The Bar Is High

Corporate profits cannot miss the bar that has been set.

After big chat on central bank policies last week, conversations have quickly turned towards earnings season, both in the US and Europe. There will be many factors at play for the direction of the major indices over the next few weeks, but one that will have a major impact is corporate profits.

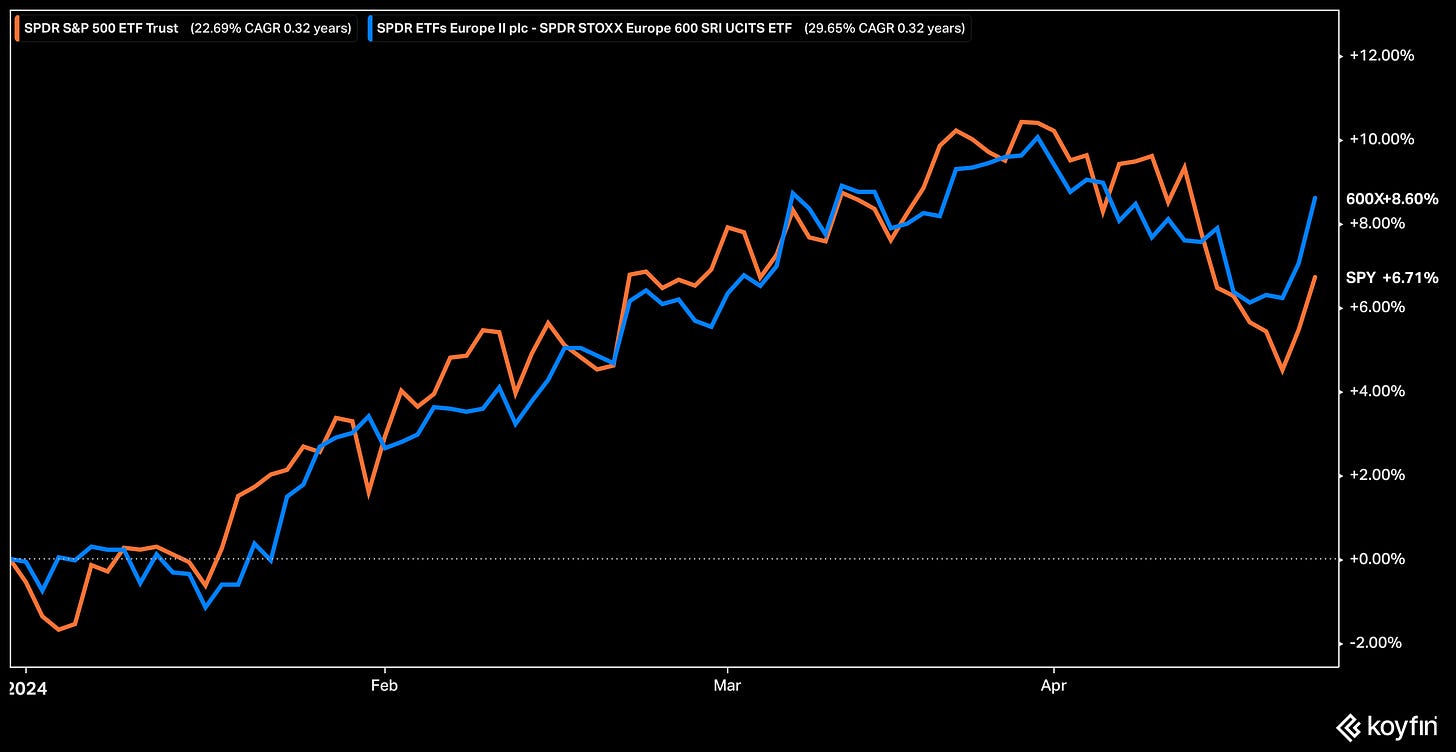

The UK’s FTSE 100 and Europe’s Stoxx 600 have both made positive moves higher this week, overshadowing the relatively small gain in America’s S&P 500.

Stoxx 600

The Stoxx Europe 600 index, a key indicator of the European market, recorded its biggest two-day gain since November. The technology sector spearheaded this surge, with a remarkable 2% increase, driven by the strong performance of ASM International NV. The company reported a decrease in earnings in the first three months of the year but raised revenue expectations for the second quarter and said it expects 2024 to be another year of growth — another positive sign for the ever-expanding semiconductor industry.

