Buy the Chaos, Watch the Deal

It started with bluster. But it’s ending, at least for now, in optimism.

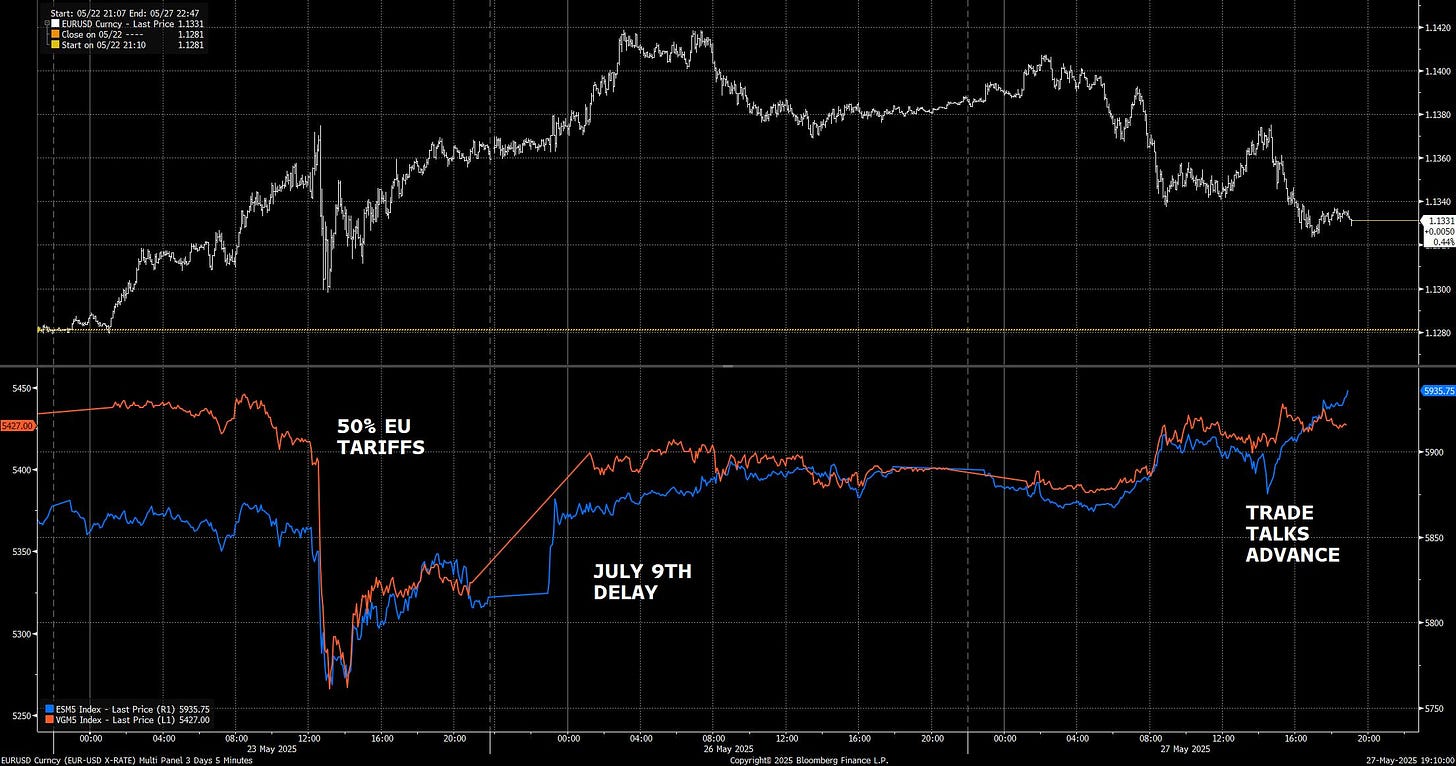

After a chaotic volley of threats, delays, and hardball rhetoric, the US and European Union appear to be edging closer to a constructive trade outcome. President Trump’s tariff gambit, which briefly floated a 50% duty on EU imports, has, for the moment, delivered what the market wanted: momentum toward a deal, not disruption. And financial markets have responded accordingly.

