Sahm, Steepeners, Speculation

It has been quite the week.

The trillion-dollar tumble had a Tuesday turnaround. That will give investors some relief, but the underlying worries about a further decline still linger.

Was Tuesday’s recovery just a dead cat bounce?

Dead Cat Bounce: A dead cat bounce is a short-lived and often sharp rally that occurs within a secular downtrend. It is a rally that is unsupported by fundamentals that is reversed by price movement to the downside. In technical analysis, a dead cat bounce is considered to be a continuation pattern.

The buying was aggressive. Institutional investors scooped up $14 billion of shares on a net basis. Hedge funds snapped up individual US stocks at the fastest pace since March, reversing a months-long selling spree, according to Goldman Sachs’ prime book:

The fact that seasoned traders chose the weakest day of the year to re-enter the market supports several bullish arguments. These include speculation that heightened volatility was an exaggerated reaction to economic data that, despite showing signs of weakness, have not signalled an impending recession.

Last night, we dropped an updated growth screener featuring a dozen names from the equity universe that look especially interesting considering the recent move lower.

When we also factor in the beta of these stocks, any rebound in the equity market should see these ideas outperform. However, the beta can also act as a negative, with losses likely amplified compared to the broader market.

You can see the screener here:

Looking at the other side of the coin… across different assets, yesterday’s rally could have been due to more shorts covering their profits and not just large dip buyers emerging. Short coverings have the same price action as new longs being added.

Pit adage: “There’s a difference between fresh longs and short squeezes.”

