Positioning Through the Noise

A weekly look at what matters and how to trade it. (September 8th)

US equities managed to grind higher in a shortened, volatile week, as markets juggled global yield concerns, heavy month-start flows, and another round of tech-led earnings beats.

Tuesday opened on shaky ground, with the S&P 500 dropping 0.7% as long-end yields rose globally and volumes spiked. The UK was at the core of the move higher midweek. But consolidation midweek came on the back of Broadcom’s strong results and Alphabet’s favourable legal outcome.

On the geopolitical front, Prime Minister Modi’s meeting with Xi and Putin came as China flexed its military muscle in front of the world. The symbolism was deliberate, Beijing signalling both capability and intent, while pulling India closer into the spotlight of great-power politics. For markets, the choreography added another layer to existing trade and security frictions, reminding investors that geopolitics can quickly feed into risk premia.

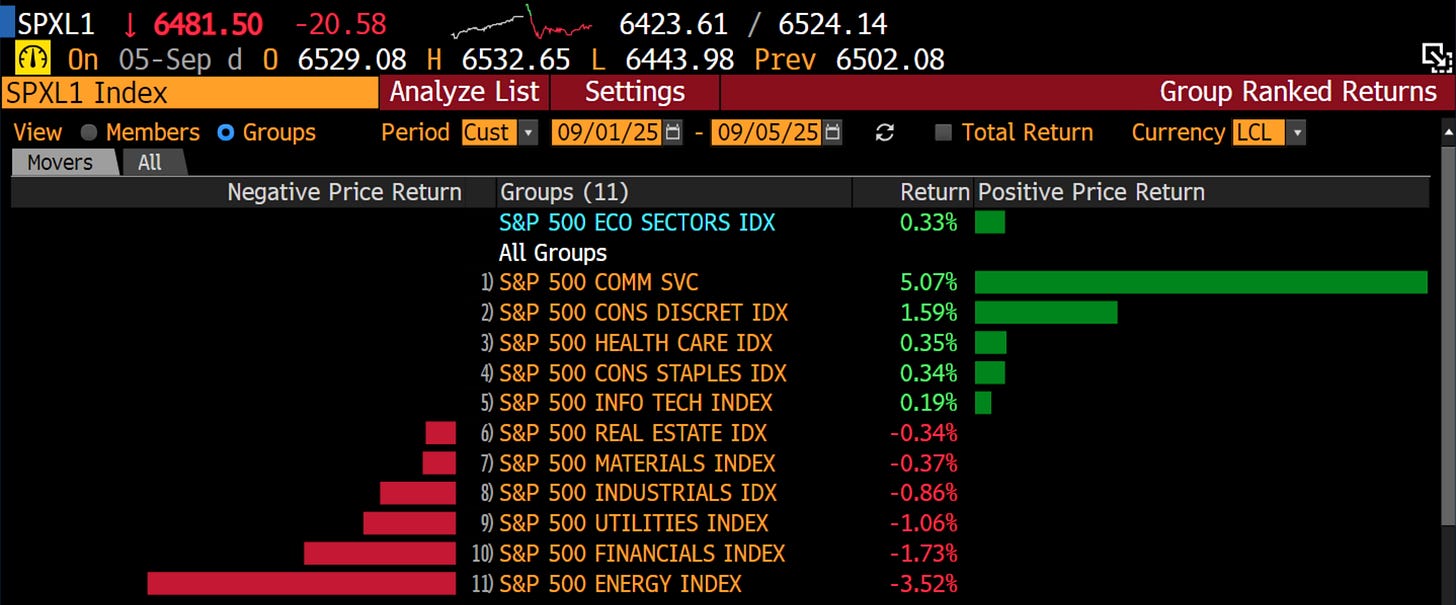

Macro data added fuel, with ISM Services and a weak NFP print reinforcing the case for a September Fed cut. Profit taking into Friday capped the move, leaving Energy and Financials lagging while tech carried the tape higher.

