Top Trade Ideas - May 12th

Looking for the tariff off-ramp.

Risk assets will kick off the week in a celebratory mood. A vague U.K.-U.S. trade announcement and a claim of “substantial progress” in China talks gave markets just enough to latch onto. In both cases, the message was clear: the U.S. is looking for a way out of its tariff entanglements. That alone was enough to ignite a rally.

But the substance doesn’t match the tone. The British deal is little more than a handshake and a menu for future discussions. The China talks, for now, are detail-free. These aren’t resolutions, but frameworks. Still, in today’s market logic, the announcement of possible progress has become progress itself.

What’s driving the euphoria isn’t what was agreed, but what it implies. If the U.S. is trying to ease off the tariff pedal, that marks a shift. Tariffs, nearly universally derided by economists and markets alike, have lingered far beyond their shelf life. The idea that they might finally start to come down feels like a reprieve.

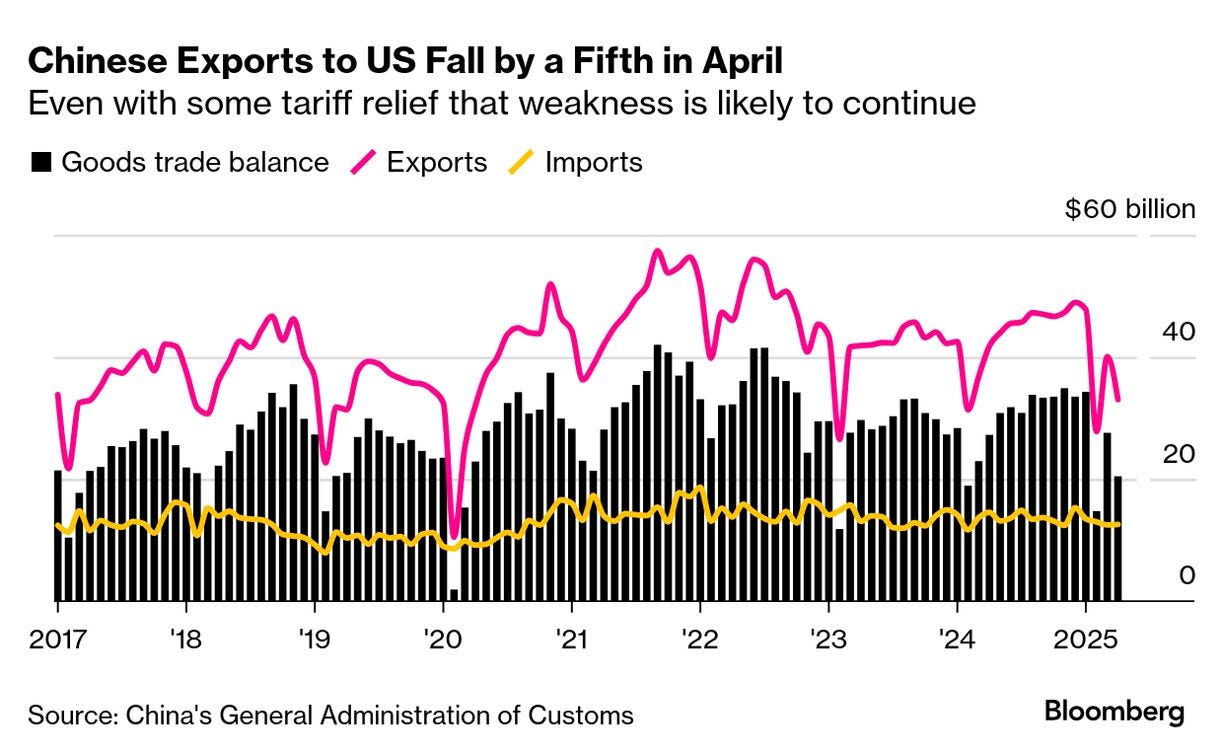

But the facts complicate that view. The UK, arguably America’s most politically aligned and economically minor counterpart, didn’t get an exemption. It still faces the same 10% tariff as everyone else. That suggests the default setting remains in place. Meanwhile, Trump seems happy with an 80% levy on China. If that remains the case, it isn’t a negotiating tactic, it’s an attempt to rewire global supply chains.

