Europe's MAG11 That You've Never Heard Of

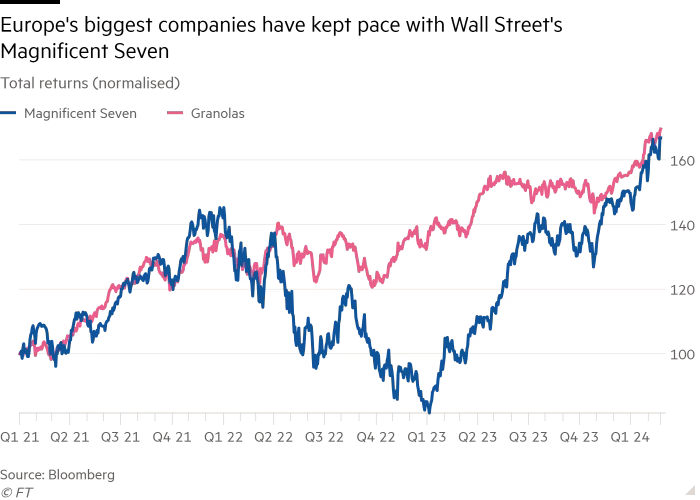

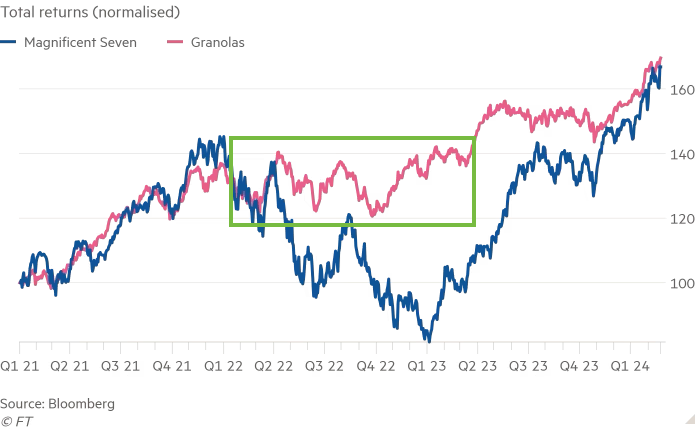

They have kept pace with the MAG7 and done so with considerably less risk.

The main European index, the Stoxx 600, notched a new all-time high last week, the first new high since January 4th, 2022. But much like many years before this one, European markets have trailed that of their big brother across the pond.

With only a 3.62% gain YTD, it trails the performance of the S&P 500 (6.22%) and the Nasdaq 100 (6.69%). We can also look to other parts of the globe and see Japan’s Nikkei 225 index up 17.26%.

However, there are a handful of European stocks that are gaining an increased amount of attention, even acquiring a title as a Magnificent Seven (Mag7) challenger.

If you haven’t heard about this group already, we introduce you to ‘GRANOLAS’.

GRANOLAS

Although much more time has been spent in the wings of the show as the Mag7 took the spotlight, things are starting to change. Granolas has been the tailwind for European markets to make new highs… much the same as Mag7 has in US markets.

Who makes up ‘Granolas’? Goldman Sachs coined the acronym for pharma companies GSK and Roche, Dutch chip company ASML, Switzerland’s Nestlé and Novartis, Danish drugmaker Novo Nordisk, France’s L’Oréal and LVMH, the UK’s AstraZeneca, German software company SAP and French healthcare firm Sanofi. (For the rest of this article, we will refer to the groups as either G11 or Mag7).

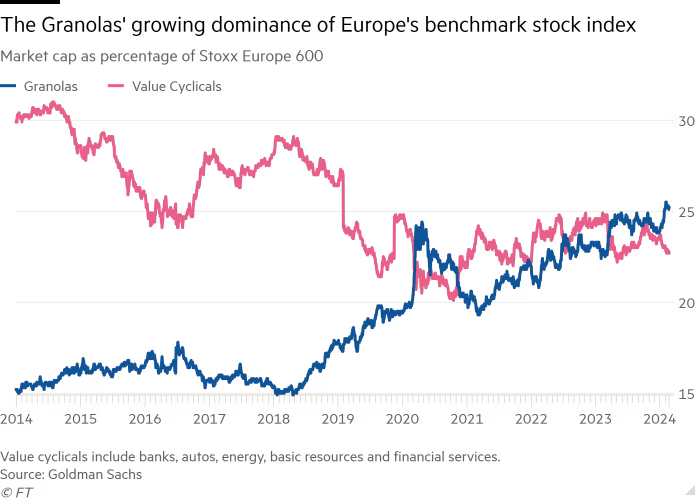

The G11 group accounted for 50% of the Stoxx Europe 600 index over the last 12 months. The total weight of the eleven companies now equates to 25% of the index (a fairly similar number to the Mag7’s 28%).

But one area where the two divide is the total market cap. A combined total of $3T for G11 is dwarfed by the $13T from the Mag7. It really puts into perspective the immense size of the US group. The leader of the pack, Nvidia, has a market cap of $2T (two-thirds of the entire G11), gaining almost $800B just this year.

So, on a performance front, it is an interesting debate to look into. But when it comes to the value of the groups, Mag7 is in another league and will likely be so for a long time to come.

That explains a brief summary of the two. Now, let’s look a bit deeper into Europe’s newest vogue.

A small ask: If you liked this piece, we’d be grateful if you'd consider tapping the ❤️ above! It helps us understand which pieces you like best and supports our growth. Thank you!