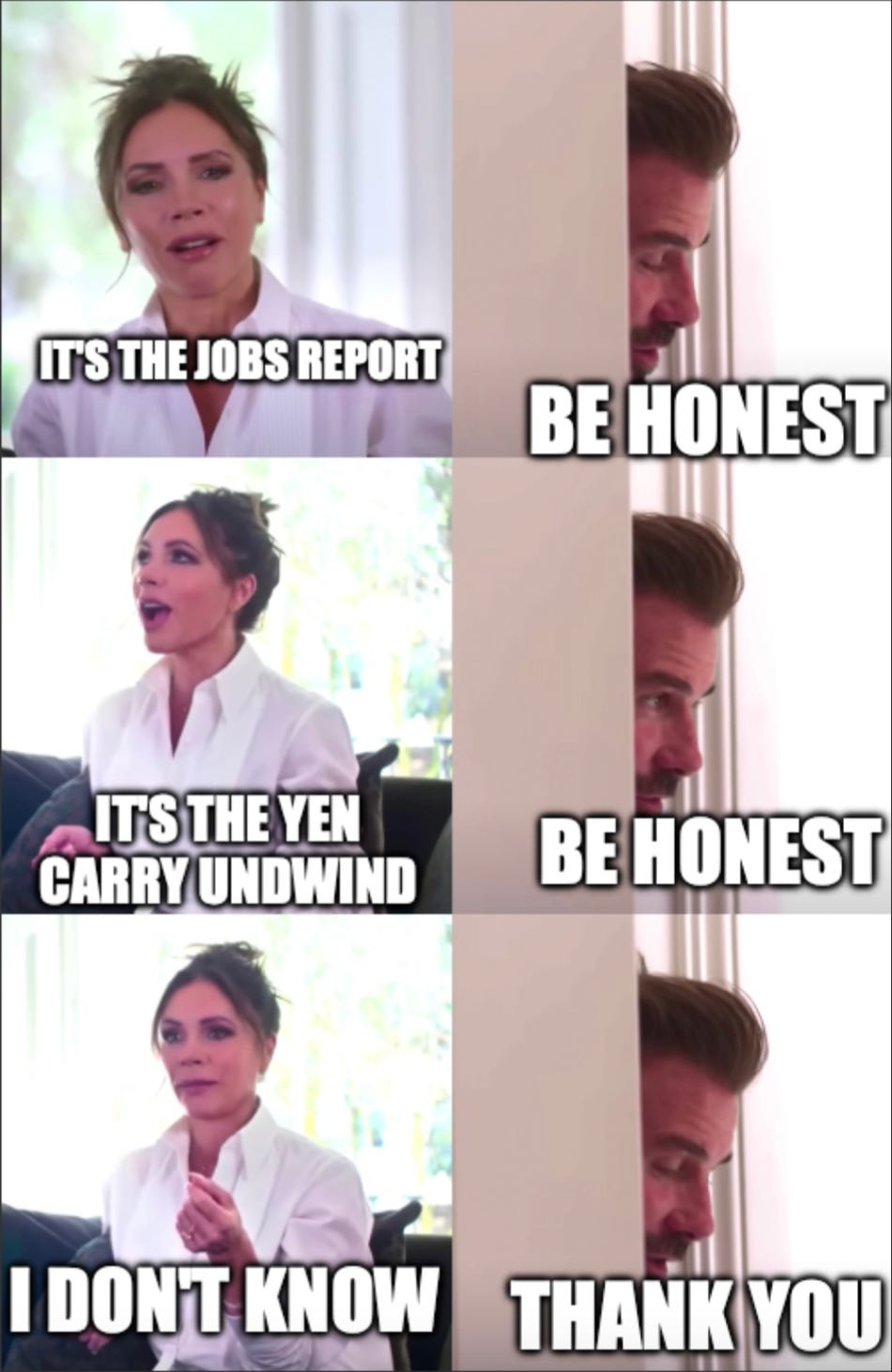

Everyone Wants to Blame One Thing

Was it one US data print and a weekend to dwell on it? Was it the Yen carry unwind? Everyone wants to point to one thing to blame for the decline. In reality, it was a combination of these and other factors.

In Japan, Nikkei margin long positions reached an 18-year high in late July. When stock prices plummet, investors on margin have to inject more capital or sell off their stocks to cover their debts. That leads to a spiral lower and a 21.5% decline across three trading sessions in Asia.

The same likely happened in the US. Leveraged positions exacerbated the selling.

And if those that were blaming the BoJ for the global move down, then they can thank the BoJ for the move higher on Tuesday.

Bank of Japan Deputy Governor Shinichi Uchida sent a strong dovish signal by pledging to refrain from hiking interest rates when the markets are unstable. The yen weakened by more than 2% against the dollar after his comments.

