Commodity: Will The Bullish Bullion Return

After starting February at 9-month highs, the price fell nearly 8%. But is a turnaround on the cards for the precious metal?

The Dollar's impact on gold

What the technical signals say

The fundamental demand from central banks

Gold was one of the strong performers to close out 2022. The strength continued through the start of this year. Market turbulence, rising recession expectations and more gold purchases from central banks underpinned demand. Throw in a weakening Dollar, and everything seemed suitable for the precious metal.

However, after starting February at 9-month highs, the price fell nearly 8%. But is a turnaround on the cards?

The Dollar rises

The main factor in the February fall is the rising Dollar. As a simple equation, the stronger the Dollar, the less you need to buy gold. The same applies to the equity markets, which also saw three weeks of negative performance last month.

It makes sense to look at the Dollar forecast for the near future to give more insight into the commodity.

From a fundamental point of view, further USD appreciation makes sense, given the rising US yields (the 2yr hit 4.80% last week, not seen since 2007) and falling equity markets. If this theme continues into next week, with PMI data and Initial Jobless Claims to support the rhetoric, the Dollar Index (DXY) could be primed to take the next leg higher.

The US rate futures have priced in a peak fed funds rate of 5.4% hitting in September. The market has all but priced out Federal Reserve rate cuts this year. Consequently, the US Dollar index managed to claw back by some 0.18% in late morning trade on Wall Street and set a February gain of over 2.5%, its first monthly increase since September.

When will it turn around?

Among the US data on Tuesday, gold prices rallied on the back of a survey of Consumer Confidence, which showed a decline to a three-month low of 102.9 in February.

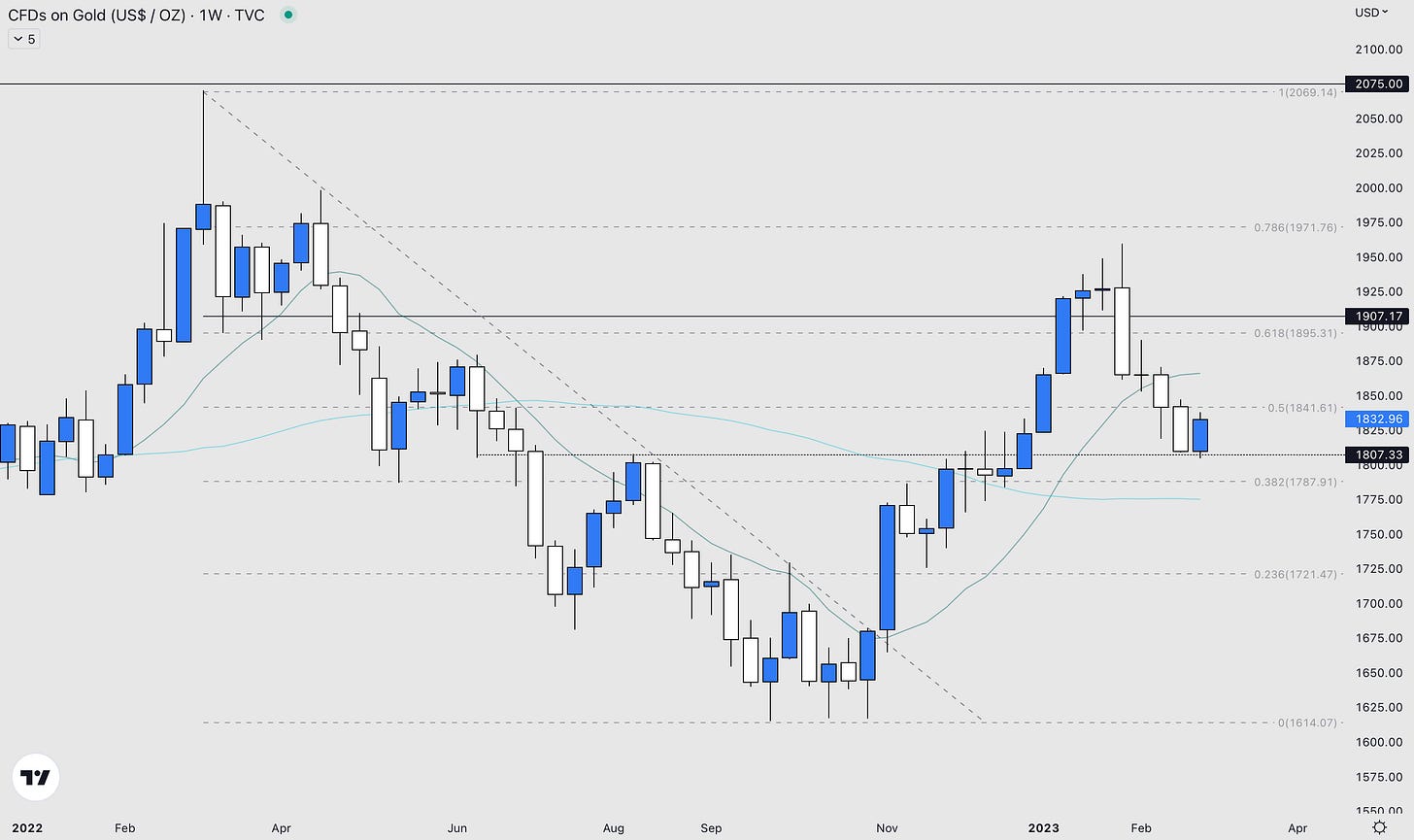

From a technical point of view, there is compelling support below. Firstly, a pivot level of $1,807.33, which has previously acted as both support and resistance, held up to start this week.

Yet, there is a more significant support level below this. As you can see on the chart below, the 0.5 Fibonacci retracement is at $1,787.58. Not only is this the 0.5 retracement from the bullish move up, but this level coincides with the 0.382 level from the move down in 2022 (see weekly chart).

This also sits slightly above the 200-day moving average, a popular metric investors and banks use to buy or sell assets, buy on support and sell on resistance.

With an expectation that the Dollar rises higher, there may be room for a further pullback in gold. This may allow some favourable opportunities to go long for a move higher.

Fundamentals

Another two key drivers that gold needs to halt its selloff are robust physical demand and continued interest in the precious metal from central banks.

One concern is that China's official sector demand could be slowing. The country added 15 tonnes to its central bank reserves in January, less than the 62 tonnes reported in November and December.

However, gold demand in China could increase over the coming weeks as investors look for safe-haven assets amid geopolitical tensions.

Bloomberg analysts have gold trading higher than predicted prices. This model is based on inflation-adjusted Treasuries and the Bloomberg Dollar Index, as well as ETF flows.

Much of this premium is due to central bank whales snapping up precious metal. And the level at which they bought seemed to be close to the $1,800, where prices were unusually well supported, and where prices currently sit just above.

Interestingly, these central banks, particularly developing market ones that run large current account surpluses and have outsized dollar exposure, tend to be long-term accumulators of the metal, as its strong inverse correlation to the US currency makes it a hedge and portfolio diversifier. At the right entry point, they see it as a long-term investment.

A range-bound asset

Although we think there may be a turnaround soon, is gold due to be a range-bound asset? The price has struggled to move more than $200 away from the above-mentioned $1,800 price.

If gold does see strong buying, we would be looking for an upside move to recent highs, ~ $1,960.

If you enjoyed reading this article, please let us know by liking this post. We write deep-dive articles into equity, commodity and FX markets twice a week, with the next article due out this Friday.

You can also subscribe to our premium content, providing you with trade ideas to start every week.

Intriguing support levels on the chart 📊

It is said " The Golden Rule: He who has the gold makes the rules." Whether this is true.. Time will tell!