Top Trade Ideas - June 23rd

Do markets fade the escalation like last week, or is this time different?

US equity markets ended slightly lower as geopolitical tensions in the Middle East overshadowed economic fundamentals. The S&P 500 dipped 0.2% for the week, dragged by defensive and rate-sensitive sectors, while energy rallied 2.8% on firmer crude prices. Reports that the US would delay involvement in the Israel-Iran conflict for two weeks helped lift markets off their lows by Friday, but uncertainty around the situation kept risk appetite subdued. However, weekend actions from the US leave markets facing a lot of uncertainty about the coming weeks.

The FOMC held rates steady, as expected, and projected two more cuts this year. Markets initially rallied on the dovish dot-plot but reversed course as Chair Powell emphasised a cautious and patient stance. The OIS curve now prices in exactly 50bps of cuts for 2025.

Fed’s Waller (voter) said, post-FOMC, that rates could be cut as soon as next month, with the impact of tariffs on inflation likely to be short-lived.

Elsewhere, a fresh threat to US-China chip trade rattled the tech sector, while stablecoin legislation passed in the Senate spurred sharp moves in financials and crypto. Mastercard and Visa sold off, while Coinbase surged 16%.

The dollar staged a notable rebound, led by gains against the yen, while Treasuries were little changed despite the Fed meeting. The 10-year yield closed roughly 3bps lower on the week, reflecting muted rate repricing and limited haven flows despite the geopolitical backdrop. Markets now turn to 4Q earnings from FedEx and Nike, and rebalancing flows into quarter-end.

(A reminder that prices are increasing for new subscribers next week. A full explanation of the changes can be found here.)

The Economic Week Ahead

Flash PMIs from the US, eurozone, and UK will headline the week, offering a real-time pulse on global growth momentum. With oil prices rising amid escalating Middle East tensions and tariff uncertainty lingering, the surveys will be crucial in determining whether April marked a local trough in business sentiment or if downside risks are building again. June’s S&P PMIs in the US and the UK will also help gauge whether recent signs of services resilience are sustainable.

For the US, additional focus will fall on the Fed’s preferred inflation gauge, May core PCE, due Friday. A softer print could reinforce expectations for a rate cut by September, especially after muted CPI and PPI data earlier this month. However, energy-driven price pressures and signs of sticky shelter inflation could keep policymakers cautious. Consumer confidence and a raft of housing and durable goods data will round out the US calendar, while $211 billion in Treasury auctions will test market appetite as fiscal concerns remain elevated.

On the central bank side, Powell headlines with testimony to Congress in the middle of the week. The Fed also holds a public meeting on Wednesday to review the SLR rule, a key constraint on bank balance sheets during Treasury market stress.

Trump attends the NATO summit that’s taking place in The Hague. Worth watching for defence names, both EU and US.

In the eurozone, flash PMIs and sentiment surveys will be assessed alongside French and Spanish inflation prints and consumer spending data, providing further context after the ECB’s recent rate cut. Germany’s Ifo and GfK surveys could show whether trade disruptions and global political risks are beginning to dent corporate optimism.

The UK’s flash PMIs will give an early look at whether May’s rebound continued into June. Markets will also watch Friday’s retail sales and consumer confidence data for signs of strain on household spending. Gilt auctions midweek and ongoing rate cut speculation will keep bond markets active.

In Canada, May CPI on Tuesday will be key for the Bank of Canada’s policy path. After headline inflation slowed in April, focus turns to core measures, where stickiness remains. The BoC has emphasised vigilance over second-round tariff effects, with surveys already indicating businesses plan to pass through higher costs.

