Every Tariff Becomes a Trade Deal

A market note on Friday's price action.

Global markets went into meltdown on Friday as Trump reignited trade war concerns. His surprise plan to slap 100% tariffs on all Chinese imports and tighten export controls on key software (effective November 1st) caught investors flat-footed and sent risk assets lower.

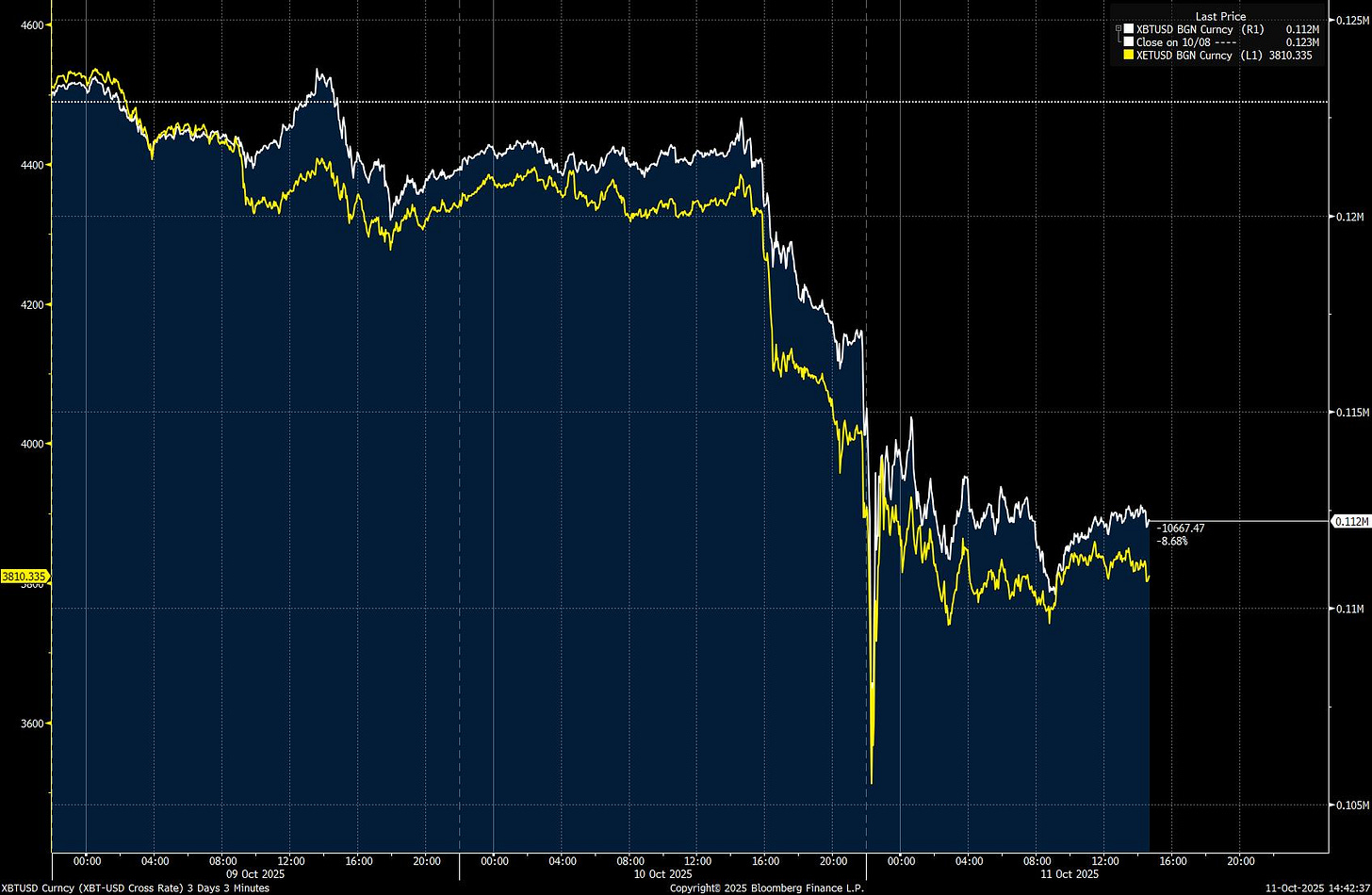

The damage was almost everywhere. The S&P 500 dropped 2.7%, its worst session since April. Oil hit a five-month low, Treasuries ripped higher, and crypto got obliterated with over $19bn of liquidations in 24 hours, with Bitcoin down 12% and some altcoins losing up to 80%.

