Top Trade Ideas - June 9th

Treasury auctions and inflation on the radar.

US equity markets held modest gains last week despite a swirl of trade and political headlines. The S&P 500 advanced 1.5%, with tech and communication services leading as investors embraced calmer markets and better tariff news. Micron and ON Semiconductor soared, lifted by improving AI capex demand and easing trade tensions. Notably, the S&P 500 saw six consecutive days of sub-0.6% daily moves through Thursday, its longest calm streak since December.

However, Thursday’s abrupt selloff, driven by the public spat between President Trump and Elon Musk over Trump’s tax bill, rattled sentiment. Tesla shares sank 15% on the week, though broader markets recouped losses by Friday as May nonfarm payrolls beat expectations, easing labour market concerns.

Earnings highlights included Broadcom’s tepid guidance, Lululemon’s sharp earnings miss, and contrasting performances from Dollar General and Dollar Tree, highlighting the crosscurrents of consumer strain and bargain hunting.

Treasuries flattened under stronger-than-expected payrolls and ECB-driven bund selloffs, with 5s30s flattening by 12bps. The dollar held steady, reflecting the week’s mild FX volatility. Meanwhile, Fed speakers reiterated that tariffs have yet to significantly impact macro data, maintaining a steady policy stance as markets watch upcoming inflation figures and capital rule discussions.

