2025 has been a year where opportunity and ambiguity have arrived in equal measure. Markets haven’t lacked for themes; they’ve just lacked clarity at times. The narrative tape has been running fast. AI build-outs reshaping capex cycles, geopolitical tensions shifting supply chains in real-time, and yes, the occasional policy signal delivered via Truth Social at 2:14 a.m.

For macro and thematic investors, the challenge hasn’t been finding stories, but filtering the signal from the spectacle.

In a landscape where headline noise travels faster than fundamentals, the aim is simple: identify the themes with structural longevity and rotate out of those running on narrative fumes. With that in mind, we’ve taken stock of where our current thematic baskets stand, how each thesis has evolved, and where the next leg of alpha may come from.

We receive messages from subscribers looking to allocate capital to our portfolio. Alongside the likes of Citrini and Le Shrub, we’ll shortly be listing our baskets on Run Plutus.

There, you can link to your IBKR or brokerage account and allocate funds to any/all of our baskets. When we rebalance a portfolio or basket, it automatically adjusts on the client’s side. Think of it as an institutional-level copy trading service.

Register for the launch here.

Art of the LNG Deal

Original Note: 16th April

The core idea here was that liquefied natural gas (“LNG”) was being positioned as a geopolitical and transactional lever, a deal-making tool for Trump’s trade objectives. We emphasised how supply/demand dynamics, contract structures and geopolitics intersect in the LNG space.

We have reduced some exposure to this theme towards the end of the summer, but like to retain it for a few reasons. Geopolitics remain very much alive: energy security, Europe’s push to diversify away from dominant suppliers, and Asian demand growth all give potential upside for LNG exporters. In the short term, if demand spikes (cold winter, supply constraints) while new capacity is delayed, LNG can outperform general energy commodity baskets.

However, our choice to take some risk off the table mainly stems from oversupply concerns. New LNG capacity is still coming online globally, which could put pressure on the margins of various stocks within the basket.

We’ve also seen AI push for clean energy, which doesn’t bode well for sentiment around LNG.

Bottom line: Hold

Back to Basics

Original Note: 28th August

From Gap’s viral denim campaign and American Eagle’s Sydney Sweeney ad, the notion of companies outperforming from broad appeal, shared recognition, and cultural resonance was the key driver in this theme.

The thematic play remains very much alive and well, but is a basket that needs to be actively traded, given the fleeting nature of some virality campaigns and subsequent share price movements.

Some of our highest conviction names in the basket, including AEO, have performed very well in just a couple of months, and we see traction in holding these for the foreseeable future.

