September saw a new chapter in the macro regime as the Federal Reserve started their descent from elevated monetary policy rates. Volatility in oil markets continued, which have been heightened as October gets underway. Of course, China took the headlines in the closing weeks, setting a strong tone for emerging market allocation.

In this article, we’ll review the performance details of our Global Asset Portfolio and explain what we bought and sold, as well as our positioning for October. To join the team at AlphaPicks and benefit from this article and the rest of our research, you can manage your subscription here.

September

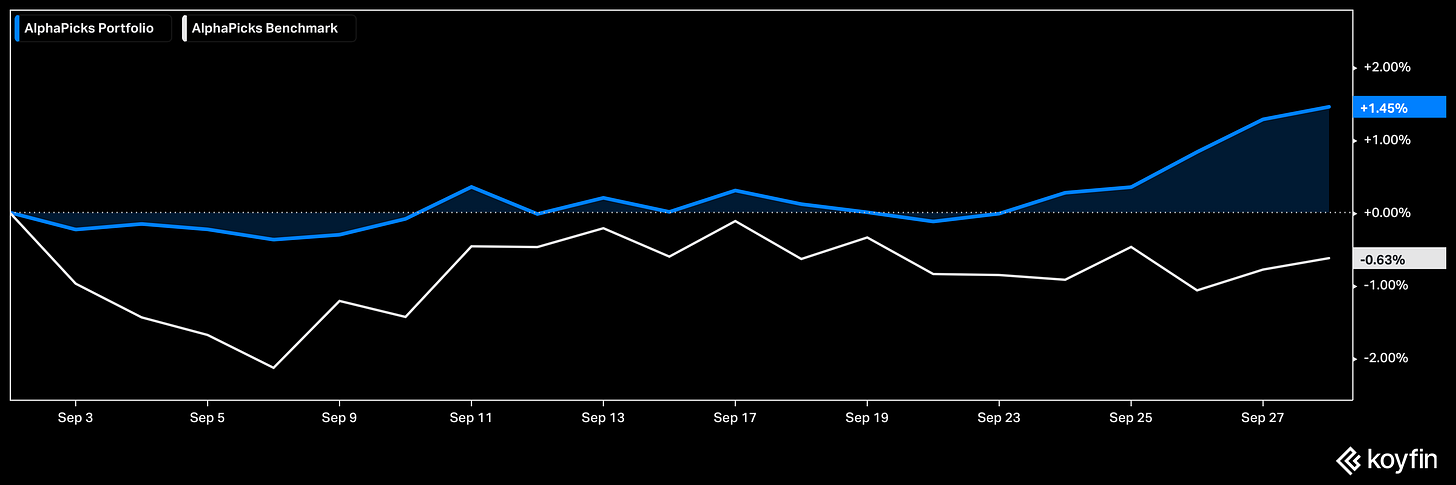

Last month, the portfolio made a 1.45% return, outperforming our benchmark by 208bps, with low volatility/drawdown. Allocation across bond markets and our positions in commodities and China equities led this this return.