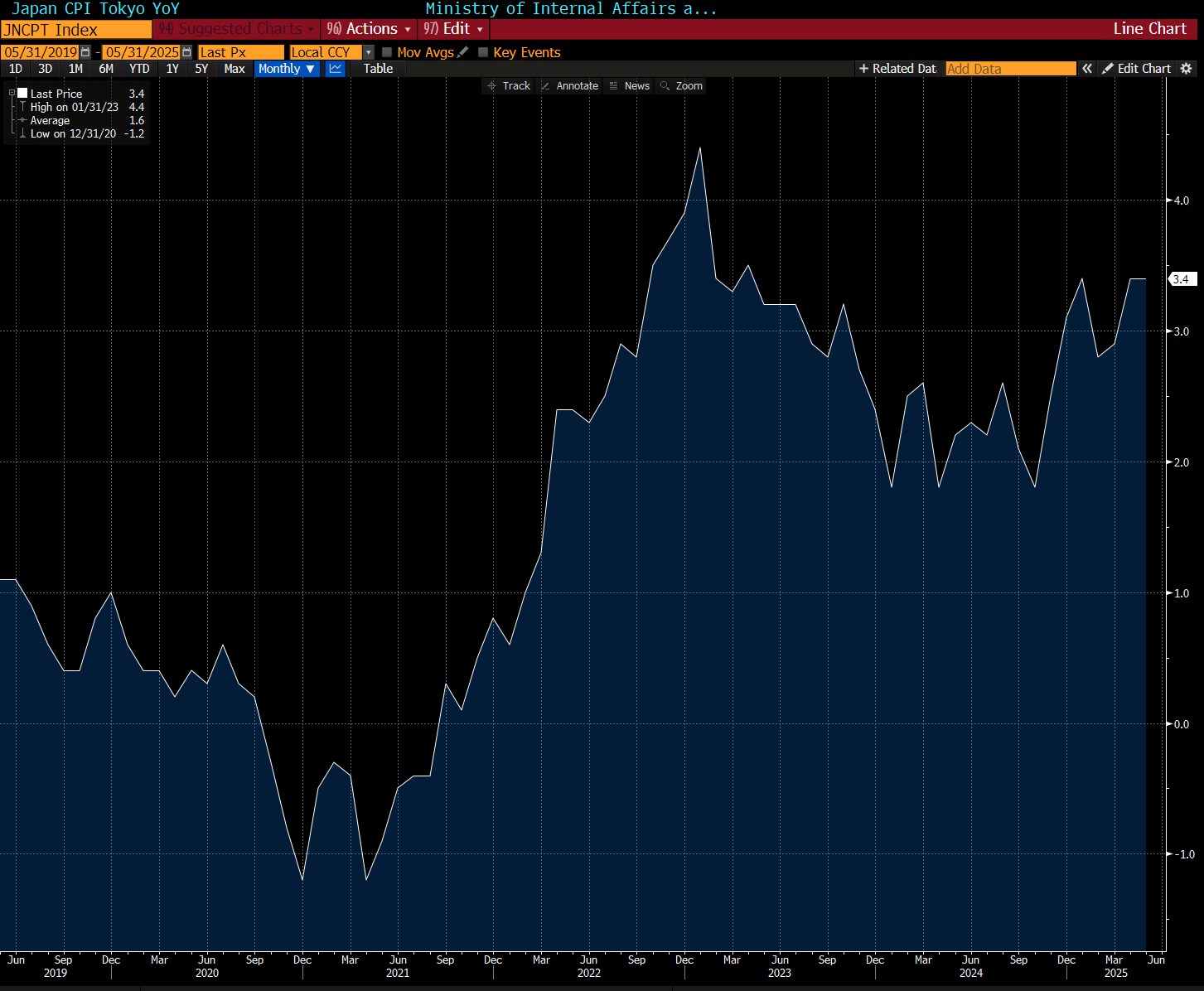

Asia’s inflation focus will be sharp. Tokyo CPI on Friday will offer the Bank of Japan an early read on price trends, while core inflation is expected to remain persistently above 3%. BOJ board member Tamura will speak midweek, and markets will parse the central bank’s June meeting summary for signals on bond purchase tapering.

Australia’s May CPI print could be decisive in cementing expectations for a July rate cut. Recent inflation moderation and global risks have reopened the door for policy easing, though oil volatility and geopolitics could inject caution.

Across emerging markets, central banks in Mexico, Hungary, the Czech Republic, and Russia will set policy, with rate cuts expected or possible in most. Meanwhile, China’s only major release, industrial profits, will be watched for signs of tariff drag, and Taiwan’s export-heavy economy faces similar scrutiny amid shifting US trade dynamics.

In Southeast Asia, rate decisions in Thailand and the Philippines are expected to lean dovish, while inflation data from Singapore and Malaysia may confirm a broader disinflation trend. New Zealand’s Q1 GDP will be pivotal in assessing whether its shallow recovery is gaining traction.

