The End of the Easing Cycle

Assessing the ECB's next steps and mapping the path forward in European rates, credit markets, curves, and equity sectors.

The European Central Bank is widely expected to deliver another 25bps cut this Thursday, bringing the deposit rate to 2.0%, the midpoint of its estimated neutral range (1.75%-2.25%). After eight cuts in this cycle totalling 200bps, we see this move as a signpost marking the end of the ECB’s rapid-fire easing phase. Markets and policymakers alike are treating it as a pivot to a more cautious, data-dependent approach.

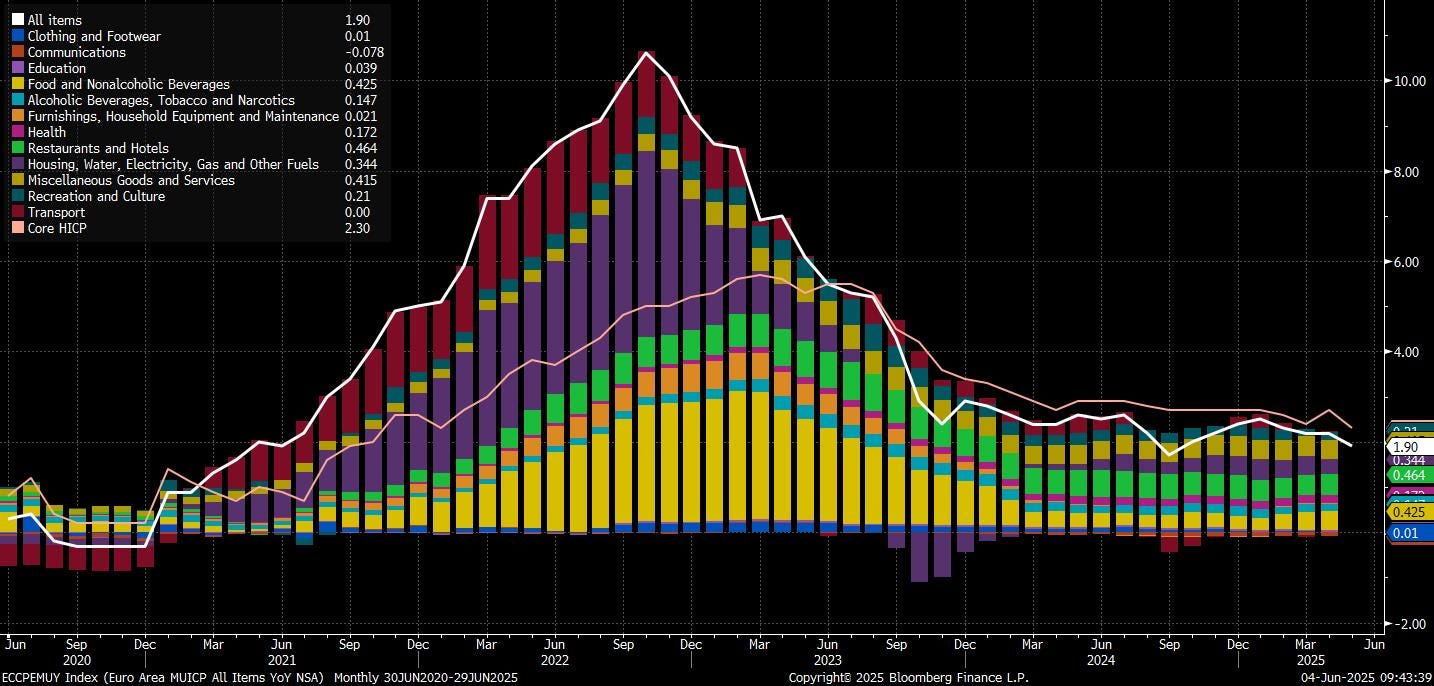

What has changed is the inflation picture. Headline inflation has already dropped below the ECB’s 2% target to 1.9%, and while services inflation remains stubborn, wage growth (a key driver) has begun to ease. Lower energy prices and a stronger euro have reinforced the disinflation process, giving the ECB confidence that it has tamed the inflation surge that once threatened to destabilise the economy.

Yet growth risks remain. The eurozone has avoided outright recession, but trade policy uncertainty and structural drags keep the outlook fragile. Europe is stuck between receding inflation fears and tepid growth prospects, and this leaves the ECB in a delicate balancing act, ready to pause and reassess rather than push further. In this note, we outline why this cut marks a likely pause, what it means for inflation and growth, and how we’re positioning in markets.

The End of the Road for Now

The ECB’s easing cycle has been aggressive: 200bps of cuts over a series of back-to-back moves. But as we approach a neutral stance, the bar for additional action is getting higher. Policymakers have been careful not to pre-commit to a path beyond this week’s move. Lagarde will likely stick to her “data-dependent, meeting-by-meeting” refrain.

Behind this caution is a real shift in the underlying macro environment. The disinflation process has gained traction, with cheaper energy, stronger FX, and, critically, cooling wage pressures all combining to bring headline inflation down. Headline inflation is now at 1.9%, below target and likely to stay there for much of the forecast horizon.

Meanwhile, services inflation remains sticky, having spent nearly three years at 3.5% or higher, though even here we expect some easing in the coming months. Wage data and business surveys suggest that service sector price pressures are starting to bend lower.

Given this backdrop, the ECB’s own projections are likely to show an inflation undershoot earlier than March’s forecasts, which had target-consistent inflation only by Q3 2026. Updated projections should move that undershoot forward, reflecting stronger FX and lower energy costs.

All this suggests to us that the ECB’s terminal rate for this cycle will likely be 1.5%, but getting there will no longer be on autopilot. We expect a shift to a quarterly easing pace—September and December cuts are possible, but only if the data (or fresh shocks) warrant it.

A Complex Picture, but the Direction is Clear

Headline inflation at 1.9% is already a win for the ECB’s price stability mandate. Wage growth, which was the final holdout in the stickier core inflation readings, has started to cool sharply. The ECB’s negotiated wage growth data has decreased decisively since the start of the year.

Services inflation remains the main reason for caution: it jumped to 4.0% in April due to holiday distortions, but May’s national prints in Germany, France, and Italy suggest that a sub-3.5% figure is likely for the final reading. This would bolster the view that the stickier core pressures are starting to ease.

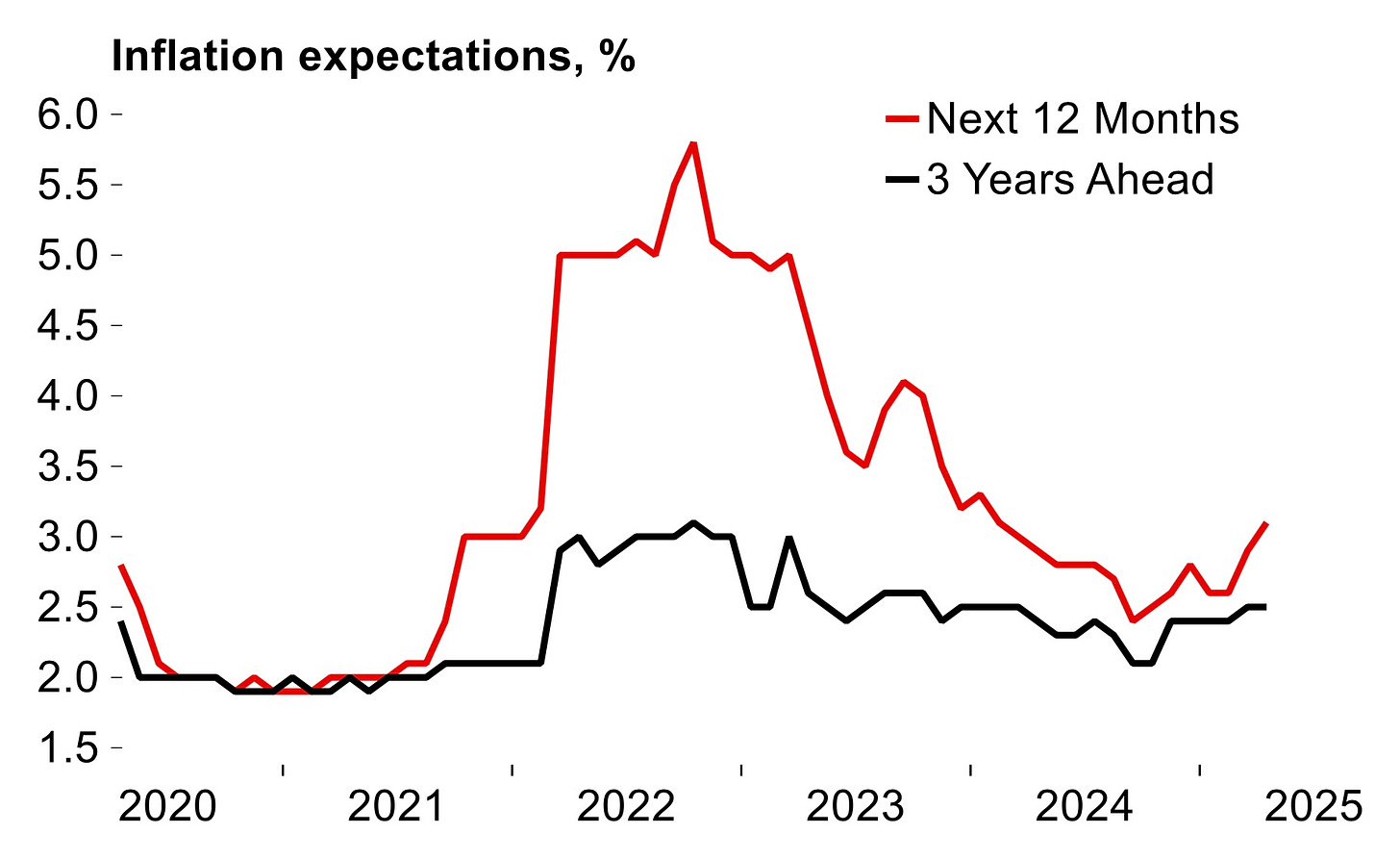

We also note household inflation expectations for the year ahead have risen slightly, to 3.1% from 2.6% in February. However, the three-year-ahead measure remains stable at 2.5%, reinforcing the sense that inflation expectations are still anchored—a key pillar for the ECB’s policy stance.

In our view, this is a classic case of monetary policy lags finally biting. The disinflation process is real, driven by weaker demand, trade uncertainties, and the lingering effects of the ECB’s prior tightening. Lower corporate profits also help buffer the impact of higher wage growth, limiting pass-through to prices.

A Wobbly Recovery, with Risks Skewed Lower

The story of growth is a bit more nuanced. The ECB’s last projections in March had euro area growth at 0.9% for 2025 and 1.2% for 2026. We still see the 2025 number as valid, helped by a surprisingly strong start to the year and trade distortions (particularly German export front-loading ahead of threatened US tariffs).

But these distortions are likely to unwind in the second half of the year, leaving a weaker carryover into 2026. In addition to that, there is uncertainty around German fiscal policy support, and we see growth projections for 2026 coming in closer to 1.1%, if not lower.

In our minds, the bigger concern is the persistent drag from trade policy uncertainty. The US threat of tariffs on European goods, now targeting steel and aluminium at 50%, has already triggered a wave of front-loading, but it could become a serious drag on investment and growth if it becomes a durable feature of the transatlantic relationship.

(To get full access to all research and notes posted, consider becoming a premium reader here.)

Trade Expressions: Turning Views into Positions

So, how are we expressing this view that the ECB’s easing cycle is at a near-term end, inflation is cooling, and growth remains fragile?

EURUSD Long Bias: Even if Lagarde sounds dovish at the press conference, we doubt any euro selling would be sustained beyond a knee-jerk move. With the dollar still overvalued and US trade policy stuck in a confrontational mode, we see the euro well supported on dips.

Bund Curve Steepeners: The ECB’s shift from “back-to-back” cuts to a more gradual easing pace should anchor the very front end of the curve (2-year yields). Meanwhile, we expect the 10-year yield to see modest upward pressure as long-term growth and fiscal worries remain in focus. This dynamic should help steepen the 2s10s Bund curve, and we see value in being long the spread here.

Front-End Receivers in 1y1y EUR Swaps: Markets are fully priced for a 25bps cut this week and no more until September. We think that’s about right, but the risk is that the ECB stops sooner if growth weakens faster than expected. Front-end receivers are a good way to express that optionality in the rates space.

EU Credit vs US Credit: We’re cautious on European growth, but the ECB’s stance is now largely neutral, and with euro area inflation risk lower than in the US, we see relative value in EU credit tightening vs US credit.

Eurozone Bank Equities (A Contrarian Play): At first glance, banks may seem an unlikely bet in a low-growth, low-rate world. But for European bank, particularly in Italy and Spain, stability in rates can be a positive. The end of the ECB’s easing cycle removes the risk of further margin compression, while the global growth backdrop offers a glimmer of loan growth potential. Europe’s banks have spent the past decade cleaning up their balance sheets, and if the region’s recovery picks up even modestly, peripheral banks could outperform broader indices. It’s a contrarian play, but one that aligns with the idea that the worst of the banking sector’s story may finally be behind us.

Other Narratives to Watch

One area we’re watching carefully is the euro’s role as a reserve currency. Lagarde has spoken about this “window of opportunity” for the euro to play a bigger global role, and if she repeats that this week, it could add a layer of longer-term euro support. Of course, the US dollar will never not be the world’s primary reserve currency—it’s the foundation of the global financial system. However, incremental euro strength, particularly as Europe’s political risk premium fades and fiscal cohesion grows, is something we’ll be watching closely.

We’re also alert to the risk of a US trade policy pivot if the legal challenges to Trump’s tariffs gain traction. If that uncertainty clears up, it could remove a key growth drag for Europe and give the ECB more confidence to keep rates lower for longer. But for now, the base case is that trade tensions linger and reinforce the case for a cautious ECB.

To Wrap This Up

This Thursday’s 25bps cut is almost certainly the end of the ECB’s rapid-fire easing cycle. Inflation is already at target, and the growth outlook is clouded by trade policy shocks and a waning fiscal impulse. From here, the ECB’s easing path will be more measured—quarterly moves at most, if the data warrant them.

For markets, the bigger message is that the eurozone has reached a turning point: the ECB is done playing catch-up, and optionality is now the order of the day. We’re positioning for a period of calm. Maybe the calm before a storm, but calm for now.

AP

This is a solid take on where the ECB stands right now. After eight rate cuts totaling 200bps, it makes sense they’re hitting pause — inflation’s finally below target at 1.9%, helped by easing wage growth, cheaper energy, and a stronger euro. The ECB seems ready to slow down and play it by ear, watching data carefully instead of rushing moves.