With traditional markets shut for the weekend, attention now shifts to whether this is just another case of TACO or the start of a more serious trade war.

From where we sit, we think the panic looks overdone.

The Trump Playbook

The tariff decision, presented as a response to China’s newly tightened export restrictions on rare earth minerals, sent an unmistakable signal that economic confrontation could again dominate US-China relations. Yet in reality, it’s just another chapter of the same Trump trade playbook that we’ve all read before.

This move has all the hallmarks of an impulsive move by the President. Everything from the timing, the percentage tariffs, and the sweeping assumption of all imports being included leads us to believe this is yet another occasion of Trump providing “performative escalation”.

Back in May, we wrote about Trump’s trade tactics (with specific reference to the EU), with our view still very much the same on the strategy in play here

“This evolving picture reinforces what markets are increasingly pricing: the tariff game is being managed, not abandoned. Escalation is performative. Resolution, however shallow, is enough to lift risk assets.

Equities are rallying not in spite of the noise, but because the noise is predictable, and the outcomes increasingly benign. From Brussels to New Delhi to Shanghai, the strategy is the same: extend the game, signal flexibility, and let markets do the rest.

The question isn’t whether the US will continue to use tariffs as a tool. It’s whether the world has now adapted to the chaos and learned how to extract growth from it.”

Trump’s playbook on trade hasn’t changed. Throw down a strong gambit that causes everyone to sit up, then look to walk back as negotiations take place.

The cross-asset move on Friday was more reflective of the market being blindsided by the news, rather than a deeper concern about long-term implications.

Positioning Flushout

In the weeks leading up to the move, markets had become heavily extended, particularly in US large-cap equities and tech stocks, as investors crowded into momentum trades fueled by optimism around AI, soft-landing narratives, and the Fed’s easing cycle picking up traction.

Positioning data for both institutional and retail flows showed net-long exposure sitting near highs, leaving the market vulnerable to any negative catalyst. Trump’s sudden tariff announcement provided that spark, not because it fundamentally altered the macro outlook overnight, but because it triggered a wave of de-risking among over-leveraged or over-positioned investors.

In no market was this more evident than in crypto. Roughly $560bn in value was erased from the total crypto market cap on Friday, as it shrank from about $4.30 trn to $3.74trn. Trading volumes surged to nearly $500bn amid the chaos, which was largely blamed on leveraged positions being liquidated. The short, sharp move and price action do give us the impression of a large forced closure of positions, which exacerbated the move.

When markets are positioned one way (in this case, heavily long), even a modest shock can cascade into a broader selloff as stop-loss orders are triggered and systematic strategies unwind. This mechanical element amplified the downside move, pushing volatility higher and prompting margin calls that forced further selling. Don’t forget this came at the end of the trading week, when few had the desire to sit on risk into the close.

In other words, the reaction was as much about positioning and technical flows as it was about policy substance. Some chat on institutional desks described the move as a cleansing of stretched risk-taking, a short-term reset that helps reduce complacency rather than signalling deep structural fear about the future of U.S.-China relations.

It also combines a couple of expressions that, in most cases, hold true for markets and participants. Firstly, a “shoot first, ask questions later” mantra when it comes to news headlines. No one wants to be left with no exit liquidity, even if the driver of a move is short-term.

The second is that markets often “take the staircase up and the elevator down”. Multiple sessions of steady green candles can be erased with one large red one as the market resets and those who were holding profitable positions see gains given back.

The Natural Corrective Mechanism

A few weeks back, we discussed The Paradox Driving Markets Higher and explained how markets are acting as a brake on policy itself. An excerpt:

“Push tariffs too far, expand the deficit too aggressively, or threaten central bank independence, and the reaction is immediate: higher yields, weaker currencies, tighter financial conditions. That negative feedback forces policymakers to moderate before mistakes compound, functioning as a self-correcting mechanism that keeps deeper declines at bay.

The political incentives to respect those signals are obvious. Aggressive market selloffs generate negative headlines, sap growth through wealth effects, and carry real political costs. That’s why policy reversals are often swift once markets push back. Liz Truss’s downfall in 2022 remains the clearest case study: her “mini-budget” was never even implemented, undone by a gilt market revolt so severe it forced her resignation.

