“All the greatest things are simple, and many can be expressed in a single word: freedom; justice; honour; duty; mercy; hope.”—Winston Churchill

Welcome to the AP Research monthly market update, a rundown of global markets for the coming weeks in under ten minutes (if you’re a fast reader).

Here’s what you need to know…

If you are not yet a premium subscriber to AP Research, you can manage your account here.

Macro

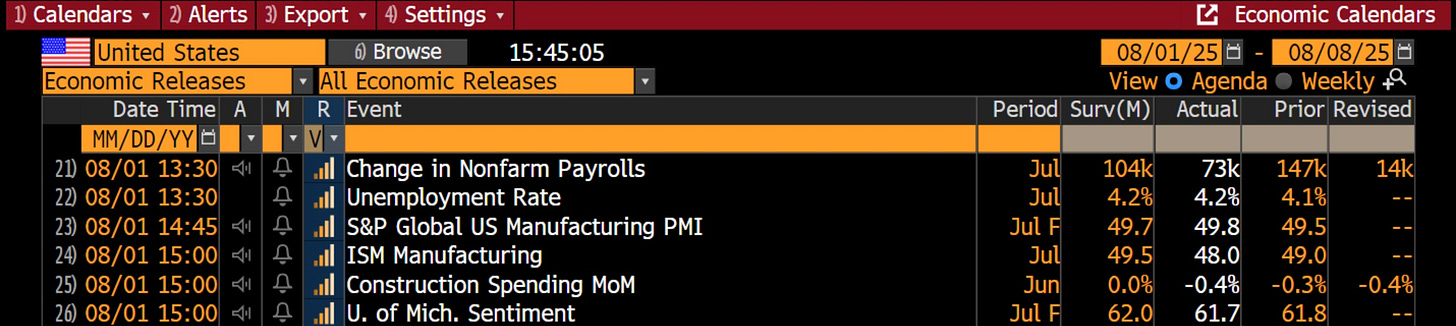

The soft landing narrative took a hit in July. What began as a resilient run of economic data in H1 has turned more ambiguous, with recent US releases showing cracks across labour, services, and sentiment. ISM Services fell below 50. NFP revisions were brutal. Even the inflation surprise came on the disinflationary side. Growth may not be falling off a cliff, but it’s no longer outpacing expectations.

This is more than just a shift in tone. The combination of weak private payrolls, downward revisions, and easing inflation prints resets the balance of risks around Fed policy. Markets are once again flirting with a September rate cut. But the deeper story is about fragility. Momentum is fading at the margin, and soft data leads positioning. Traders are no longer pricing upside growth with the same conviction.

We released further thoughts on the US macro landscape in Friday’s note. That can be read below:

Flipping the Macro Script

After months of resilience in US data, July’s nonfarm payrolls miss, combined with deep revisions to prior months, has pulled the employment side of the Fed’s dual mandate back into the spotlight. Treasury yields fell sharply, the dollar gave up gains, and equities sold off… A narrative shock for a strong-stanced Fed.

Globally, macro divergence is intensifying. Japan is back in play, but for all the wrong reasons. While equities have staged a relief rally on trade deal optimism, the post-election fiscal picture is increasingly cloudy. Real rates remain too low, CPI remains above target, and the BoJ is stuck between a rock (political gridlock) and a hard place (rising US pressure over JPY weakness). Japan’s structural reflation is still a work in progress, with markets beginning to price more volatility in response.

In the UK, the story is deteriorating further. Stagflation is not just a talking point—it’s the baseline. Growth is flatlining. CPI remains elevated. And fiscal arithmetic is tightening. The new Labour government is learning that tax hikes are the only politically palatable path forward, but the market is watching for signs of slippage or backpedalling. Confidence in UK macro is brittle, and rightly so.

Equities

Most major global equity benchmarks posted a positive gain for July, although performance tailed off in the last few trading days of the month.

Before we get to the end-of-the-month antics, let’s focus on the main catalyst that aided stock performance, namely corporate results. Earnings season for major US companies has been positive.

A sign of investor sentiment was evident when it came to AI-related stocks, with investors rewarding those firms that outlined higher capex spend in this regard. For example, Microsoft popped 9% post-market and Meta pushed 11% higher following earnings releases. Even though some of this was down to solid revenue and EPS beats, a big factor was the push on AI initiatives.

For example, Microsoft plans to spend $30bn in capital expenditures for the coming quarter. If this is kept up, the $120bn annual run rate of spending would exceed that of Alphabet at $85bn. Remember earlier this year when people were scoffing at Alphabet’s spend? How times have changed.

Meta is in a great position, where AI is already helping to boost revenue on the ad side of the business, while pumping cash into the superintelligence team provides optionality for new projects.

If AI is helping to drive the market higher, and the MAG7 is leading AI, there’s a clear case for keeping exposure to this group over the summer.

Another takeaway from earnings season was an apparent lack of tariff impact. One clear case is Sanofi, which described the U.S. tariffs as “manageable” and simultaneously raised its full-year sales growth outlook, suggesting any tariff-induced cost pressures were minor and not materially affecting its performance.

Even Amazon’s CEO Andy Jassy chimed in, saying it’s still unclear “who's going to end up absorbing the higher costs.”

Jassy brushed off tariff concerns, saying the company hadn’t noted diminishing demand or meaningfully appreciating prices at this point in time.

This marks a sharp shift from the previous earnings season, where several major companies decided to pull future guidance altogether due to the uncertainty that existed at that time. The reversal (and overall positive financials) is another boost for investor sentiment in the equity space heading into the late summer.

However, the sell-off to end the month, followed by a 1%+ loss on the first trading day of August for several indices, does show some market fragility. A disappointing set of US data (shown below) didn’t help, with Trump’s antics on fresh tariffs targeting Canada and Switzerland were two catalysts to the price action.

FX

July turned out to be a turning point for the US dollar, even if it eventually turns out to just be a tactical bid.