"Sell In May And Go Away"?

"Sell in May and go away" is a popular adage in the investment world. But in doing so, investors could be missing out on gains.

A famous stock-market maxim, “Sell in May and go away,” illustrates the seasonality of stock market gains in the first several months of the year and the historically weaker performance of equities from May to October.

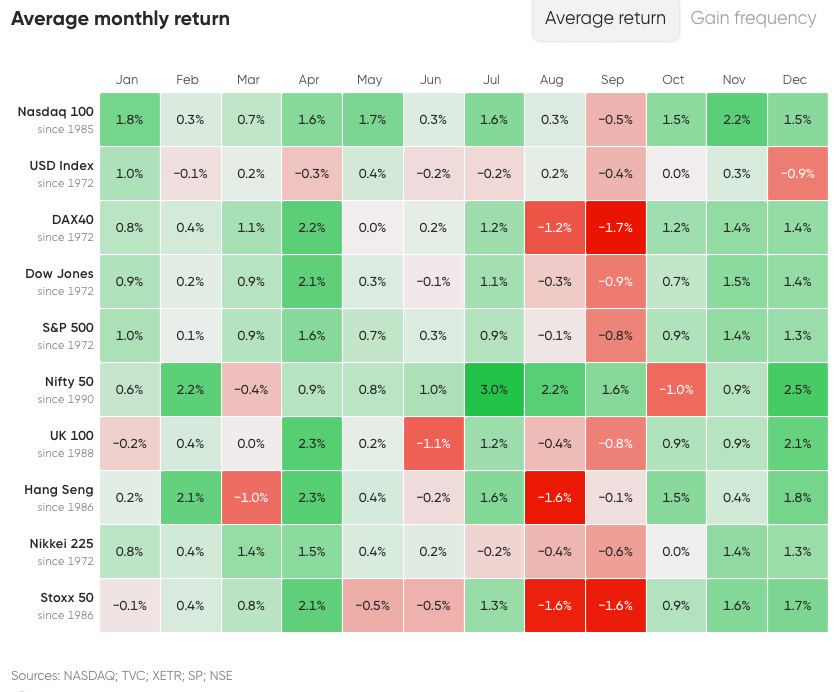

The chart above highlights the seasonality trends across the major indices worldwide. September immediately stands out as a typical risk-averse month for global equity markets.

Since 1990, the S&P 500 has averaged a return of about 2% annually from May to October versus about 7% from November to April.

The only drawback of historical patterns is that they don't reliably predict the future. That's especially true of well-known historical patterns. If enough people were to become convinced the “Sell in May and Go Away” pattern is here to stay, it would, in fact, promptly start to go away. Early-bird sellers would all try to sell in April and bid against each other to buy the stocks back ahead of the pack in October.

But 2023 has been different, at least for the US. Nasdaq looks set to close up 8.7% for May, and the S&P 500 1.1% (based on the May 30th closing price). Yes, there is one final day which could weigh into those figures.

Sell or Stay?

What is the argument for selling? Markets are being affected by several factors. First, high inflation remains persistent across the globe, particularly in the UK, where high food prices have kept inflation at 8.7% – over four times the Bank of England’s target of 2%.

There’s also the issue of high-interest rates to consider. The BoE has hiked rates to 4.5% – a rate not seen since 2008, and it’s indicated that it won’t stop in its battle to control inflation.

The federal reserve has indicated it might be done with hikes in the US. But at a range of 5 to 5.25%, they remain high. Markets are also pricing a 65.3% chance of further hiking at the next meeting on June 14th.

While the UK has been predicted to avoid a recession in 2023, growth is expected to remain subdued until 2024.

So it’s likely that, considering macroeconomic headwinds, companies will underperform, especially as consumers’ budgets remain tight due to the effect inflation has on wages.

So for global markets, we could be on the side of “Sell in May” (or June) and go away.

But as far as the US is concerned, we see a year that breaks the typical performance. So investing in the US throughout this historic underperformance period might prove how to hold on to your returns.

An interesting survey among retail and professional investors showed the highest expectation was an increase of 5-10% from current levels by the year-end.

Tech and its AI boom could be the catalyst that keeps Nasdaq running high. The index has risen from 13,530 to 14,530 in just four trading days, an increase of 7.4%. Of course, there could be a pullback in this rally, which would only be healthy for continuation. But throughout the months towards October, we think tech is still in for some strong upside.

The S&P 500 is likely in for more muted returns than its peer. This is because many sectors are not performing well, and an equal-weight ETF shows that the yearly performance is flat. You can read more about this in our article, “The Battle Of The Bulls And Bears.”

We hope you enjoyed this investing article written by us, AlphaPicks. Feel free to reach out if you have any questions or feedback. Subscribing, sharing and liking this article is greatly appreciated as it helps us grow as a page. The more people reading our articles, the greater the compounding effect.