The Battle Of The Bulls And Bears

The market leaders, the beast of Nvidia and the ongoing debate between famous bulls and bears.

Who is leading the market?

Why short-sellers keep getting burned on Nvidia

Morgan Stanley’s Mike Wilson vs Bank of America’s Savita Subramanian

The bull/bear debate is in full flow. The S&P 500 and Nasdaq continued to trickle higher as bears carried on their claims of an impending reversal. Volatility has stayed muted, rarely closing above 20 over the last eight weeks.

The Nasdaq is up 23% so far this year. The S&P 500, although quieter than its Tech counterpart, is up 6.6%.

So, what stocks are leading this rally? And why are the loudest bear voices still shouting on Wall Street?

The leaders

It’s no secret about the performance of some of the most popular names. Companies like Nvidia and Meta are up over 100% this year. Most of the names below are tech, which explains the differentiation between the 23% of the Nasdaq and the 6.6% of the S&P 500.

However, these two indices are not weighted equally. For example, Amazon has a 6.69% weight inside the Nasdaq, Nvidia has a 5.626% weight, and Meta has a 3.983% weight. These three names make up 16.3% of the index and are up an average of 80.7% YTD.

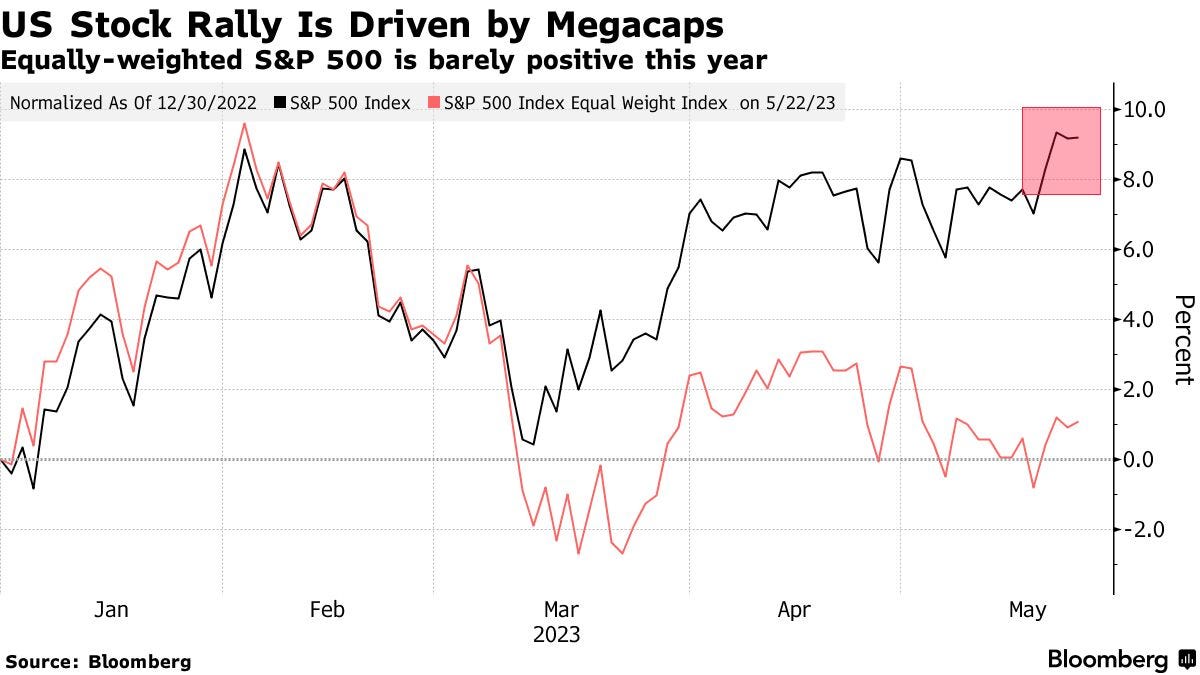

What if we look at the S&P 500 (which is more diversified than the tech-heavy Nasdaq) and the equal-weight performance this year?

