Capex, Credit, and Crowded Exits

A weekly look at what matters and how to trade it. (February 9th)

A duck sits calmly on the water while its feet churn beneath. The index is flat. The market is not.

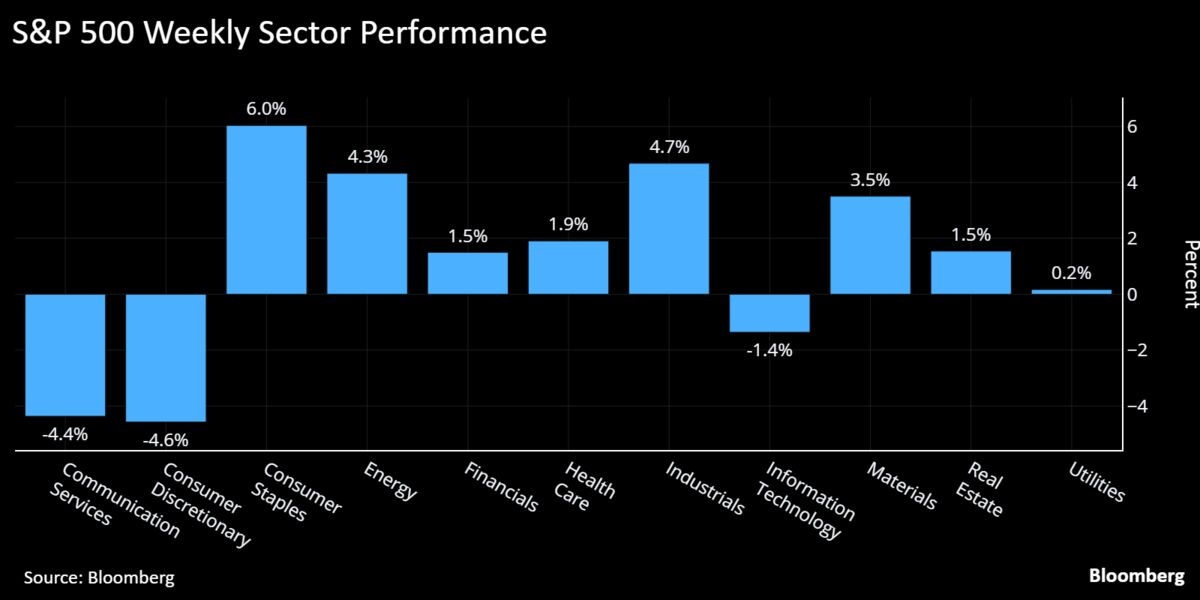

US equities spent most of the week digesting a sharp regime shift in how investors think about software, AI, and capital intensity. Earnings positioning quickly morphed into a broad de-risking across growth, sparked by the release of Anthropic’s new automation tools and reinforced by hyperscalers dropping eye-watering spending plans into an already fragile tape. Software, crypto (the tip of the spear for risk appetite) and adjacent sectors were put through the wood chopper, with megacap tech losing its role as the market’s shock absorber.

The selloff was fast and unforgiving. Software, financial services, and asset managers were hit simultaneously, underscoring how deeply embedded the growth narrative had become across portfolios. Wednesday’s drawdown marked the worst day for hedge fund equity strategies since Covid, a reminder that positioning, not fundamentals, was doing most of the work.

At the same time, volatility spilt into other crowded corners. Silver whipsawed, crypto unravelled, and Bitcoin briefly traded more than 50% below its October peak. Leverage was being reduced, not rotated.

Yet this wasn’t a blanket risk-off. Old-economy exposure did its job. Energy, defence, staples, and industrials outperformed, buoyed by geopolitical tension and relative insulation from AI disruption. The Dow’s break above 50,000 said as much, a milestone achieved through balance-sheet stability and pricing power. With growth multiples under pressure and capex scepticism rising, value and cash flow are back in the conversation, whether investors like it or not.

