US equities were on track for another quiet gain before Friday’s late-session shock. President Trump’s threat of a “massive increase” in China tariffs triggered the sharpest one-day selloff in the S&P 500 since April, snapping a months-long calm. The reaction was swift: risk assets tumbled, Treasuries rallied, and oil dropped below $60 a barrel as traders braced for another escalation in the trade war narrative.

The likelihood that we refer to and manage this as the same trade war, rather than trade war 2.0, is high. Trump already backpedalled on his aggressive stance over the weekend.

The main thought that we can’t stop thinking about is that, in 2025, every tariff eventually wants to become a trade deal. We wrote an extensive note on this yesterday, and so far, it is playing out as expected.

Through most of the week, markets had been driven by tech strength and the persistent AI buildout story. AMD’s landmark deal with OpenAI dominated early trading, sending the stock to record highs and briefly lifting the entire semiconductor complex. Utilities outperformed, a blend of defensive rotation and the inflationary knock-on from higher power prices, while energy names slumped alongside crude’s decline.

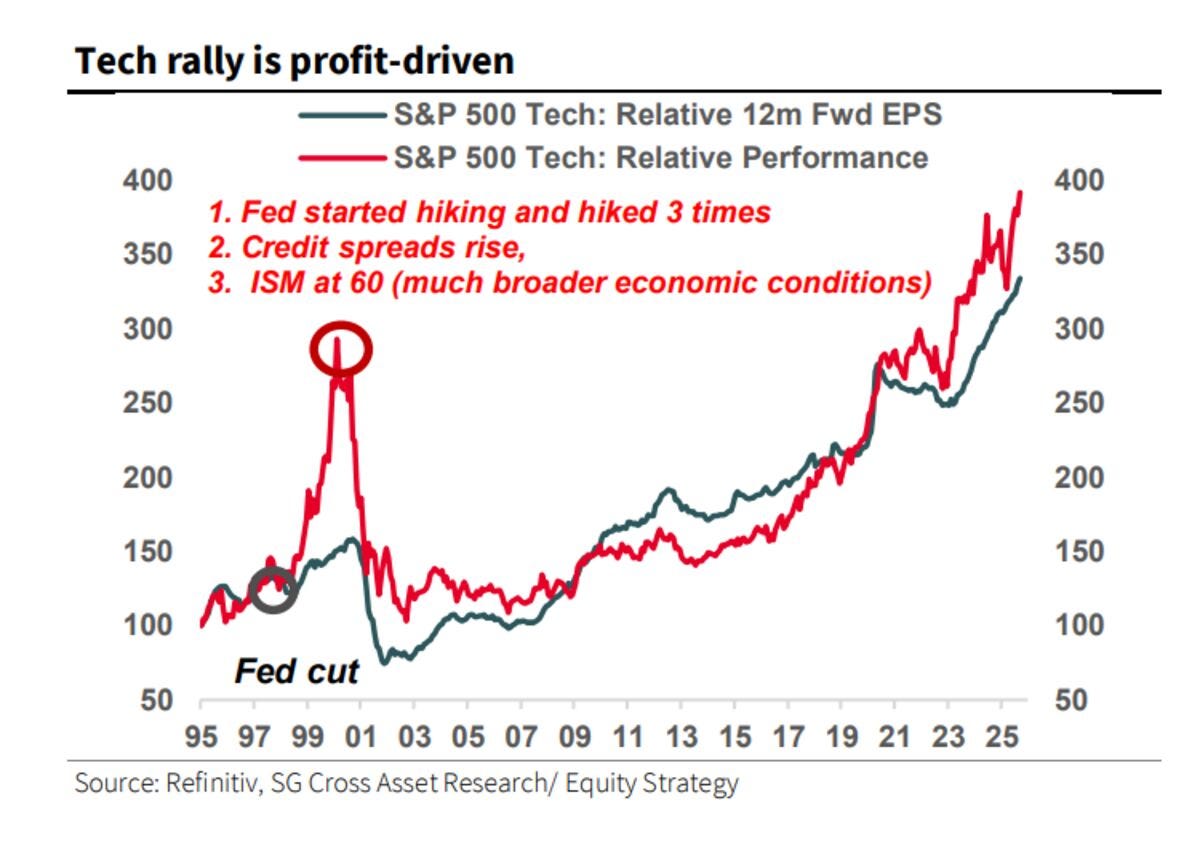

Still, the week wasn’t just about tariffs or tech. Beneath the surface, an emerging debate took hold: Is the AI trade morphing into bubble territory? Several strategists drew parallels with the dot-com era as mega-cap valuations stretched further, though SocGen pushed back, arguing the rally still reflects “earnings strength rather than speculative excess.” That confidence was tested on Friday, when the entire complex sold off sharply.