The chart shows that the average performance of all the stocks in the index is 1% compared to the actual performance, which was 9% before this week’s sell-off.

So, stocks are actually having an average year, whereas the indices are performing well.

The beast that is Nvidia

Nvidia has been a spectacular watch this year. Every leg up has had shorts pile in, declaring that it is extremely overbought. However, the stock trickled higher.

One lesson that all traders and investors should take from this is, “What’s high can go higher, and what’s low can go lower.” So just because a stock is up, even if it looks unjustified, be careful jumping into short positions.

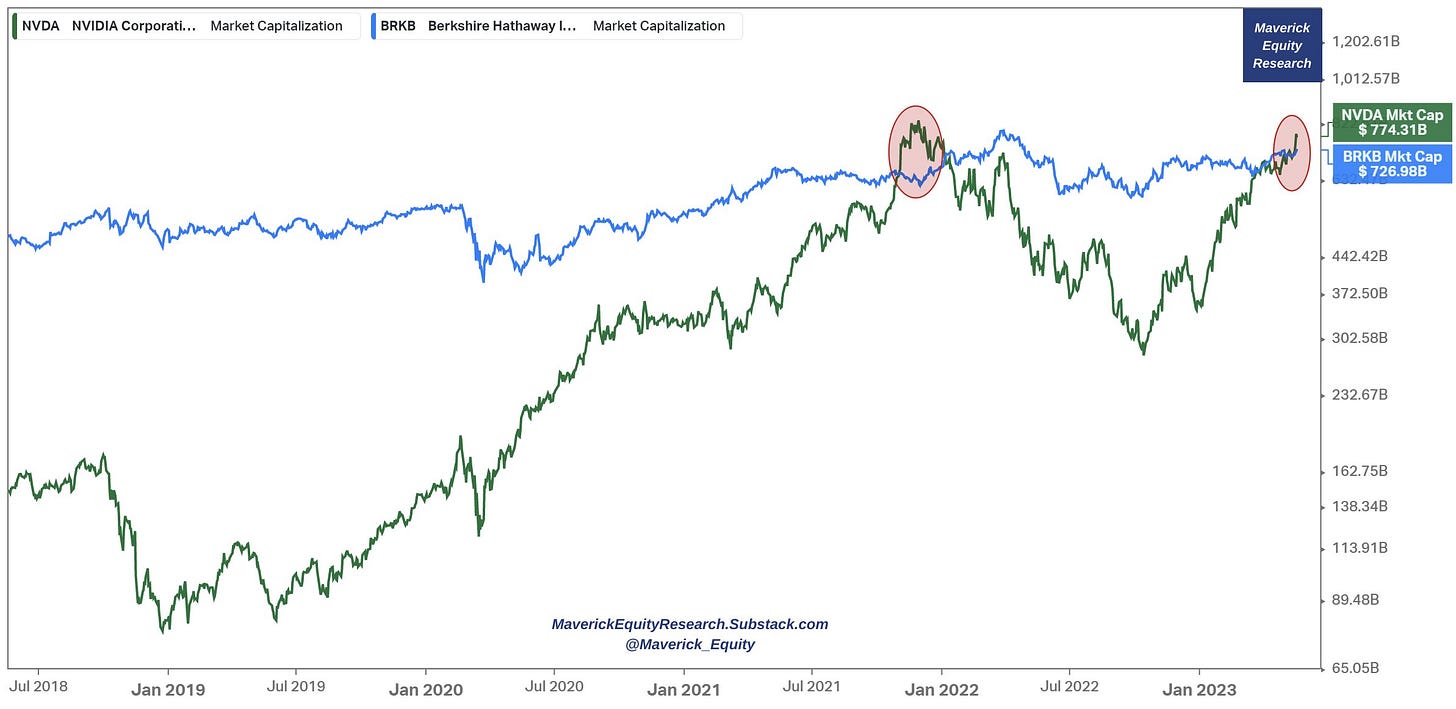

Here are a few chart comparisons that put this rally into perspective, courtesy of Maverick Equity Research. Firstly, Nvidia has just surpassed Berkshire Hathaway (for the second time) in market capitalisation.

