Top Trade Ideas - December 16th

A 24-hour flurry of decisions to finish the year off, plus lots to talk about in cross-assets.

Last week, a momentum unwind saw the U.S. indices make a tricky start to the week, but strong earnings from tech saw the Nasdaq close the week up. The S&P closed the week slightly down, while the Dow and Russell sold off heavier.

There has been lots of talk about negative breadth across U.S. markets. To add more context to the catchy tweets and headlines, this is just the fifth time since 1997 that the SPX has had negative breadth for eight days in a row.

Alphabet has unveiled a new quantum computing chip, which has the ability to solve in minutes problems that take supercomputers millions of years.

The chip, dubbed Willow, is the latest development in this area and stands above the rest, according to Hartmut Neven, Google’s Quantum AI lab leader. However, it’s still years away from being able to carry out commercial operations, so maybe this headline caught too much attention.

The Hang Seng index dropped by over 2% to close the week, with Chinese property developers falling the most after new stimulus plans failed to live up to expectations. The much-anticipated statement following the Chinese economic policy meeting was light on detail but pledged to loosen monetary policy, raise the deficit ratio, and help home prices.

2Y & 10Y yields are up 15bps and 25bps, respectively, over the last week. The economy has remained stable, and substantial fiscal stimulus associated with the next administration (tax cuts, deregulation measures) is on the way. Monetary stimulus in the current environment will just raise inflation concerns.

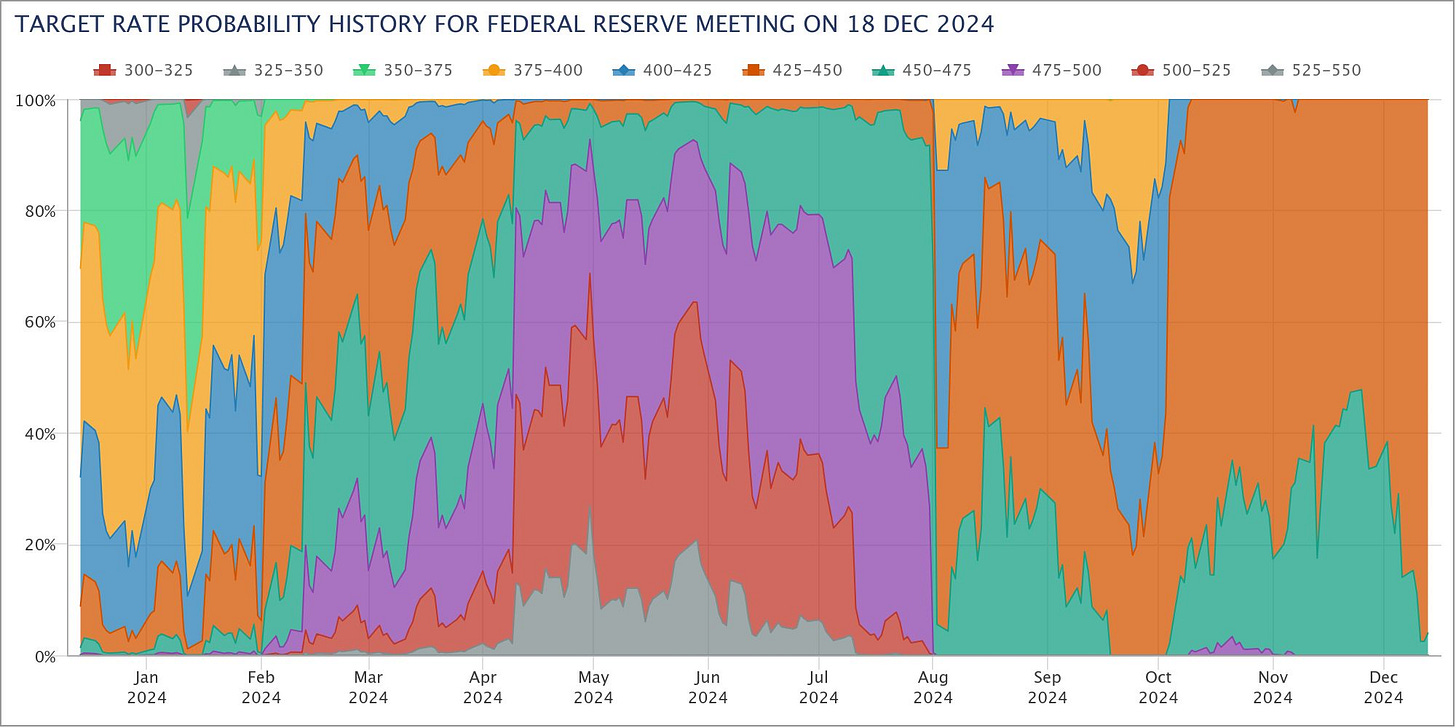

Last week, neither the payroll nor the CPI report were strong enough to deter the Fed from cutting in next week’s meeting (96% chance of a cut). Bonds responded by tanking and driving up their yield.

