Is A Bitcoin Breakout Coming?

Four reasons that suggest a move higher is brewing.

Frequent readers of ours will be aware that we don’t often dedicate piece to cryptocurrency. We acknowledge that we aren’t experts in this ever evolving asset class, as well as acknowledging that Bitcoin and other related coins can often move and exhibit volatility without actually having a fundamental reason that it can be explained by.

Despite this, we did want to explain some reasons behind why we think that Bitcoin could do well through to year-end.

Trading cryptocurrencies carries a high level of risk and may not be suitable for all investors. Before deciding to trade cryptocurrency, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Nothing mentioned in this article constitutes investment advice or a recommendation to buy or sell.

A Trump Trade

Earlier this week, we released our U.S. Election Trading Primer. In it, we outlined actionable ideas for both a Trump and a Harris victory. However, we didn’t specifically say who we thought would win.

We don’t want to endure the wrath of anyone, as we are politically neutral. Yet, if you had to hold a gun to our head right now, we’d say that Trump is more likely to win.

On that basis, one of our favourite Trump trades is to be long crypto. As we flagged up:

“Of the two candidates, Trump has definitely been the most pro-crypto, with a notable appearance and speech at the Bitcoin 2024 conference in Nashville. Amongst some of the soundbites from the conference, Trump said that he would make America “the bitcoin superpower of the world” and that “my job will be to set you free.”

Trump has also stated that he would fire U.S. Securities and Exchange Commission Chair Gary Gensler “on day one” of his presidency. This doesn’t actually appear to be plausible, but the sentiment behind the message is clear.

In terms of putting this trade into action, we definitely feel that some of Trump’s winning probability has already been priced in the current Bitcoin levels.

However, the coin is clearly in a holding pattern that does appear to want to break higher, and a Trump victory could enable the coin to snap above the lower-highs trend line (currently just below $70k). This would likely see even more fast money pile in. Beyond the ATHs, the next psychological level would be $100k.

Based on the technicals, we’d leave a limit order to buy Bitcoin at $63k, targeting a break higher with a stop at $59k.”

The Technical Picture

Although we touched on it above, the techs behind Bitcoin warrant a section by itself. First, take note of the daily chart:

Since the rally stalled in early March, we believe the coin has been forming a bull flag.

This is characterised by lower highs and lower lows. Yet this appears to be coming to an end, with lower lows being traded over the course of the past month or so. We might be trying to get too greedy by placing a limit order, but if we do get one more move lower, this is where we’d be keen to get involved.

From here, we’re looking for a breakout higher, with a move to $70k likely enough to establish the start of the second breakout. Granted, charting patterns look better with hindsight, and we’ll only know if this is a bull flag in the next month or so.

Yet it makes sense to be a buyer before the breakout, as any move higher will likely see other technical indicators triggering buy signals, as well as an inflow of buying activity from tech based algos.

In terms of targeting a take-profit level, the last (albeit shorter) bull flag from February saw the breakout move higher by around 44%.

If this was to occur again from a $70k base, the percentage gain would take us to just under $101k by year-end.

Investor Flows

We’re seeing strong inflows into BTC ETFs, with $1.5bn taken in on the iShares Bitcoin ETF in the past six trading days (dating up to Oct 22nd).

Of note, those figures alone would make the fund a top 5 (out of 570) ETF launch so far this year. Let alone the total fund assets since launch, depicted below:

It’s also key to note that the opening up of the ETFs has allowed hedge funds and more sophisticated investors to get involved.

Here are some of the big names on the Street that have added the iShares ETF:

Alicia Kao, MD for cryptocurrency exchange KuCoin, recently touched on this, noting that:

“Nearly half (47%) of traditional hedge funds now have exposure to digital assets, have presented a marked increase from 29% in 2023 and 37% in 2022. Furthermore, 67% of those hedge funds plan to maintain their current exposure in digital assets, while 33% intend to increase their digital asset investments by the end of 2024, indicating growing institutional confidence and contributing to significant inflows into Bitcoin ETFs.”

