Global Primer Series: Convertible Bond Arbitrage

Understanding convertible bonds and convertible bond arbitrage.

Convertible bonds are a unique class of hybrid securities that combine features of both debt and equity. They provide investors with the benefits of fixed-income investments while offering the potential for capital appreciation through an embedded option to convert the bonds into shares of the issuing company. This dual nature makes them attractive to various investors, including hedge funds, institutions, and retail traders.

This guide explores convertible bonds in depth, covering their structure, valuation, trading mechanisms, key market participants, and the arbitrage strategies commonly employed in the convertible bond market.

What Are Convertible Bonds?

Convertible bonds are corporate bonds that give the holder the right to convert the debt into a predetermined number of shares of the issuer’s stock. These bonds are typically issued by companies looking to raise capital while offering lower coupon rates than traditional bonds, as the conversion feature provides an added benefit to investors.

Key Features of Convertible Bonds

- Par Value (Face Value): The amount paid back to the bondholder at maturity if the bond is not converted.

- Coupon Rate: The interest rate paid by the issuer to bondholders.

- Maturity Date: The date when the bond must be repaid if not converted.

- Conversion Ratio: The number of shares the bondholder receives per bond upon conversion.

- Conversion Price: The effective price per share at which the bond converts into equity.

- Call and Put Provisions: Some convertible bonds have call provisions (allowing the issuer to redeem early) or put provisions (giving bondholders the option to sell back the bond).

Let’s talk through what this looks like in real life. Below shows the screengrab for an Alibaba convertible bond, issued in May 2024.

It can be converted until maturity in 2031, with it paying a relatively low coupon of 0.5% but coming with a conversion price of $102.80. As you can note, the stock price is currently $136.89. Using the conversion ratio of 9.72, the cost of conversion would be $102.80 x 9.72 = $1,000.22, whereas the current conversion value is $136.89 x 9.72 = $1330.50.

As converting the bond yields proceeds greater than the cost, it would be profitable for an investor to convert this into BABA shares.

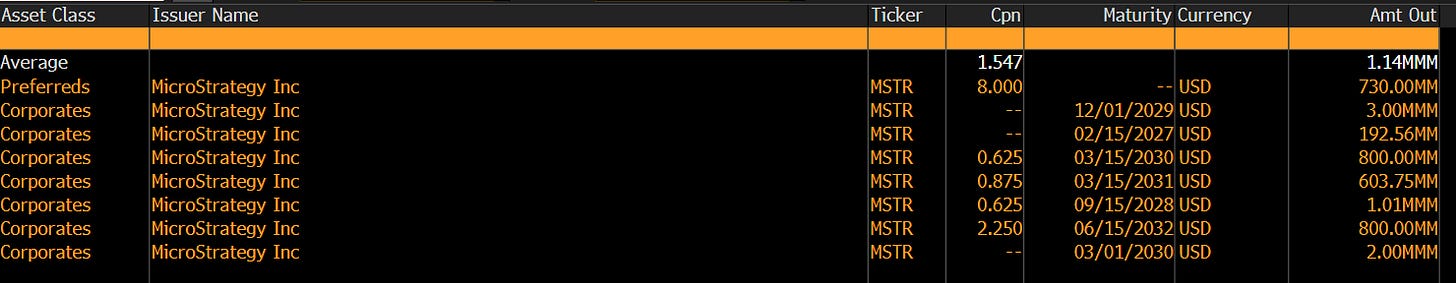

As a note, not all convertible bonds offer a coupon. Strategy (fka MicroStrategy) has been one of the most recent well-known players in this space that have issued zero-coupon convertibles, with the perceived value being all in the equity upside:

How Are Convertible Bonds Valued?

Convertible bonds have two primary sources of value:

1. Bond Value (Debt Component): The present value of the future cash flows (coupon payments and principal repayment).

2. Conversion Value (Equity Component): The value of the bond if it were converted into stock at current market prices.

Valuation Models

- Straight Bond Value: The price of the bond assuming no conversion option.

- Conversion Value: The value of the bond if converted into shares.

- Market Price: The actual trading price, which reflects both bond and conversion values plus market expectations.

The bond’s price depends on the movement of the underlying stock. When the stock price is low, the bond trades like a traditional fixed-income security. When the stock price rises above the conversion price, the bond begins to behave more like an equity instrument.

How to Trade Convertible Bonds

Convertible bonds can be traded in different ways, depending on the investor’s strategy.

