The Case for Tactical Dollar Longs

Even consensus trades pause.

It began with a tremor, not a quake. A few basis points here, a shrug in the yen, a flicker in EM FX. But by midsummer, the ground beneath the dollar had shifted.

The once-invincible greenback, global benchmark and battlefield currency, posted its worst start to a year since 1986. A full 9% down. Sure, monetary policy and fiscal rot haven’t provided any support. But the main driver behind the move was that the United States declared a different kind of war, one not waged through interest rates or capital flows, but tariffs.

Trump’s “Liberation Day” levies didn’t just redraw trade routes. They rewired expectations. The dollar, once a safe harbour in times of political stress, became collateral damage in a world of weaponised uncertainty.

What followed was textbook: a consensus short. Systematic strategies and discretionary desks leaned into the move. Real money followed. Retail caught the scent. The trade made sense, and still does, on paper. But markets don’t move on paper alone. And now, the setup is turning.

This isn’t the end of the dollar’s decline. But it may be time to step aside, or even step long, while the consensus catches its breath.

The structural bear case for the dollar is intact. But the market never gives clean trades in straight lines. What we’re seeing now isn’t a reversal of narrative, but a recalibration of pace.

The Anatomy of the Breakdown

I. The Trigger

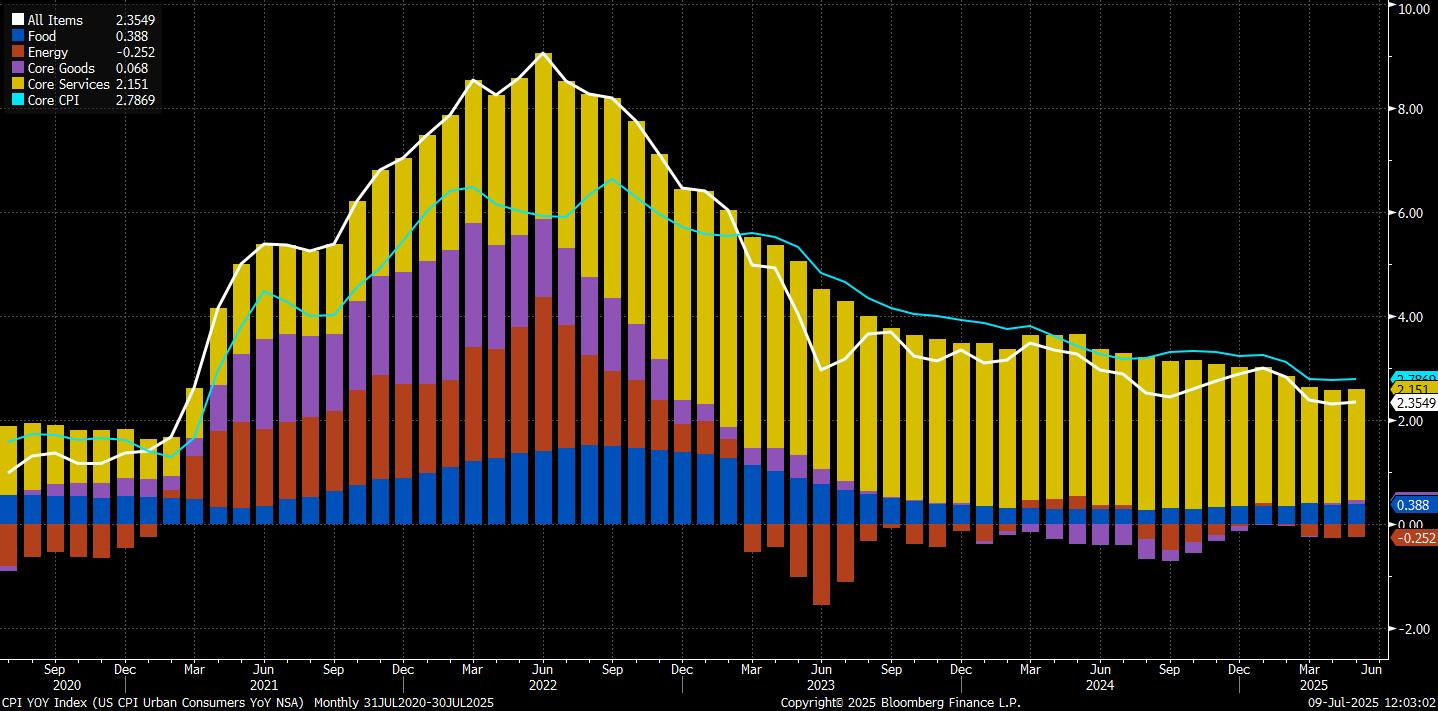

The dollar’s fall in 2025 has been as relentless as it has been rational. It’s true that the fall began before the start of April. During February and March, the greenback lost ground, with investors anticipating that the Federal Reserve would start cutting interest rates sooner than expected, due to signs of slowing inflation and a cooling labour market.