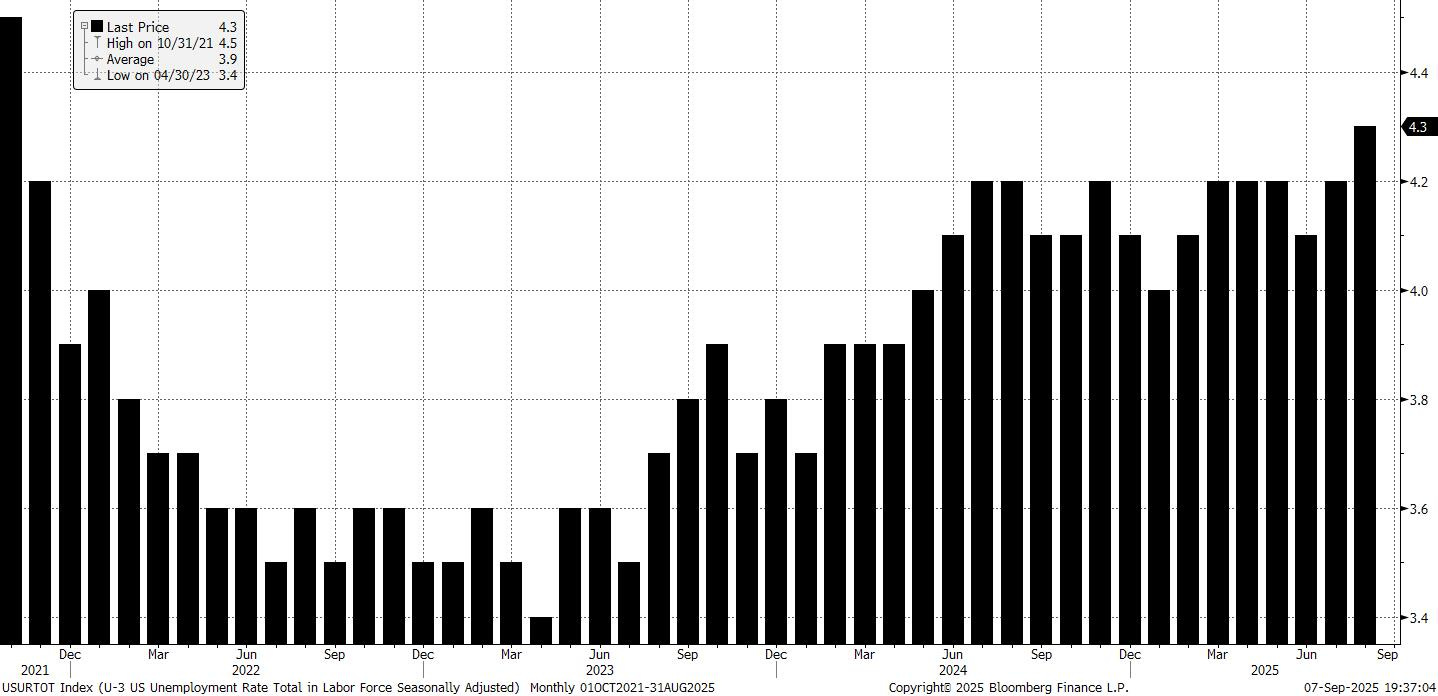

The macro picture continues to lean dovish. August payrolls badly missed at just 22k, with unemployment ticking up to 4.3%. Combined with Powell’s dovish tilt last week, markets now see September as a lock, with nearly 70bps of easing priced by year-end. Waller and Bostic underscored the case for near-term action, pushing policy expectations deeper into easing mode.