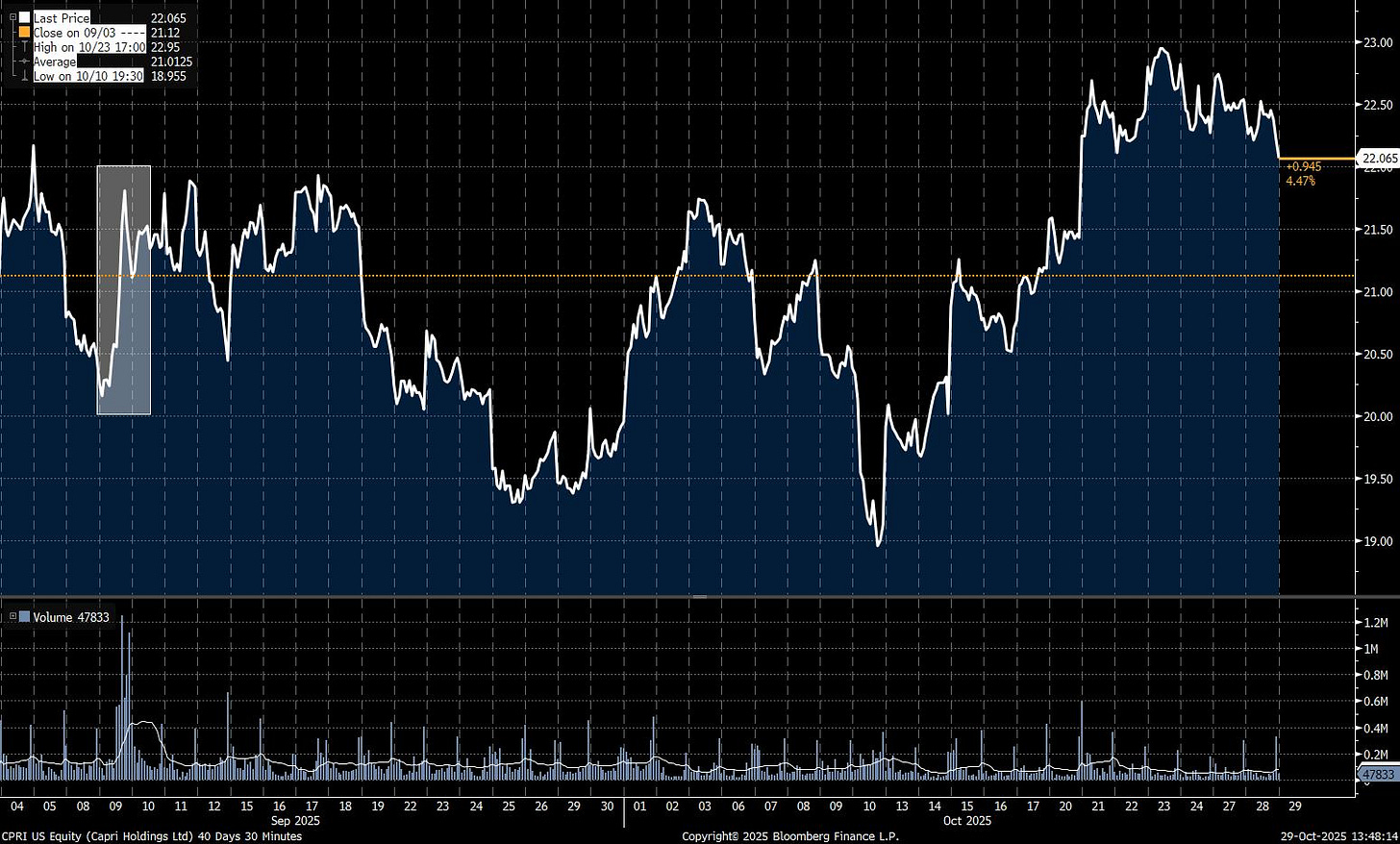

Yet evidence of being careful came from us buying CPRI (the owner of Jimmy Choo) in early September, with a volume spike on the stock following Sydney Sweeney’s appearance in a new campaign. We ultimately sold this position earlier this month after a lack of meaningful follow-through.

Bottom line: remain active and nimble

Lean Mass, Fat Margins

Original Note: 30th July

The explosion of GLP-1 therapies (weight-loss drugs) is reshaping not just the obesity market but the broader pharma landscape. The next leg of the trade, which we flagged in the summer, was finding companies that can preserve or build lean mass while delivering fat loss. Think of combining GLP-1s (or GLP-1/GIP combo drugs) with myostatin inhibitors or other muscle-anabolic adjuncts. If you don’t know all the details, don’t worry.

This theme still has a large upside. Clinical efficacy is real, as GLP-1s deliver sustained double-digit % weight loss.