The Economic Week Ahead

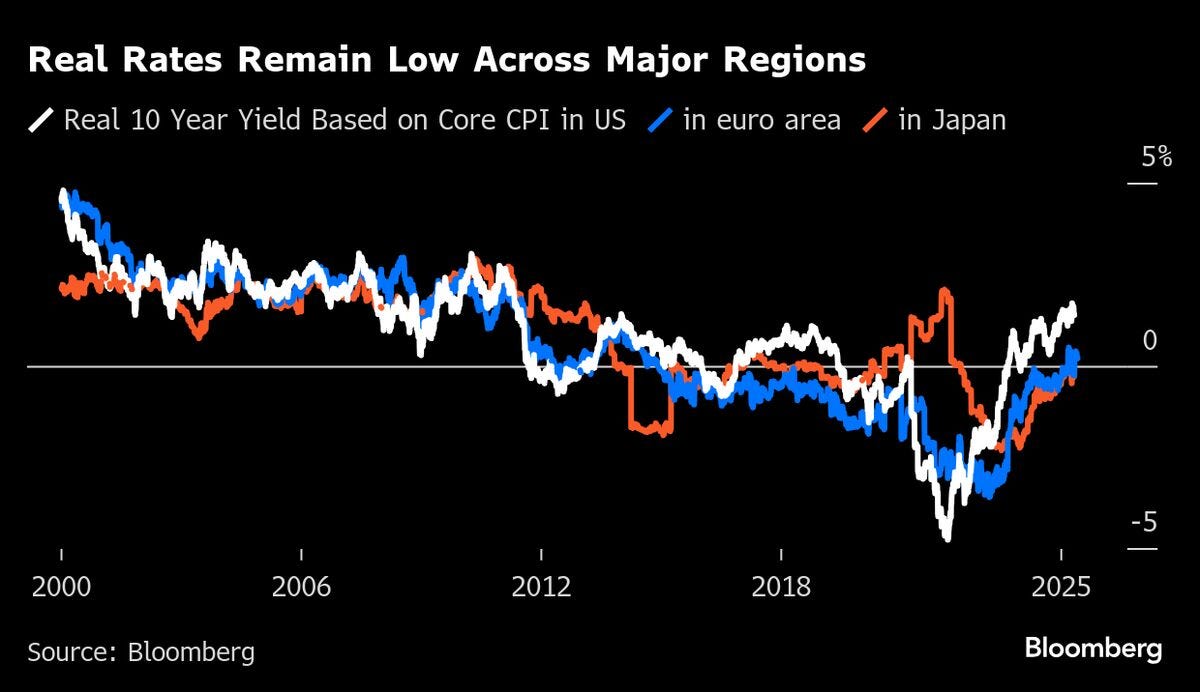

Markets will be laser-focused on US inflation data for May, due Wednesday, to see if tariffs are starting to filter through to consumer prices. While the Fed remains cautious on rate cuts, any sign of persistent price pressures could delay policy easing even further, with some analysts now pushing expectations for the first cut into early 2026. Recent jobs data have been mixed, but still point to a resilient labour market despite weaker ISM surveys, underscoring the crosscurrents in the US economy.

