Cockroaches and the Credit Concern

A weekly look at what matters and how to trade it. (October 20th)

US equities closed the week higher, though the calm belied renewed undercurrents of volatility. Regional banks briefly reignited systemic concerns after loan fraud revelations at Zions and Western Alliance rattled confidence in credit markets, echoing memories of 2023’s banking turmoil. Losses were largely contained by week’s end, with broader financial conditions stable, but a mild uptick in SOFR and the Fed Funds Effective Rate will be watched closely should funding pressures re-emerge.

Markets also grappled with US–China trade tensions, after President Trump threatened to “massively increase” tariffs before retreating from the stance late in the week. Despite the noise, equities advanced: S&P 500 +0.5%, Nasdaq 100 +2.5%, Dow Jones +1.6%. Mag7 once again carried the tape higher. Volatility remains elevated, however, and if price swings persist, the focus will likely return to overextended valuations in the AI-driven segments. UBS estimates CTAs could sell $46bn in S&P futures if the index retreats toward 6,500 this week.

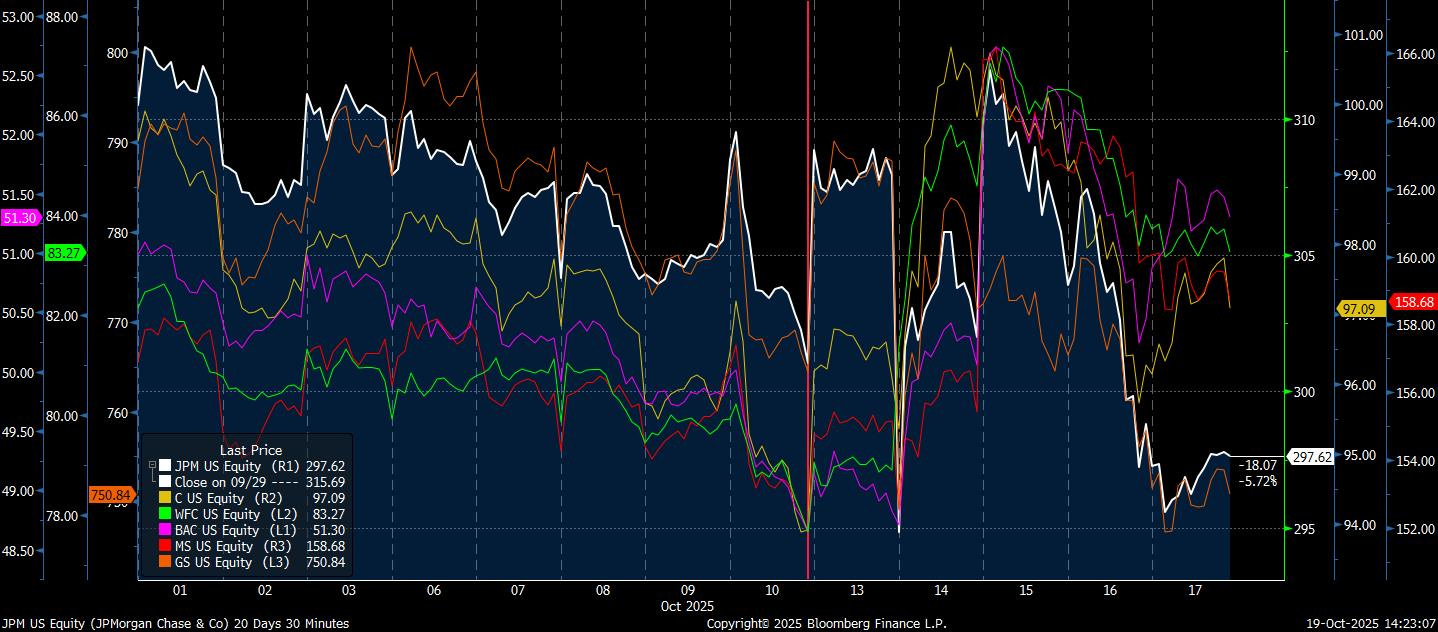

The start of earnings season brought a mixed picture for US banks. Trading revenues were robust across the majors, but stock reactions diverged. JPMorgan softened on cautious credit commentary, while Wells Fargo, Citigroup, Bank of America, and Morgan Stanley posted strong gains. By contrast, Goldman Sachs underperformed after missing in equities trading. Regional lenders were the weak link, though late-week results from Truist and Regions Financial helped stem losses.

Elsewhere, Fed Chair Powell reiterated that policy remains on track for two potential cuts by year-end, emphasising the nearing end of quantitative tightening but avoiding any shift in tone. The OIS curve continues to price 25bps cuts for October and December, keeping the market comfortably in a dovish stance. The US dollar weakened for much of the week, with traders reluctant to hold longs ahead of the delayed September CPI report due Friday, now set to anchor near-term macro positioning.

The Treasury curve was little changed, though intraday swings were pronounced as front-end yields briefly hit new lows for the cycle. Positioning remains skewed toward easing expectations, highlighted by a large SOFR December mid-curve options trade targeting rates near 2% by the end of 2025. For now, volatility (not direction) is the defining feature of the market.

The Week Ahead

Delayed US inflation data are due to be released during the week and will attract attention from investors seeking evidence on the likelihood of future interest-rate cuts.

As long as the US government shutdown continues, however, major US data will be delayed, leaving greater focus than usual on provisional purchasing managers’ surveys for October for a gauge of how well the US economy is performing.

In Europe, focus will centre on purchasing managers’ surveys and UK inflation data. In Asia, political developments in Japan and a key economic meeting in China could set the tone for market sentiment in the weeks ahead.

US Regional Banks / Credit Risks

The “Cockroach” Problem:

What began as another “better-than-expected” earnings week for the big banks has ended with a different mood. Jamie Dimon’s warning about the collapse of subprime auto lender Tricolor Holdings (“When you see one cockroach, there are probably more”) was more than a colourful soundbite. It was a signal that investors are once again being forced to look under the hood of the financial system.

Within days of those remarks, regional banks Zions and Western Alliance disclosed fraud-related losses tied to loans for funds investing in distressed commercial mortgages. Markets, conditioned to dismiss every mishap as idiosyncratic, suddenly began asking the question that always surfaces late in the credit cycle: How deep does this go?