Beta

The reason behind G11 being able to compete with Mag7 on a performance level is to do with the reduced beta that European stocks have in general.

Beta (β): A measure of the volatility, or systematic risk, of a security or portfolio compared to the market as a whole.

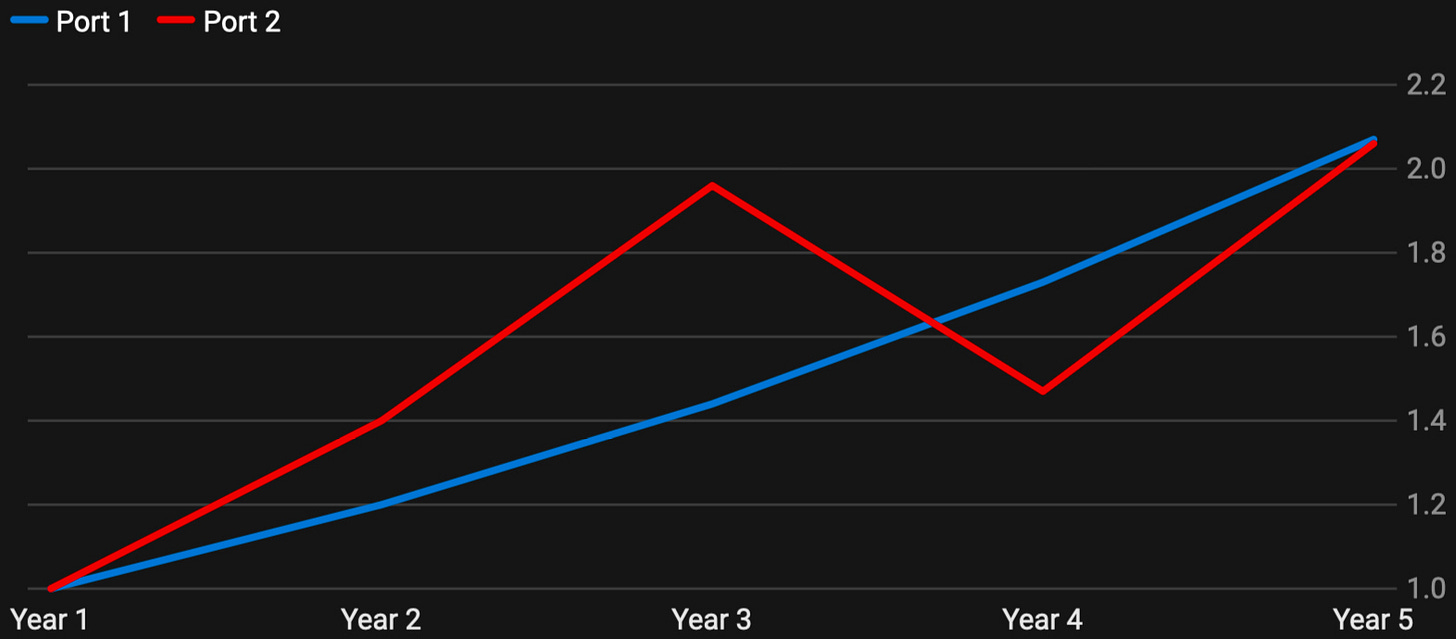

Protecting your downside risk has a wonderful effect on your compound interest in the future. It potentially has a bigger impact than most realise. Here’s a question for you: Out of the following two portfolios, which one would you take?

Portfolio 1 - 20% annual return for five years.

Portfolio 2 - 40% annual return for four years, with one year of a 25% drawdown.

Your system one brain might instinctively go with the second portfolio. The 40% is significantly larger than the 20%. And it only has one year of drawdown, which is a fraction of the average return from the other years…

Regardless of choosing the first or second portfolio, you finish the five years with a healthy return. One nets you a 107% return, the other a 106% return. But it is actually the 20% portfolio that generates the greatest alpha. Why? Because it avoided the drawdown.

Here’s the chart:

Also, it doesn’t matter what year the 25% drawdown happens. It can be year one or five. The end result is the same.

It’s an interesting concept to keep in mind as a retail investor. Recall to mind Warren Buffett’s number one and two rules of investing - “Rule number one: never lose money. Rule number two: never forget rule number one.”

What has this got to do with our new friend Granolas? 2022 saw US markets decline by the fourth largest amount this century. The Dot-Com Crash and the Great Financial Crisis (along with the very quick pandemic crash in 2020) are the only pullbacks that are bigger.

The 27% crash in the S&P 500 and the 37% crash in the Nasdaq 100 were eclipsed by the more-than-50% decline in the Mag7 from market top to bottom. In comparison, the G11 remained rangebound for that period with a max drawdown of just 15%. (green square on chart)

Before we continue further, we wanted to highlight a recent article from Conor Mac that spoke more on the fundamental side of Granolas. It’s a good write-up and worth the read.

What about future returns?

The Mag7, and now the G11, have shown us that a concentrated portfolio of the strongest and biggest names is an attractive one for investors. After all, the benchmark is hard to beat (hedge funds know this all too well after an average return of 8% in 2023 compared to the S&P 500’s 24% return). Both the G11 and Mag7 had a CAGR of nearly 20% (2021-2023) compared to the S&P’s average of 10.4% over the last 20.

Stanley Druckenmiller said, “Put all your eggs in one basket and watch the basket very carefully.”

When looking at the potential for either the Mag7 or the G11, there are a few things to consider.