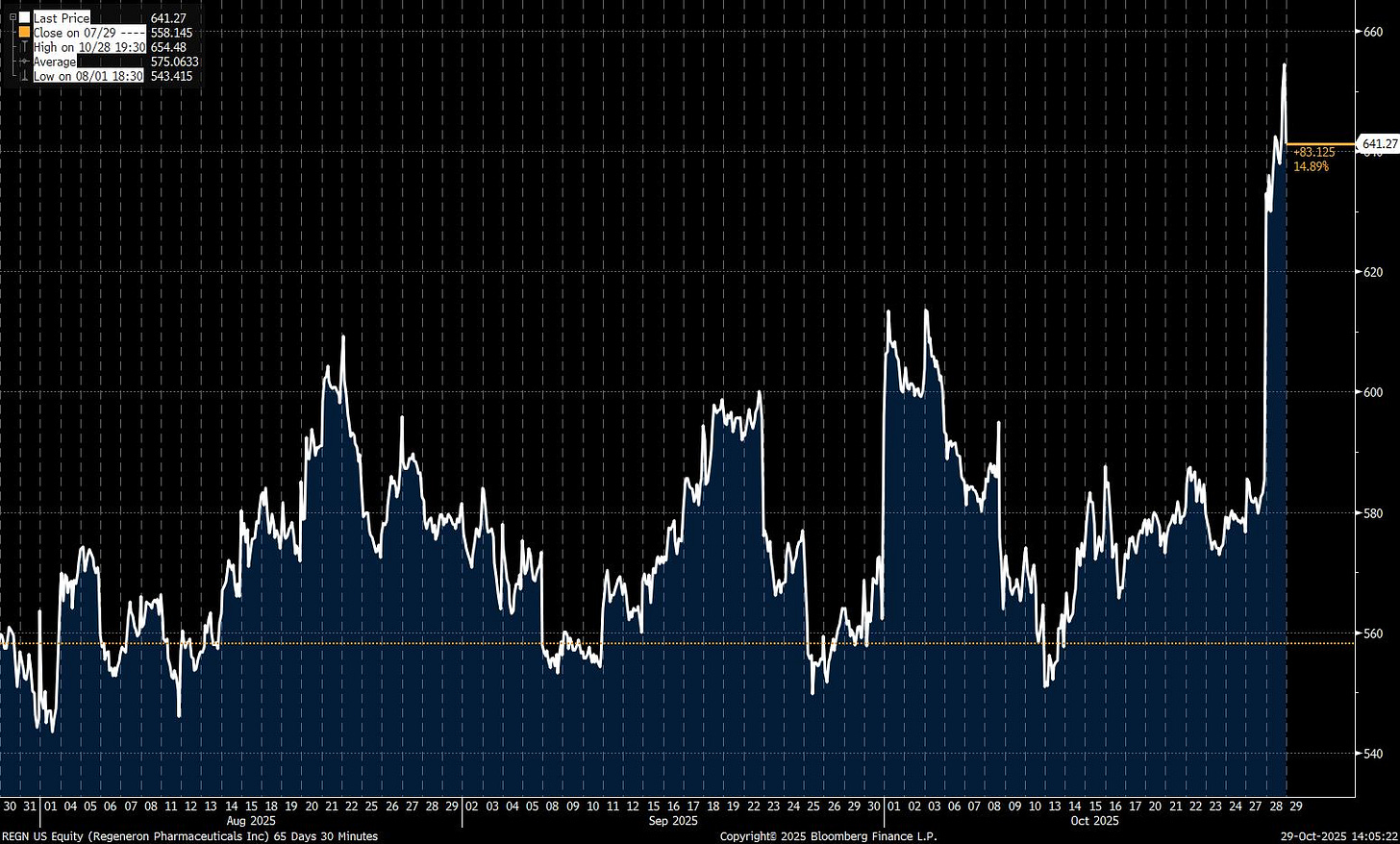

The article’s poster child, Regeneron, is up 15% since publication. It reported strong Q3 2025 results on Tuesday, with revenue of $3.75 billion (beating estimates) and non-GAAP earnings per share (EPS) of $11.83 (significantly beating estimates). It saw positive performance in key drugs like Dupixent, whilst also achieving several regulatory and clinical milestones, including FDA approval for Libtayo and positive Phase 3 results for drugs in trials.

Bottom line: Overweight (pardon the pun)

Lighting the AI Fuse

Original Note: 11th September

Are AI stocks in a bubble? Yes and no. The broad notion of buying AI is a problem due to the varying ways in which it is being used and adopted, both at a commercial and a personal level.

