Central Bank Focus Across the Board

A weekly look at what matters and how to trade it. (September 15th)

US equities pressed higher into fresh records this week, led by a resurgent technology sector, as markets locked onto the near-certainty of a September Fed rate cut. Oracle’s extraordinary forecast for its cloud unit lit up tech, while Adobe’s results reinforced the AI-driven momentum across software. The combination of corporate strength and a dovish policy backdrop carried the S&P 500 to new highs, even as official data reminded investors that inflation remains sticky and above target.

Apple’s much-hyped product event provided little relief to AI anxieties, with sentiment swinging further negative on a string of downgrades. The iPhone maker now trades under the cloud of lagging behind its peers in AI adoption, with pricing power rather than innovation in the spotlight.

Meanwhile, Warner Bros. Discovery ripped higher on fresh takeover speculation from Paramount Skydance, though regulatory hurdles and political noise will be formidable. Health insurers also rebounded sharply as Medicare star ratings provided relief for both UnitedHealth and Centene, suggesting policy headwinds may be easing at the margin.

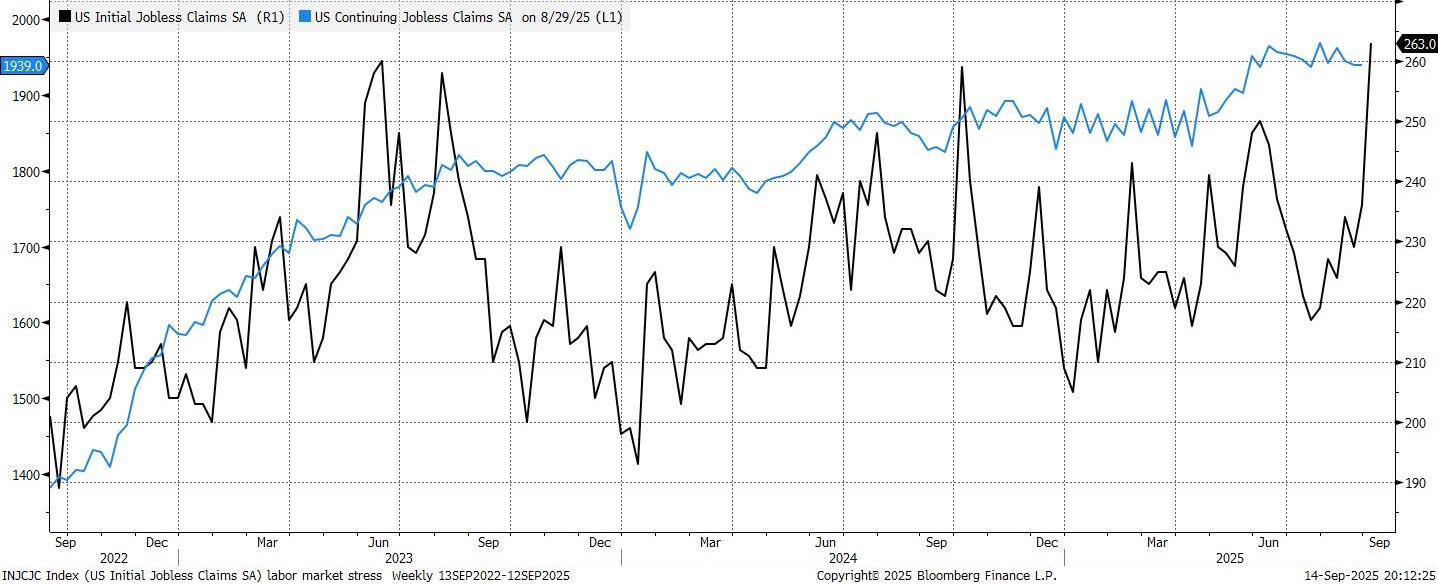

Macro conditions continue to dominate. Initial jobless claims climbed to their highest level since 2021, underscoring a labour market that is clearly softening. August CPI accelerated to 2.9% year-on-year, marking the highest print since January and complicating the Fed’s balancing act.

With no speakers in the blackout period, markets turned to OIS, which remains fully priced for a 25bp cut next week and leans toward another 45bps by year-end. The tension is clear: equities have already run hard on Powell’s Jackson Hole pivot, leaving little room for the Fed to over-deliver in the near term. Our team released some thoughts on the Fed over the weekend:

Elsewhere, USD traded soft into the Fed, with Thursday’s claims and CPI data triggering sharp moves in EUR/USD and USD/JPY before fading. A marginally more hawkish ECB decision added to cross-currents, but the dollar remains the consensus short according to positioning surveys. Treasuries saw a mixed week: the long end was supported by strong 30y demand, while the belly absorbed supply pressures, leaving the curve pivoting around 10s. Rates volatility remains pinned near the lows, with MOVE drifting back toward year-to-date troughs.

(Upgrade to a paid subscription to unlock full access to all research.)

The Week Ahead

Most of the calendar for the next few days is occupied by central bank meetings: the Fed, BOC and Brazil on Wednesday, followed by the BOE, Norges and SARB on Thursday, and capped off by the BOJ on Friday. Inflation data from Canada, the UK and Japan are also due.

It’s a very macro-focused week, with equity earnings season mostly behind us. But of course, Powell’s comments at the FOMC meeting will be the direction for markets into the week’s end, with price action likely contained in the run-up.

Before we start on the commentary for the next few days, truthfully, there may be nothing meaningful before Wednesday. Our view is markets will mostly stand still into the FOMC, so this will be a tighter note, but the few points in here are worth your time.

Software Strength

Oracle Highlights Software Strength:

Following Oracle and Adobe’s strong weeks (combined with a backdrop of an easing Fed that, at this moment, doesn’t look headed for a recession), tech has been and will continue to lead as markets stay risk on, especially software.

We see it as unlikely that any Powell comments will shock markets to the downside. Towards the back end of the week, we’ll be watching some of the names listed in the article below for tactical longs.