“What a blessing it is to be tired in the pursuit of a challenge of your choosing.”

Welcome to AlphaPicks’ monthly market update, a rundown of global markets for the coming weeks in around ten minutes.

This month, our guest contributor is Donnie Phillips (@dcpcooks from Twitter), an ex-CME local trader.

Here’s what you need to know…

If you are not yet a premium subscriber to AlphaPicks, you can manage your account here.

Rates

By DCP

With the One Big Beautiful Bill (OBBB) now passed, the focus shifts to Trump’s August 1 tariff deadline. Markets are preparing for what could be a significant shift in inflation dynamics—one that won’t fully register in CPI and PPI data until the fall.

Tariff-Driven Inflation Is the Next Shoe to Drop

The nonfarm payroll data released yesterday underscored just how sensitive markets remain to the jobs-inflation balance. Any lingering hope for a July rate cut was effectively erased.

But with the August 1 tariff implementation date fast approaching, the bigger question is now whether a September cut is still on the table.

We’ll begin to see some early signs of the tariff impact in the July and August inflation reports, but the full effect is likely to appear only in the September and October prints. The Fed may be forced to wait and reassess, especially if headline inflation starts to reaccelerate into Q4.

Treasury Supply and the Inflation Feedback Loop

I expect a large T-bill issuance at the end of the month—likely around $800 billion—as the Treasury replenishes the TGA. This adds another layer of tightening, particularly as the market digests:

Fiscal-driven spend

Tariff-driven inflation

A Fed trying to stay “data dependent” in a noisy environment

Higher bill issuance increases leverage in the system, which could add to inflationary pressures. That could be offset by the Fed selling MBS, but don’t hold your breath.

OIS vs SOFR: Diverging Views on Cuts

While markets have priced in multiple rate cuts this year, options market implied cuts and OIS curves are now offering fewer cuts than SOFR futures or broad market sentiment suggests post non-farm payrolls.

It’s worth noting that Scott Bessent recently remarked that the administration may begin the search for a new Fed Chair this fall—a statement that should be somewhat reassuring that Powell will remain chair despite what I expect to be more mean tweets about the Fed.

What to Watch:

Tariff impact on July & August inflation data

T-bill issuance relative to duration and bid-to-cover trends

Market pricing for September vs December Fed meetings

The next few weeks could bring volatility and slightly higher yields as supply, inflation, and policy digest news. The market may be underestimating the upside risk to yields and the downside risk to rate-cut expectations.

