Top Trade Ideas - May 19th

The downgrade itself may not matter; what matters is the deficit trajectory.

Equity markets staged a decisive rebound last week, powered by a US-China trade détente and headline-grabbing deal activity from President Trump’s Gulf tour. The S&P 500 surged 5.3%, erasing its 2025 losses and posting a five-day winning streak, while the Nasdaq 100 ripped 6.8% higher, led by semiconductors and AI-linked names.

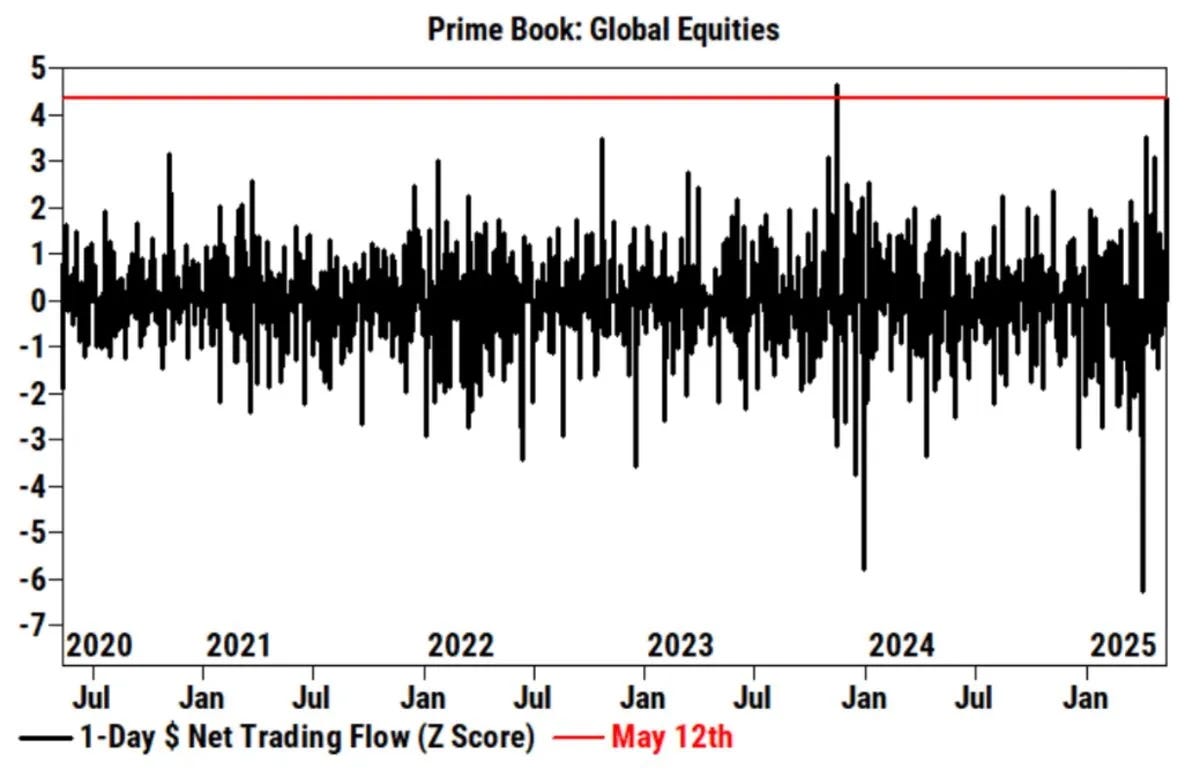

The catalyst was Monday’s dramatic “total reset” in US-China relations, which saw both sides agree to slash tariffs for 90 days. Trade-sensitive sectors rallied sharply, while Goldman Sachs reported the second-largest net equity buying on its Prime desk in five years.

Trump’s visit to Saudi Arabia and Qatar yielded splashy (though contested) pledges exceeding $1tn. AI infrastructure deals lifted Nvidia and AMD, while Boeing climbed on Qatar Airways’ $96bn aircraft order.

Cooling CPI and PPI prints added fuel to the rally, though soft retail sales and plunging consumer sentiment signalled underlying demand fragility. Fed rhetoric remained cautious. December OIS pricing retraced to 50bps of cuts from 67bps. Treasuries steepened modestly, the dollar was stable, and gold fell 4%. Risk sentiment overwhelmed weak macro data.

The biggest news of the week came just after the cash close in NY on Friday, as Moody’s downgraded the credit rating of the US from AAA to AA+, citing concerns about the nation’s growing $36tn debt pile. The downgrade exacerbated investor worries about a looming debt time bomb that could spur bond market vigilantes who want to see more fiscal restraint from Washington. More on this later.

Our Global Asset Portfolio performance is shown below. For complete holdings and commentary, consider becoming a paid subscriber.

MTD: +4.00%

QTD: +13.51%

YTD: +9.79%

The Week Ahead

Markets enter the week with attention shifting from tariff headlines to their broader economic impact. In the US, Thursday’s May PMIs will be a key gauge of business sentiment and activity amid softening confidence indicators. Housing market resilience will also be tested with April existing and new home sales due later in the week, while the Treasury issues $34bn in long-duration supply.

