Levels Not Seen Since...

This week, we've seen it all from 2020, 2007 and even 3000 BC. Everything seems to be at a level not seen before.

To be honest, the phrase is starting to annoy us. Yes, the headlines are true. These aren’t levels seen since X, Y or Z. But let’s break down what is actually worth noting at a new high and what noise to ignore from those enticing titles.

(and yes, we know we’ve used the title ourselves, but more out of irony than anything else)

Level not seen since… 2009

High Grade Yields

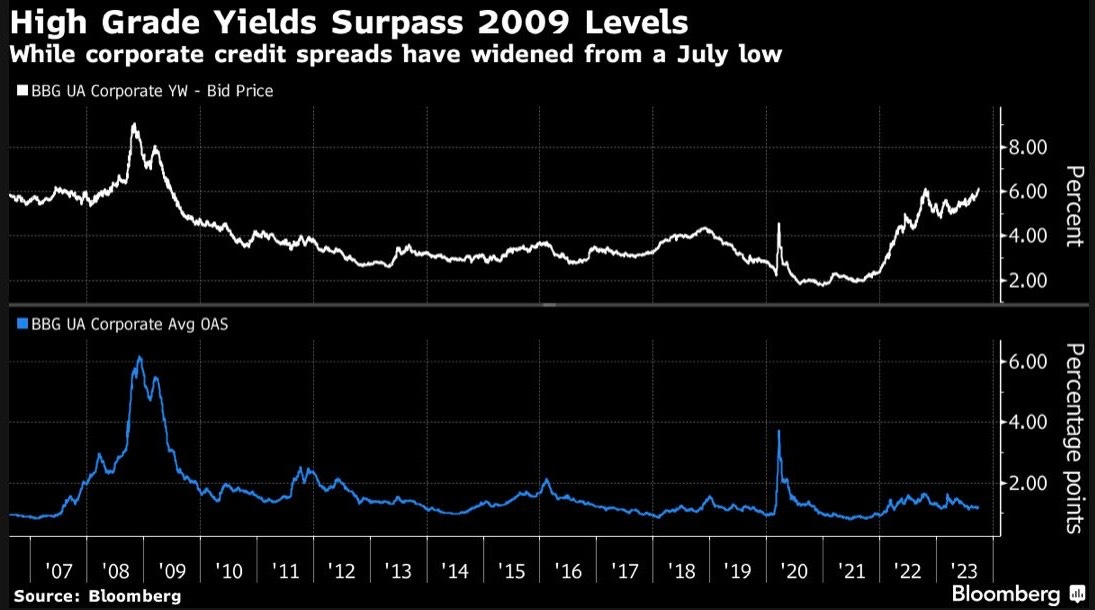

Blue-chip bond yields have surged to the highest level since 2009 as Federal Reserve members continue to point toward an additional interest rate hike this year and a higher-for-longer regime.

The average US investment-grade yield-to-worst stood at 6.15% on Monday, surpassing last year's high of 6.13%. Among the factors driving the rise in yields are “concerns around the fiscal picture,” according to Winnie Cisar, global head of strategy at CreditSights, referring to the swelling federal budget deficit.

Also pushing yields higher are “expectations that the Fed is on hold at higher policy rates for an extended period,” as well as “the dollar strength, which makes buying US fixed income less attractive on an FX hedged basis for a lot of non-US investors,” Cisar said.

At the same time, spreads for high-grade borrowers have widened 11 basis points since hitting a 2023 low of 112 basis points at the end of July. Partly contributing to the widening is the ongoing selloff in the rates market - driven by persistent inflation - which saw US Treasury yields soar to the highest levels in more than a decade. At least two potential issuers called off sales in the high-grade market Tuesday amid the volatility, extending the uncertainty seen last week as deals face higher attrition rates and lower book orders.

As a result of the central bank's hawkish pause in September, investors are betting that the Fed will hold interest rates above 5 for longer than anticipated and may be considering another rate hike this year, which would put more pressure on the bottom lines of corporate borrowers.

Meanwhile, the year-to-date cumulative returns for high-grade corporate debt in the United States have decreased by 0.75%. Returns on debt with a AAA rating, which represents the topmost tier of investment-grade bonds and is particularly influenced by interest rates, have seen a decline of 1.07% for the year.

Level not seen since… 2007

Long Dated Treasuries

Also moving higher is the 30-year Treasury yield. Trading at 4.9%, we haven’t seen these kinds of levels since 2007.

In the short term, yields have pushed higher thanks to solid JOLTS data, with positive expectations for NFP data on Friday also in view. The strength of the labour market is a factor at play in showing resilience in the US economy.

Not only this, but it shows to a certain extent that the US can withstand higher real borrowing costs.

Last week we ran through Bill Ackman’s trade on shorting the US 30-year in detail, which is well worth a read if you haven’t already:

Levels not seen since… 3000BC

Low rates

This one is less serious and more fun. But it is another example of a “level not seen since” that came across our timeline this week.

Rates are coming off 5,000-year lows. Maybe we should have been more grateful for 2% in the 2010s.

A friendly reminder: You can subscribe for free to our page if you’re new. We’re a reader-supported publication, so any help is appreciated. But you can also access our premium content for free. How? There’s just two steps….

1. Share AlphaPicks on Wall Street. When you use the referral link below, or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1 month comp for 5 referrals

Get a 3 month comp for 10 referrals

Get a 6 month comp for 20 referrals

There’s two more “levels not seen since” to note for equities and currencies that we will look at in the rest of this article.