FX: Why It's Not The Right Time To Short The USD

The US Dollar Index (DXY) is down 10.6% from the peak last September. Positive risk sentiment so far in 2023 has pushed it lower, but we feel it's not the time to add short positions.

The USD remains a high yield, good quality asset for investors

Plenty of risks still present that warrant buying USD as a hedge

Long-term USD decline forecasted, but timing the entry is important

There’s no denying the fact that the DXY looked invincible back in Q3 of last year. It was trading at levels last seen in 2002, with a mix of reasons ensuring that it simply couldn’t fall in value.

This included the meteoric shift in monetary policy from the US Fed, that was comfortable in hiking by 75bps (with some mulling over 100bps) in a single meeting. This gave significant value to the dollar as a place to gain valuable yield, at a time when other countries were behind the hiking curve.

The best visualisation of this can be seen with USD/JPY, mirrored with the yield differential between the US and Japanese Gov Bonds. The strong correlation between the two highlights the key driver.

Another key factor that supported the strong dollar was that other currencies didn’t look that appealing. The UK was changing Prime Ministers and Chancellors seemingly every month, the Eurozone was struggling under Putin’s economic blackmail and China was still in lockdown mode.

What has changed recently?

The sell-off in the dollar can be put down to various reasons. Firstly, US inflation has started to roll off rapidly. This is shown below, with it shedding over 0.5% for the past couple of readings. Lower inflation eases pressure on the US Fed to raise rates, decreasing the yield potential of holding dollars.

Add into the mix the easing of Covid-19 restrictions in China. This re-opening came quicker than many expected. It helps to relieve supply chain problems for manufacturers, as well as boosting workforce participation and efficiency levels. In turn, this helps investors to feel more confident in moving into riskier assets, ditching the safe haven USD in the process.

Finally, we note that from a technical perspective, the DXY was ripe for a correction lower. The rapid pace of appreciation in 2022 ( it was up 20% for the year at one point) is unusual in the currency markets. The DXY itself was flagging up on traditional indicators as being overbought. Therefore, xUSD pairs were also looking very overbought/oversold, including USD/JPY, EUR/USD and USD/CHF.

We’re not out of the woods yet

Despite this correction down to ~102.00, we don’t feel now is the time to short the dollar index.

The inherent risks globally are still high, and we feel the market may be experiencing some misplaced optimism right now.

Take GBP/USD, which has rallied recently to 6-month highs above 1.24. The fundamentals do not support this move continuing higher. UK manufacturing and services PMI’s released earlier this week shown contractionary numbers. The elevated base rate is continuing to put pressure on those re-mortgaging, with payments becoming an increasingly high proportion of take-home pay. This in turn weakens the housing market. On top of all of this, inflation is still running above 10% (10.5% in the latest release). We think this all points to flows moving out of GBP and into USD in coming weeks.

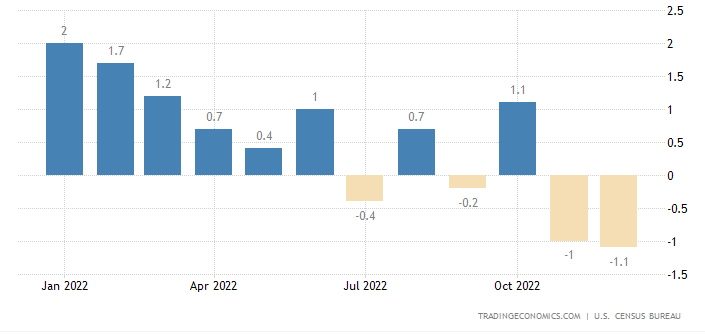

We’re also cautious about the state of corporate earnings that are due out over the next 2-3 weeks. The retail sales readings (see below) for the US have been very poor for Nov and Dec, and we fear this will spill over into the Q4 earnings reports. If we are correct in this thinking, not only will it send US equities lower but it will also see inflows back into USD as a haven.

Some will flag that this would be a short-term move, only relevant for the next month. This is true, but if this causes an X% rally in the DXY, it provides a much better entry point to re-establish short trades than current levels.

There could also be a realisation that the tensions with Russia and the West are not thawing out. The war in Ukraine is far from over, and although we don’t think the situation will go nuclear, we did note the Bulletin of the Atomic Scientists announcing the latest Doomsday Clock time. The impact of Putin and war was one key factor that moved the needle to 90 seconds to midnight, the closest it has ever been.

As a traditional safe haven asset, we think investors will look to allocate funds to the dollar in the short-term to try and compensate for both political and economic risks.

Even if you strip out all the associated risks in the near-term, the appeal of the dollar is there from a high-yield perspective. The projected 5% terminal rate by early spring will put it only behind NZD as the highest yield in the G10 space. This will continue to give it carry trade advantages, where clients buy USD and sell the likes of EUR, CHF and JPY to pick up income.

Let’s not forget the overlay implications for the dollar. Given the relatively depressed levels in equity and bond markets after the 2022 rout, foreign investors likely have to sell X and buy USD to then purchase stocks and bonds. This should be the most pronounced over the next couple of months.

Down, but not out

We feel that the DXY will finish 2023 lower than it is now. Yet we don’t feel that now is the time to jump in. Rather, we anticipate a short-term move back higher in the index in coming weeks/end of Q1. At that point, we feel there will come a time to get a good entry point to establish short positions.

Stay up to date

We bring you market updates on stock sectors and commodities every Wednesday and keep you in the FX loop every Friday. These articles can be accessed for free by subscribing below. We would love your support and look forward to bringing you more content.

If you found this article interesting, please tell us what you thought below in the comments and share with friends and colleagues.