How does this impact our short-term view? Well, should we see continued inflows and buying that the recent trend suggests we are seeing, fast money is likely going to exacerbate this and push the price even higher. With approvals now in place for any of the above institutions to buy the spot ETFs, it’s much easier and faster for new exposure to be added.

Cross-Asset Correlation

Finally, we note that some crypto experts are looking at other assets to get a gauge on when the next move higher for Bitcoin is coming.

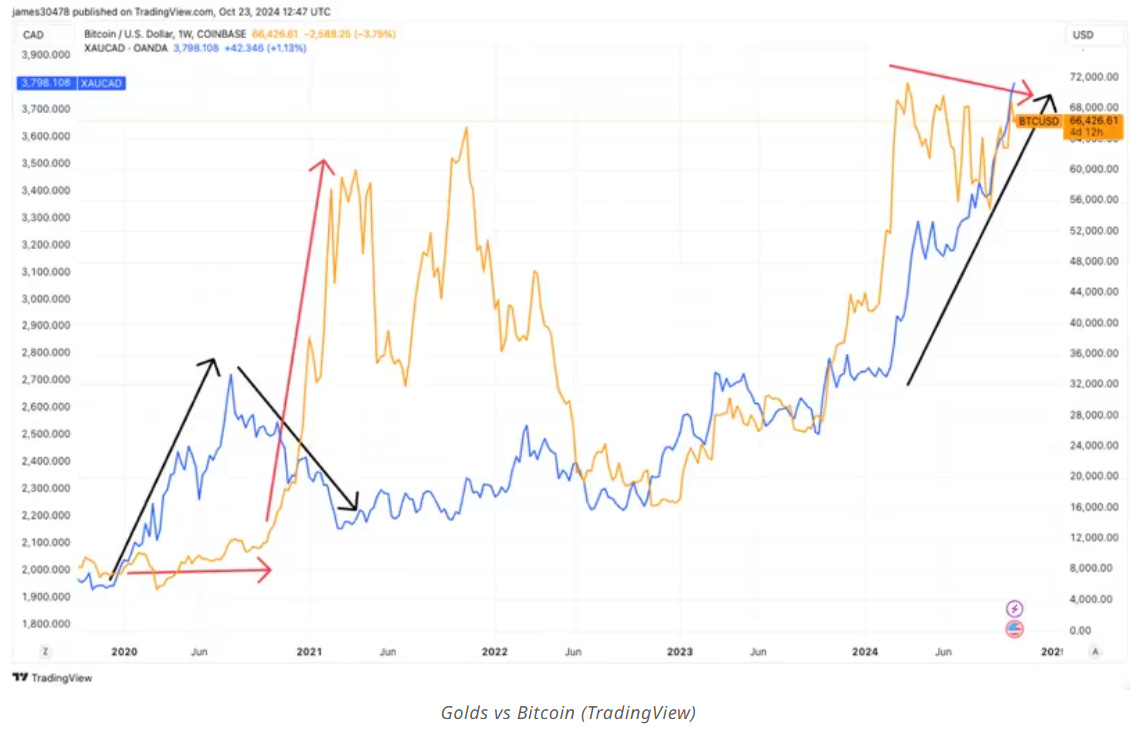

For example, gold. A recent CoinDesk piece from strategist James Van Straten noted that Bitcoin will likely surge to new highs once gold’s bullish momentum runs out of steam. He points to the move back in 2020 (shown below) as a case in point:

Put another way, it was only when gold started to pull back in late 2020 that Bitcoin started to run higher, suggesting a rotation trade exists.

Don’t get us wrong, we’re still bullish gold, but feel there will inevitably be some profit taking before year end. If this stalls momentum or if profits head into something like Bitcoin as a rotational play, the above theory could hold true.

Gold moving higher isn’t a bad sign, anyway. In an interview with CNBC Squawk Box on Tuesday, hedge fund legend Paul Tudor Jones outlined that he’s bullish on both Bitcoin and gold, using them as effective tools to protect against inflation.

When we put the four reasons together, we feel there’s enough there to outweigh the risks for a sharp move lower. On that basis, we’re looking to add exposure directly via Bitcoin into our Global Asset Portfolio, which you can see here.

Trump isn't really pro anything, he just likes that crypto is unregulated so he can grift through it.