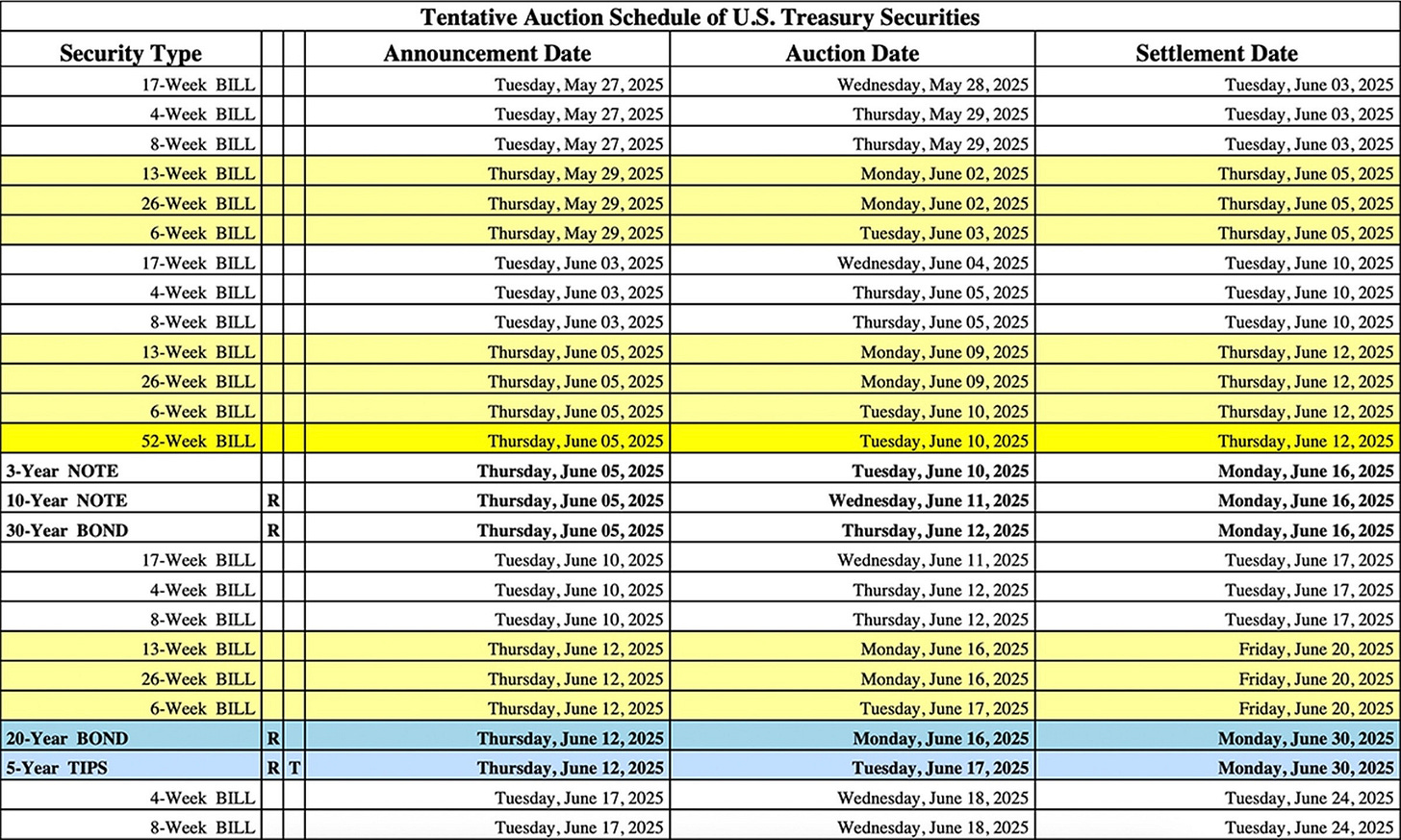

Also to note in the US is an upcoming 10- and 30-year auction, which may draw more attention than usual following the recent moves in yields and investors’ concerns about the “Big Beautiful Bill.”

In Europe, investors will watch how the eurozone trade and industrial production fared in April, looking for early signs of the impact of US tariffs. With the ECB having already cut rates last week, attention will turn to how quickly the bank might move again if trade headwinds deepen. Germany and France’s final inflation data for May, along with German industrial output, will add further colour to the eurozone’s growth and price outlook.

The UK will release jobs, GDP and industrial production data for April, giving a fresh read on how Britain’s economy is navigating tariff-related shocks. The Treasury chief’s spending review on Wednesday will also draw scrutiny as the government looks to balance growth and fiscal discipline. A new gilt syndication will test investor appetite for long-dated UK debt.

In Asia, Japan’s final Q1 GDP figures are expected to confirm a mild contraction, raising recession fears if tariffs continue to weigh on trade. China’s trade and inflation data will offer crucial insight into how the world’s second-largest economy is coping with ongoing export weakness and domestic deflationary pressures. Meanwhile, India’s CPI data will help set expectations for further RBI rate cuts as the economy faces slowing external demand.

Australia and New Zealand markets will be watching business sentiment and central bank minutes for clues on the timing of further rate cuts, as weak growth and softer inflation keep policy bias tilted dovish. With global trade tensions back in the headlines and long-end bond yields under pressure from fiscal worries, the challenge for central banks remains finding the right balance between supporting growth and containing inflation risks.

Onto the ideas and thoughts on cross-assets for the next few days.