On Tuesday, US and European equities surged. The S&P 500 snapped a four-day slide, gaining over 1.6% as US consumer confidence surprised to the upside and optimism returned to the trade front. The Stoxx 600 rose in tandem. Treasury yields fell, led by the long end. The dollar advanced across the board, rising against the euro—a signal that investors interpret the trade thaw not as a weakness in the US negotiating hand, but as a sign of strategic control.

Whether design or dysfunction, markets are content with the outcome.

(To get full access to all research and notes posted, consider becoming a premium reader here.)

Chaos, Then Concession

The Trump administration’s threat of a 50% tariff on EU goods came just days ago—a dramatic escalation that triggered immediate volatility in European equities and spooked bond markets already on edge. But in typical fashion, the heat was dialled back just as quickly. A call with Ursula von der Leyen produced a deadline extension to July 9, with both sides committing to accelerate negotiations. And now, according to Trump, the EU “is speeding up” talks.

This sequence (a maximalist threat followed by strategic de-escalation) is the blueprint of the “chaos strategy” that has come to define the US trade posture under Trump. A more generous description? Not randomness, but leverage dressed as volatility.

Markets used to panic at this pattern. Now, they fade the noise and position for resolution. The EU tariff reprieve until July 9 is an important step in the overall resolution of this trade situation, which is the exact messaging the market hopes for.