Gold stole the spotlight midweek, surging past $4,000 an ounce for the first time in history. The combination of geopolitical tension, economic uncertainty, and persistent disinflation fears has reignited demand for safe havens, with returns in bullion now outpacing equities over the past two decades. Silver followed suit, hitting multi-decade highs as the precious metals complex extended its parabolic run.

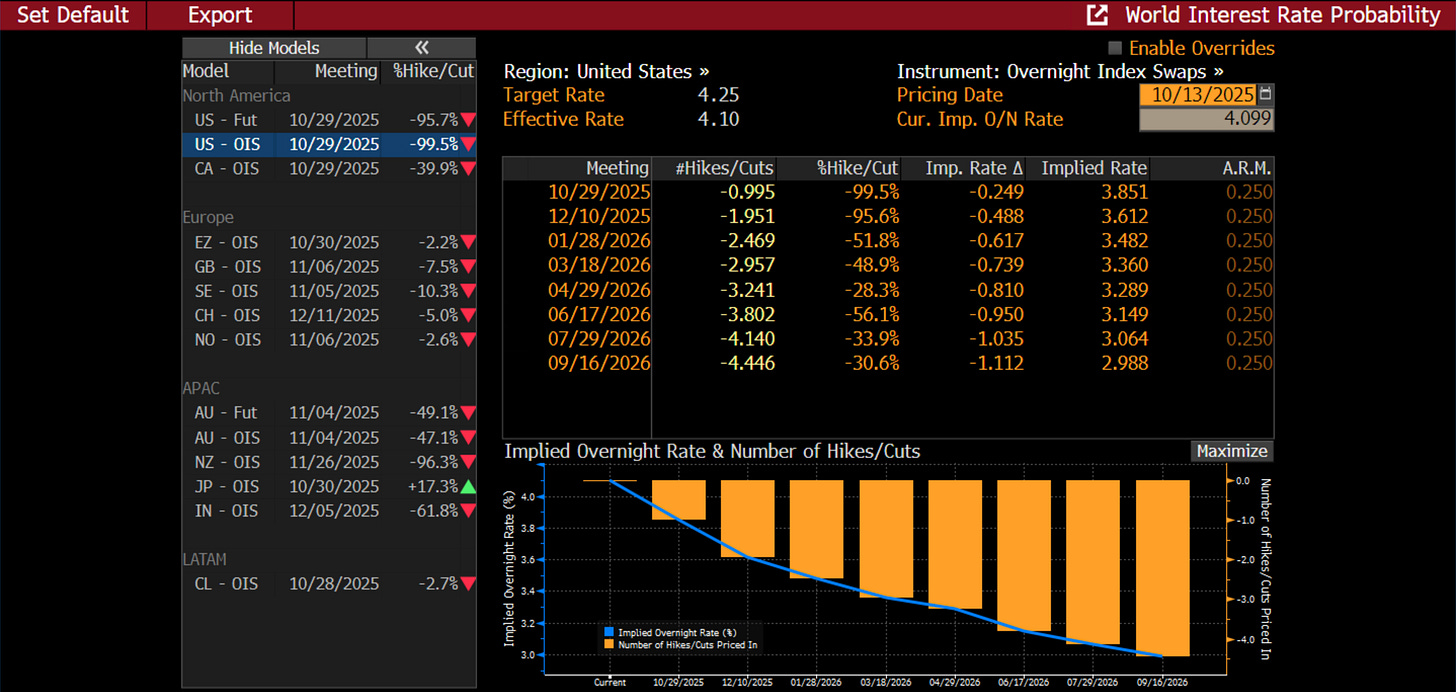

The government shutdown again muted the flow of hard data, leaving traders focused on the FOMC minutes and the evolving rate outlook. The minutes revealed a more divided committee, with a few officials open to holding in September, while most still expect further cuts by year-end. Markets interpreted the tone as broadly dovish.

OIS pricing was little changed by week’s end, with roughly 25bps of cuts priced for October and 49bps in total by December, levels that continue to underpin the bull case for equities. The minutes also highlighted the Fed’s growing discomfort with the political noise surrounding its decisions, a tension likely to resurface in Powell’s remarks this week.