Commodities

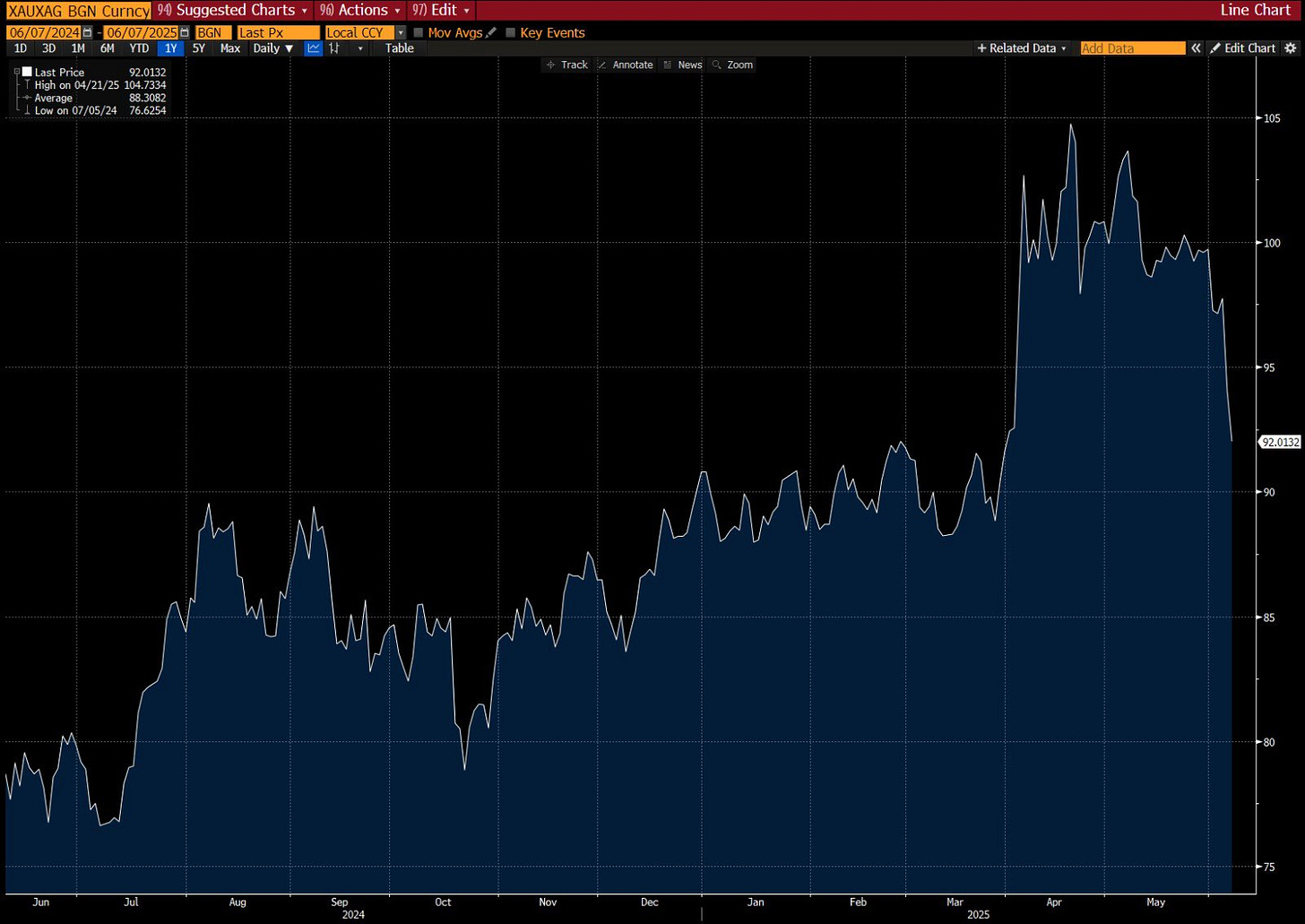

Silver ripped higher last week, with the move finally rebalancing the XAUXAG ratio, which we discussed in late April as something that should happen.

We feel there’s potential for silver to keep running towards $38 in the coming weeks, as long positioning isn’t that high, and plenty likely aren’t onboard yet.