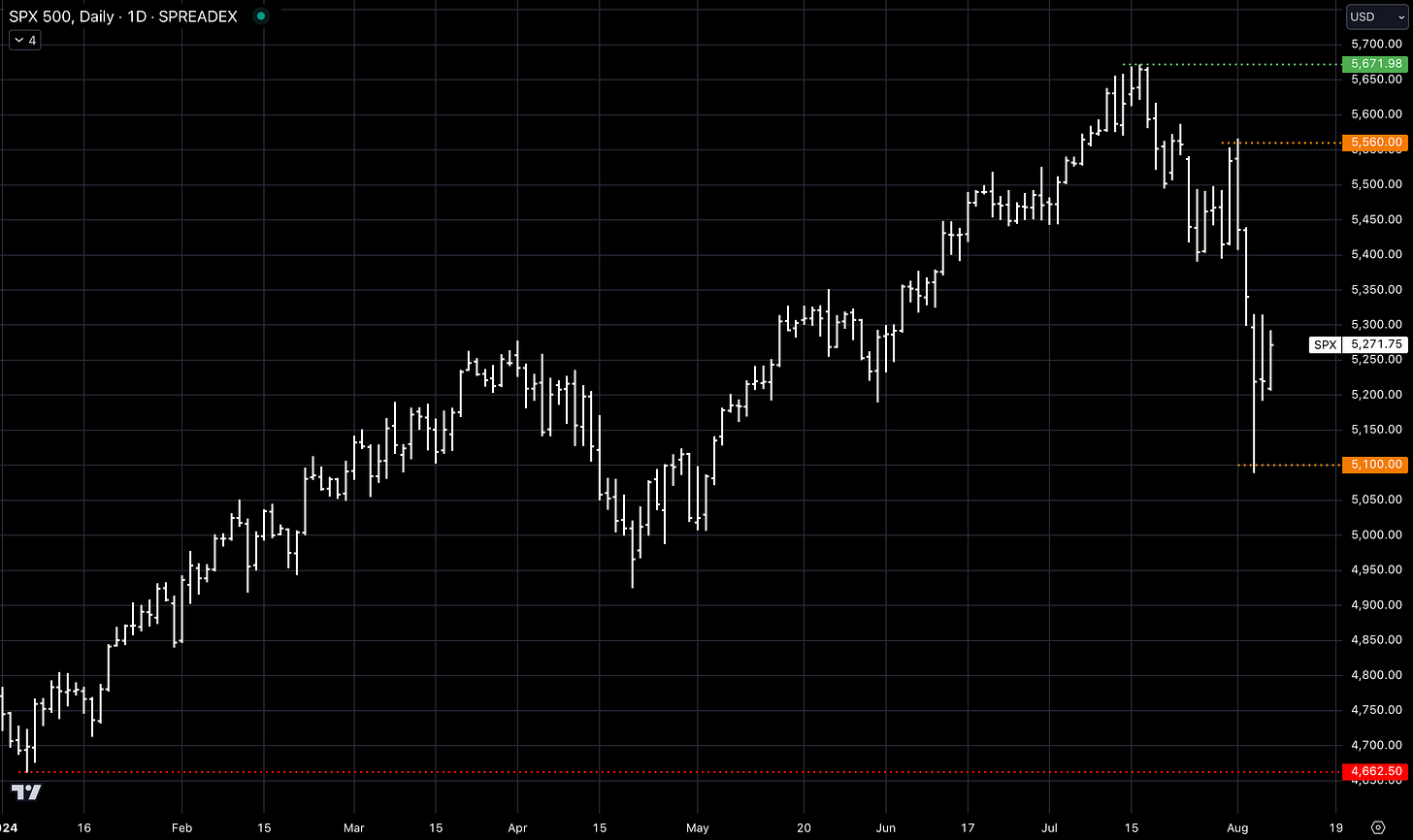

Mapping Out a Move

The 8% drop from highs could be labelled as short-term and sentiment-driven versus a long-term issue with the fundamentals of listed businesses or even the wider US economy.

US equities are still not pricing in an economic contraction, even though growth-sensitive cyclical stocks have trailed defensive shares in this month’s rout.

Lots of the recession talk has come from the Sahm rule.

The rule indicates a recession has started when the three-month moving average of the US unemployment rate is 0.5 percentage points or more above its lowest during the previous 12 months.

However, one data print is hard to call anything for certain. Talk of emergency Fed meetings quickly faded after Monday. Let’s see how the next few data prints are. That will signal more for the markets to react to.

Before the downturn, the S&P was up 19% off the back of tech strength and the AI trade continuation. A correction of this size doesn’t do too much harm in the long run.

However, we will say that we think the top for equity markets are in for the year. Do we think the recent bottom will be a distant memory soon? We’re less sure. There is a chance we will trade back down to that level in the coming weeks.

Our thinking is a more concentrated choppy range to see out the year, between the price of the move higher on the back of FOMC and the move lower this week. 5,100 to 5,560 for rough levels.

As for FX markets, we’re looking to sell any rallies on USDJPY.

The current market and vol environment means people won’t be putting carry trades back on anytime soon. Carry trades also work better in low vol environments.

The unwind will continue.

Same, Jim. Same.

A soft landing is still possible. To achieve it central banks globally will need to bring policy rates to a more neutral footing more quickly than they had previously been suggesting.

Implied cut pricing for the Fed is now at -40bps,-35bps, and -30bps for the last three meetings of the year.

Today’s article was a freebie for all. However, you can become a premium subscriber with us for just $20/month. This provides full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

Trade safe,

AlphaPicks

Great article AP. For me, ignore the macro and focusing on individual company valuations is where it's at. Of course, it's nice to understand the wider market, but it's almost impossible to know.

Nice summary of the happenings of the past week!