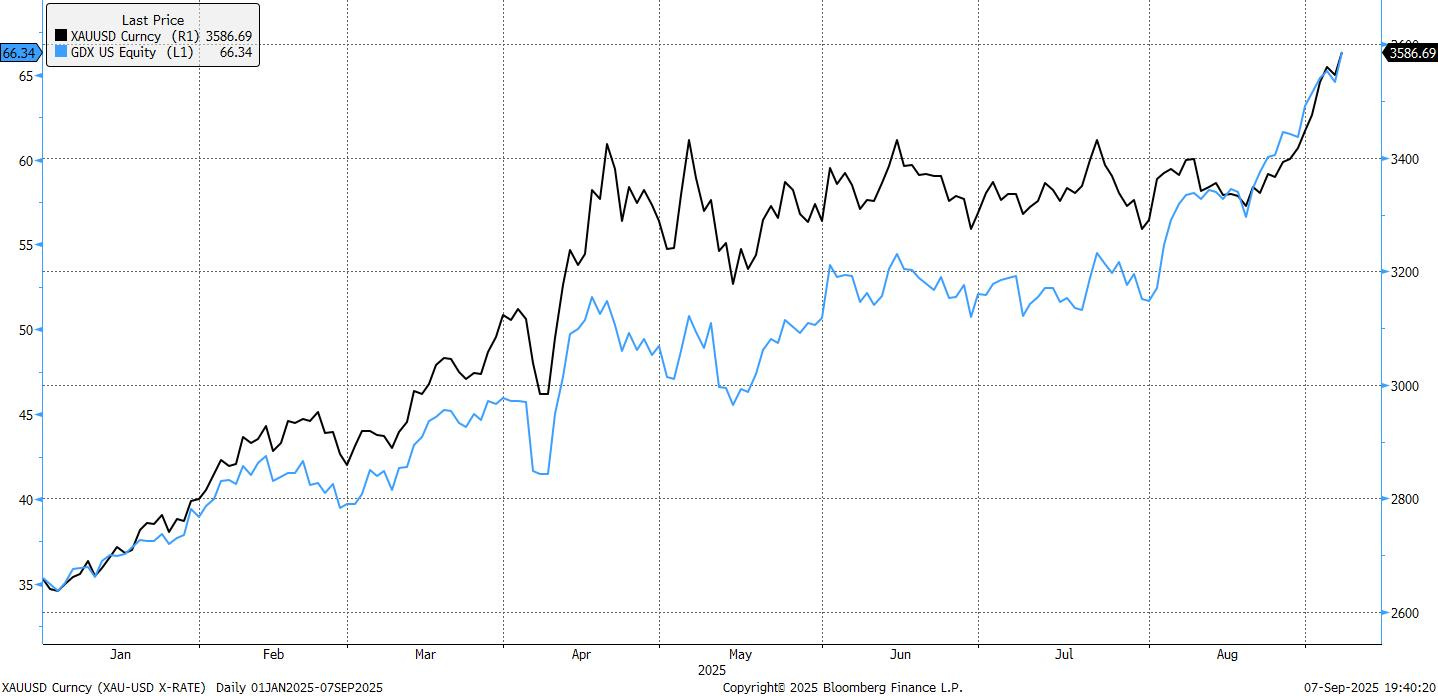

The dollar followed a familiar pattern: early strength tied to yields, then faded as weak jobs data reasserted the rate-cut narrative. USD/JPY and GBP/USD were choppy on local stories, while EUR vols stayed inverted, pointing to more near-term activity. Treasuries shifted lower in parallel, shrugging off global supply concerns as rates vol collapsed. Gold surged to fresh record highs near $3,600/oz, supported by USD weakness, geopolitical risk, and tight physical supply, a move that helped miners extend their strong year-to-date outperformance.

Enough of what was. Here’s what we’re looking at ahead of the new week.

(Upgrade to a paid subscription to unlock full access to all research.)

The Week Ahead

The team has a few key areas of focus. 1) Ishiba is set to depart as Prime Minister, which should see some increased volatility in the Japanese markets. 2) An ECB meeting is on the schedule this week, with some accompanying trade ideas for the euro, as well as a confidence vote in France due to disagreements over the budget. 3) The latest labour market data in the US added to the recent rate cut narrative, as the U3 rate touched its highest level since 2021.

We’ll start this week’s notes on the latter point. Post-payrolls, the outlook from the team hasn’t shifted as much as markets have repriced.

US Labour Market Print

September Cut Sizing:

The idea of a 50bp “insurance” cut in September should be buried by now. Inflation is still sticky enough to prevent the Fed from front-loading easing, even if the labour market is softening at the edges.

A 25bp cut remains the cleanest option: symbolic enough to acknowledge cooling momentum, but measured enough to keep policy credibility intact. Anything more risks looking panicked, and Powell is not in the business of panic. It’s also worth stressing the market dynamics. A 50bp cut would catch positioning offside, even if pricing has crept above 25bp over the past week. The Fed has no incentive to engineer unnecessary volatility; if anything, the communication has been remarkably consistent.

The committee as a whole have offered no signal of a 50bp move, and history tells us the Fed prefers to guide the market toward its decision rather than spring a surprise. Members have now entered a pre-FOMC blackout period.

The December Conundrum:

December is still too far away for conviction. The Fed has made it clear: this is a data-dependent regime, and the data is noisy. A one-and-done scenario remains alive, particularly if inflation proves stickier than growth slows. Don’t underestimate the optics of Powell cutting once and then retreating to the sidelines, signalling flexibility without surrender.

