“Things may come to those who wait, but only the things left by those who hustle.”

—Abraham Lincoln

Welcome to the AP Research monthly market update, a rundown of global markets for the coming weeks in (just over) ten minutes.

Here’s what you need to know…

If you are not yet a premium subscriber to AP Research, you can manage your account here.

Macro

September’s FOMC meeting left markets with more than just a single cut. It reinforced the delicate policy balancing act the Fed now confronts. Chair Powell described the Fed’s rate stance as “still modestly restrictive” even after the quarter-point reduction, implicitly leaving room to ease further, should the data justify it. But he cautioned that there is “no risk-free path”: move too aggressively and inflation could reaccelerate; move too cautiously and the labour market might erode. The policy dots from September reflect that tension. While a narrow majority now pencilled in two more cuts this year (in October and December), the forecasts underscore how difficult consensus will be to maintain in a softening yet sticky inflation environment.

That fragility is already visible in the labour market. The ADP private payrolls report for September came in with a surprising -32,000 job loss (following a revised -3,000 in August), the largest monthly drop since March 2023. This weak reading, especially in a month where the official BLS nonfarm payrolls release was delayed by the government shutdown, sharpens scepticism about labour resilience and re-energises the case for further rate cuts. With hiring decelerating even inside private payrolls, the Fed’s “data dependence” posture will be tested more than ever in October.

The unfolding US government shutdown compounds that challenge. With nonessential federal services shuttered, data collection and publication for key releases (particularly the monthly nonfarm payrolls, CPI, jobless claims, and various Census surveys) are already delayed or suspended. For a Fed that now claims it will “move policy if policy is not in the right place,” being forced to act amid data blackouts raises risks. Compounding that, each week of shutdown is estimated to shave ~0.10 % (annualised) off GDP growth via lost government output, and the sentiment drag could amplify those losses if the impasse lingers.

In effect, a protracted shutdown makes the October FOMC decision significantly trickier. The Fed may face pressure from weak forward indicators (like ADP) and delayed core metrics, but must also resist overreacting in a fog of uncertainty. A soft landing narrative becomes harder to defend without clean, timely data; yet impatience to cut could reignite inflation expectations. If the government impasse deepens, the Fed risks acting on noisy signals or lagging indicators, thereby raising the potential for policy missteps. That makes October not just another cut meeting, but a delicate juncture in the Fed’s transition from “data dependent” to “forward guiding” in a less transparent environment.

Equities

Earlier this week, we published our year-end outlook on emerging markets, a segment of global risk we remain constructive on. The full report is available below.

The Emerging Market Mosaic

Emerging markets live in the gap between fragility and opportunity. Right now, that gap is widening. A softer Fed and a weaker dollar are breathing life into battered valuations, even as political risk keeps everyone honest. After a lost decade of underperformance, EM is finally benefiting from liquidity rotation out of the US and Europe. Investors are still structurally underweight, and that under-ownership leaves plenty of room for flows to do the heavy lifting.

Regarding the US indices, the market’s summer resilience has left positioning full but not euphoric, valuations stretched but not unanchored. The next leg will be defined less by momentum and more by execution, particularly in terms of inflation, earnings, and policy. The macro hinge remains the inflation–Fed trajectory: a stabilisation in price pressures would preserve optionality for rate cuts into 2026, reinforcing the soft-landing narrative that has underpinned equity multiples. But persistence, particularly around services or wage inflation, would challenge that equilibrium. The October 15 CPI print is the most consequential macro event of the month, sitting at the intersection of monetary flexibility and market sentiment. In short, the setup is binary, but the balance of forces still tilts constructive into year-end.

With real yields stabilising and the long end absorbing Treasury supply without disorder, financial conditions remain accommodative enough for risk. Inflation’s descent has slowed, but not reversed. The Fed’s messaging has softened (from “restrictive for longer” to “attentive to lags”), a tone that supports multiple expansion so long as macro data remain orderly.

