In G10 FX, Monday woke us all up very quickly, after which most cross-JPY pairs eased off, and cross-USD pairs recovered during the rest of the week. Was it the yen carry trade or something more? We shared our thoughts in Wednesday’s article. You can read that here.

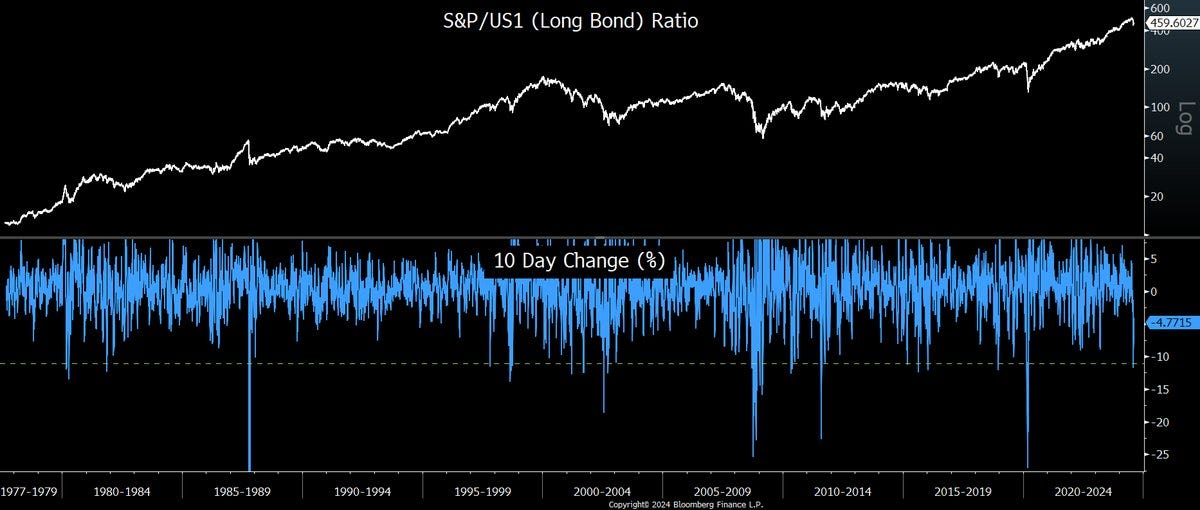

S&P/Long Bond ratio fell 12% over 10D as of August 5th. That suggests a flight to safety, something that has historically happened before big drops. No one bit of analysis can determine what will happen next, but this was an interesting point we saw over the weekend.

The Week Ahead

Data on US inflation and other US economic indicators will be scrutinized after recent weak jobs data sparked fears of a possible recession. Earnings from some of America’s top retailers will also be in the spotlight, with investors seeking to discern if American households face more stress from elevated inflation and higher interest rates.

In Europe, a raft of UK data, including inflation figures and a rate decision in Norway, are due.

In Asia, a decision from New Zealand’s central bank and economic growth estimates for Japan are in focus, with a stream of data out of China also set to command attention.

FX

USD/JPY printed lows below 142.00 last week but recovered through the middle part of the week, fuelled by the lower-than-expected initial jobless claims.

We’re now in a position whereby we don’t really know if NFP’s was the outlier print or if IJC was. Yet it’s clear that investors are still cautious, as to end the week we saw the pair break out of the mini-trend channel recovery to the low side.

We feel the pair is heading lower in the coming week, especially if we see US CPI at or below 2.9% on Wednesday.

We’d cut our position if we broke back above the 147.75-148.00 region but would only change our conviction of a short bias if we broke above the orange line at circa 150.70

TRADE IDEA - USD/JPY ROLLING LOWER

Limit Order: 146.60

Take Profit: 142.00

Stop Loss: 148.10

We caught the rip higher in EUR/GBP nicely a couple of weeks back, although we were targeting a move to 0.8550 and it overshot even that as it comfortably traded above 0.8600 last week.

Some profit taking late last week made sense, but we feel the winds of change have now set in and we look for the next leg higher this week.

GBP was one of the few currencies that didn’t get caught up in the rush to price in more cuts as part of contagion from the US. We feel that the current rate pricing is too little for the UK over the next six months, and a CPI print close to 2% (i.e. unchanged) on Thursday should give the BoE confidence to push ahead with at least one more 25bps cut in the autumn.

We therefore look to make a play for the pair moving back towards the YTD highs above 0.8700 in coming weeks, with 0.8644 the only real resistance we see on route.

TRADE IDEA - NEXT LEG HIGHER FOR EUR/GBP

Buy a 2-week call option at 0.8600, costing 0.2%, targeting a move to 0.8700.

You can access our full articles and this week’s complete idea rundown by joining as a premium subscriber to the AlphaPicks team.