The second chart shows the S&P 500 components with 2023 total return & the percentile of each stock's forward PE ratio vs their 10-year history: NVDA is a big outlier also via this view relative to the market & itself.

Why is Nvidia so high? AI is part of the answer.

The sector has been one of the hottest topics inside and outside the markets. The speed at which it is growing and making its way into day-to-day life is a conversation many are having.

But we are interested in the stock side of things. One popular name that caught the eye of traders and investors this year has been C3.ai (NYSE: AI). The stock has performed well, but concerns have been raised over the long-term reliability of this play. Firstly, C3.ai is in the middle of the AI boom. But how much market share can a smaller company capture against Google and Microsoft?

Also, C3.ai is still losing money. In fact, as much as it was in 2019. Revenue is starting to slow, with revenue expected to expand by 10% a year for the next few years.

This isn’t a short report on C3.ai. The company seems to be capturing the short-term interest of AI speculators, but we don’t think it will be a name in the conversation down the line. However, Nvidia will be.

Part of this year’s growth is to do with the AI boom. Nvidia state on its website that they are “the world's most advanced AI platform with full-stack innovation in computing, software, and AI models & services.” And investors seem to agree.

Nvidia has earnings releasing tonight. It will be interesting to see the performance against estimates and how the markets react. Could this finally be the pain relief for bears, or will the stock move even higher?