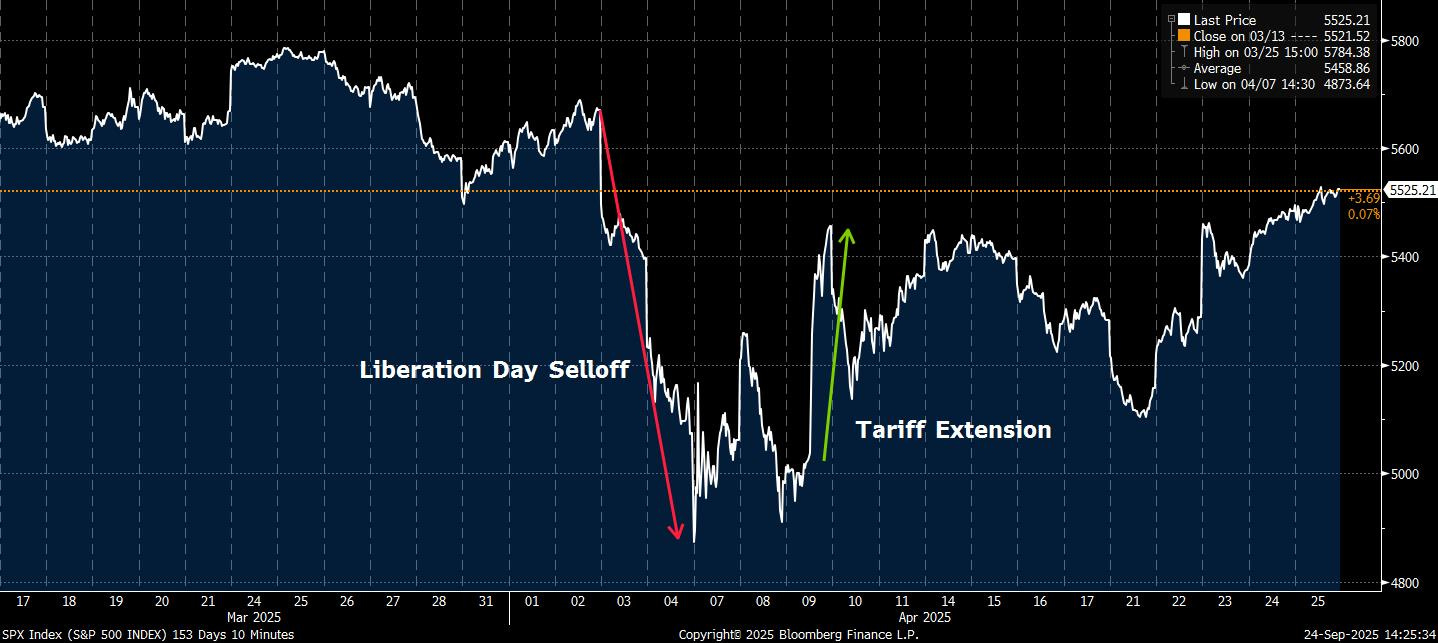

The same reflex has been visible in 2025. In April, Trump extended tariff implementation by 90 days after market turmoil followed his initial announcement. In July, he floated the idea of firing Powell and even waved a letter of intent, before walking it back as “highly unlikely” in the wake of a 0.75% S&P 500 pullback. The sequencing is familiar: markets react first, policy adjusts second.

That dynamic matters because the biggest risks today are policy-induced. Unlike 2020, when Covid dictated outcomes beyond government control, today’s cycle is being shaped by tariffs, deficits, and central bank independence, all areas where policymakers retain discretion, even if hemmed in by politics. And as long as they remain unwilling to tolerate sharp selloffs, markets themselves will continue to act as a disciplining force, preventing the conditions for a deeper break.

We believe Friday’s price action was the latest move in the negative feedback loop that will eventually lead to policy reversal from a President.

The Risk to Our View

As a caveat, it’s interesting to note the fall in Treasury yields, which contrasts with the spike that we experienced during the Liberation Day fallout. Back in April, we had an inflation/term premium shock. Yields were driving the selloff as investors were dumping both bonds because of concerns around sticky inflation, heavy Treasury supply, and the Fed staying higher for longer.

This time around, yields are falling (at least as the knee-jerk reaction), which suggests this is a growth shock. The tariff trigger hits global trade and growth expectations first. So risk assets fell, but bonds rallied as investors sought safety and priced in potential policy easing or weaker demand.

Therefore, the main risk to our view is that Trump, who has been more focused on lowering bond yields, will see the reaction in other markets and be happy to tolerate the pain if it means yields keep falling.

Cross-Asset Rundown

Below we flag some of the charts and levels we’re watching, as well as where we see the best opportunities.

Semiconductors