Even before we got to “Liberation Day”, concerns over new US tariffs on Mexico, Canada, China, and others weighed on investor sentiment.

Yet the main trigger as we entered Q2 (and the dominant theme that has prevented any meaningful rally) was the imposition and subsequent uncertainty surrounding import levies.

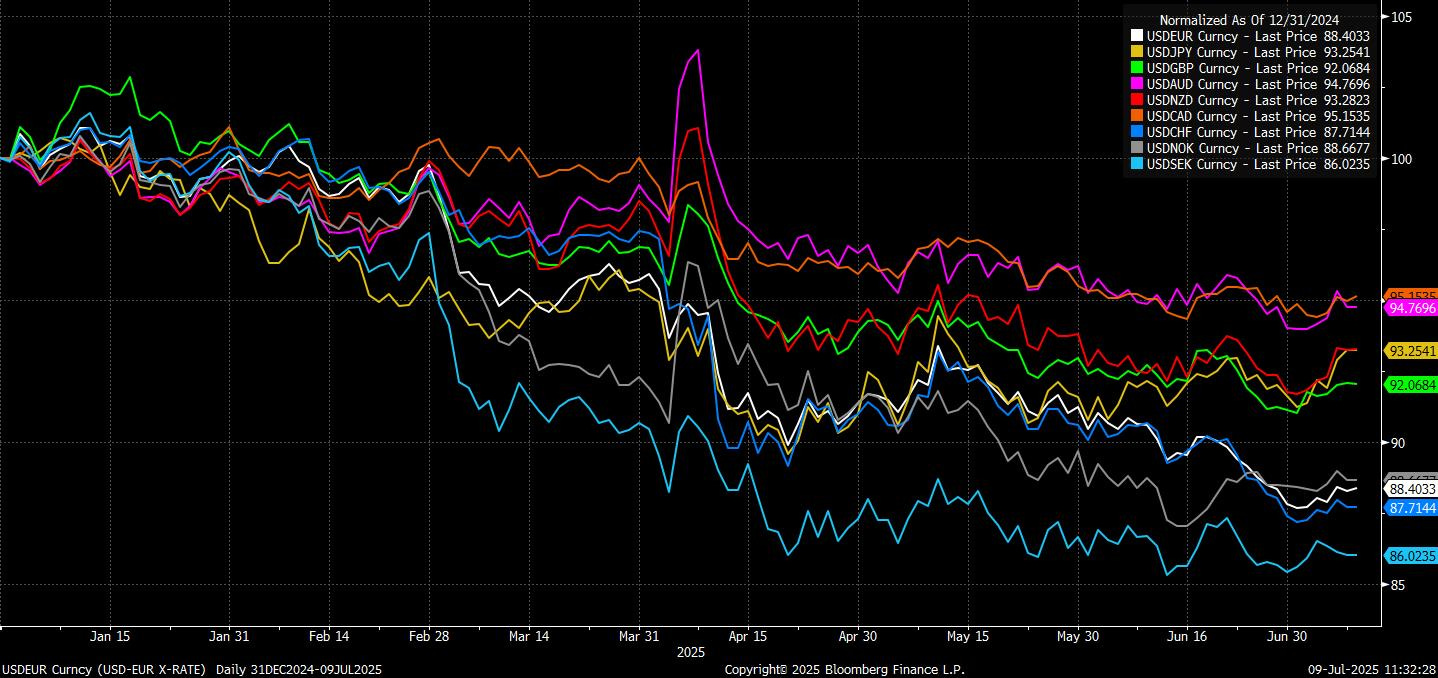

The Bloomberg Dollar Spot Index is down nearly 9%, underperforming every major G10 peer and many EMs. The DXY has drifted further below its 200-day moving average than at any time in two decades.

Trump’s second-term trade doctrine arrived with a bang: 20% to 40% tariffs on allies and adversaries alike, with more in the pipeline. The geopolitical optics rattled investors. The dollar’s credibility as a store of value wavered. Foreign buyers turned skittish. FX hedging flows surged. And then came the cascade: a risk-off move not into the dollar, but out of it.

It was a paradox. Rising trade friction usually props up the greenback. But this time, the US was the source of volatility, not the shield against it.