Since the Fed started cutting in September, the 10Y is now up 80bps. No other rate-cutting cycle of the last 40+ years has seen long rates soar like this.

Reminder: Bear steepening into a rate-cut cycle = Inflation and growth are perhaps not as soft as we’d expected initially, and rates might not need to go down as much as initially thought.

The Week Ahead

A year when inflation subsided enough for monetary policy easing to start in most advanced economies is about to conclude with a 24-hour flurry of decisions led by the Federal Reserve.

The U.S. announcement will take centre stage on Wednesday, followed by peers in Japan, the Nordics and the U.K. over the following day—amounting to half the world’s ten most-traded currency jurisdictions. By the close of play on Friday, at least 22 central banks accounting for two-fifths of the global economy will have set borrowing costs. The upshot will underscore how momentum for easing now looks increasingly uneven as policymakers weigh differing risks in the coming year.

While the Fed is poised to deliver a quarter-point rate cut, the dawn of 2025 and the prospect of inflationary import tariffs threatened by Donald Trump’s incoming administration may concern officials about the pace of further moves. Keep an eye on the dot plot and commentary from Powell for more information on that.

The Bank of England, mindful of the growth shock Trump’s trade policies could cause and of lingering price pressures, is reducing borrowing costs only cautiously and is widely expected to keep them on hold on Thursday.

The Bank of Japan, having finally exited negative rates this year, will probably wait until 2025 before raising again.

Decisions in the Nordics will highlight divergence even across a smaller region. Sweden’s Riksbank is almost certain to cut for the fifth time, and its Norwegian counterpart is likely to confirm that its first reduction of the cycle won’t come until next year.

Elsewhere, key data on the health of China’s economy, a likely pickup in U.K. inflation and business surveys from the Eurozone may be among the highlights.

Meanwhile, in geopolitics, a German no-confidence vote will take place, and Russian President Putin will hold his annual news conference.

Lots to talk about on cross-assets. If you’re not yet a premium reader, you can manage your account here.

FX

The DXY followed U.S. Treasury yields higher last week, as concerns around inflation next year helped to fuel another bid in the dollar.

We feel there’s scope for this to continue this week with the FOMC meeting on Wednesday. We expect a 25bps cut (this is fully priced), but there’s some potential for the dot plots to become less dovish in nature, along with some change in language from Chair Powell.

Trading around FOMC meetings can be messy, so we turn to the options space and focus on a pair that could have a sharp move lower based on the techs. We choose AUD/USD, which is right on the cusp of breaking lower, testing 52-week lows.

We buy a 2-week put option here (little point going further out) to try and squeeze some juice out.

TRADE IDEA - FOMC PLAY

Buy a 2-week 0.6300 strike put option costing 0.42%, playing for a break lower to 0.6200 pre-Xmas.

The 50bps cut from the SNB last week shows their intent concerning monetary policy, but we doubt that it’ll stem CHF strength in 2025. For a tactical expression of this, the new week could see CHF bulls emboldened to add new longs, and with the BoJ in a real head spin at the moment, we feel long CHF/JPY could be the place to be.

From a technical perspective, resistance will come into play around the 176 mark (shown via the descending trend line), but in terms of support, it tried several times last Wed/Thurs/Fri to take out 170.80 but failed. We place our trading levels accordingly and have a good R/R setup.

TRADE IDEA - SNB CAN’T STOP THE FRANC

Limit Order: 172.00

Take Profit: 175.90

Stop Loss: 170.70

Finally, we take on a very opportunistic trade on EUR/GBP. The pair got a really nice pop on Thurs and Fri, with GBP weakness from poor GDP data. On the EUR side, the ECB didn’t really say anything terrible enough to push an already weak EUR lower, plus so relief rally bids coming in to close the week.