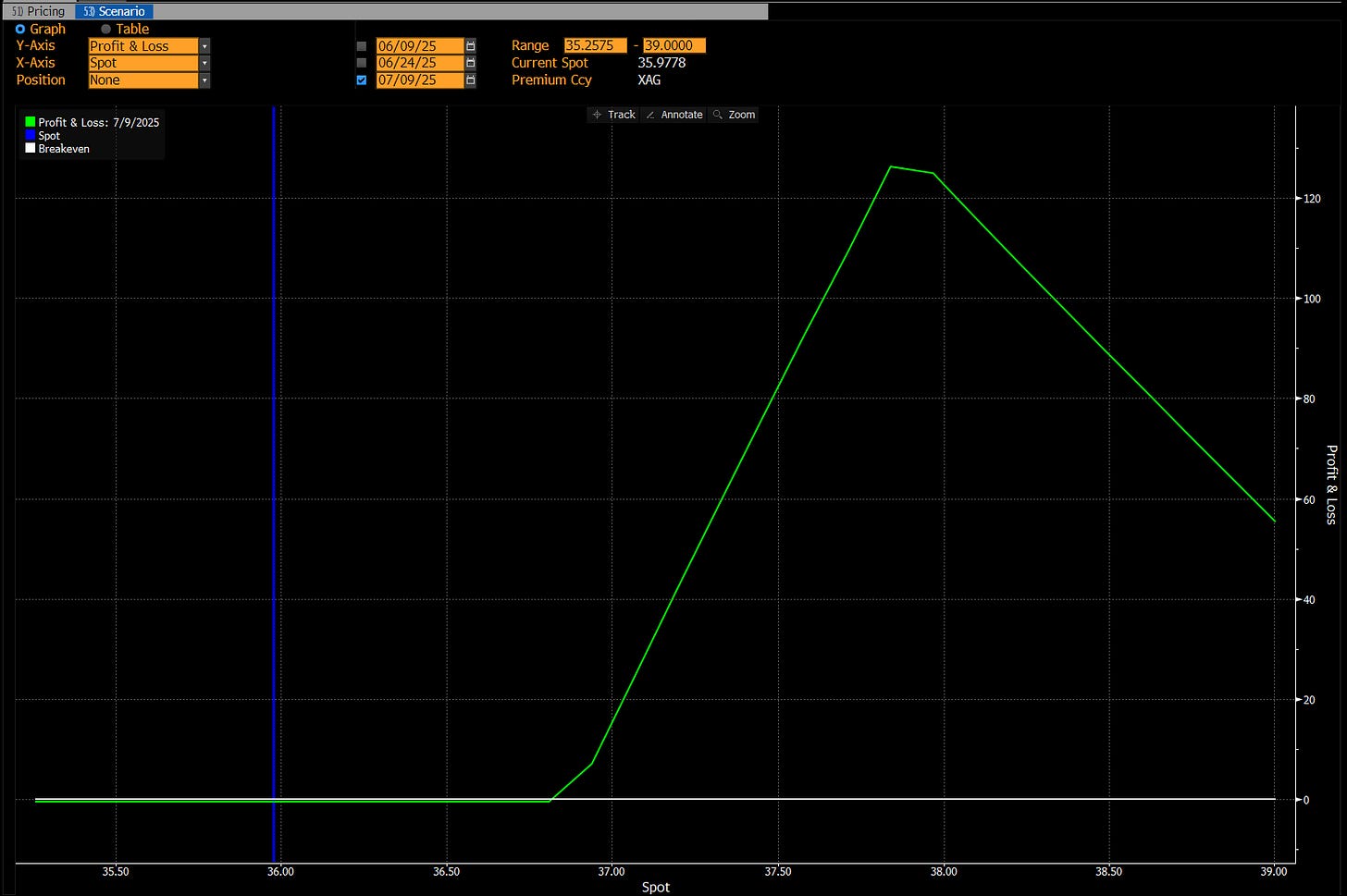

However, to reduce the risk of a sharp pullback stopping us out at spot, we turn to the options space and use a leveraged call spread to juice up the potential reward if we’re right here.

TRADE IDEA - CAPTURING FURTHER XAG UPSIDE

Buy a one-month 1x $37 strike call and sell a 1.5x $38 strike call at zero initial cost, targeting a move to $38.

Payoff visualisation below:

FX

The NFP print and related jobs data were enough to push the USD higher at the end of the week.

With CPI inflation due on Wednesday and the consensus being for a rise from 2.3% last release to 2.5% now, there’s further reason to anticipate that a more meaningful bounce for the greenback could be looming.

The US 2-year closed above 4%, and even with Trump’s brash calls for a 100bps cut, the bias towards rates in this uncertain environment to stay elevated should feed through to USD strength.

From a technical perspective, the dollar index (DXY) needs to break above 99.70 (close last Friday was 99.19) to justify getting long. Yet if it does, there could be a sharp move higher to 102.00 as sentiment quickly shifts and short positions get cut.

TRADE IDEA - POTENTIAL FOR A DXY POP

Limit Order: 99.80

Take Profit: 102.00

Stop Loss: 99.10

EUR/CHF rejected a move above 0.9400 again late last week. From our perspective, it’s a tussle between the two pairs which could likely see a lack of meaningful price action in coming weeks.