What the bears have to say…

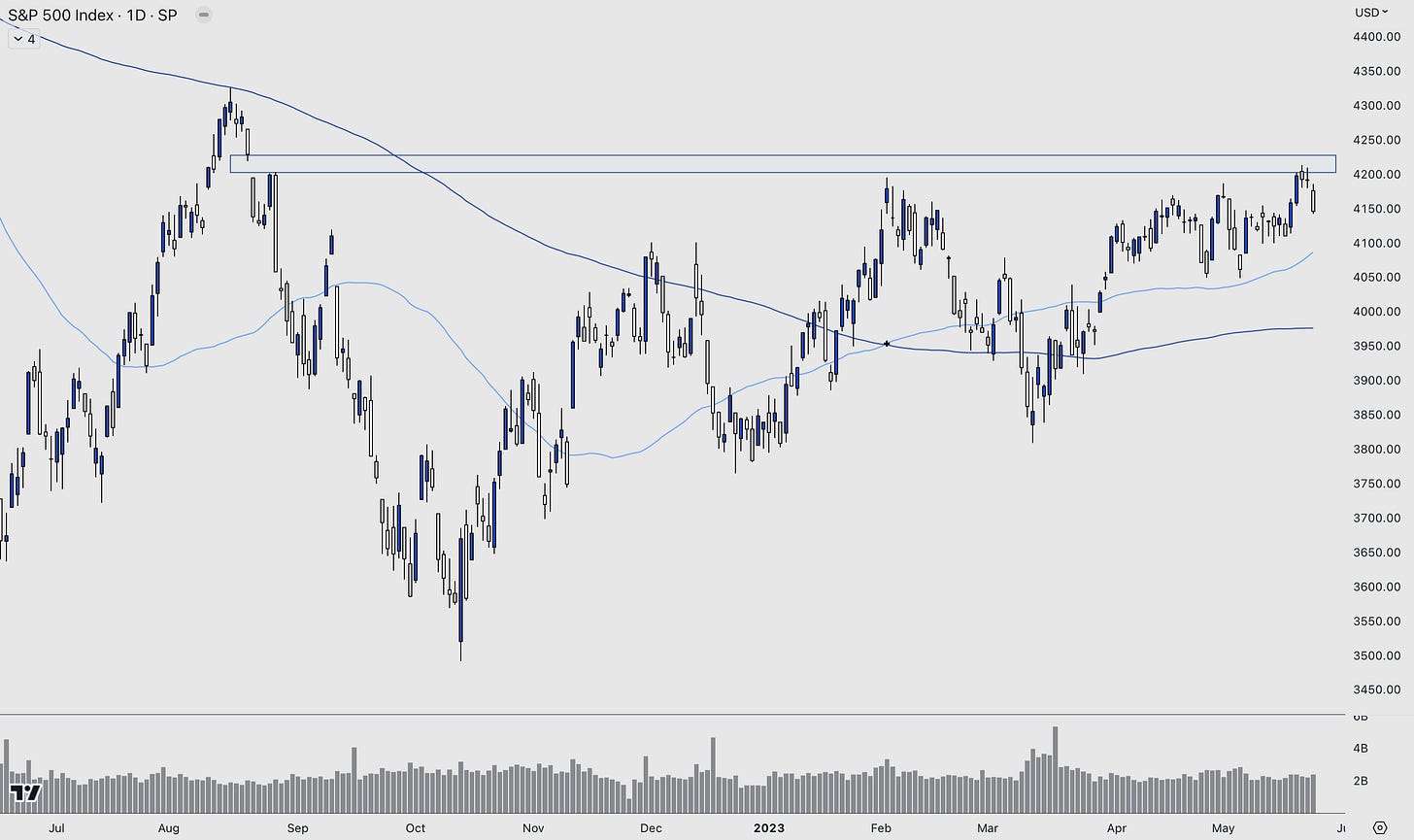

We may as well bring up Michael Wilson of Morgan Stanley, one of the most famous bears on Wall Street. Even after a 9% gain to start the year, he sees too many troubling triggers to believe the gains will stick.

“Is this finally the breakout to confirm a new bull market?” Wilson wrote in a note to clients Monday. “The short answer is no.” In particular, he sees risks in lofty valuations, a narrow breadth of stocks driving the gains and the outperformance of defensive stocks.

Here is an excerpt from Morgan Stanley:

The current rally seems to be based not on improving economic fundamentals but on easing financial conditions, which we believe are likely to reverse later this year.

As stocks trade higher, recent market action for other asset classes paints a starkly different picture. There are three that merit particular attention:

U.S. government bonds: Treasury yield curves remain deeply inverted, a time-tested signal that an economic downturn is on the horizon.

Gold: Since the October low for the S&P 500, gold continues to outperform both the S&P 500 and the Nasdaq. This is curious, given that many investors view gold as a safe haven when turbulence looms.

Oil: If equity investors expect a “soft landing” and a potential rebound in economic growth later in 2023, oil prices do not reflect that.

One short-term risk for the market is the ongoing debate in Washington over raising the US debt ceiling. Wilson said a resolution in the negotiations may briefly drive stocks higher, but “we would view that as a false breakout/bull trap.”

The bulls reply…

But where Wilson and Morgan Stanley are looking at a half-empty glass, Bank of America’s Savita Subramanian says she sees a “half-full” one. She raised her 2023 year-end price target for the S&P 500 to 4,300 from 4,000. The equities benchmark topped 4,200 on Friday before drifting lower.

“The era of easy money is behind us, but that might be a good thing,” she wrote in a note to clients on Sunday. “Corporate America has shifted focus to structural benefits — efficiency/automation/AI — and have bought themselves time to adapt via long-dated fixed-rate debt. Old economy cyclicals, capital-starved since 2008, have become disciplined and self-sufficient, evidenced by lower betas and more stable earnings.”

