Equity: Is the AI Mania a Quick Fad or Something Bigger?

Following triple-digit rises in AI names, are we due to see a fade away, or is this the start of the next boom?

Why the mania has started for AI stocks

The potential downside to come

Tech names are all for it long term

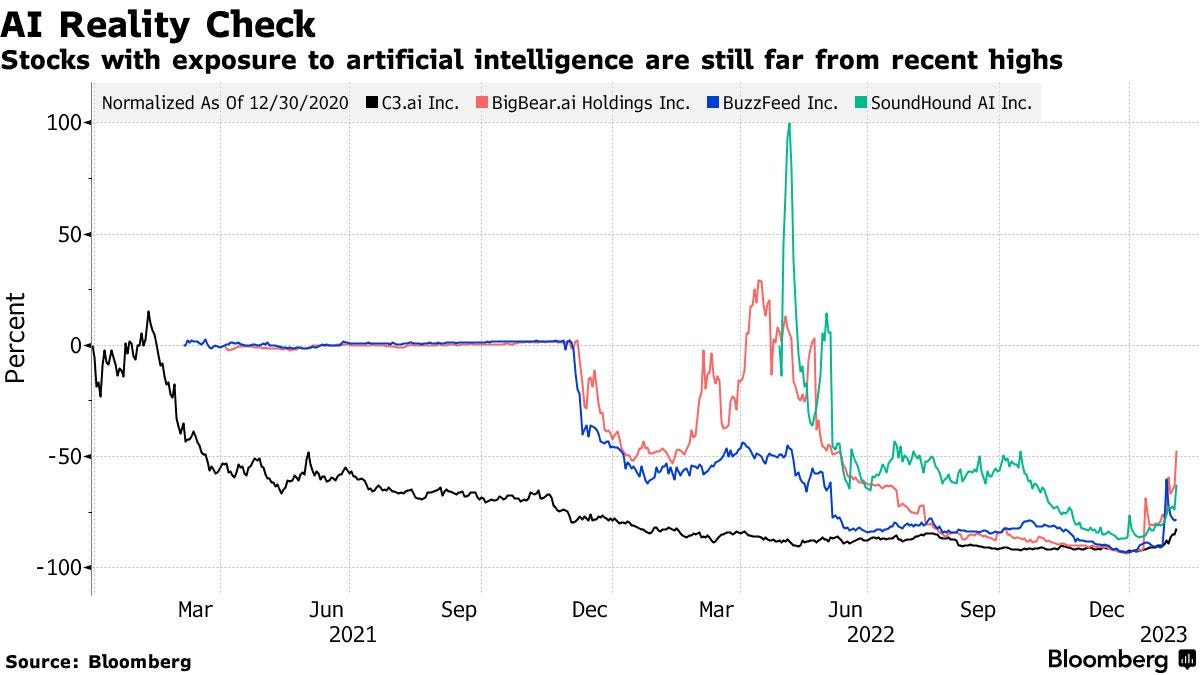

The triple-digit rally for many AI-related names has caught a few eyes, to put it lightly. A nearly 150% surge in C3.ai AI 0.00%↑ shares to start the year has been cheered across social media. Other names, such as BigBear.ai BBAI 0.00%↑ and SoungHound AI SOUN 0.00%↑, have also seen significant gains.

After what looks like an extended move up, are we going to see some downside soon, and what is the longer-term view of these companies?

What got this started?

You may have heard the name ChatGPT in recent weeks. ChatGPT is a language model developed by OpenAI. It is a variant of the GPT (Generative Pretrained Transformer) architecture, specifically trained to generate human-like text. As a result, it can be used for various tasks such as text completion, conversation generation, language translation, and more.

The software debuted in late November and quickly became a viral sensation as tech executives and venture capitalists gushed about it on Twitter, even comparing it to Apple’s AAPL 0.00%↑ debut of the iPhone in 2007.

On Jan 23rd, Microsoft MSFT 0.00%↑ announced an investment of $10b in OpenAI, the creator of ChatGPT. This is the main driver behind the hype, with investors anticipating more outside investment in AI names.

As recently as this week, Google GOOG 0.00%↑ CEO Sundar Pichai revealed Bard, an experimental conversational AI service powered by the company's Language Model for Dialogue Applications (LaMDA). What separates Bard from ChatGPT is that it can derive information from the web.

