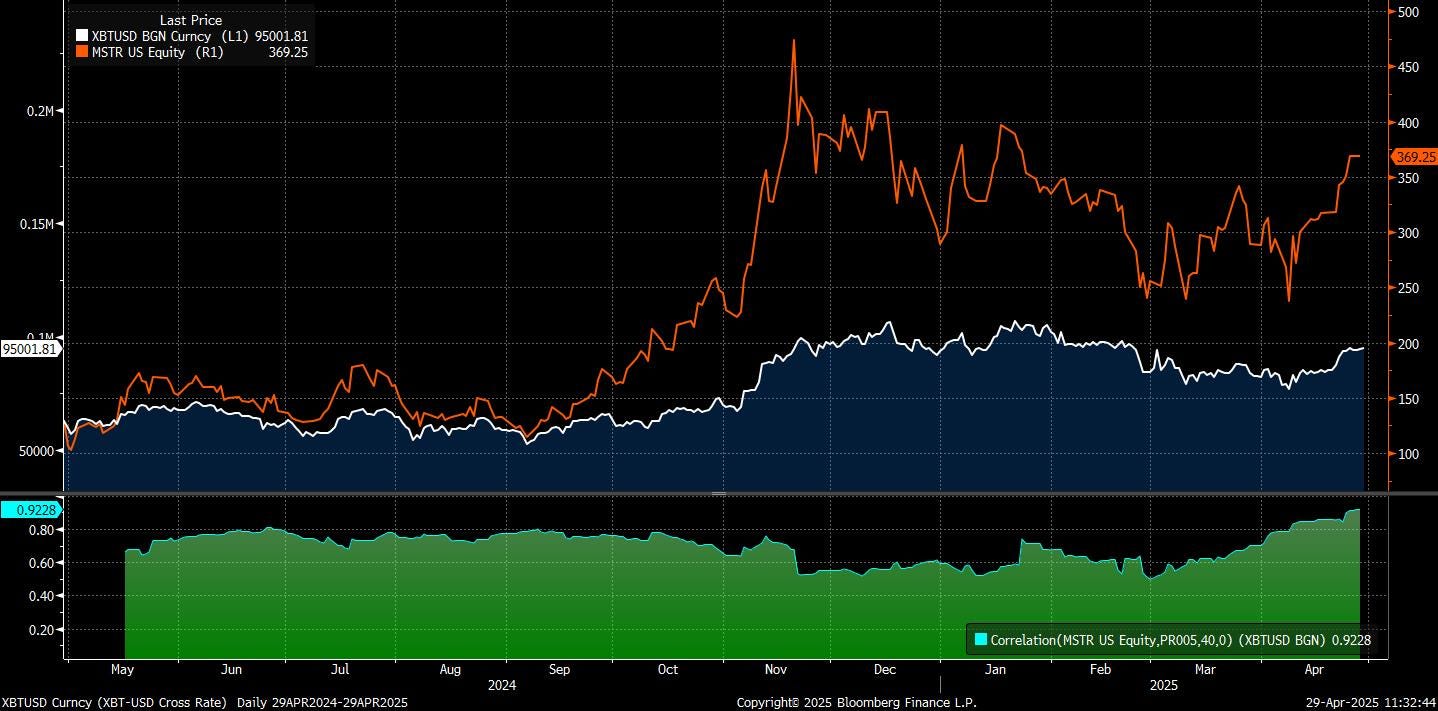

The chart below illustrates that Micro Strategy (MSTR) maintains a high correlation to Bitcoin while delivering amplified returns due to its leveraged exposure.

Twenty One’s structure is heavily skewed toward strategic ownership. Post-closing (assuming full conversion of convertible debt), public SPAC shareholders would own just 2.7% of the company. The cap table will be dominated by Tether (43%), Bitfinex (16%), and SoftBank (24%), with Cantor retaining a small stake. This tight ownership aligns long-term incentives around Bitcoin accumulation rather than short-term public market liquidity.