The Greatest Investor You've Never Heard Of

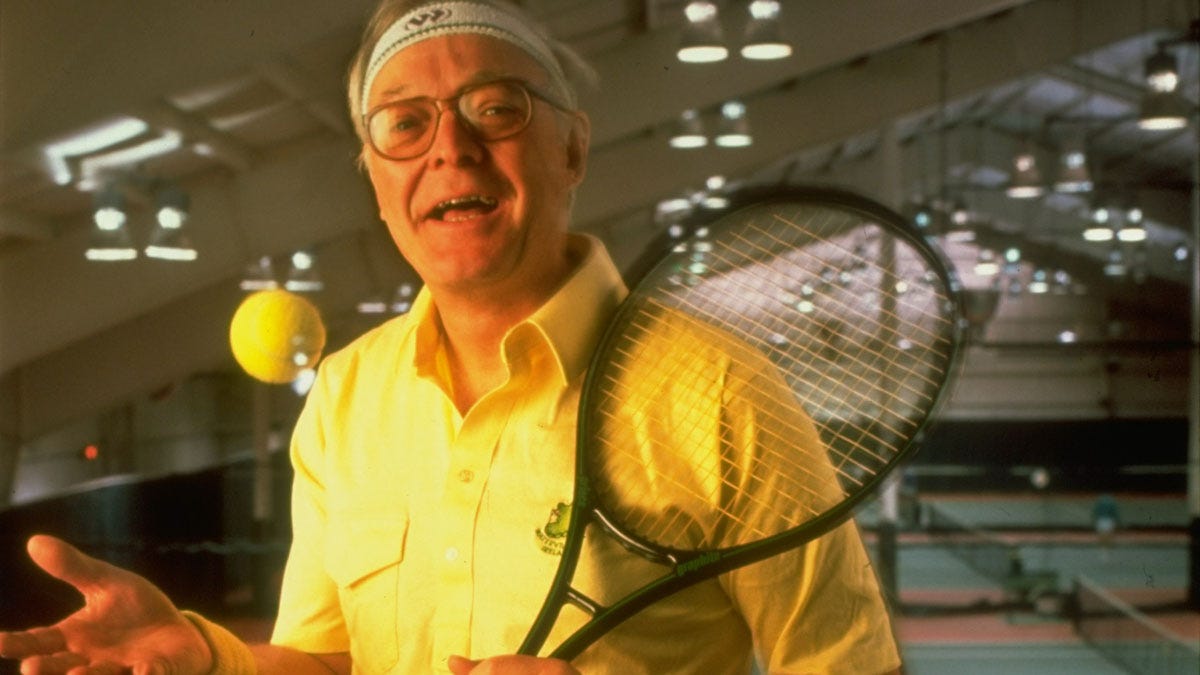

John Neff was an architect of value-centric investment.

Celebrated as one of the greatest value investors in history, John Neff's life was imbued with learning, determination, and a deep curiosity for business and investing.

John Neff was a highly regarded American investor who significantly impacted the field of value investing. Born on June 19, 1931, Neff gained prominence during his tenure as the manager of the Windsor Fund at Wellington Management Company. Over his 31-year tenure, he generated a return of 5,546%, nearly two-and-a-half times the performance of the S&P 500 over the same period.

His disciplined investment approach, characterised by a focus on undervalued stocks with strong growth potential, earned him the nickname “The Low-PE Investor.” Neff's astute stock-picking skills and ability to identify companies with long-term growth prospects allowed him to consistently outperform the market.

How Neff picked his stocks

Neff used a screening model to find undervalued stocks. Although many use a price-to-earnings (P/E) ratio, an estimated growth (PEG) ratio or even the dividend yield, Neff preferred to combine them all via one tidy ratio…

The Dividend-Adjusted PEG Ratio

The above ratio is a financial metric that takes into account both the growth prospects and dividend payments of a company. It is derived by dividing the price-to-earnings (P/E) ratio of a stock by the sum of its expected earnings growth rate and dividend yield.

The P/E ratio reflects the market's valuation of a company relative to its earnings, while the growth rate indicates the expected future earnings growth. By factoring in the dividend yield, which represents the cash returns to shareholders, the Dividend-Adjusted PEG Ratio provides a more comprehensive assessment of the investment potential.

A lower ratio suggests a potentially undervalued stock, as it implies a relatively lower price for the expected growth and dividend rewards. Conversely, a higher ratio may indicate an overvalued stock. Neff often used this ratio to evaluate the relative value and attractiveness of dividend-paying stocks in comparison to their growth prospects.

Neff also focused on the below criteria that he felt would add to the potential to find a gem:

Strong Sales Growth

Good Free Cash Flow

High Operating Margin

In each case, if a stock was trading at a low level but exhibited at least two of the three elements, Neff would consider it an undervalued pick.

His philosophy

His tenure at Vanguard Windsor wasn't solely defined by impressive numbers. Neff's approach to value investing became a blueprint for many seeking long-term success in the stock market. His philosophy was primarily grounded in the following principles:

Be Disciplined: Neff emphasised the significance of self-discipline tied to investing and argued that this was crucial in order to remain diligent, focused, and true to one’s investment strategy.

Take Risks: He frequently argued that avoiding risks could result in missed opportunities. Neff believed it was crucial for investors to dare to take risks, which in this context could be interpreted as making bigger bets to maximise returns. However, he also emphasised that risk-taking should never be based on emotional or impulsive decisions.

Find Value: Neff saw value in beaten-down or unloved stocks. He believed that, over time, the market would recognise these undervalued assets, leading to rising stock prices — especially for companies trading at low P/E multiples despite performing well.

Study the Industry: John Neff once said that a wise investor always studies an industry and its economic structure and continually seeks opportunities that offer the best deals, regardless of the sector.

One of his best trades: Ford

During the US recession in 1984, Neff noted that Ford Motor Co was trading at just 2.5x earnings. Using his screenings, he decided this was too cheap.

He purchased $172m worth of shares (a lot in 1984) for an average purchase price of $14.

Fast forward three years and the US was out of a recession, demand for cars was booming, and Ford was killing it. The share price had jumped to $50, netting circa $450m in profits for the fund.

Granted, the 1980 Ford Mustang might be one of the worst muscle cars of that generation, but Neff didn’t care…

Favourite quotes

“It's not always easy to do what's not popular, but that's where you make your money.”

This quote emphasises Neff's contrarian investing style, urging investors to seek opportunities in undervalued assets.

“Time is on your side when you own shares of superior companies.”

Neff highlights the power of long-term investing and the importance of focusing on fundamentally strong companies that can deliver sustained growth.