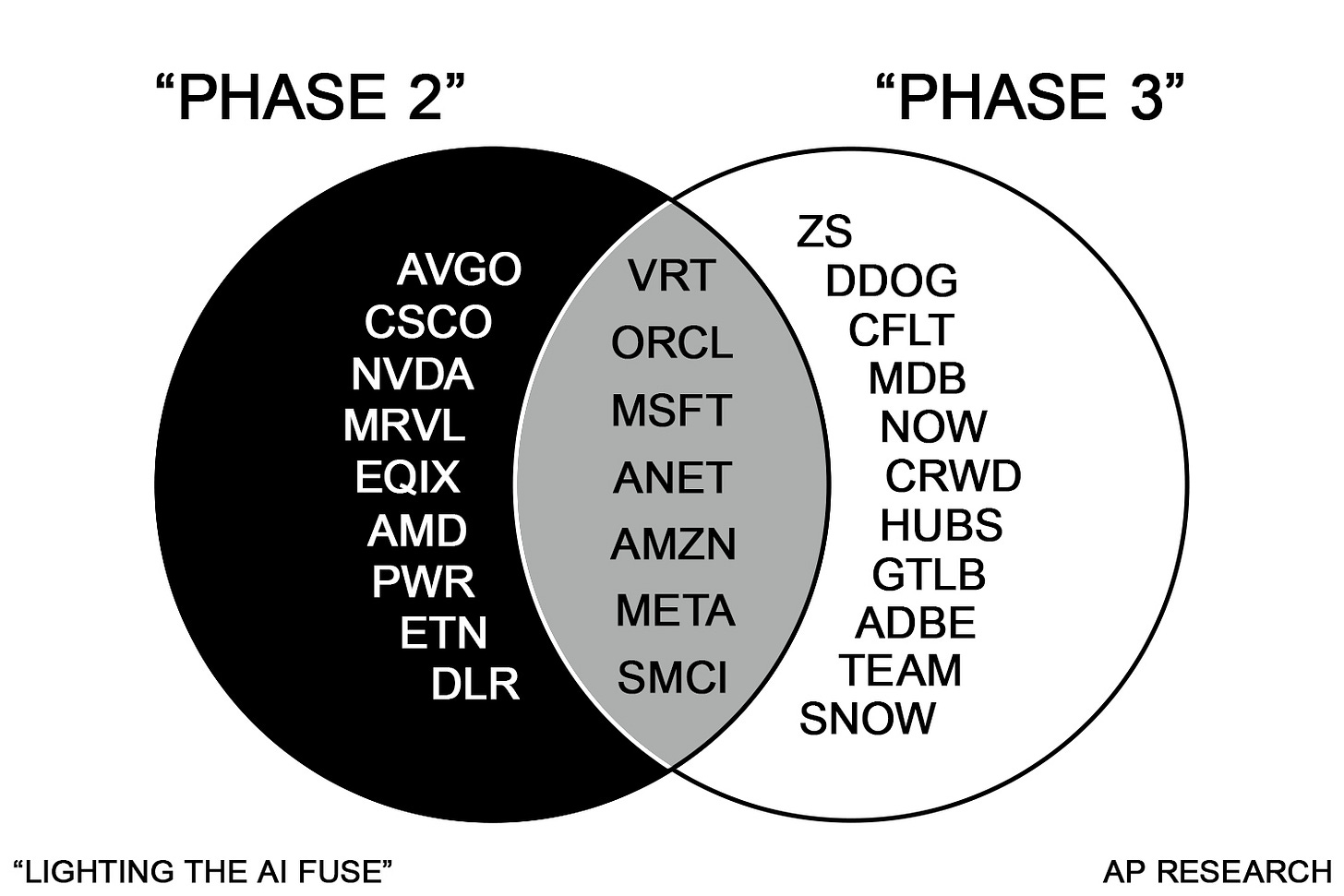

That’s why we laid out three phases in the AI boom:

Phase 1: Chips & raw hardware—basically “buy Nvidia and chill”. (The market caught this early.)

Phase 2: Infrastructure—hyperscaler cap-ex, racks, data centres, power, cooling. The build-out.

Phase 3: Enabled revenues—the moment when the infrastructure delivers monetisable applications, services and business models.

We feel this differentiation has become even more relevant for investors evaluating their equity exposure heading into year-end and beyond. Does the risk/reward stack up in adding new longs to NVDA as it passes $5trn in market cap? Probably not. Want selective beta exposure in case of a potential short-term tree shake? That’s where we feel people can be more confident in owning Phase 2/3 names and not fretting over a drawdown.

The bottom line: Be selective, but don’t bet against AI.

Power in Play

Original Note: 3rd July

The core argument of Power in Play is that the global power sector is shifting from a simple “generate electricity and sell it” model to a more complex landscape where control of the grid, pricing architecture, and regulatory positioning determine where returns accrue.

AI compute loads are driving power requirements sharply higher, as evidenced by last week’s news of Alphabet and NextEra Energy partnering to revive a nuclear site in Iowa.