With the macro narrative now balancing easing inflation, rising geopolitical risk, and residual tariff shock, this week’s PMI and CPI data will shape the tone for both bond markets and policy signalling heading into Q3.

FX

CAD/JPY primed for a move higher:

Historically, the correlation between CAD/JPY and oil has been decent, but the pair hasn’t yet caught a material bid from the recent pop in oil following the conflict in the Middle East.

We think the pair has legs to catch up in the coming weeks, especially following a BoJ meeting that’s clearly more focused on handling bond purchase reductions right now. The Yen could see weakness from the lack of meaingful guidnace going forward on future rate hikes.

From a technical perspective, the pair is knocking on the door of a break higher should it manage to take out the resistance from the downward trendline. From there, we wouldn’t rule out a medium term move to 110.00.

Entry: 106.35

Take Profit: 109.50

Stop Loss: 104.95

Adding OTM GBP/USD put exposure:

So far this year, any dips in GBP/USD have been swiftly bought, as we’ve seen the UK seemingly impress while the USD has capitulated.

At the end of last week, this dip appeared to have been bought again. The short-term move lower was partly due to more poor UK data. We’re already expressing our short GBP view via long EUR/GBP.

Yet in conversation late last week, a good point was raised that it’s not bad value at all to hold some OTM GBP/USD puts, both for a GBP lower view but also in case the short USD train (which is fast becoming a crowded trade) gets a sharp unwind.

Therefore, we look to add a small position in the options space with a generous payoff.

Buy a three-month 20 delta (1.3010) strike Put costing 0.5%

Commodities

Long PAU5 futures contract:

Palladium has started to come up again in more chatter, partly relating to the continuation of declining demand for EVs. If we see the US economy hold up better-than-expected in the coming months, it could support higher confidence for consumers to look to upgrade their vehicle.

If traditional combustion engine vehicles are favoured over EVs, demand for palladium could tick higher, given the role in catalytic converters.

Around 80% of global palladium demand comes from the use in the converters, so this could have a notable impact on the price (and it likely why we have already seen a move higher over the past month).

Entry: $1054

Take Profit: $1250

Stop Loss: $990

What’s the safe haven?

Gold over bonds as the geopolitical hedge:

The next bout of flight-to-safety flows, likely triggered by US strikes on Iranian nuclear facilities, won’t favour Treasuries the way past crises have. Market reflexes have shifted.

Yes, risk aversion still matters. But this time, the structural backdrop for US debt is deteriorating. Higher defence spending, a sticky fiscal deficit, and doubts around the long-term credibility of US policy are now meaningful headwinds for the bond market. That makes duration a less reliable hedge.

Add to that: breakeven inflation is highly sensitive to oil. In the event of retaliation or a Strait of Hormuz blockade, higher crude prices will widen the gap between TIPS and nominals, reducing the room for nominal yields to fall. So even if bonds catch a bid, it may not be clean.

Swap spreads remain negative and stubbornly wide, despite ongoing speculation about regulatory easing. That suggests a reluctance to hold Treasuries even on a relative basis, and reinforces that sovereign debt is no longer a no-brainer safe haven.

Meanwhile, gold offers cleaner exposure to geopolitical risk, with fewer entanglements in US policy credibility or fiscal arithmetic. In a scenario where Middle East tensions escalate and the US response looks undisciplined (militarily or fiscally), gold has the dual benefit of absorbing both hard-risk aversion and soft-dollar scepticism.

Positioning takeaway: Stay long gold over Treasuries as a hedge into geopolitical volatility.

Comments on Crypto

Crypto’s early tumble sets the tone, oil will dictate the rest:

Risk sentiment is already on the back foot, and crypto is leading the way. Bitcoin dropped nearly 4% from Friday’s close, with Ethereum off ~10% over the weekend. That’s a signal that investors are repricing geopolitical risk ahead of broader market open.

The fact that BTC and ETH broke lower before traditional FX markets even opened underscores the expectation of equity weakness once cash trading begins. Unlike G10 currencies, where moves have been modest, crypto trades globally and continuously, giving it first-mover status in this kind of weekend headline shock.

That makes oil the next key data point. Crude spiked materially on supply fears (and can do more if traders price in the risk of Hormuz disruption, thoughts on that posted last week) which will amplify risk-off. If instead oil fades the move, equities could again find some footing later in the day, much like last Monday.