And from AP…

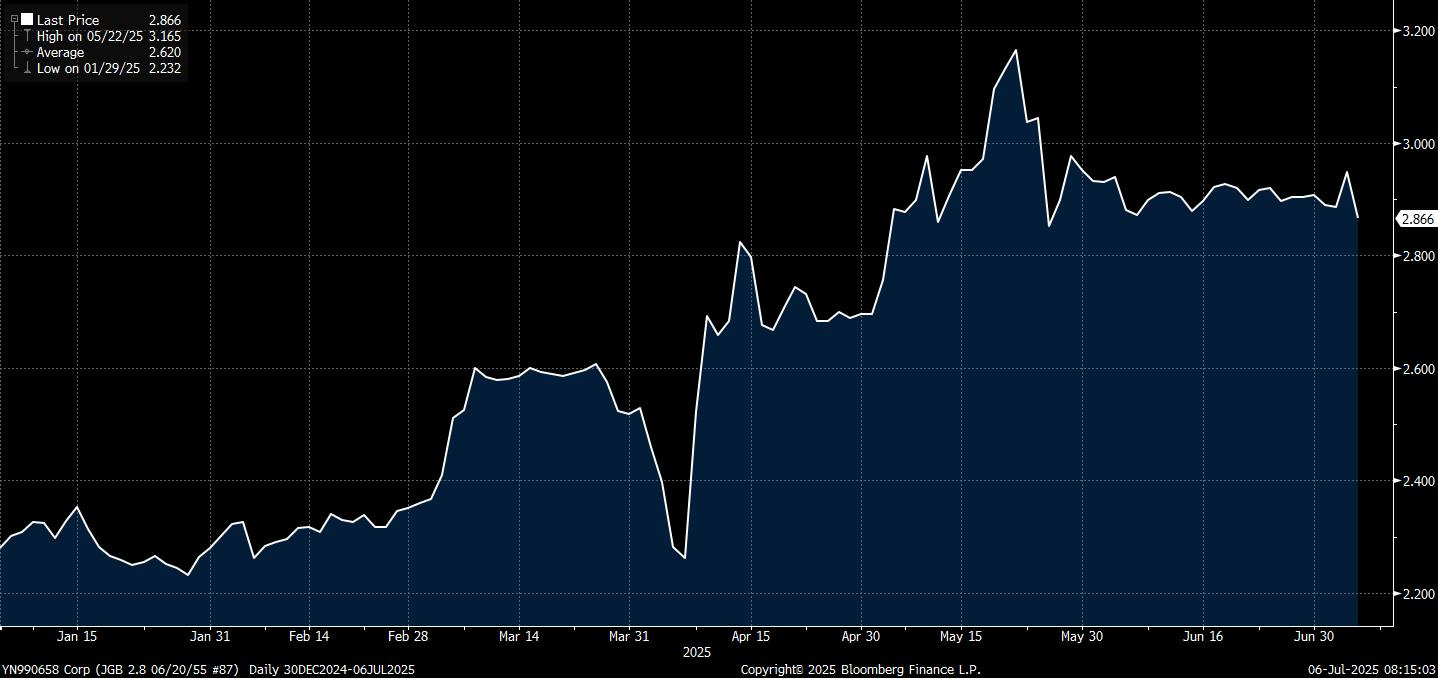

JGB Update: Still Waters, Rising Tension

Since our June 18th note, Japanese yields have held steady, but the quiet belies the pressure building beneath the surface. Volatility has cooled, but only because the market is in wait-and-see mode ahead of the Ministry of Finance’s next move. Super-long JGB auctions remain fragile, BOJ tapering continues in the background, and speculation around a modern-day Operation Twist is intensifying. The 10-year yield may look anchored, but this is a market in transition, not stability. The absence of fireworks is not a signal of resolution, but of coiled uncertainty.

Equities

With the OBBB now signed, sealed, and spun into campaign glory, we expect Trump’s rhetorical pivot back toward tariffs to be swift and deliberate. The fiscal win has been booked. Time to bring the trade war sabre back out of the sheath.

But investors have seen this movie before, and they’re not buying the ending. The “TACO” trade (Trump Always Chickens Out) remains firmly in play. Each tough-talking headline will be met with brief dips and fast recoveries. The reflex is well-worn: threaten tariffs, stir headlines, then pivot to ‘negotiation wins’ before real damage is done. It’s a policy show designed for media cycles, not macro consequences now.

So while volatility may tick up around soundbites, the bigger trend remains: we are still bullish US equities through July.

That said, after the sharp rally post–Liberation Day selloff, the pace of gains may decelerate. Fiscal thrust, AI optimism, and a structurally resilient consumer have already repriced a good portion of the soft landing narrative. The summer grind is now in play. We’re shifting from price discovery to price digestion, with returns harder-earned and more rotational.

Earnings Season: More Noise Than Narrative

With earnings season approaching, positioning will likely turn cautious but not bearish. Barring any true downside surprises, the market reaction should be contained. As Morgan Stanley’s Wilson team pointed out recently, “negative earnings revisions are now in the rear-view mirror,” and markets are more interested in 2026 than Q2 margins.

Tariffs: Fog of War Returns

The most acute risk this month is not earnings, it’s uncertainty around tariffs, particularly for non-US indices. Trump’s post-bill pivot puts trade back at the top of the macro worry wall. But without specific numbers or timelines, it’s hard to model the impact, especially across geographies.

Take Japan: they were first in line for trade talks back in April, but the handshake hasn’t materialised. The Nikkei, which had run hard on both AI optimism and relative policy stability, now faces headline risk. Tariffs on Japanese autos would be particularly sensitive, not just economically but symbolically, reigniting a Reagan-era dynamic in markets already cautious on industrial exposure.

Any hard tariff announcement could knock the Nikkei sharply. But again, the TACO playbook suggests any sharp drawdown would attract domestic pension buying and fast money reversal.

China: Fragile Truce, Real Momentum

Meanwhile, the US–China truce has underpinned a quiet rally in both onshore and Hong Kong indices. No tariffs, no tweets, no tension—just flows, tech optimism, and recovering local liquidity. BofA noted this week that Southbound inflows into HK equities are at a 3-month high, and mainland tech has outperformed MSCI China by over 300bps in the past 10 days.

With the trade war narrative on pause and sentiment recovering from last year’s doom loop, Chinese equities have a window to rerate. Add in the local AI push—now attracting state-banked capital and real VC scale—and there’s a credible case for continued strength.

We remain bullish on China tactically, with a bias toward tech and semis. It’s still a politically fragile rally, but for now, the tailwinds outweigh the tension.

Bottom Line

Trump’s tariff theatrics are back, but so is the well-worn TACO playbook.

US equities are likely to grind higher in July, just with less velocity than post-April.

Earnings could bring some chop, but won’t derail the broader equity story.

Japan’s Nikkei faces near-term risk if auto tariffs are confirmed.

China has regained momentum and remains tactically attractive, with tech and AI leading the charge.

It’s not a quiet summer, but it is a manageable one. For now, risk stays on.