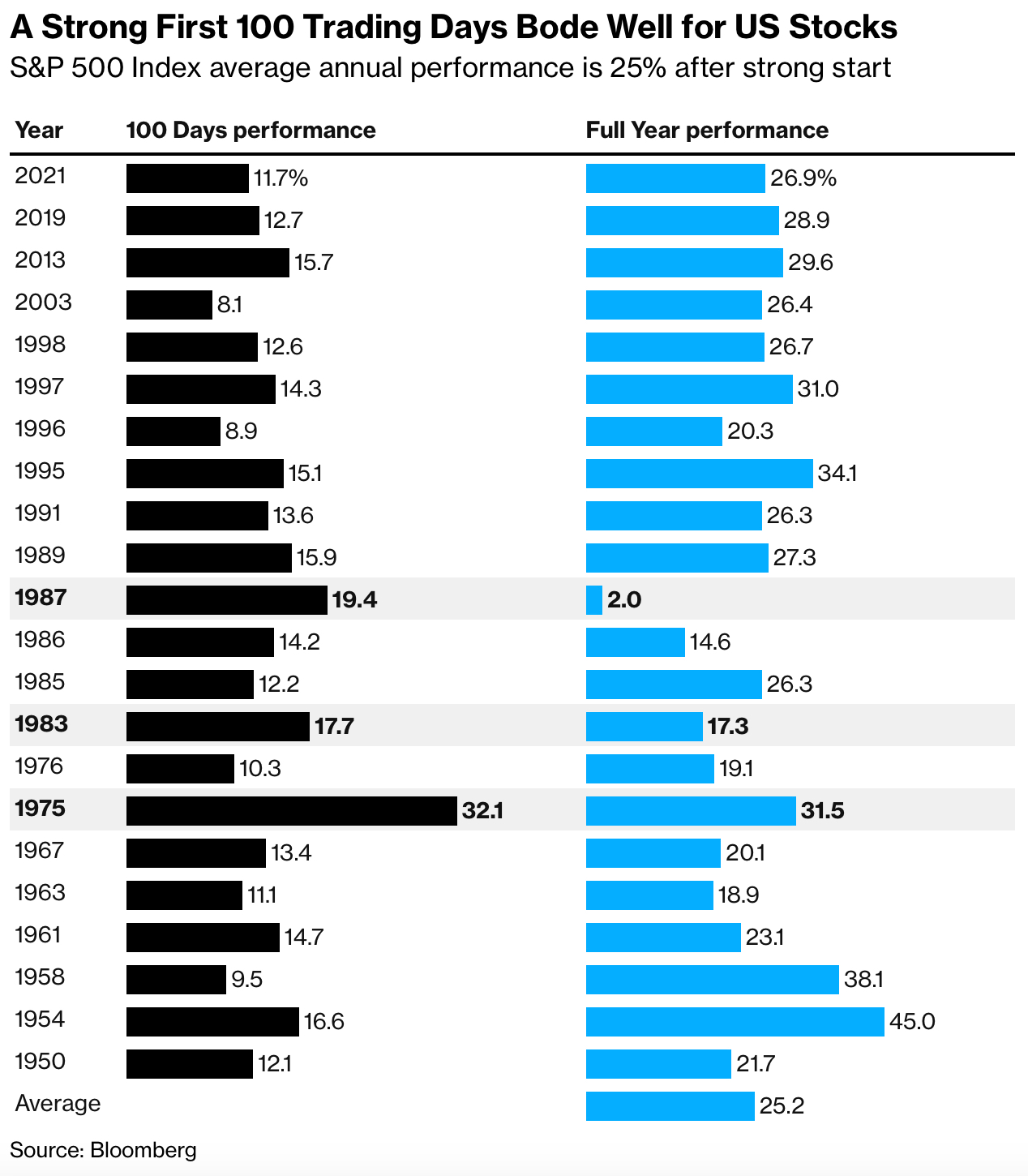

If history has anything to say, a strong first 100 days in the S&P 500 typically means a significant upside for the rest of the year.

If you enjoyed this article, please like the post and leave a comment with your thoughts.

Also, if this is your first time reading, you can sign up to receive all of our posts straight to your inbox. We post trade ideas across all markets to start the week, along with deep-dive articles on Wednesday and Friday and some light weekend reading.

great take ... NVDA quite a case out there to be followed. And an outlier no matter how one slices and dices the fundamental data :) ... Have a great week!