The tactical read here is to respect early weakness in risk assets, with crypto’s breakdown giving a more honest read than FX. But also to be nimble: watch crude closely. A sustained rally in oil changes the inflation-risk calculus and could reinforce equity selling, especially in duration-sensitive sectors. A quick fade, though, would reinforce the idea that the geopolitical shocks remain contained, for now.

Crypto is the new tip of the spear for risk-off pricing. Trade equities tactically around crude. If oil fades, risk can recover. If it doesn’t, step aside.

Final Note: Flows

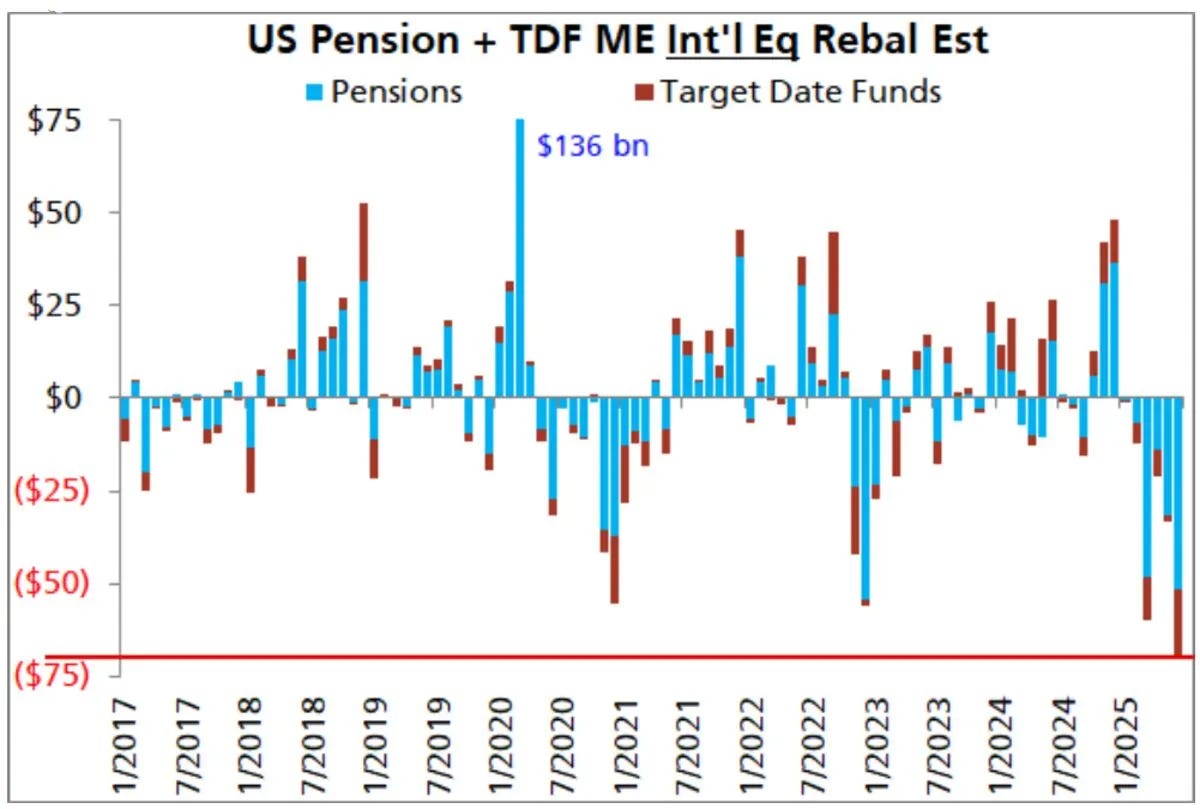

Month-end rebalancing could trigger $89bn in equity selling, led by international markets:

UBS estimates that pension and target date fund rebalancing into month-end could drive $89bn of equity selling, the largest monthly total this year. The bulk of the pressure is expected to fall on international equities, which have outperformed the US and may see $69bn in outflows, a new record in UBS’s data. US equities are set for a more modest $20bn of selling.

This rebalancing pressure comes just as other key sources of demand begin to fade: systematic buying is slowing, corporate buybacks are heading into blackout, and geopolitical uncertainty is rising, a combination that could leave markets more vulnerable to downside volatility into quarter-end.

That’s all for the week. As always, leaving a like below always goes a long way.

See you Wednesday,

AP