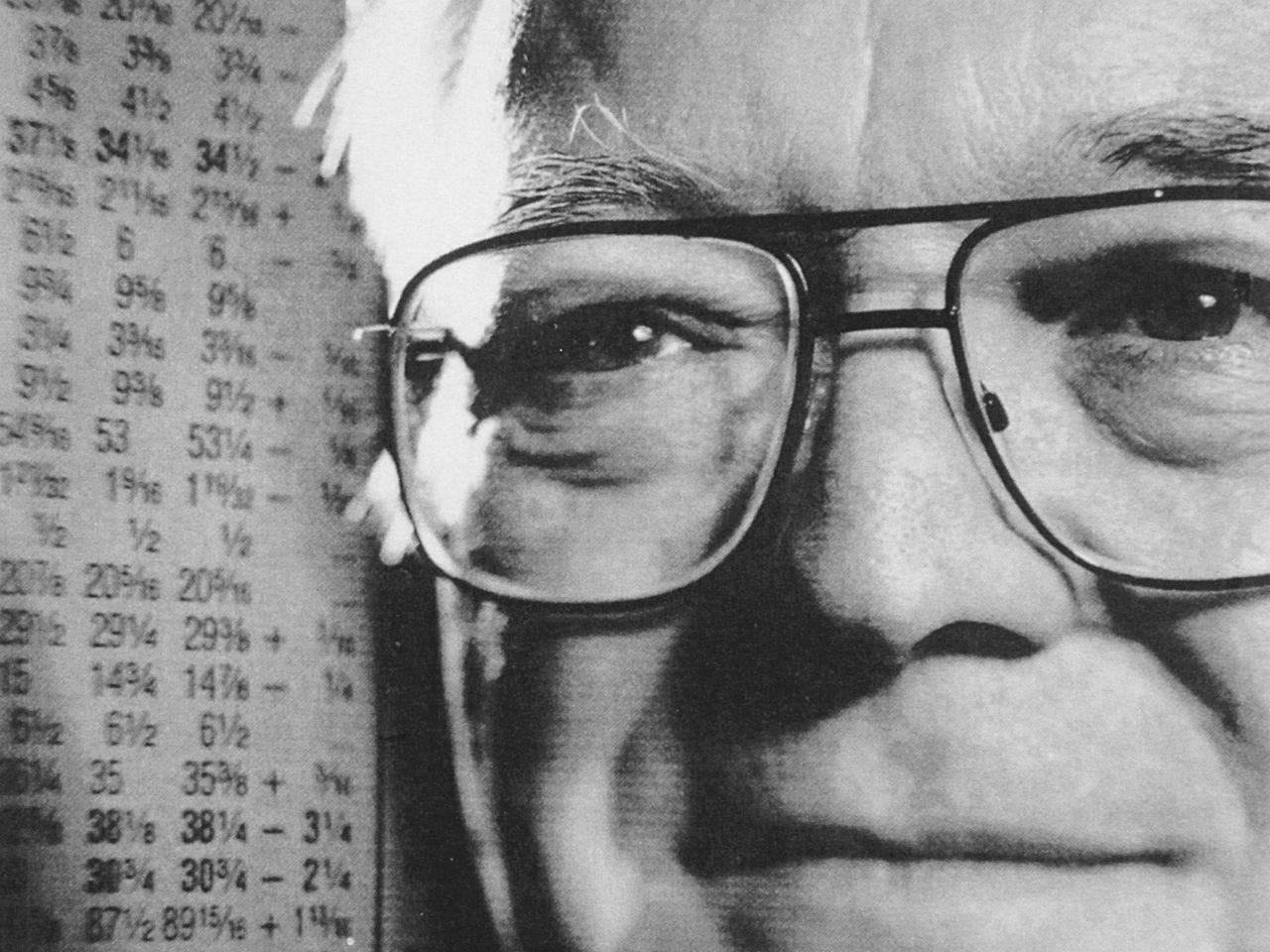

The Greatest Investor You've Probably Never Heard Of

In generating a 5,546% return over 31 years, John Neff deserves legendary status.

Neff ran the Windsor Fund at Wellington for over three decades, easily beating the performance of the S&P 500 over his tenure.

He focused on picking undervalued stocks via the Dividend Adjusted PEG Ratio.

One of his best trades was buying Ford at 2.5x earnings, which netted him $450M in profits back in 1987.

Who are we talking about?

John Neff was a highly regarded American investor who made a significant impact on the field of value investing. Born on June 19, 1931, Neff gained prominence during his tenure as the manager of the Windsor Fund at Wellington Management Company. Over his 31-year span as manager of the fund, he generated a return of 5,546%, nearly two-and-a-half times the performance of the S&P 500 over the same period.

His disciplined investment approach, characterised by a focus on undervalued stocks with strong growth potential, earned him the nickname "The Low-PE Investor." Neff's astute stock-picking skills and ability to identify companies with long-term growth prospects allowed him to consistently outperform the market.

He died in 2019, aged 87.

How Neff picked his stocks

Neff used a screening model to find undervalued stocks. Although many use a price-to-earnings (P/E) ratio, an estimated growth (PEG) ratio or even the dividend yield, Neff preferred to combine them all via one tidy ratio…

The Dividend-Adjusted PEG Ratio

The above ratio is a financial metric that takes into account both the growth prospects and dividend payments of a company. It is derived by dividing the price-to-earnings (P/E) ratio of a stock by the sum of its expected earnings growth rate and dividend yield.

The P/E ratio reflects the market's valuation of a company relative to its earnings, while the growth rate indicates the expected future earnings growth. By factoring in the dividend yield, which represents the cash returns to shareholders, the Dividend-Adjusted PEG Ratio provides a more comprehensive assessment of the investment potential.

A lower ratio suggests a potentially undervalued stock, as it implies a relatively lower price for the expected growth and dividend rewards. Conversely, a higher ratio may indicate an overvalued stock. Neff often used this ratio to evaluate the relative value and attractiveness of dividend-paying stocks in comparison to their growth prospects.

Neff also focused on the below criteria that he felt would add to the potential to find a gem:

Strong Sales Growth

Good Free Cash Flow

High Operating Margin

In each case, if a stock was trading at a low level but exhibited at least two of the three elements, it would be considered by Neff to be an undervalued pick.

One of his best trades

Buying Ford

During the US recession in 1984, Neff noted that Ford Motor Co was trading at just 2.5x earnings. Using his screenings, he decided this was too cheap.

He purchased $172m worth of shares (a lot in 1984) for an average purchase price of $14.

Fast forward three years and the US was out of a recession, demand for cars was booming and Ford was killing it. The share price had jumped to $50, netting circa $450m in profits for the fund.

Granted, the 1980 Ford Mustang might be one of the worst muscle cars of that generation, but Neff didn’t care…

Favourite quotes

"It's not always easy to do what's not popular, but that's where you make your money.”

This quote emphasises Neff's contrarian investing style, urging investors to seek opportunities in undervalued assets.

"Time is on your side when you own shares of superior companies."

Neff highlights the power of long-term investing and the importance of focusing on fundamentally strong companies that can deliver sustained growth.

Good article. Enjoyed the read

Neff was a heavy smoker, commonplace for his era. Followed his career for decades and Vanguard was a far better place then than now. He was right up there with Lynch and all the others of his time.