Earnings are now the swing factor. The Q3 reporting season begins October 13, led by the banks, with consensus expecting S&P 500 earnings growth of nearly 19% year-on-year and over 30% in Information Technology. Those are exceptional expectations that require exceptional delivery. Q2’s 11% growth surprised positively, but the hurdle is now far higher. Mega-cap tech’s ability to deliver operational leverage and sustain the AI narrative will set the tone for risk assets into year-end. Leadership breadth remains the key tell: broadening beyond the Mag7 would confirm market durability; failure to do so reinforces fragility. Execution must validate the premium valuations that investors have been willing to pay for AI-driven growth.

Volatility itself remains deceptively calm. Hedge funds and large speculators are heavily short VIX futures, among the most crowded positioning since 2022. Implied vol has reset lower, creating an attractive entry point for institutional hedging, which has quietly increased in recent weeks. The asymmetry is low, as realised vol supports carry and performance-chasing, but it also raises the risk of an abrupt repricing if shocks emerge, such as from inflation data, trade policy, or a surprise miss in tech earnings. Low volatility is not complacency, but it is concentration, and that makes the system fragile.

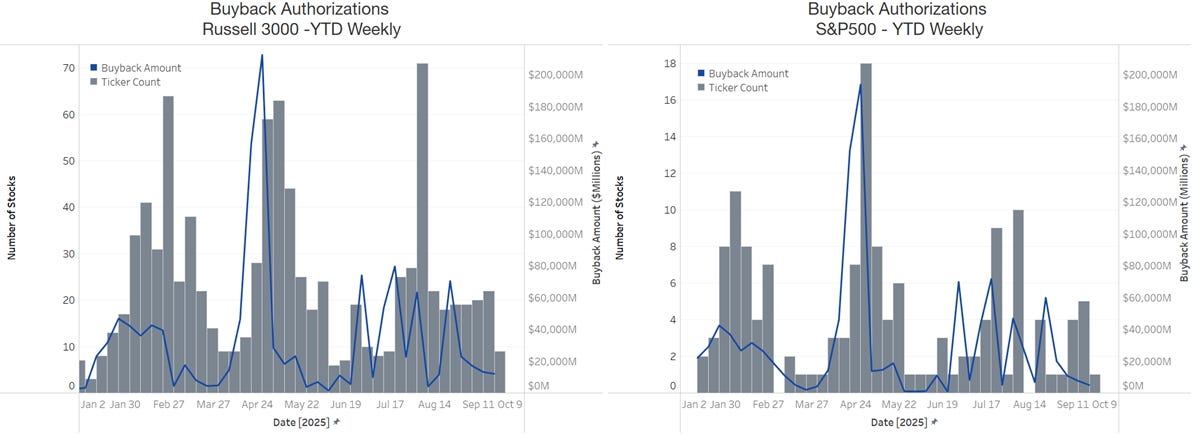

Corporate demand, the quiet tailwind, is temporarily on pause. The buyback blackout window began last week and will last through much of earnings season. But once companies exit blackout, the scale of potential demand is formidable. EventVestor data show over $1.3 trillion in announced authorisations year-to-date, the fastest pace on record. The return of buybacks will coincide with the seasonal pickup in retail demand and the typical late-year risk appetite recovery, creating a synchronised tailwind into year-end.

October itself, however, is the inflexion month. Historically, among the choppiest periods for equities, it tends to mark the transition between correction and rally. Over a century of market data shows that October 26–27 typically marks the Q4 trough for both the S&P 500 and Nasdaq 100. Late-month volatility often gives way to the strongest trading stretch of the year as earnings visibility improves and corporate demand resumes. Retail activity, too, tends to rebuild through October and peak in November, reinforcing the seasonal dynamic. This time should be no different. The path forward likely involves turbulence in the first half of the month as investors digest inflation data and earnings surprises, followed by a resumption of risk-taking once event risk clears and buyback flows return.

Fixed Income

UST