II. A Trade Becomes a Theme

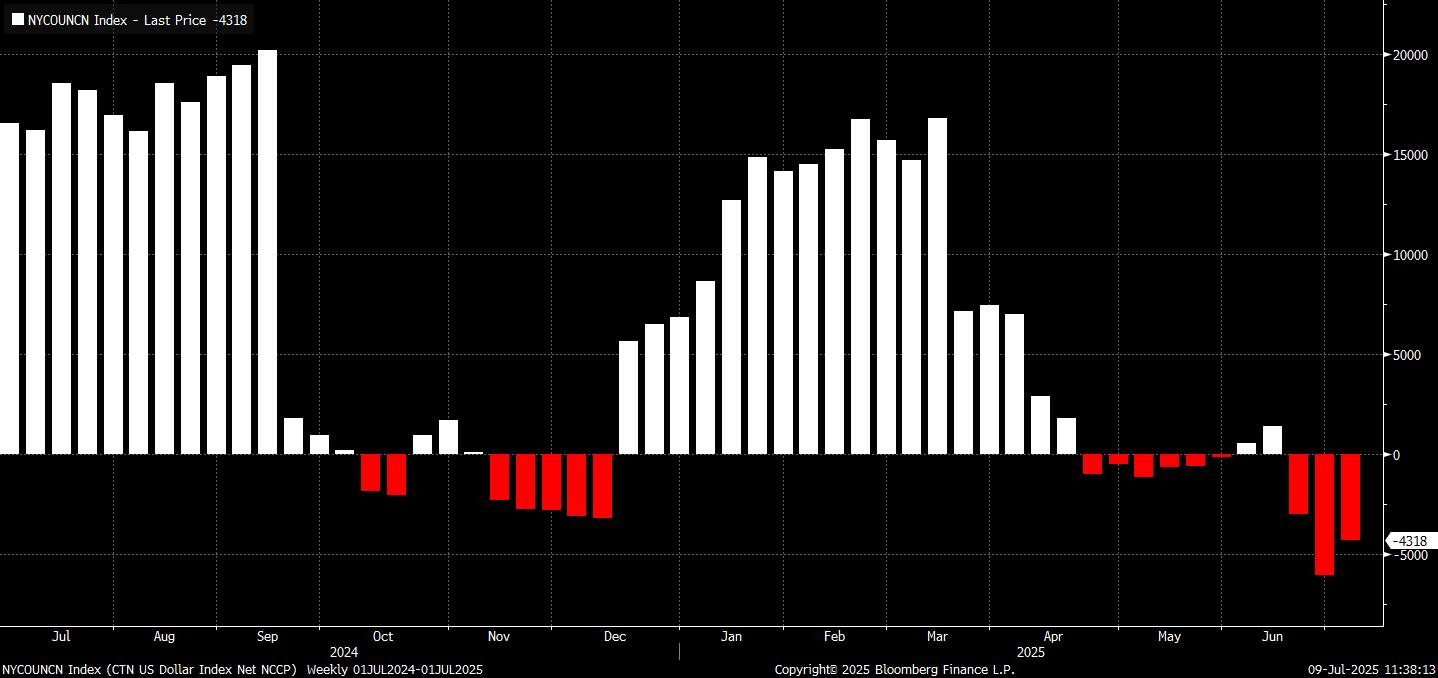

Positioning tells the story. As of July, speculative net shorts on the dollar stood at $18.3 billion, according to CFTC data. That’s down modestly from the prior week, but still heavy.

The dollar short has become the consensus macro expression of the moment. It captures everything: Trump risk, trade friction, inflation pass-through, the Fed’s constrained dovishness, and the slow erosion of reserve currency privilege.

But consensus trades bring fragility. All it takes is one catalyst to force an unwind. And last week, we may have seen the first spark.

III. A Window for Tactical Longs

The nonfarm payrolls beat caught the market leaning the wrong way. Unemployment fell to 4.1%, trimming rate cut expectations materially.

Fed funds futures now price in roughly 51bps of easing by year-end, down from 65bps a week earlier.

Meanwhile, EM FX buckled under the renewed dollar strength. The Japanese yen dropped 1.2%, the South Korean won 1.1%, and the MSCI EM currency index notched its biggest intraday loss in months.

This isn’t a trend change… yet. But it’s a reminder. Tactical dollar strength can emerge even in structurally bearish regimes. Especially when positioning is crowded and catalysts misfire.

IV. The Macro Math Still Favours Weakness

Over the medium term, the dollar remains vulnerable. Fiscal deficits are widening. Tariffs threaten to reaccelerate inflation just as the Fed nears its pain threshold.

Foreign central banks, particularly in Asia, are enjoying a weaker dollar and are unlikely to intervene. China’s trade-weighted yuan has hit a 12-year low. Even with a modest USD/CNY rebound, Beijing has breathing room.

The White House, too, is incentivised to keep the dollar weak. Currency debasement helps exports, boosts nominal growth, and eases debt servicing.

But that’s the long game. The near-term setup is more nuanced.

V. The Setup Into Summer

With the 90-day tariff pause set to expire (on August 1) and US CPI looming, volatility is inevitable. But directionality is not. If inflation surprises to the upside while labour data holds firm, the dollar could grind higher as cuts are pushed into 2026.

Alternatively, if tariffs bite more than expected and market volatility picks up, a flight to dollar liquidity can’t be ruled out.

In either case, dollar shorts may need to lighten up.

(To get full access to all research and notes posted, subscribe to premium.)

Market Expression

The dollar’s decline this year has been swift, logical, and well-telegraphed. But even in secular trends, markets pause. The consensus is short. The data is noisy. The positioning is stretched.