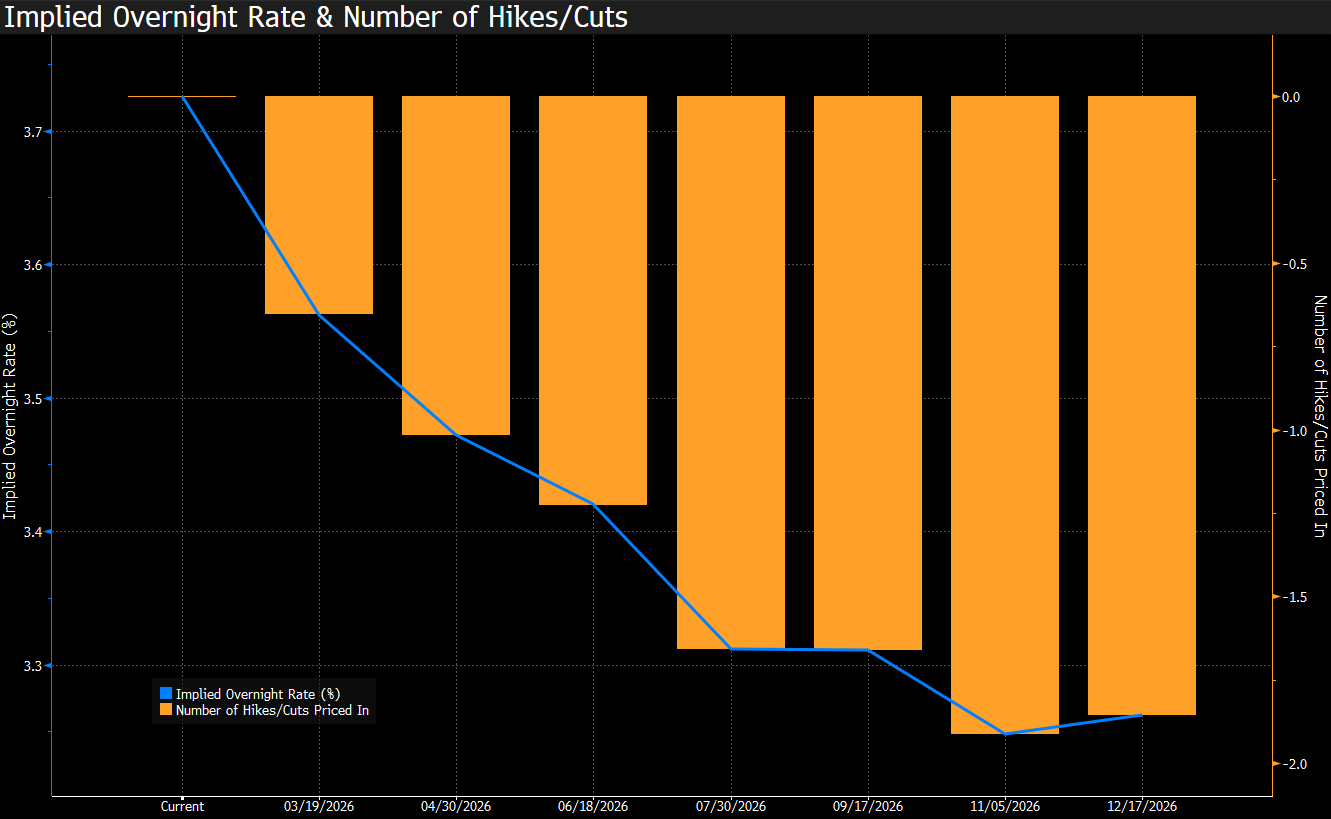

In macro, the Bank of England delivered a more dovish meeting than markets had anticipated, with the committee split 5-4 to hold rates. Governor Andrew Bailey said there “should be scope for some further reduction in bank rate this year,” as the BoE predicted inflation near its 2% target in April, as well as slowing growth and rising unemployment. Markets are beginning to align with the views we shared on APFX last week for a March cut, False Comfort in SONIA, and pricing has moved from a 5% chance to a coin flip. Upcoming data may confirm the MPC’s dovish views and move the needle further towards our base case.

There were no fireworks from the ECB, which held rates as expected.