The Week Ahead

The spotlight shifts to the banks, with JPMorgan, Goldman Sachs, and Citi all reporting on Tuesday. Strong equity trading revenues are expected to offset weaker dealmaking activity, while Bank of America and Morgan Stanley follow midweek. With official US data still frozen by the shutdown, Powell’s speech on Tuesday may become the key macro catalyst ahead of the October FOMC. The shutdown’s continuation will further extend the market’s reliance on secondary indicators. Treasury auctions across the curve will provide another test of investor sentiment as fiscal risks mount.

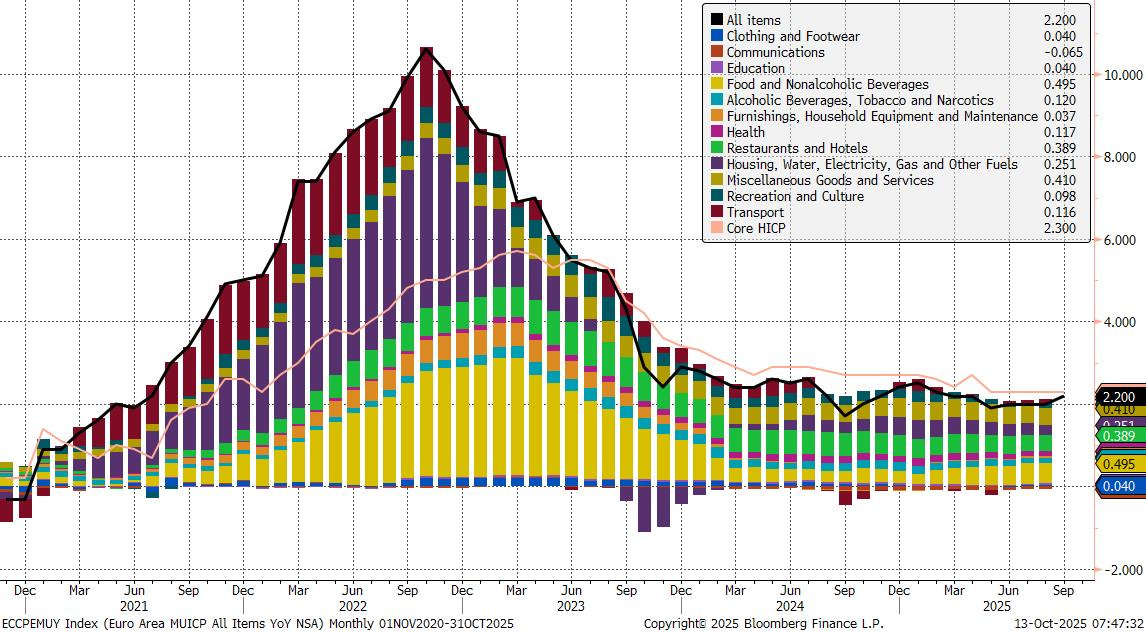

In Europe, the focus will shift to inflation data, which will shape expectations for the ECB’s next move amid fading growth momentum. Price pressures remain the main constraint on further easing, though recent softness in energy prices may reinforce the case for patience.

Across Asia, markets will key in on monetary policy signals and fresh data on trade and growth. China’s trade figures will reveal how the economy is adjusting as tariff-frontloading unwinds, while Singapore and Malaysia’s growth releases will give a read on regional resilience. The RBA minutes will also be watched for hints on how quickly Australia could pivot toward further policy easing.

Moving towards our cross-asset commentary for the week, we start with Chair Powell and the October FOMC meeting.

Powell and Fed speakers

Short SFRV5

At 96.11, the October SOFR contract has a full 25bp cut locked in—a confident read for a market flying blind through a government shutdown and missing data. The Fed may have turned dovish, but cutting again so soon after restarting the easing cycle feels premature.

The asymmetry here is the appeal: upside in SOFR is capped as the Fed won’t shock with 50bps, but downside opens quickly if policymakers pause or hint at waiting for cleaner data. A hold in October with a follow-up cut in December feels the more plausible path.

The calendar sees a few Fed members speaking throughout the week, so we’ll know how they are guiding markets on their decision in the coming days.

Market takeaway: Pricing is too sure of itself. With limited upside and clear two-way risk, this setup favours a speculative short, a way to fade overconfidence in the Fed’s immediacy.

US/China

A bigger report on the trade conflict was released yesterday.

Much of Friday’s equity rout was a positioning flush. Markets had been running on light hedges and heavy confidence, so the tariff shock simply found the weakest length in the market. The weekend’s softer tone from Washington has helped risk assets rebound, with S&P futures retracing half the drop and Europe’s Stoxx 600 following suit. But the tone has shifted: investors have been reminded that complacency is a risk.