The Central Bank Cheatsheet

All you need to know and digest ahead of the US Fed, Bank of England and Bank of Japan meetings.

As we flagged up in our Monday trade ideas publication, this week sees a host of major central bank meetings. The below graphic shows the extent of the meetings around the world and the dates.

For the purpose of this piece, we want to give a brief run down on the three major ones. This is the US Fed (Wednesday), the Bank of England (Thursday) and the Bank of Japan (Friday).

US Federal Reserve - Wed 20th

The two-day meeting has begun already, with the press conference taking place tomorrow at 2.30pm Eastern.

There’s a 98% probability of no hike from the Fed, so this isn’t going to be a market mover, given the expectation. What will be key is the extent to which this is seen as a hawkish hold.

When we talk about a hawkish hold, we’re referring to whether Powell and Co. speak about the potential for a further rate hike between now and the end of the year.

At the moment, there’s a 35.4% probability that we’ll get one more hike by December (shown below).

What to watch to suggest a hawkish hold

It’s the Fed's monetary policy statement and the tone of Powell’s post-policy press briefing that will be the giveaway.

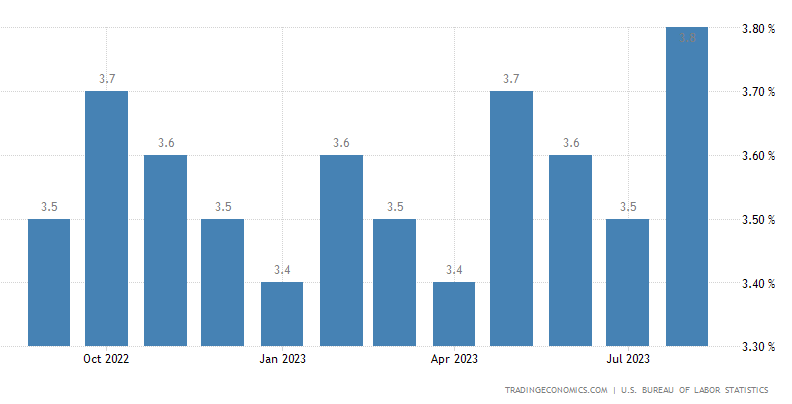

Yet it really boils down to the fact that the Fed are a data-driven central bank. So the fact that Core PCE inflation (one of the Fed’s preferred measures) jumped in July, with CPI inflation now up to 3.7% from the 3% lows (see below) could justify Powell coming out with a hawkish stance.

The other element of a hawkish hold would be to analyse the updated dot plot chart. This reflects where policy members think rates will be in the longer term.

We’ve heard some members speak recently of ‘higher for longer’ rates, so want to see if this is reflected in the dot plot taking away some of the cuts that were pricing being forecasted for 2024. Again, this would be a hawkish note.

What to watch to suggest a dovish turn

On the flip side, we’ll be watching for the Fed to lean more on the softening labour market as a sign that maybe we’ve reached the terminal rate already.

We had a surprising jump in the unemployment rate last month, with it at a 12-month high of 3.8%.

Even though we’re not at the stage to panic, the Fed really won’t want all the hard-won job gains since the pandemic eased to be lost over the coming year.

For the rest of the article we’ll go through:

Why the Bank of England will be forced into a hike

GBP trade ideas to implement

Why it’s key to be patient with the BoJ