Merz's Bund Bomb

How to remove the debt brake, and what the market implications are.

Yesterday, the Bundestag reconvened for a special session to debate the required legislation to remove the debt brake to free up the potential for large-scale spending.

Over the past two weeks, Germany has unveiled plans to significantly increase bond issuance to fund defence and infrastructure projects, marking a notable shift from its traditional fiscal conservatism. Friedrich Merz, the anticipated Chancellor, is leading the initiative to increase state borrowing. We’re talking about big numbers here, with the removal of the historic ‘debt brake’ allowing for over €1tn in spending directed towards defence and infrastructure. This includes a €500bn infrastructure fund and exemptions for military spending exceeding 1% of GDP from debt limitations.

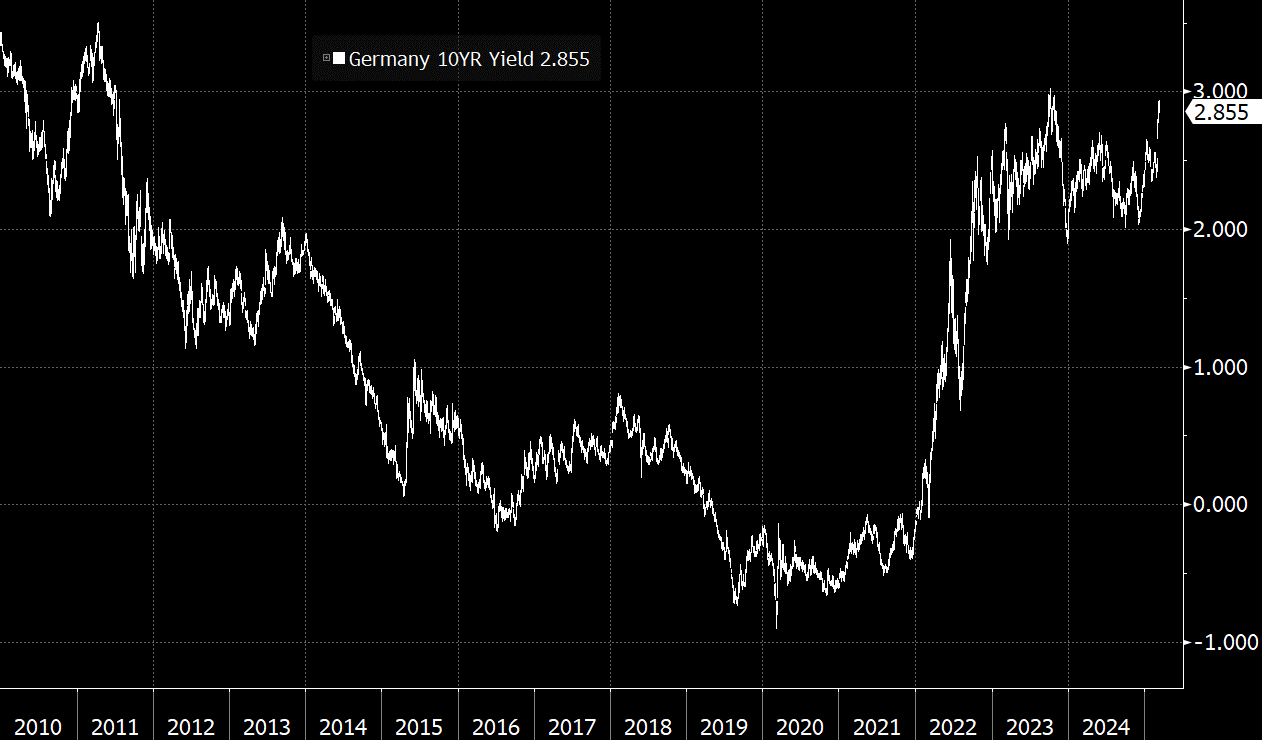

The 10yr bund yield has spiked off this news, closing in on 3%. Should it manage to push to 3.04% it would be the highest since 2011, a point at which the EU was just starting to recover from the financial crisis.

Merz’s Spending Plan

This contrasts sharply with the campaign pledges that Merz and the rest of the CDU/CSU made, where limiting spending was more on the menu. Yet the world can change quickly, as evidenced by the U.S. putting pressure on NATO members to increase their defence spending or be left without U.S. support.

We wrote about the market implications of this (and equity ideas) back in late January, which can be read below:

The spending plan is split into two separate areas. The first one is defence, as we briefly mentioned above. This initiative seeks to bolster Germany's defence capabilities and contribute to European security.

The second relates to infrastructure investment. Merz proposes a €500bn investment in infrastructure projects, targeting the modernisation of transport, energy, and digital systems. Ultimately, this will aim to stimulate economic growth which the country so desperately needs right now.

In order to get the ball moving, Merz needs to target the removal of the debt brake…

Schuldenbremse

The debt brake (which sounds much cooler in German: Schuldenbremse) is a constitutional fiscal rule introduced in 2009. The main purpose of it was to limit government borrowing and ensure long-term fiscal discipline. The details basically restrict the federal government’s structural budget deficit to 0.35% of GDP per year. State governments are required to maintain a balanced budget with no new borrowing.

The rule was adopted after the 2008 financial crisis to prevent excessive debt accumulation and ensure sustainable public finances. It is embedded in articles in the German Basic Law, making it difficult to change.

Yet this is exactly what Merz is trying to do and is being debated right now. There are three main ways he could do it:

Amending the Constitution

Since the debt brake is a constitutional rule, removing or permanently altering it requires a constitutional amendment. This means securing a two-thirds majority in both the Bundestag (lower house of parliament) and the Bundesrat (upper house, representing federal states).

This is politically difficult, as opposition parties—especially the Greens and FDP —may resist changes. We’ve already seen headlines earlier this week with this:

Declaring an “Emergency Exception”

The debt brake allows temporary suspensions in times of severe economic crises or emergencies (e.g., COVID-19 pandemic, Ukraine war). To bypass the limit, the government must declare an “exceptional emergency” and obtain Bundestag approval. This approach has been used before but is controversial, as it was originally intended for short-term crises, not long-term spending plans.

Using Off-Budget Funds and Special Accounts

The government can circumvent the debt brake by setting up off-budget special funds that do not count towards the regular deficit. Germany already used this method to create the €100bn defence fund in 2022. Merz could propose similar funds for infrastructure or defence, but this could face legal challenges from Germany’s Constitutional Court.

We feel the first option will be tried and stands a decent chance of being successful. Failing that, option two is more likely to work than the third option.

Bund Response

It’s very telling to us that bund yields have spiked even before the debt brake has been removed and further details of the planned spending have been announced. It shows us that investors are taking this very seriously and see a high likelihood of this package being pushed through.