Oil Markets And Opec+ Expectations

Falling oil prices put pressure on further Opec+ supply cuts — all eyes on this weekend's meeting.

On October 11th, we published our thoughts on oil as tensions in Gaza and Israel unravelled. The article highlighted the possibility of Iran’s involvement with tensions and what that would mean for the oil supply.

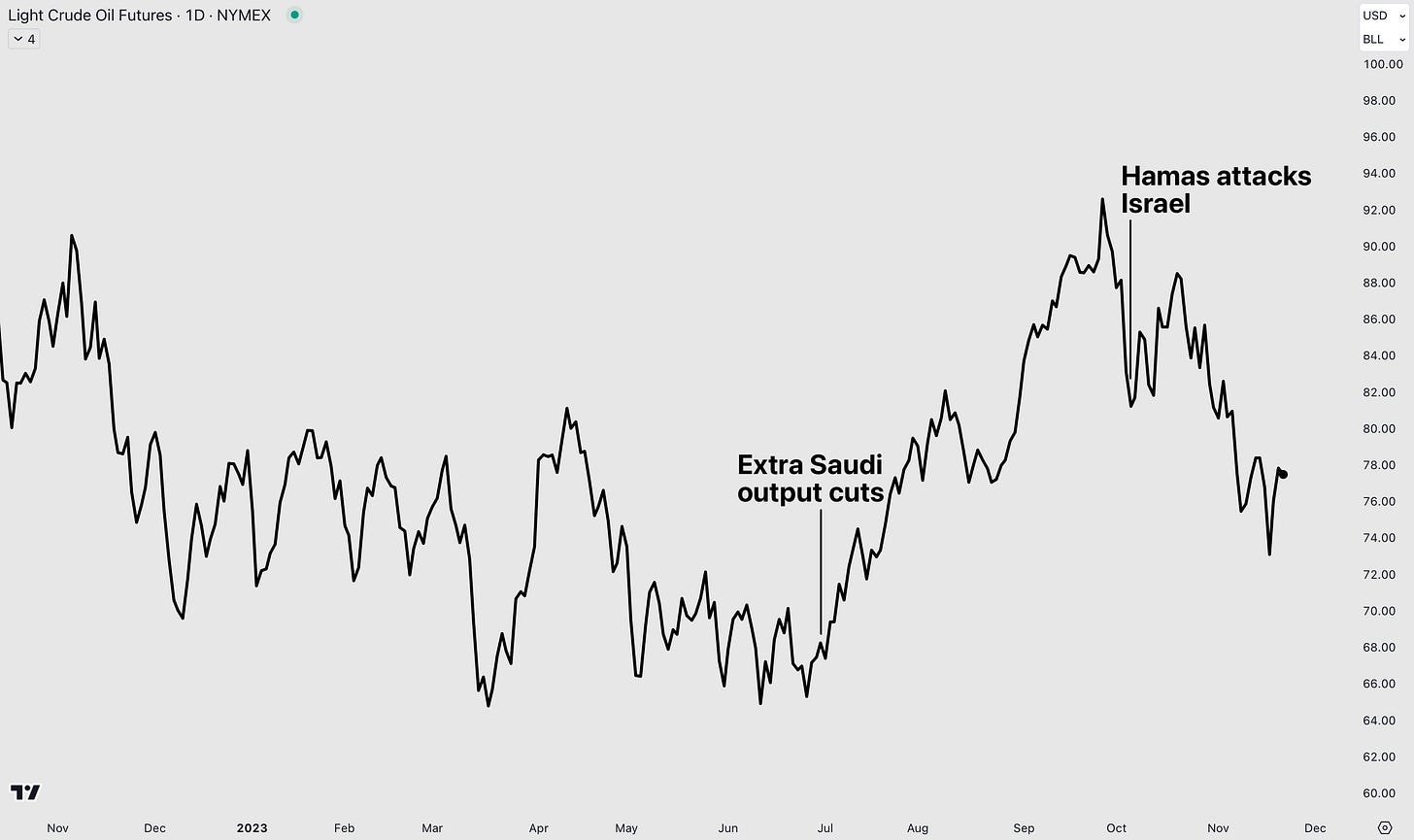

Although oil did have a war premium added (price rallied 10% from the Friday close before the war broke out), it has unwound significantly (-19%) since that high.

One contributing factor is that the conflicts remain contained between the two countries, neither of whom is an oil exporter. However, between early October and now, there has been another factor at play and a factor that will be a crucial interest, particularly this weekend:

Supply and demand.

International Energy Agency

When the IEA released their monthly report on November 14th, it was made clear that upward revisions to demand had been outpaced by increasing supply. Hence, markets started to anticipate that oil wouldn’t be as tight during the remainder of this quarter as they had first thought.

The IEA boosted forecasts for world fuel consumption this year on surprising strength in China and still anticipates a supply shortfall during the fourth quarter. But it will be roughly 30% smaller than previously projected, at about 900,000 barrels a day.

“World oil demand continues to exceed expectations,” the Paris-based agency said in its latest monthly report. Yet “world oil supply growth is also exceeding expectations” as “production growth in the US and Brazil has been outperforming forecasts.”

Crude oil futures fell below $73/bll last week as supply fears receded.

Global oil demand will increase by 2.4 million barrels per day this year, slightly more than predicted last month, to reach a record annual average of 102 million barrels per day. Roughly 75% of the increase will come from record levels of Chinese consumption.

Indications that non-OPEC crude supplies are expanding have buffeted prices in recent weeks, with the gains in production offsetting the impact of collective and voluntary reductions agreed by the Organisation of Petroleum Exporting Countries and its allies, including Russia.

Please be sure to like this post if you have enjoyed it so far. The support is greatly appreciated.

The Recent Advance

Crude fell from just below $90 to about $72.50 during the four-week decline. But the price quickly snapped back to $78.50, maybe because the sell-off was so strong that the price was oversold or because sellers took their foot off the gas as we approached the OPEC+ meeting.

The oil price was also buoyed by the news that Saudi Arabia is considering an extension of its supply cut. We'll let you know more about this later.

Between now and this Sunday's meeting, traders will get fresh insights into US fundamentals by releasing official figures on crude and product stockpiles. US crude inventories have expanded for the past four weeks to the highest since August.