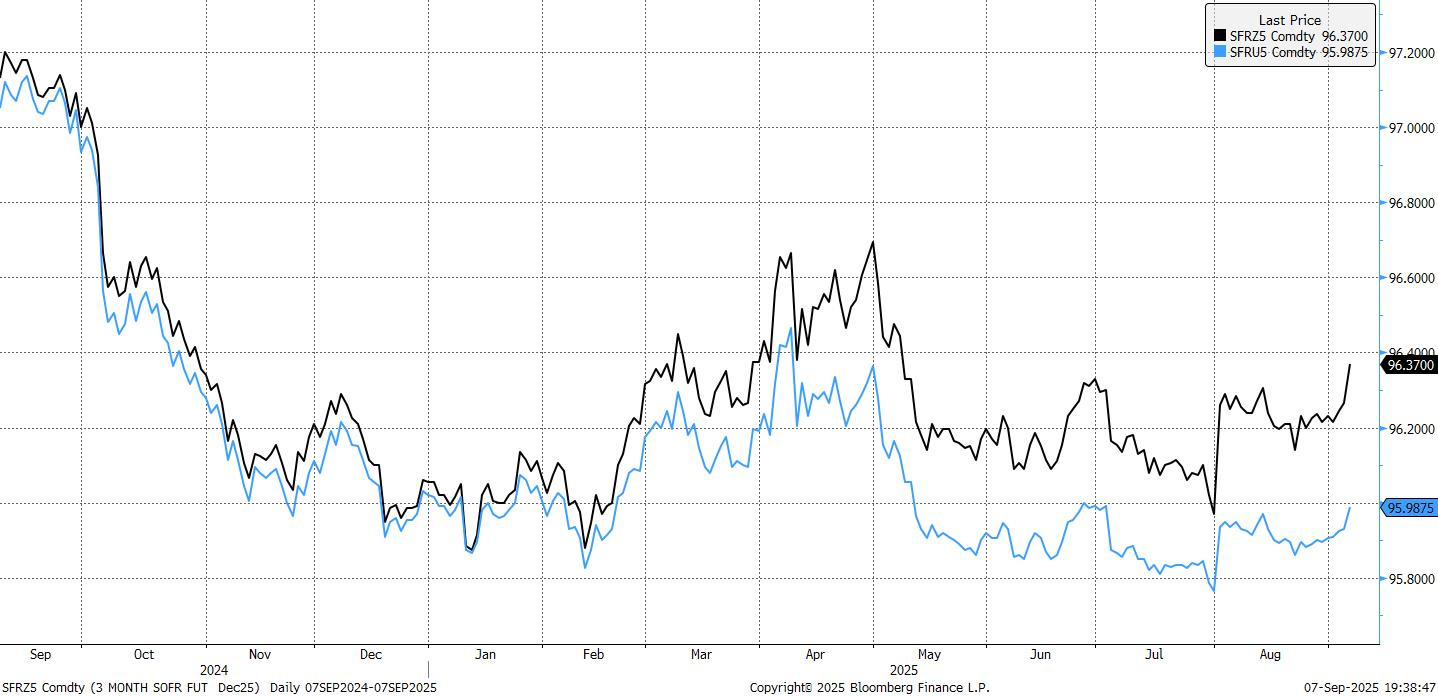

Market takeaway: Z5 overpricing three cuts into year-end is still a fade as the team sees it, but positioning for certainty this far out risks getting chopped up.

Equities and the Bad News Loop:

Equities are still a buy on dips. The playbook hasn’t changed, but the character of the tape matters. Right now, bad news is being treated like bad news. We’re in that awkward middle ground where growth jitters can outweigh the prospect of easier policy, at least in the short run. This doesn’t break the bullish equity thesis, but it does mean you need to respect the tape’s mood swings.

Sectors Tell the Truth:

The sector breakdown speaks louder than the index. A weak payrolls print should have been a gift to defensives, but they lagged. That tells you everything about where flows are still parked: tech. Earnings strength is doing the heavy lifting, and investors remain reluctant to rotate out of growth. The fact that real estate, materials, and tech led even against softer labour data reinforces that positioning inertia. Money wants to stay in the winners, and until the earnings cycle breaks, it will.

Market takeaway: Stay disciplined. Use weakness as an opportunity, and don’t chase euphoria. The rotation trade is still a mirage, with tech dominance not done yet.

US Long-End Trade Setup: