The Great Rotation to Small Caps

A weekly look at what matters and how to trade it. (January 19th)

A volatile week left equities slightly lower amid earnings noise and policy headlines.

US equities drifted lower with little conviction, weighed down by financials after bank earnings failed to provide their usual early-season lift. Misses were largely idiosyncratic, but the sector was hit hardest by politics. President Trump’s call for a one-year cap on credit-card interest rates at 10% landed squarely on payments and lenders, dragging Visa (V US) and Mastercard (MA US) sharply lower.

Consumer discretionary weakness added to the drag as legal uncertainty around tariffs lingered. The Supreme Court again declined to issue an opinion on the legality of IEEPA tariffs, extending a policy overhang that has become increasingly market-relevant. Housing-linked stocks moved the other way following Trump’s proposal to allow penalty-free 401(k) withdrawals for down payments, another boost to our housing affordability thesis and portfolio holding, Builders Firstsource (BLDR US).

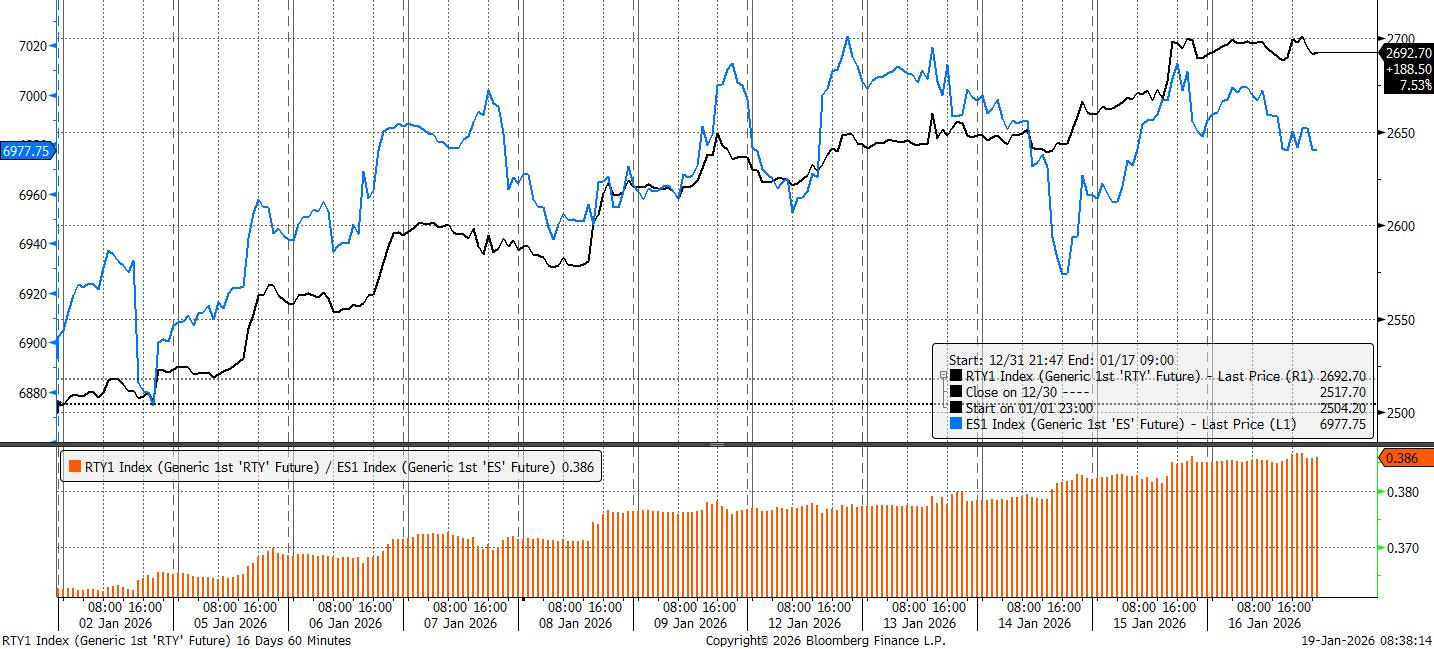

Tech remained unsettled. Megacaps are struggling to regain leadership even as select pockets of the semiconductor complex show signs of life. Sandisk’s (SNDK US) strength highlighted a rotation within tech rather than a revival of broad enthusiasm, reinforcing the sense that markets are becoming more selective. That same logic has helped fuel sustained outperformance in mid- and small-caps, with the Russell 2000 extending its relative run as concentration risk in megacaps becomes harder to ignore.

Overlaying everything was a growing institutional unease around policy credibility. Trump’s escalating pressure on the Federal Reserve, including the DOJ subpoenas targeting Chair Powell, reintroduced questions about central bank independence. Markets ultimately shrugged it off in price terms, but the episode contributed to a cautious tone beneath the surface. Rate markets responded more clearly. Hawkish Fed commentary and firmer data nudged expectations for cuts further out, pushing the first fully priced move from June into July.

Markets are back into “headline trading,” with courts, banks, and the Fed all now potential catalysts for market direction.

The Week Ahead

A quick rundown of what we’re focusing on in this week’s report:

“Trump’s Greenland Threats Reopen Tariff Wounds”

Geopolitical tensions rise between Europe and the US. A familiar 2025 theme, tariffs, is back as the leverage in the latest developments.

“For Now, It’s Pain Across Equities”

The impact is likely to be on equities in the short-term and less obvious for bonds and currencies.

“Second Order on Commodities”

The second-order risk may be a counterintuitive correction in precious metals.

“Takaichi Ready to Go”

Takaichi and her cabinet have enjoyed high public support since taking office last October.

For full access to each weekly note, see subscription pricing here. As a reminder, prices for new paid subs is increasing from $30 to $40 a month at the end of the month.