So we’re left with a contradiction. Markets are pricing a retreat in tariffs, but the U.S. administration is walking back, for now, the most important trade participant: China. Traders assume the rhetoric is hollow. But what if it isn’t?

The easy interpretation is cynicism: that Trump 2.0 is staging another empty show, and the U.K. deal is just window dressing for a policy walk-back. Maybe. But Trump’s protectionist instincts are long-held, not manufactured for this campaign. And if there’s no major constituency behind tariffs, there’s also no pressure to kill them quickly.

The base case forming in markets, 10% blanket tariffs and a possible 80% hit on China, would have sounded like a worst-case scenario just months ago. The only thing that’s changed is that traders have convinced themselves it won’t happen.

Our Global Asset Portfolio performance is shown below. For complete holdings and commentary, consider becoming a paid subscriber.

MTD: +2.93%

QTD: +12.35%

YTD: +8.66%

The Week Ahead

Following the announcement of a U.S.-U.K. trade deal, markets will focus squarely on the potential for further U.S. trade developments, particularly with China. In the U.S., April inflation and retail sales data will offer a critical update on how tariff uncertainty is filtering into prices and consumer behaviour. While the Fed held rates steady last week, signs of sticky inflation or weakening sentiment could shift expectations around the timing of rate cuts.

The eurozone will release second-estimate GDP and employment data, while Germany’s industrial production and ZEW sentiment surveys will provide a read on Europe’s economic resilience as trade risks mount. In the U.K., the Bank of England’s recent rate cut and a divided vote will be followed by commentary from all nine MPC members, alongside fresh GDP, wages, and trade data that may shape the trajectory for further easing.

Japan is expected to report a Q1 contraction, with external demand dragging on growth even as domestic activity holds up. The Bank of Japan’s April meeting summary and Friday’s bond auctions will also be in focus as markets reassess the outlook for further policy normalisation. Meanwhile, Australia’s employment and wage data are unlikely to derail expectations for a rate cut later this month, which may mark the start of a new easing cycle.

China has no major data releases this week, but policy signals from ongoing trade talks will be closely watched. In India, softer inflation could reinforce the case for further rate cuts, while April trade figures may highlight pressure on the current account. Indonesia’s trade report and Malaysia’s final GDP print will offer further insight into how Southeast Asia is absorbing the external shock.

In Latin America, Mexico’s central bank is expected to deliver a 50bps rate cut as it tries to revive a stalling economy. In contrast, Brazil has paused its own easing cycle, and focus now turns to how core inflation trends evolve. Taiwan, Singapore, and the Philippines will each release trade and inflation data that should clarify whether the recent resilience in Asia’s export complex is sustainable.

Global attention remains fixed on the intersection of trade and monetary policy. With inflation proving persistent and growth momentum softening, central banks are entering a phase where timing and tone may matter more than magnitude.

We start the asset breakdown in FX, before moving to bonds, commodities, equity indices, and a single stock idea.

FX

The Bank of England meeting from Thursday proved to be interesting in that even with a 25bps cut, two members had preferred a larger 50bps cut while two others wished to hold rates unchanged, reflecting a rare three-way split.

The market doesn’t like uncertainty, and the outlook that was painted from the vote split, along with the press conference, makes us concerned for GBP in the coming weeks.

We think that this pairs well with the technical setup on EUR/GBP, which has retraced lower over the past month. Yet between 0.8440 and 0.8410 there are several levels which could act as support, for the pair to bounce off (i.e induced GBP weakness).

TRADE IDEA - LONG EUR/GBP

Limit Order: 0.8420

Take Profit: 0.8600

Stop Loss: 0.8375

Over the past month, we have played USD/JPY higher in both the options and cash space. Notably, the options trade paid off significantly better than the spot trade did.

We’re in a position now where the pair is likely to test the top of the downward trendline (shown below) over the next week. This represents the first major test for the USD since it managed to regain a footing after the April losses versus G10 peers.

We don’t have a clear view on the next move for the pair, but are taking off our remaining long exposure and moving to the sidelines. We’d look to jump on a clean break above 147.00, but wouldn’t really want to engage on any shorts if the pair moved back to the low 140s.

TRADE IDEA - WATCH AND WAIT ON USD/JPY

Cutting remaining exposure, would jump on a break above 147.00 to target a move to 150.00