The Week That Broke The Dollar

Is it the beginning of the end for the world's reserve currency?

It was the week that broke the dollar.

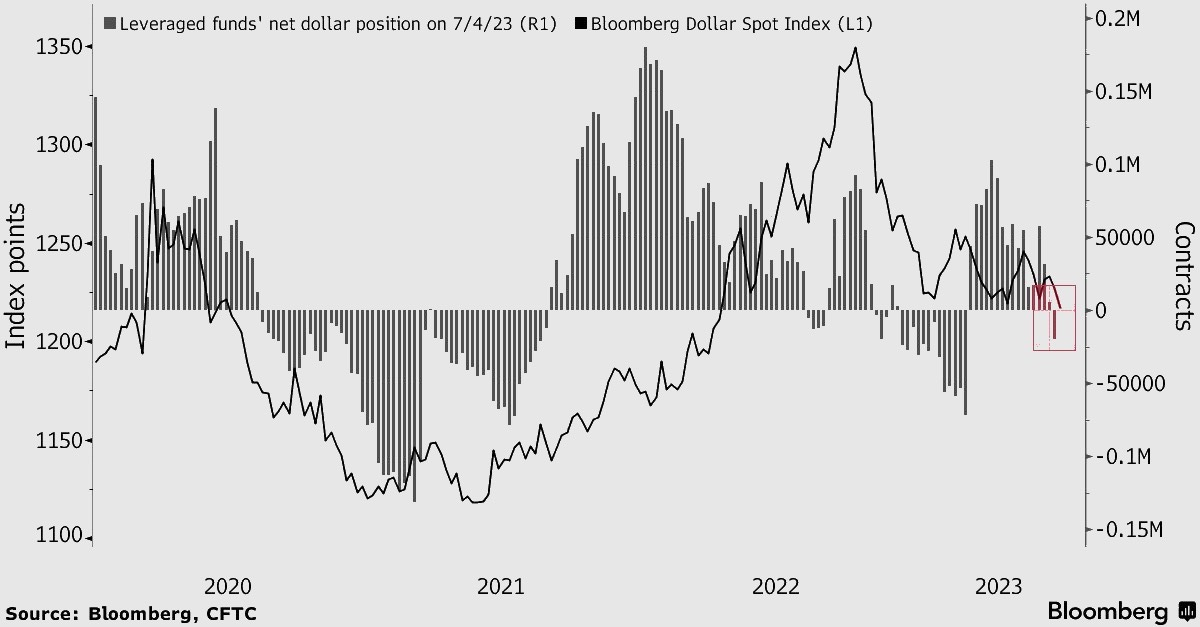

Numerous strategists and investors believe that the US dollar's worst decline since November signals the beginning of the end for the main reserve currency of the globe. If they are correct, there will be significant repercussions for the world economies and financial markets.

Effects of an easing cycle

The US dollar is teetering at its lowest point in more than a year as speculation that the Federal Reserve will soon cease raising interest rates is strengthened by signs of slowing inflation. Dollar pessimists are looking even further out to what they claim are inescapable rate cuts that the market expects to occur somewhere in 2024.

The possibility that the Fed's tightening cycle may transition into an easing cycle, which would drag the dollar down even while other central banks decrease interest rates, is one reason why the dollar may begin a multi-year downturn.

Repercussions

It's difficult to emphasise the potential repercussions of a sustained decline in the dollar's value. It would lower import costs for poorer countries, easing the impact of inflation there. A change in the dollar's direction also can strengthen currencies like the yen, which has been falling for months, and torpedo well-liked trading methods based on a weaker yen. More generally, a weaker US dollar would likely increase the exports of American companies at the expense of their competitors in Europe, Asia, and other regions.

The selloff has fund managers from M&G Investments to UBS Asset Management bracing for outperformance in currencies like the yen and emerging-market currencies. Many investors have been waiting for a decline in the dollar for months.

Track record

Investors have a lengthy history of losing money when they make rash predictions about Fed rate cuts that will devalue the dollar. That was the situation earlier this year when the currency appeared to be headed for a protracted downward trend before stabilising. US economic statistics proved the Fed wouldn't stop its rate hikes.

That scenario repeating again poses a challenge to the bears, especially given that the Fed is expected to tighten further this month.

Georgina Taylor, an analyst at Invesco Asset Management, is still deciding whether to cut back on her exposure to the dollar. She is not yet prepared to declare that the fight to control inflation has won since she is still firmly in data-watching mode.

“The interest-rate differential story is wavering, but I wouldn’t give up on the dollar,” she said, given that the absolute difference in real yields remains high.

Because of the US economy's durability, Michael Cahill of Goldman Sachs Group predicts that any dollar decline will be less severe than in previous cycles. However, if the Fed ends its fight against inflation and the European Central Bank is forced to maintain higher rates for longer, support for the dollar may shatter.

Dollar bears can also lean on valuation measures. The currency’s strength has been particularly pronounced against the yen, where the real effective exchange rate has Japan’s currency trading near its lowest level in decades.

Yen bulls, who have only experienced disappointment since 2023, are now finally anticipating rewards as the currency soars to its highest level in a month.

Although the yen's expected 10% surge as Japan eased up on its ultra-dovish monetary policy has yet to materialise, there are growing indications that the currency is nearing a tipping point. Therefore, some overseas investors are diversifying their thinking rather than shifting their positions and basing a growing portion of their expectations for yen strength on the onset of a worldwide recession.