Entropy In Asset Allocation

A measure of risk.

The history of the word “entropy” can be traced back to 1865 when the German physicist Rudolf Clausius tried to give a new name to irreversible heat loss, what he previously called “equivalent value”. The word entropy was chosen because, in Greek, en+tropein means content transformative or transformation content.

Entropy can be understood in three aspects. Firstly, in the field of information, entropy represents the loss of information in a physical system observed by an outsider, but within the system, entropy represents countable information. Secondly, entropy measures the degree of freedom. A typical example is gas expansion: the degree of freedom of the position of gas molecules increases with time. Finally, entropy is assimilated to disorder.

The application of entropy in finance can be regarded as the extension of the information entropy and the probability entropy. It can be an important tool in portfolio selection and asset pricing.

Financial Markets

Financial analysts and market technicians employ the concept of entropy to assess the probabilities that specific types of price movements, predicted for a particular security or market, will materialise.

Entropy has been the subject of extensive study and discussion among market analysts and traders. It is utilised in quantitative analysis and can aid in forecasting the likelihood that a security will fluctuate in a specific direction or adhere to a particular pattern. Securities characterised by high volatility exhibit greater entropy than those that maintain relative price stability.

One significant source of entropy in financial markets is noise. In this context, noise refers to random, irrational, or misinformed trading activities that obscure, distort, or misrepresent genuine underlying trends. Such noise frequently results from the trading behaviours of novice or retail investors, who may base their decisions on emotional responses, trend-chasing, or rumours. We wrote about the role of emotional biases when discussing prospect theory:

Using Prospect Theory In Trading

If we gave you a choice of either taking a guaranteed £50 profit from a trade, or having the 50/50 shot at making £100, which would you choose?

The entropy generated by market noise can complicate investors’ efforts to interpret the factors influencing trends and to determine whether a trend is undergoing a change or simply experiencing temporary volatility.

A Measure Of Risk

The concepts of beta and volatility, alongside entropy, serve as critical measures of financial risk, particularly in terms of randomness. Within finance, risk can be viewed from dual perspectives; it may yield both advantageous and disadvantageous outcomes based on the investor’s objectives. Generally, it is accepted that an increased level of risk may facilitate enhanced growth opportunities. Consequently, investors targeting elevated growth are often advised to pursue asset classes characterised by high beta or high volatility.

Entropy functions parallel to these risk indicators. A stock exhibiting a high degree of entropy is regarded as possessing a greater risk profile compared to its peers. Some analysts contend that entropy may offer a more comprehensive model of risk than beta. Research has demonstrated that similar to beta and standard deviation, both entropy and risk diminish as the diversity of assets or securities within a portfolio expands.

In the realm of finance, the ultimate pursuit has been to ascertain the optimal methodology for constructing a portfolio that realises both growth and minimal drawdowns. This objective can be articulated as achieving maximum returns while minimising risk. Considerable time and resources have been dedicated to the analysis of data sets and the evaluation of numerous variables.

Asset Allocation

In the pursuit of a competitive advantage in portfolio construction, entropy optimisation proves to be a valuable tool. It allows analysts and researchers to delineate a portfolio’s inherent randomness or the anticipated level of surprise.

Entropy can guide asset allocation and rebalancing strategies by helping identify when a portfolio has become too concentrated or when the distribution of investments has drifted from the desired level of diversification. By calculating entropy at regular intervals, portfolio managers can detect shifts in diversification and take corrective action by reallocating assets to maintain an optimal balance.

Some advanced strategies use entropy alongside machine learning algorithms for dynamic asset allocation. These approaches adaptively adjust portfolio weights to maintain high entropy while responding to changing market conditions, improving long-term portfolio stability.

The Main Issue

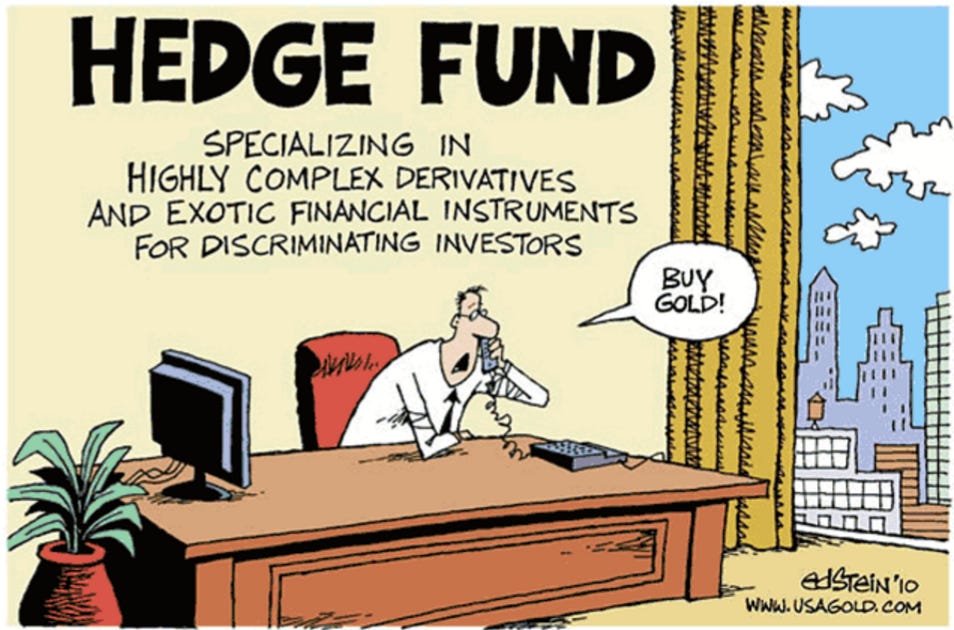

The primary challenge associated with the application of entropy lies in its calculation. Within the analyst community, there are various theories regarding the optimal methods for implementing this concept in the realm of computational finance. For instance, in the context of financial derivatives, entropy serves as a mechanism for identifying and mitigating risk. The conventional Black-Scholes Capital Asset Pricing Model (CAPM) posits that all risks can be hedged, suggesting that all risks are quantifiable and manageable.

However, this assumption does not always reflect realistic market conditions. Entropy can be utilised and expressed by a variable that removes the randomness inherent in the underlying security or asset, thereby enabling the analyst to isolate the price of the derivative. In essence, entropy aids in identifying the most suitable variable to define risk within a specific financial system or instrument arrangement, typically one that aligns closely with physical reality. This can be illustrated through the use of probabilities and expected values.

Although the calculation methods are continuously evolving, the objective remains evident: analysts are increasingly leveraging this concept to develop enhanced methodologies for pricing complex financial instruments.

Thanks for shining light on an important concept. Entropy can help us find regularity in the natural disorder of the markets.

https://open.substack.com/pub/cedarshillgroup/p/chg-issue-143-finding-order-in-disorder?r=1qscct&utm_medium=ios

Lucid thinking. I first heard the entropy from a bean trader working for Continental Grain in the late 70s. He said it was an irreversible force acting on your P n L when you are winning. He was also the first guy I met that charted his P n L by hand during the session and often dispassionately liquidated his entire account. He selected trades carefully but treated his account as a single entity.