All Quiet On The FX Vol Front

But for how long?

As I sit staring at my screens on a normal Thursday halfway through the trading day in London, movements in major FX pairs is benign to say the least.

EUR/GBP is up 0.02%, USD/CHF down 0.04%, USD/JPY up 0.09% and GBP/USD up a rather incredible (relatively speaking) 0.17%.

These movements in the spot market are fed through to the implied volatility that market makers in the derivatives space use to try and protect themselves. After all, a market maker who offers a price to buy an Option is essentially hoping for realised volatility to be below the implied volatility they have quoted.

Volatility, particularly in the FX space, has been in a downward spiral for the past couple of years. We shared the below chart at the beginning of the week, showing the steady downward trend in the JP Morgan FX Vol index, in comparison to volatility measures for the bond market (blue line) and the equity market (purple).

What’s made clear here is that FX vol is lagging other market gauges. Take the US regional banking crisis from Q1 2023. Bonds had a large move, as did equities. FX vol did spike, but to a much smaller degree, and it retraced quicker than volatility in the MOVE index.

By all counts, it is quiet on the FX vol front. For the rest of the article, we’ll run through:

Why FX vol has been declining

What could spark a change from this pattern

Trade ideas on how to profit from this

Become a premium subscriber to access all of our content, including our flagship Monday Trade Ideas. Here is a 14-day free trial to be able to see all of our content over the coming weeks. We want you to see the value we bring to ‘AlphaPicks on Wall Street’, so join the team now.

The death of FX vol

There are at least three factors that we can point to when trying to put the blame on someone/something for lower vol over the past year or so:

Intervention - either in a direct or an indirect way, we’ve seen some of the largest and most powerful economies act to influence their currency. The obvious one that springs to mind is Japan, who have acted on several occasions to stem the weakness in JPY. China is another case, with the fixing of CNY often different (in most cases stronger) than where the actual rate should be.

With such intervention, it not only can distort the market but can dampen volatility as you almost have a ‘buyer of last resort’ case in action.

Predictable unpredictability - no one could have forecasted the extent of US rate rises or indeed perfectly assume when the Fed will start to cut. But this hasn’t been a volatile period for the US Dollar, because the Fed have done a good job in keeping the market in the loop on where it sees policy going.

So even though movements in CPI data and labour market readings have provided short-term bouts of vol, the reaction of the Fed has been calm. This has meant that sudden policy pivots have been avoided, lower volatile reactions.

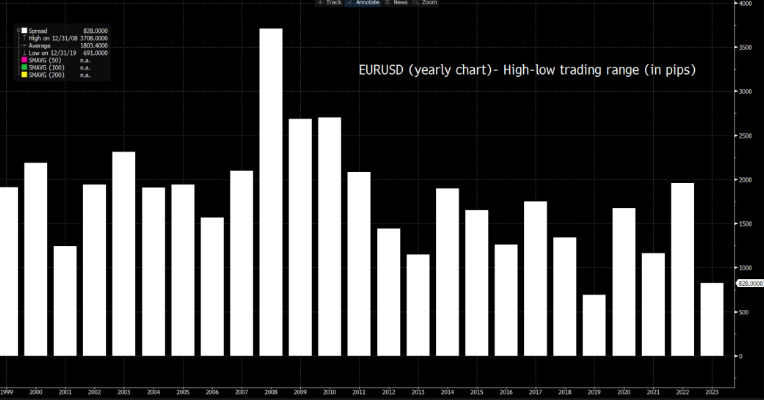

This is one reason why the high-low pip value movement in EUR/USD last year was one of the lowest for decades:

Rise in derivatives - the size and notional of FX options being traded actively is no small figure. Yet managing such positions can act to dampen volatility. For example, the trend lower in vol means that if we get a short-term move, a shrewd trader might look to sell volatility. This can be done from being short an Option, or combining Calls and Put into a structure.

Either way, a market maker has to be long the Option in order to buy it from the trader. To protect himself, the market maker will aim to hedge his delta. to do this, he would need to sell the underlying currency to make him delta neutral. As a result, selling any rally causes volatility to fall as the spot market can’t break out in either direction.

Are things going to change anytime soon?

The short answer is probably not. The environment described above of predictable unpredictability is unlikely to be shaken with the information we have at present.

However, there are some factors that have the potential to change things.