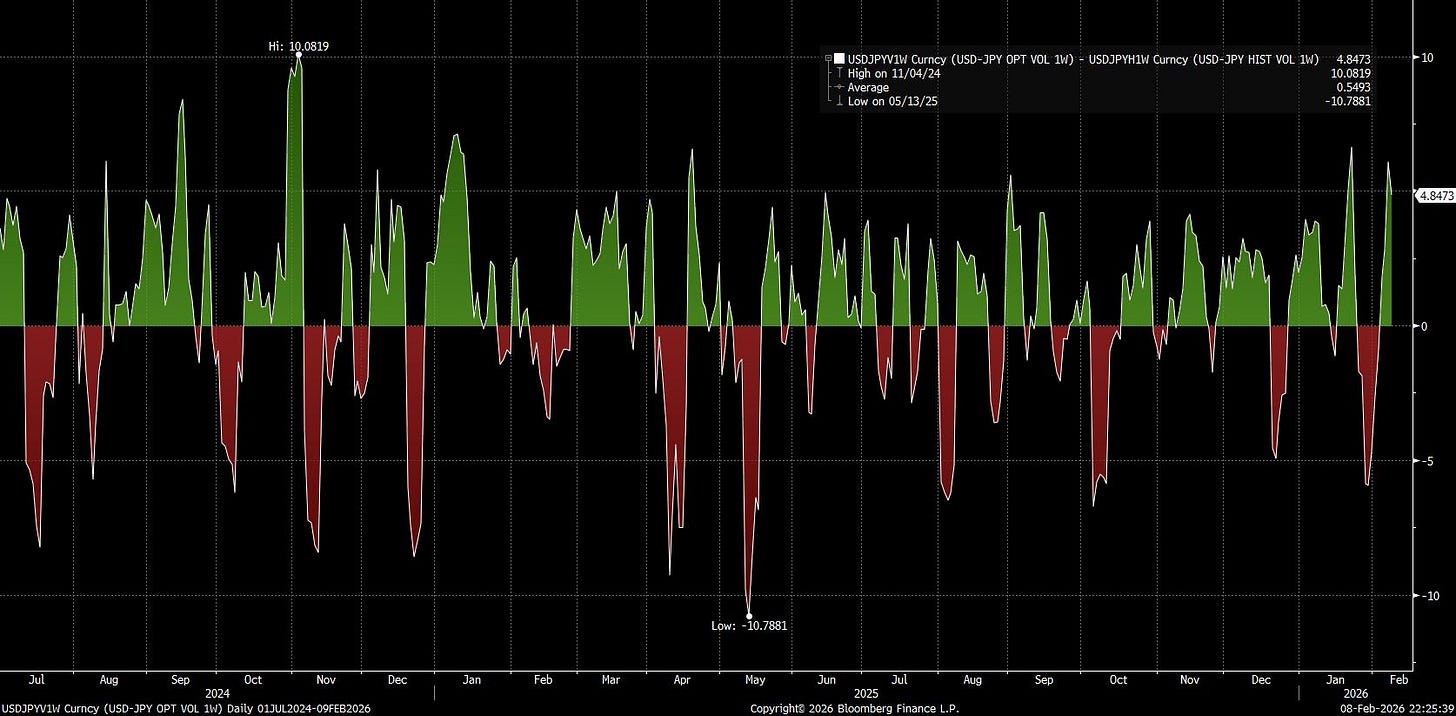

The dollar finally caught a bid, its first positive week in a month, helped by the churn in metals and crypto that forced some de-levering into USD. Warsh’s nomination as Fed chair offered a convenient excuse to trim crowded shorts ahead of key data this week. As usual, USD/JPY was the cleanest expression, especially in the options market as realised volatility widened. For now, the dollar bounce looks tactical rather than the start of something durable.

Let’s get into the guide to trades moving markets, where things stand and where they may be heading.

“Investment Gone Bad”

“A Case of Duck Syndrome”

“AI Capex: The Winners Are Downstream”

“A Jobs Report with No Middle Ground”

“Takaichinomics Takes Its Seat”

“A Crypto Winter”

Investment Gone Bad

Software-as-a-Selloff was the biggest market mover last week. We wrote in-depth about this market reaction and our preferred expression to the theme, turning to the alternative asset manager space to find weakness in software-linked exposure. Following the swift re-rating of software names, markets have quickly turned skeptical of private equity and loans premised on supposedly predictable results

A broad market recovery to end the week on Friday saw software only modestly higher, and the bounce in asset managers signals to us an opportunity to increase short exposure in this space, seeing limited upside and decent downside.

Recall Jamie Dimon’s warning from last year about “cockroaches” in private credit markets after two auto-related blowups last year. We may see more of this concern related to private credit firms in the software space.

So as not to repeat our thougths from last week, see the below if you missed it.

Software-as-a-Selloff

It has been instructive to see which of this year’s early convictions have survived contact with reality. Precious metals are attempting to redeem their bull-market credentials, with gold and silver making a valiant effort to recover. The USD/JPY trade has recovered a majority of its post–rate-check slide, an

Alongside our short basket of Blue Owl (OWL US), Ares Management (ARES US), and KKR & Co. (KKR US), we’re looking to add Saratoga Investment (SAR US) and TriplePoint Venture Growth BDC (TPVG US). The latter two were highlighted by Cluseau Research as having significant software exposure (h/t). His recent note is worth a read.

A Case of Duck Syndrome

If you only glanced at the index this week, you would call it a routine wobble. The S&P dropped less than 1%. The Nasdaq down 2.5%. However, the story beneath the surface tells a deeper story.