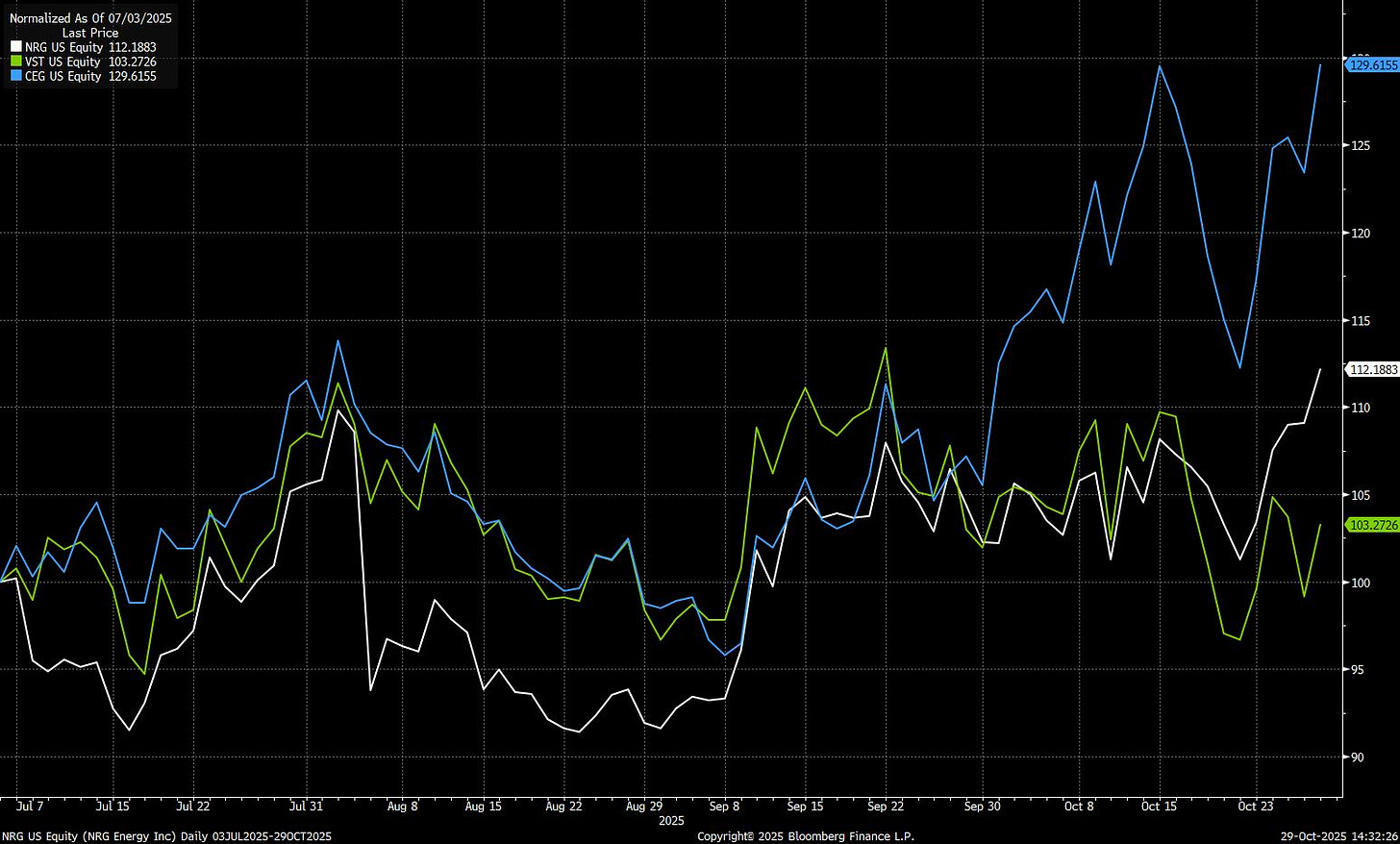

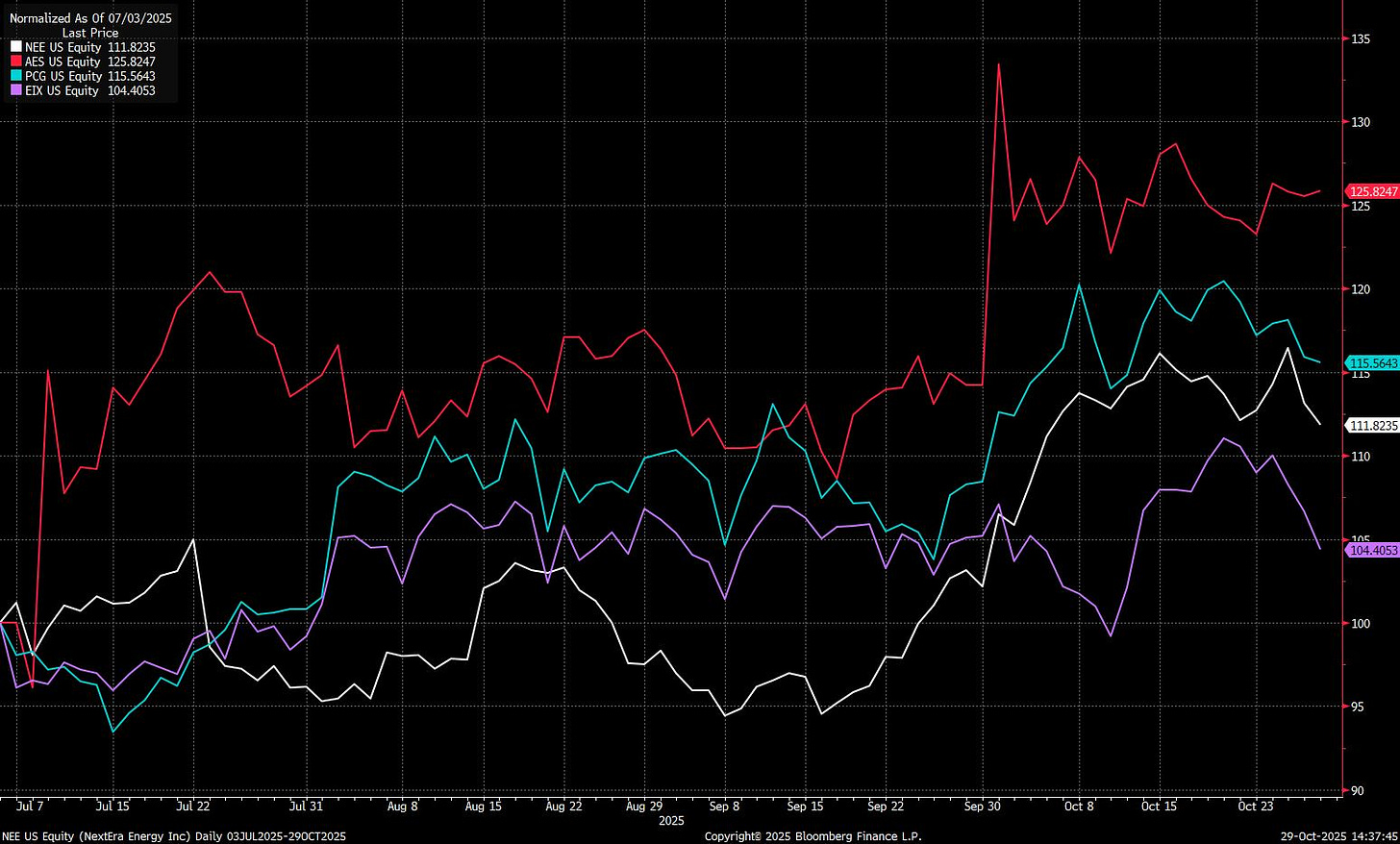

We’re in a multi-year capex cycle for transmission, storage, and grid flexibility. Yet baskets need careful review. Our three core longs of NRG, VST and CEG are all up from July, but our short legs (the companies most exposed to regulatory lag, wildfire liability, rate cap risk, and renewables margin compression) have actually risen in value too, as the sector in general has been bid. As a result, we’ve shed the short positions and now run this as a long-only basket.

The bottom line: Long-only for the build-out.