Primary and Secondary Market Trading

- Primary Market: Investors can buy newly issued convertible bonds directly from companies.

- Secondary Market: Bonds can be traded in the open market, where prices fluctuate based on interest rates, credit risk, and stock price movements.

Trading Strategies

- Directional Trading: Investors who expect the issuer’s stock to rise may buy convertible bonds as a way to gain upside exposure while limiting downside risk.

- Credit Trading: Investors analyse the creditworthiness of the issuing company and trade based on anticipated credit rating changes.

- Yield Enhancement: Some investors hold convertible bonds primarily for their fixed-income component while benefiting from potential stock appreciation.

- Arbitrage Strategies: Hedge funds and sophisticated investors use convertible bond arbitrage to exploit mispricings.

Who Trades Convertible Bonds?

Convertible bonds attract a diverse range of market participants:

- Institutional: Pension funds, insurance companies, and mutual funds invest in convertible bonds for yield and equity exposure. Hedge funds employ convertible bond arbitrage strategies to take advantage of market inefficiencies. Convertible bond arbitrage is a market-neutral strategy employed by hedge funds and proprietary trading desks. It seeks to exploit mispricings between a convertible bond and the underlying stock.

- Corporates: Companies issue convertible bonds to raise capital while potentially reducing their cost of borrowing.

- Retail: Individual investors who understand the hybrid nature of convertibles may include them in diversified portfolios.

The Mechanics of Convertible Bond Arbitrage

A precursor to the following section: If you want to understand option Greeks or feel a refresher is needed, please visit our previous primer here.

Buying the Convertible Bond:

The arbitrageur purchases a convertible bond issued by a company. This bond has both a fixed-income component (coupon payments, credit protection) and an equity component (the embedded option to convert into stock). If the bond is trading at a discount relative to its theoretical fair value, it presents an arbitrage opportunity.

Shorting the Underlying Stock:

To hedge equity risk, the trader simultaneously shorts the issuer’s stock. This is done in proportion to the delta (Δ) of the convertible bond, which measures the sensitivity of the convertible bond price to changes in the stock price. Delta represents the probability that the bond will be converted into stock. A high delta (close to 100) means the bond behaves more like equity, while a low delta (close to 0) means it behaves more like a traditional bond.

The trade creates a long bond/short stock position that is delta neutral and long equity volatility and long credit of the issuer.

Let’s go back to the BABA Convertible we discussed earlier. Below is the snapshot of the Greeks:

As you can see, the delta is currently above 85, meaning that the ITM nature of it will see it trade more like the equity. This makes sense, given the conversion ratio and conversion price and subsequent share price rally. A quick look at the bond price action confirms that the high delta is causing the bond to trade more like an equity position. Note also the vol of 41.7!

Adjusting the Hedge: Rebalancing the Short Position

One of the key complexities of convertible bond arbitrage is the dynamic nature of the hedge, requiring continuous adjustments to the short position as the stock price moves.

Stock Price Increases → Short More Shares

- As the stock price rises, the convertible bond becomes more valuable because conversion into equity becomes more attractive.

- The bond’s delta increases, meaning it behaves more like equity rather than debt.

- To maintain a neutral position, the arbitrageur must short additional shares to offset the increasing equity exposure.

Stock Price Declines → Cover Some of the Short

- If the stock price drops, the probability of conversion decreases, and the bond starts behaving more like a traditional bond (with a lower delta).

- The trader reduces the short position by buying back some shares since less equity exposure needs to be hedged.

This process, known as dynamic hedging, requires continuous monitoring of delta and frequent rebalancing.

Key Risks in Convertible Bond Arbitrage

While this strategy is designed to be market-neutral, several risks can affect profitability:

- Stock Borrowing Costs: Shorting the stock requires borrowing shares, which can become expensive if demand for the borrow is high or if the stock becomes hard to locate.

- Credit Risk of the Issuer: If the issuing company experiences financial distress, the bond price may decline, and the strategy could suffer losses despite the equity hedge.

- Corporate Actions: Events such as dividends, share buybacks, or takeovers can impact both the stock and the convertible bond, affecting the effectiveness of the hedge.

- Volatility Risk: The effectiveness of the strategy relies on stable volatility levels. A significant drop in volatility can reduce the value of the embedded option within the bond, impacting profitability.

Risks and Challenges in Trading Convertible Bonds

While convertible bonds offer benefits, they also come with risks:

Market Risks

- Equity Risk: If the stock price declines significantly, the bond may trade as a regular fixed-income security.