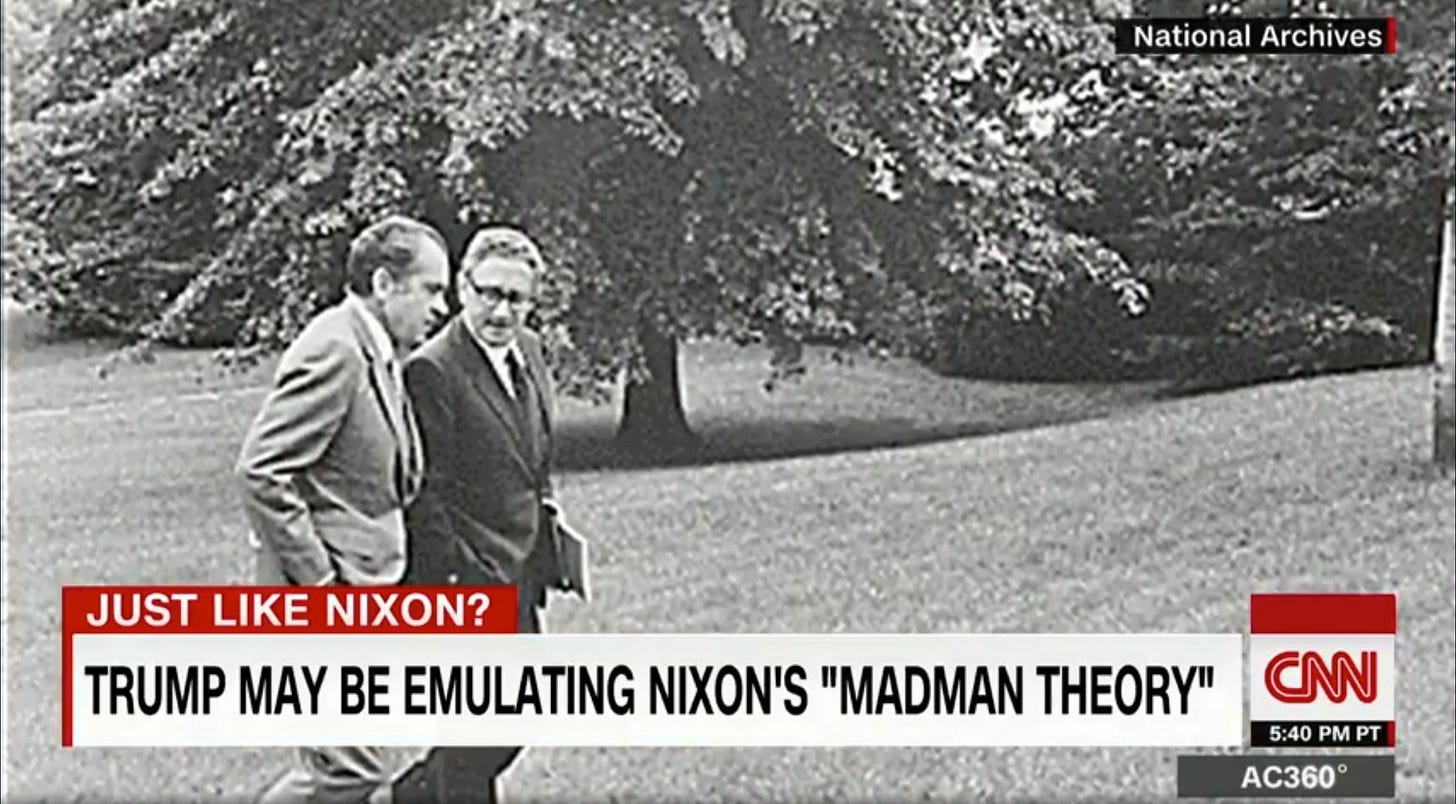

Trump’s approach borrows from Nixon’s madman theory: act irrationally enough, and the other side will blink first. But what once looked like unpredictable escalation now functions more as tactical choreography. Markets aren’t reacting to the drama. They’re anticipating the de-escalation.

That doesn’t make the strategy toothless. On the contrary, its effectiveness lies in how performative it has become. Europe knows the 50% tariff would hurt both sides. US GDP would drop more than 2%, inflation would rise, and supply chains would convulse. That’s why the policy is unlikely to materialise. But the threat itself extracts attention, forces urgency, and resets the negotiating timetable.

And this time, the gambit has yielded results. The EU has moved faster. Trump has publicly acknowledged the shift. Equity markets, especially cyclicals and exporters, are pricing in a path to resolution. The S&P 500 and Stoxx 600 aren’t climbing in spite of the chaos, they’re climbing because it now looks choreographed, and now, conveniently, contained.

Europe’s Strategic Logic

Behind the scenes, Brussels is playing a more measured hand. The EU understands that outright retaliation, especially in kind, would be counterproductive. However, it also recognises that Trump’s tariff threats aren’t just about trade imbalances but also about narrative.

To that end, Europe is offering carrots: faster trade talks, discussions around increasing LNG purchases (rings a bell), even hints at easing digital service tax frictions. But the sticks are quietly being assembled. Chancellor Friedrich Merz signalled that US tech companies, which derive 20–30% of their revenues from Europe, could face tighter scrutiny if tariff threats escalate.

What the EU won’t do is surrender its regulatory model or fiscal sovereignty to avoid a 50% tariff threat that markets have already priced as performative. As some economists noted, the pain from such a policy would be symmetrical—devastating for Germany’s export engine, yes, but also a domestic inflation bomb for the US consumer.

Instead, Europe’s response is strategic patience: buy time, offer symbolic wins, and maintain internal cohesion. BNP Paribas estimates that even a 10% drop in exports to the US could be offset by just a 1% increase in intra-EU trade. That’s a credible backstop and a reason why Europe is not blinking under pressure.

Why This Is Bullish

The current setup is classic buy-the-dip material. The worst-case tariff outcome looks increasingly remote. Consumer confidence in the US has rebounded. Treasury yields are falling for constructive reasons (more confidence in soft landing scenarios, less worry about runaway inflation). And the dollar is rising, not out of panic, but strength—an endorsement of America’s leverage in negotiations and macro positioning.