The Emerging Markets Mosaic

Original Note: 2nd October

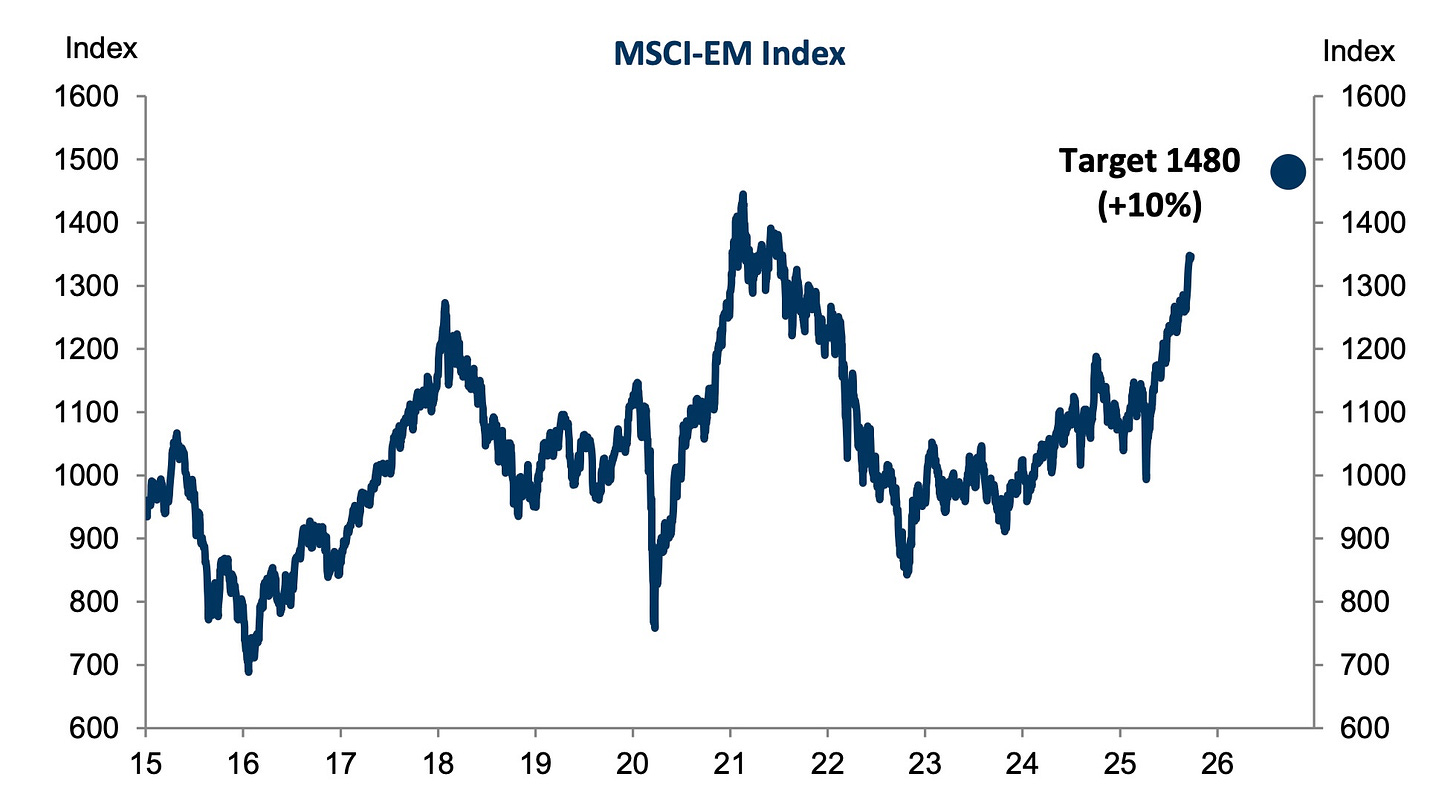

The mosaic concept from October was built on the idea that emerging markets (EM) aren’t a monolithic block anymore, but a mosaic of very different country stories.

Argentina has proven in recent weeks that these countries can exert a strong influence on global markets, along with selective intervention from developed economies (in this case, the US).

We believe EM has been neglected, with countries like Brazil posting substantial equity gains YTD yet receiving little coverage. The broader appeal of this theme lies in its truly cross-asset nature, which allows it to be covered.

Given we only posted this theme a month back, there are no fundamental changes to comment on, bar the incredible moves in Argentinian assets post-election, which show the size and nature of flows that can get involved at very short notice.

The bottom line: Go company-specific for in-depth views, or passively track MSCI EM:

That wraps up the rundown of where the portfolio sits to date. As always, a like and/or comment if you’d like us to provide these thematic ledgers more regularly.

AP

Great resource to have, thanks for posting/sharing!

The NextEra Iowa restart fits your long-only Power in Play thesis perfectly since they control both generation and grid positioning through their regulated utility arm. While CEG and VST are pure play merchant generators benefitting from AI power demand, NextEra has the advanatge of integrated rate base growth plus merchant exposure. The 25-year Google PPA essentially converts merchant risk into quasi-regulated cash flows at what are likely premium rates given the timeline pressure.