- Interest Rate Risk: Rising interest rates can lower bond values. The sensitivity of long-dated convertibles can’t be ignored, with some convertibles being very long-dated:

- Credit Risk: A company’s deteriorating creditworthiness can hurt convertible bond prices.

Arbitrage-Specific Risks

- Stock Borrowing Costs: Shorting the underlying stock may become expensive if shares are hard to borrow.

- Liquidity Risk: Some convertible bonds are thinly traded, making execution difficult.

- Corporate Actions: Events like dividends, stock splits, or takeovers can impact arbitrage strategies.

Why Convertible Bonds Attract Funds, Or At Least Used To

Convertible bonds appeal to investors for several reasons:

- Downside Protection: The bond component provides fixed-income security.

- Equity Upside: Investors can benefit from stock price appreciation.

- Yield Advantage: Convertible bonds may offer higher yields than common stock dividends.

- Diversification: They provide exposure to both debt and equity markets.

In the book “Beat the Market,” Dr. Edward Thorp reveals that by employing convertible arbitrage techniques, he achieved annualised returns of 25% with virtually no risk during the years 1961 to 1965.

Looking at more recent performance, between 1990 and 2007, the Hedge Fund Research (HFR) convertible arbitrage index managed to secure annualised returns of 10%, accompanied by an annualised volatility of just 5% based on quarterly returns. However, this performance no longer quite matched the level to beat the market, as the S&P 500 delivered annualised returns of 11%, albeit with a much higher annualised volatility of 15%.

The market crash of 2008 stands out as one of the most significant events in recent financial history. In 2007, more than 81% of fund managers managed to achieve positive returns, with many funds holding steady through the early months of 2008. However, the collapse of Wall Street firm Lehman Brothers had far-reaching consequences. The fallout from Lehman’s troubled shares led to significant devaluations of convertible bonds, among other financial instruments. Additionally, a global ban on short selling left fund managers unable to effectively rebalance their portfolios. To make matters worse, managers faced difficulties selling their underlying securities since potential buyers couldn’t hedge their positions. Ultimately, fund managers saw their portfolios take a nearly 40% hit as a result of the crisis.

The ensuing post-crisis era of zero rates and repressed volatility did little to help convertible arbitrage (and indeed, most other discretionary strategies) replicate pre-crisis investment performance.

That has left the convert arb strategy with a much smaller share of what it used to have.

Sizing of the Market

As of 2024, the global corporate bond market has experienced significant growth, with total issuance reaching a record $8tn. In contrast, the convertible bond market, while also expanding, remains a smaller segment. Global convertible bond issuance in 2024 amounted to $110bn.

That makes the convertible bond market represent just a fraction of the broader corporate bond market, accounting for approximately 1.4% of total corporate bond issuance in 2024.

The surge in corporate bond issuance can be attributed to companies capitalising on strong investor demand. Conversely, the convertible bond market’s growth, though notable, reflects its specialised role in corporate finance strategies and investor portfolios. Namely, Michael Saylor and Strategy were a large issuer of convertible bonds to the market last year.

Conclusion

Convertible bonds are a compelling asset class that blends fixed-income stability with equity upside. They are widely used by institutional investors, hedge funds, and retail traders seeking diversified investment opportunities.

Convertible bond arbitrage is a sophisticated strategy that involves buying a convertible bond while dynamically shorting the underlying stock to hedge equity exposure. The key challenge is adjusting the hedge as the stock price moves—shorting more shares when the price rises and covering shorts when it falls. Proper execution requires access to efficient stock borrowing, robust risk management, and expertise in pricing convertible securities. Despite its complexities, this strategy can provide steady, market-neutral returns when managed correctly.

For those considering convertible bond investing, understanding valuation, market trends, and potential risks is essential to making informed decisions. Whether used for directional bets, income generation, or arbitrage opportunities, convertible bonds offer a unique way to navigate financial markets.

Although subdued since the GFC, there could be a possibility for convertible arbitrage strategies deserving renewed consideration from asset allocators. With the global economy stagnating, convert arb can benefit from a potential new era of increased volatility and significant macroeconomic uncertainty due to trade wars, turbulent yields and increasingly ineffective central bank intervention.

We hope you enjoyed this primer and insights on convertible bonds and the arbitrage strategies related to the securities. Comments and opinions are welcome, as always.

AP

Awesome piece

Fantastic primer!