As we highlighted in our Q4 thematics note, Fall Risk, markets were awash with narratives but relatively short on clarity. Themes proliferated, yet only a handful demonstrated structural longevity worth capital allocation.

Heading into 2026, that challenge hasn’t gone away. Several themes have raced out of the gate in January, putting them front and centre in the portfolio:

The continued spike in Commodities merits serious attention.

Defence has come out of the background and firmly warrants a seat at the table when it comes to allocating capital right now.

The rise of GLP-1 is another theme we continue to bang the drum on, with headlines so far in January indicating it has legs to run higher.

In other areas, conviction in picking becomes harder. For example, as the AI capex cycle matures beyond raw hardware into power, grid, and real-economy bottlenecks, the task isn’t just identifying the themes (anyone can say buy AI), but understanding where infrastructure, energy, supply chains, and demand drivers intersect in ways markets are just beginning to price.

This note updates our views on each thematic basket and current portfolio positioning (live portfolio access linked at the end).

At midnight on January 31st, the price for new paid subscriptions will increase from $30 to $40 per month.

Anyone who subscribes before then will be grandfathered in at the current rate — your price stays $30 going forward, as long as your subscription remains active.

If you’ve been on the fence about going paid and getting full access to all of our work without a paywall, now is the time. Locking in now means permanent access at a lower price.

Don’t Fade The Commod Boom

+32%. Plenty of tailwinds are driving us to increase our existing allocation to hard assets.

The boom in metals, both precious and non-precious, has been quite extraordinary. Yet despite some calling for a crash in position unwinds late last year, the commodities have pushed even higher over the past month, with silver leading the charge, +41.9%, and +73% from our longs in mid-November.

We’ve been in the bullish camp for some time now and outlined in our November note that we prefer to play the moves on related equity names to benefit from operational leverage. What we mean by that is when a miner experiences an increase in the price of the underlying metal, the boost to revenue outstrips any higher costs. Of course, this works the same way on the way down: fixed costs must be paid even when the metal is trading below the firm’s breakeven price. But when we’re in a bull market (hint, we are), it can provide scaled upside. This is reflected in our holdings in Freeport-McMoRan, which provides a high-beta vehicle for both copper and gold, along with Pan American Silver, a key silver name.

We see a supportive macro and micro backdrop for gold, silver, and copper this year, with each metal offering a distinct but complementary expression of the broader commodities bull case.

Gold remains the clearest vehicle for what we would characterise as the ongoing “debasement trade,” as persistent fiscal expansion and rising sovereign debt burdens globally reinforce the case for reserve diversification and hard-asset hedging. The situation in Japan this week is a good case in point. With the Federal Reserve likely to move further into an easing cycle, the prospective decline in real rates should reduce the opportunity cost of holding gold, while elevated geopolitical risk related to Trump should continue to put a bid under the precious metal.

Silver appears positioned to benefit both from idiosyncratic fundamentals and from its historical tendency to lag and then accelerate after gold-led moves. The market continues to face a meaningful supply-side imbalance, driven by constrained mine output and limited primary silver project development, even as industrial end-use demand remains firm. At the same time, silver’s higher beta to US equities and risk sentiment gives it convexity in a risk-on environment, creating a setup where firm equity markets can reinforce the ongoing move.

