The BoJ Blunder

Why it looks like a lose, lose, lose scenario.

Sometimes, you’re stuck between a rock and a hard place. For Governor Ueda, he’s stuck in (arguably) a worse position.

The Bank of Japan (BoJ) meeting on Thursday showed that Ueda and Co. are in a pickle when it comes to monetary policy actions.

On the one hand, they are holding off hiking rates further as they wait to see whether the current wage momentum in Japan continues. Ueda also mentioned they want to see what happens with Trump’s trade policy stance to the country. Yet in sitting on their hands, they risk getting behind the curve of any potential uplift in inflation.

Yet, on the other hand, there’s the case to be made that rates should be coming lower, not higher. Japan has painful memories of deflation, and it took a pandemic to give the country rising price levels. With the current reading of 2.3%, just above 12-month lows, there’s the danger that tightening monetary policy will only push inflation back down towards 0%.

In our view, the BoJ has already blundered policy actions over the course of 2024. Here’s the breakdown of the troubles that lie ahead and how to trade it via the Yen.

Sitting On Their Hands

Let’s explain why yesterday’s ‘no move’, for the third month in a row, was akin to giving traders the green light to short the Yen.

Take a look at Japan IOS pricing a month back, with a focus on the Dec meeting:

There was a 53% chance of a 15bps hike. The coin flip of a will they/won’t they wasn’t the best pricing anyway, as the market clearly didn’t have clarity from the central bank. Yet this probability got whittled over the past week or so as it became more apparent that no policy change was coming.

Given that a key part of a currency movement is dictated by the relative interest rate differential versus another currency, the reduction in OIS pricing was a factor in the weakness of JPY in the run-up to the meeting (shown below):

This isn’t a groundbreaking discovery, but we can use it to extrapolate potential price action into 2025. After all, the market has simply shifted the next rate hike expectation to January, where we now have another coin flip implied probability of a 15bps hike.

Let’s consider some of the comments that Ueda made in his speech. He said that the “decision to keep rates was mainly based on assessment of wage trends, uncertainties of overseas economies and next US administration’s policies. We need to gauge situation for quite a while whether for wages or Trump administration.”

Personally, we don’t see this as a man (or a policy committee) that’s ready to hike rates in January. We won’t have much more key data out for them to hike with confidence on the 24th Jan. The holiday season, etc, means that from now until the second week of January, there will be little to move the needle for the BoJ, based on their above assessment linked to raising rates.

From our perspective, a fourth month of sitting on their hands awaits us, and this again should propel USD/JPY higher as the implied probability falls from 50% down to zero.

Damned If They Do

Let’s say that the BoJ do hike in January and signal that another hike is coming in March. Beyond an initial knee-jerk reaction of Yen strength, is this really a pillar of support for the currency? We doubt it.

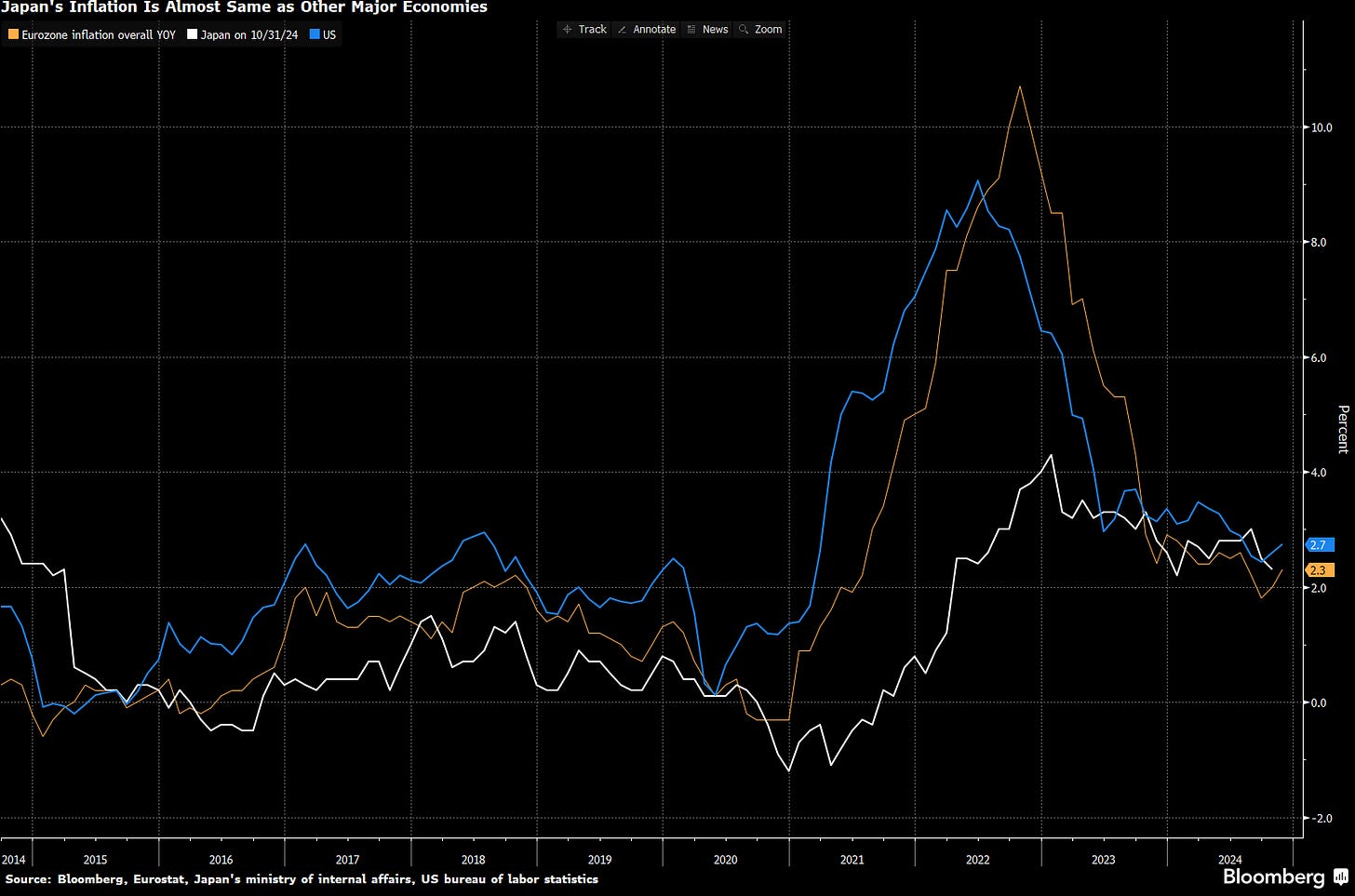

Japanese inflation is virtually the same as that of the EU and US:

Both the E.U. and the U.S. have already begun cutting interest rates this year, as inflation is back down towards a 2% level, which most central banks look to as a target level.