A quick trend or the start of something bigger?

The stock market always has sectors that trend, and many smaller or mid-cap companies often see strong moves matching this interest. The figures mentioned in the intro shows that AI is no different.

Investors are interested in this potential. But have we gone up too quickly?

Taking C3ai as an example, current stock prices are 30%1 above the 9-day EMA. This adds a lot more risk to these names taking long positions. Also, trends such as these are always targeted by short sellers. They are looking for over-extended moves to short back down to support levels.

The increased interest and volume make for volatile moves.

In the short term, we may see some pullbacks in price. However, this is healthy for stocks to continue higher and offers more favourable entries to invest in names.

But longer term…?

This is not the start of AI. It has been around for many years. But this may be the start of longer-term moves in their stocks.

Interestingly, many of the high-volume names of the last week are well off initial prices and all-time highs. For example, only BigBear.ai is past the -50% mark following the recent move.

So, the first target for these names would be returning to IPO or SPAC prices.

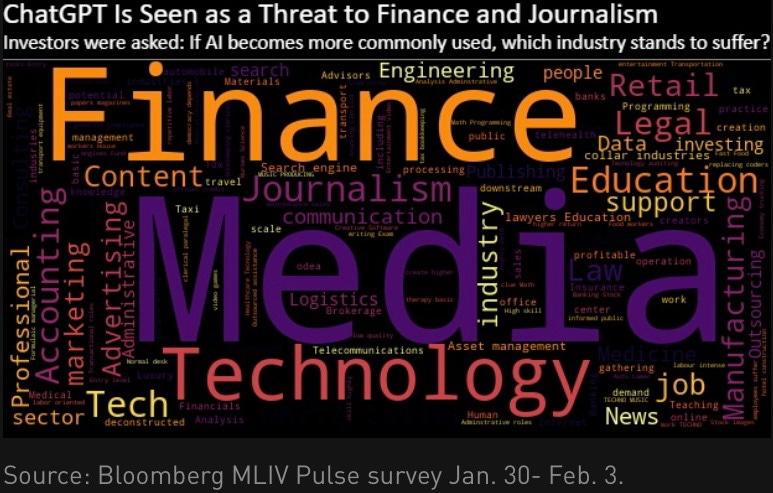

AI will continue to become more powerful and find more uses in business. This will drive the value of AI stocks higher. However, a survey taken from Bloomberg shows the industry that stands to suffer the most from an AI boom.

However, we would like to point out that there is some caution to consider. Currently, any name with any slight link to AI has seen shares purchased in large volume, likely by many FOMO traders.

“It is total buyer-beware unless you know what you’re doing and have proper risk management,” said Matthew Tuttle, CEO of Tuttle Capital Management. “You can’t just go in and buy any company that says they’re in AI.”

Quantum-computing stocks also added to gains amid the recent frenzy as investors speculated on which areas could benefit from the boom in AI technology. As a result, Arqit Quantum ARQQ 0.00%↑, Rigetti Computing RGTI 0.00%↑, and D-Wave Quantum QBTS 0.00%↑ are all de-SPACs that have rallied 20% each in the past week.

Our take

If you missed out on the current move, there might be a better time to jump in on the long side. The volatility also suits day traders rather than swing traders or investors.

However, a cooling off in this sector may be an excellent opportunity to start looking long-term. Major companies may be looking to purchase AI names to bring them into their portfolios. These buyouts add a premium to the current value, creating profitable moves for investors.

“More than six years ago, I first spoke about Google being an AI-first company. Since then, we’ve been a leader in developing AI” — Alphabet Inc. CEO Sundar Pichai GOOGL 0.00%↑

“We’re going to lead in the AI era, knowing that maximum enterprise value gets created during platform shifts” — Microsoft CEO Satya Nadella MSFT 0.00%↑

“One of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI” — Meta CEO Mark Zuckerberg META 0.00%↑

“Tesla is really one of the world’s leading AI companies. This is kind of a big deal, with AI on the software side and on the hardware side” — Tesla Inc. CEO Elon Musk TSLA 0.00%↑

If you enjoyed this deep dive, subscribe for free below to stay updated with article releases.

We release trade ideas at the start of each week, providing strategies to capitalise on moves within equities, commodities, indices and FX. You can get 25% off below on any plan. Must be redeemed by February 15th, 2023.

Figures as of Feb 6th close.