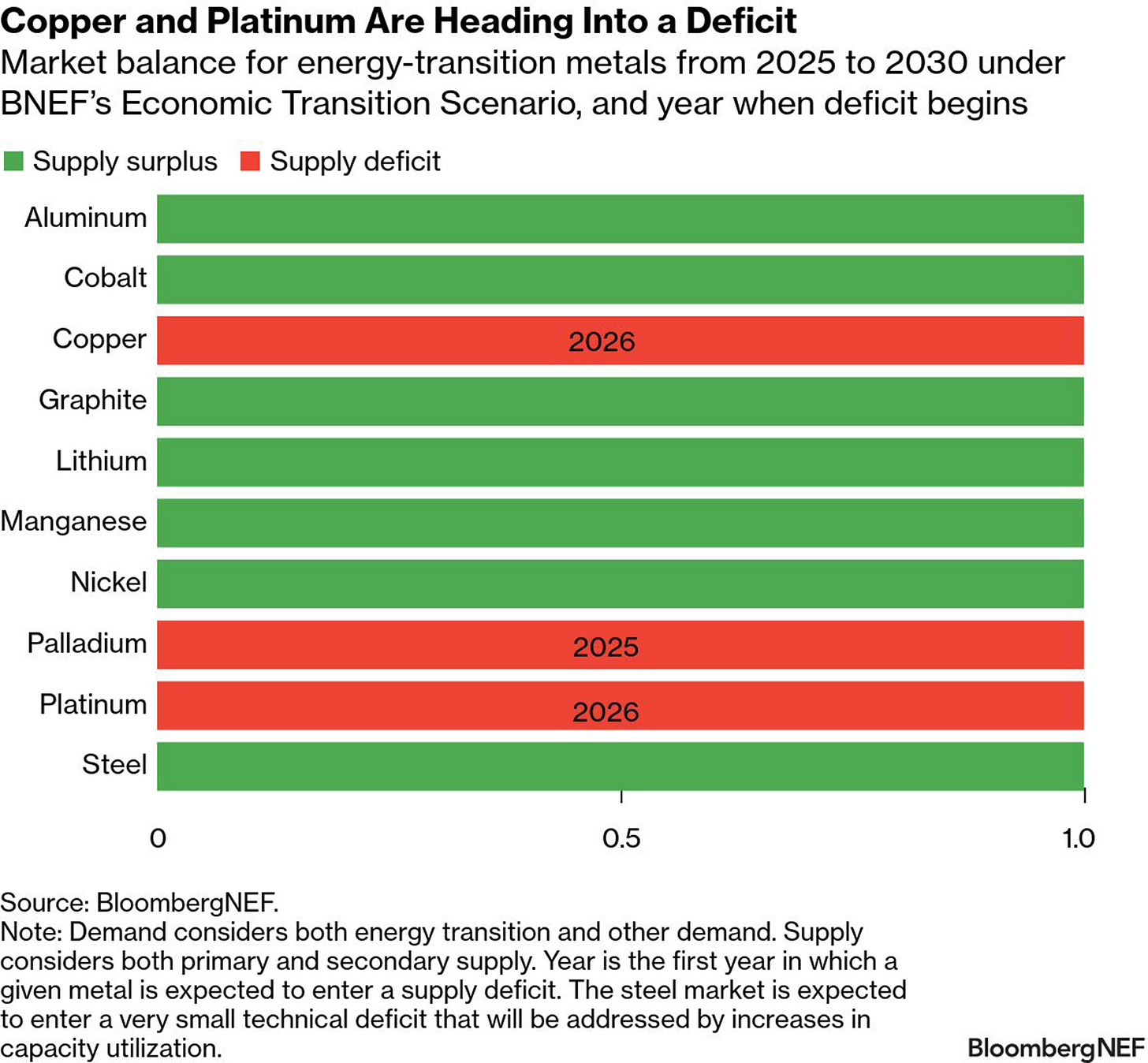

Copper, meanwhile, reflects the industrial backbone of the cycle. Years of underinvestment have tightened the supply outlook. The data below suggests it’ll enter a supply deficit this year.

This comes just as demand is being structurally reset higher by electrification, grid expansion, and, increasingly, the build-out of AI and data-centre infrastructure. These projects are copper-intensive across various parts of the build-out, embedding long-duration demand into the outlook at a time when new large-scale supply remains scarce. The combination of constrained mine development and accelerating technology-driven consumption leaves copper well positioned for sustained pricing power.

Both platinum and palladium are experiencing related supply deficits, with basket exposure via Valterra Platinum and Impala Platinum.

Finally, a word on natural gas. We continue to hold EQT, which is still up circa 2% over the past year despite the 23% fall in Nat Gas over the same time period. This has impressed us, and partly speaks to its delivering strong earnings growth and cash flow generation even as gas prices have softened. Therefore, we’re happy to hold here. Even though the opportunity cost of allocating the capital elsewhere exists if gas continues to roll over, it provides a great way to capture upside on a bounce.

We currently hold in our basket:

Freeport-McMoRan (FCX US)

Pan American Silver (PAAS US)

EQT (EQT US)

Valterra Platinum (VALT US)

Impala Platinum Holdings (IMPUY US)

Rio Tinto (RIO LN)

A New Dawn for Defence

+117%. Defence spending has shifted to a new gear in 2026 on the back of rising geopolitical tensions.