Central Banks Recap: Fed Pivot Pressures ECB And BoE To Follow

It was set to be a big week on the calendar for monetary policy, and it didn't disappoint.

There was a lot on the cards this week. Alongside some key Treasury auctions earlier in the week, we also had a US CPI release and a 19-hour window, which saw rates set for three major central banks - the Federal Reserve, the Bank of England, and the European Central Bank.

The Fed all but declared victory with inflation, but the UK and Europe sang a different song.

BoE: “Sufficiently Restrictive For Sufficiently Long”

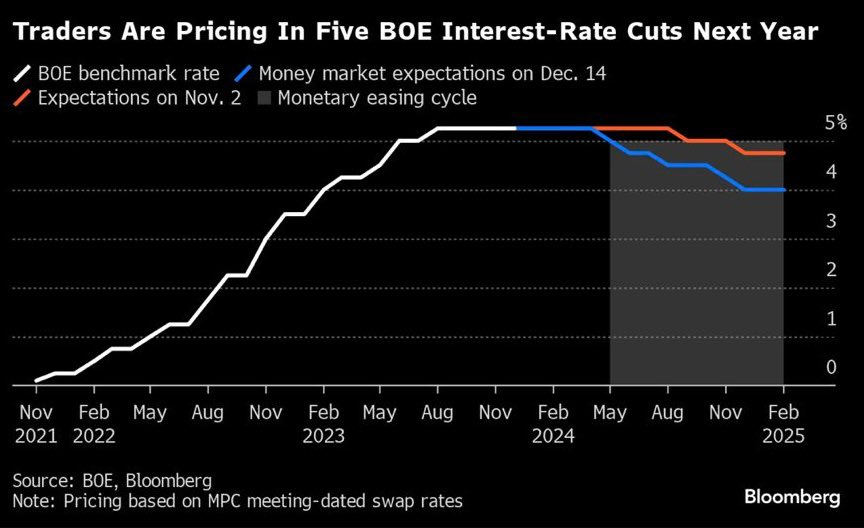

The Bank of England (BoE) kept interest rates at a 15-year high, sticking with its message that borrowing costs will remain elevated for some time despite growing bets on a wave of cuts in 2024.

The BoE reiterated its policy would be “sufficiently restrictive for sufficiently long” to curb inflation. Officials split along the same lines as in their previous meeting in November, with three still supporting a hike.

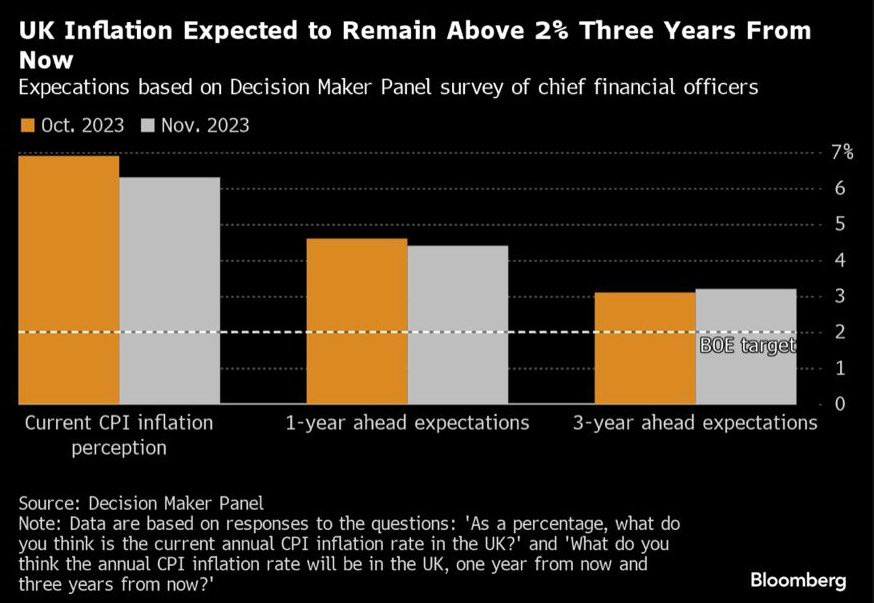

Governor Andrew Bailey said in a statement released alongside the decision that “there is still some way to go” in the fight to control inflation. The Monetary Policy Committee repeated its guidance that it could hike again “if there were evidence of more persistent inflationary pressures,” with price growth still more than double the 2% target. But Jeremy Hunt, Chancellor of the Exchequer, did admit that they had “turned a corner” in the fight against inflation.

Hunt also said, “By cutting taxes for hard-working people and businesses, and helping people into work, we are forecast to deliver the largest boost to potential GDP on record.”

Markets priced in 1.25 percentage points of cuts in 2024 on Thursday for the first time, with the move to easier policy expected to begin in May. That shift was accelerated by a more dovish stance from Fed policymakers who projected an end to its rate hikes and more aggressive cuts in 2024.

The stance of the BoE was starkly different to that of the Federal Reserve. Markets will question if they can really resist following the pull of the US central bank, who decided it was time to throw caution to the wind and came as close to promising rate cuts as they possibly could. Generally, where the Fed goes, the rest follow.

That moves us on nicely to our FOMC recap.

Fed: “[Rate Cuts Were] A Discussion For Us At Our Meeting”

The Federal Reserve kept rates unchanged, as expected. The headline was never going to be about this week’s rate decision, but more so the “Dot Plot” for 2024.

The median forecast in Federal Open Market Committee members’ latest Summary of Economic Projections has the federal funds rate ending 2024 at 4.6%. Investors expected significantly more cuts in 2024, but markets still rallied after the announcement.

Powell said the committee discussed rate cuts at the meeting this week but hasn’t ruled out the possibility of another hike if the data calls for it. Even so, the statement added to the sense of a dovish pivot. The FOMC softened its stance toward further hikes by adding one word to the statement, saying officials will consider the extent of “any” additional policy firming that’s needed.

The committee is looking for a soft landing for the US economy, not a recession, with unemployment forecast to rise only slightly over the next few years. Powell said the labour market is coming into better balance, and wages have cooled, though they remain a bit above the level consistent with 2% inflation.

You can read more about US rate cuts in our article that was released earlier this week.

In the rest of this article, we summarise the European Central Bank meeting, where an interesting topic was actually left out of the meeting, as well as sharing our overall thoughts from the week. This can be accessed by becoming a premium subscriber, which will also give you access to all future research and archived posts, as well as trade ideas and weekly rundowns every Monday.

ICYMI, a new feature coming to the newsletter. Four new stock screening models: Value, Growth, Dividend and Momentum.

ECB: “We Did Not Discuss Rate Cuts At All”

The European Central Bank (ECB) held rates steady, but like the BoE, they showed a different tone to that of the Fed.