However, the index was weighed down by the banking sector, with Lloyds Banking Group Plc’s lending income missing estimates. Another of the big banking names, Barclays, is due to report earnings on Thursday.

In the luxury sector, Kering SA’s warning of a plunge in profits due to sluggish sales at its flagship brand, Gucci, caused a slump, dragging the luxury peers lower. The stock hit its lowest price since September 2017. The poor performance looks contained to just Kering, as LVMH continues to trend higher, up 8.9% YTD.

S&P 500

Tesla was the first major name to report in a week when 40% of the index constituents will release earnings. Shares rose 13.3% in after-hours trading, more than the implied move of 8.4%. The rally came despite a fall in quarterly revenue. The electric car maker said it had “updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025.” Tesla’s increase represented about a third of the rally in Nasdaq futures.

Resilient consumer spending helped Visa to beat estimates. US consumer spending has remained remarkably resilient despite higher-for-longer interest rates, with Americans still looking to spend on big-ticket purchases and international travel.

The rest of this week will see Meta, Microsoft, Alphabet and Exxon report earnings. These names alone represent 14.8% of the index weight.

Strategists Split

Wall Street’s top banks are split on a 2024 outlook. Morgan Stanley forecasts a positive trend in profit growth during 2024 and 2025 as the economy strengthens. However, JPMorgan Chase & Co. suggests that the current scenario is uncertain due to factors such as high inflation, a stronger dollar, and an increase in geopolitical tensions.

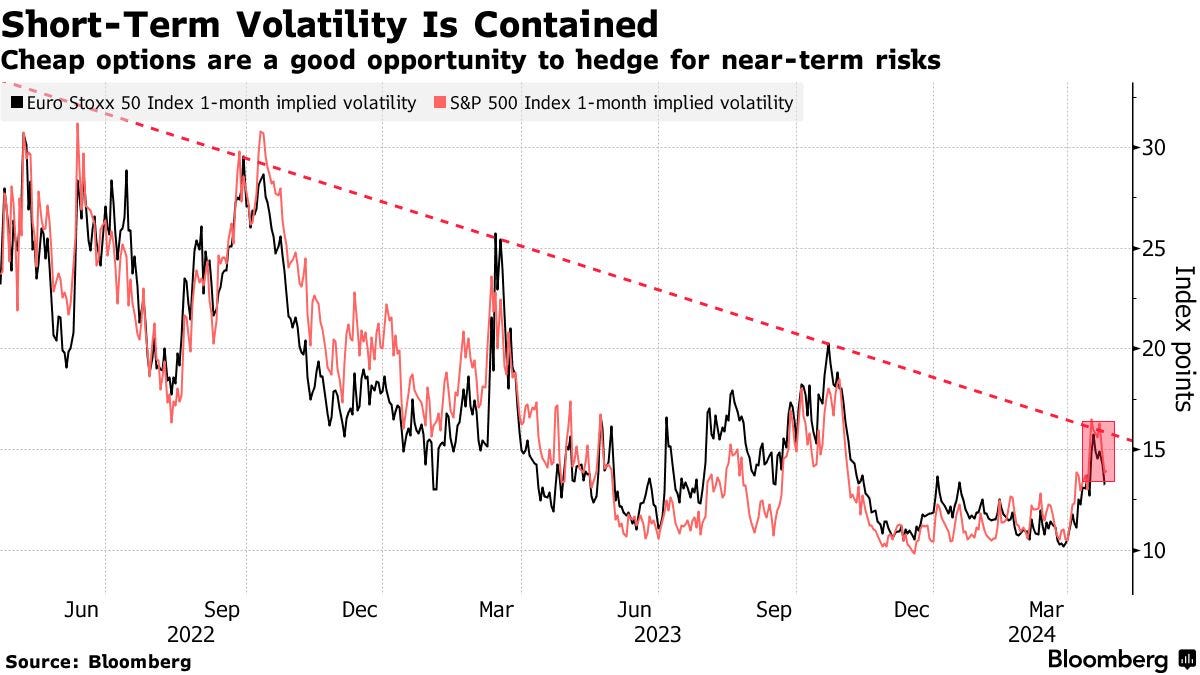

For both the US and European stocks, volatility has remained contained from recent elevations. You can read more about rising global volatility here:

What’s driving the index and what isn’t?