In Europe, the focus will be on preliminary May PMIs for the euro area, Germany and France on Thursday, alongside Germany’s Ifo survey on Friday. Final April CPI and PPI readings will test whether inflation pressures are fading in line with expectations. The ECB releases its April meeting minutes on Thursday, offering insight into the policy stance as markets begin to reprice cuts.

The UK sees a busy macro calendar with April CPI on Wednesday expected to jump due to higher regulated prices. Retail sales, consumer confidence and flash PMIs later in the week will shed light on domestic momentum, while gilt issuance continues with a new 2056 syndication.

In developed Asia, the RBA meets on Tuesday and may deliver a surprise 25bp cut despite strong wage data. Japan’s April CPI on Friday is expected to rise to 3.4% y/y.

Time to get into the trade thoughts for the week.

Starting With the Downgrade

After digesting the news overnight, we posted the following to X on Saturday morning:

“Moody’s downgrade isn’t a market shock, it’s a recognition of what bond markets have been pricing for months. It caught headline news, but the knee-jerk market reaction may have already done most of the repricing Friday night. The message is clear: deficits are rising, debt servicing costs are climbing, and there’s little political appetite for restraint. With Treasury supply accelerating into a world of reluctant buyers, we continue to hold our bearish stance on bonds. [We’re] not sure what stops this bear steepener. The long end is doing the tightening now.”

Following the downgrade, ES dropped approximately 40bps and ZB about 50bps. As we approach the London open, ES is down another 50bps in the futures session, and ZB a further 45bps. The move has been relatively muted so far.

There have been two downgrades before Friday’s, so not a large sample of data, but it is worth a quick rundown of these events.

Following the S&P downgrade in August 2011, equity markets dropped sharply. The S&P 500 fell 6.5% the next day, yet paradoxically, Treasuries rallied hard, with long bonds gaining over 20% in the subsequent months as investors rushed into perceived safety amid Eurozone turmoil.

In contrast, the Fitch downgrade in August 2023 coincided with a sharp bond selloff, as increased coupon supply from the Treasury’s QRA overwhelmed markets. Equities fell over 10% in three months, but bonds fared worse, dropping over 15%. The 2023 episode underscored the shift in market psychology, away from “buy bonds on fear” to a regime dominated by supply, deficits, and duration risk.

Without foresight into what may happen this time, we can likely draw more parallels between the current dynamic and the 2023 downgrade. We enter the week expecting lower prices from both equities and bonds, with a greater focus on the bond market.

Positive news on the trade deal tape can help cushion any equity selling. News on the “big beautiful [tax] bill” likely adds more problems to the bond market and the deficit situation.

Our recent trade ideas on a bond steepener, TLT puts, and Friday’s article looking at equity hedge trades all position us well for what’s ahead.

FX

The more we think about it, the more the monetary and fiscal uncertainty in the UK makes us believe that GBP gains from here are capped. Post-BoE, we feel that one rate cut per quarter through to year-end is fair pricing, with limited GBP upside based on this angle.

We’ve made no secret that we don’t have a high conviction on the USD right now, and valid arguments have been made for both sides of the coin. For those that think we get a continued rebound over the next month or so, we do like the look of selling Calls around the 1.3450 mark, which is just above the potential double top from the past year. Risk can be capped in buying strikes further up, but you obviously reduce gains in the process.

TRADE IDEA - GBPUSD UPSIDE CAPPED?

Sell three-month expiry 1.3450 strike call options, netting 0.90% in premium

The RBA meeting on Tuesday will be interesting, given the slight pivot in expectations over the past couple of weeks. We went from chatter around a jumbo 50bps cut to now pricing in 25bps, alongside a decent April employment report and continued wage growth.

With further benefit coming indirectly from the further thawing of tensions between the US and China, we feel there’s potential for the RBA to not be as dovish as some might expect. Over three cuts are already priced for this year, so the bar to out-dove themselves is quite low.

From a technical perspective, AUD/NZD could look to trade up to circa 1.0970 before it meets the 200 DMA, with any break from there likely clearing 1.1000.

TRADE IDEA - RBA NOT THAT GLUM

Entry: 1.0890

Take Profit: 1.1000

Stop Loss: 1.0850

Volatility

Last week, we explained why we felt that volatility, particularly in the equity space, would return over the coming month.

One of our favourite ways to express this view is via VIX futures, being arguably the cleanest way to take a view on SPX volatility for the short term.

Buying Call options on the June 18th expiration (M5) can provide an attractive payoff. For example, a Call spread of buying the 23 strike and selling the 33 strike helps to capture a reasonable range for any pop in coming weeks, regardless of the underlying catalyst.

We like the positioning here because something serious would need to kick off in order to breach 33, but it still cheapens the overall structure enough to warrant selling that strike. It’s true that the June expiry only provides a month or so of time value, so some might want to trade this more OTC or simply look for a later futures contract.

TRADE IDEA - BRACING FOR VOL

Buy a 23 / 33 Call spread on VXLM5, with a max payoff of circa 9:1

nb this was priced on Friday pre-market close.

Equity Names

For investors who missed the initial rerating in European defense, Leonardo (LDO) is offering a good second-chance entry here. The stock is pressing up against all-time highs, but doing so with discipline: tight consolidation, strong volume, and a bullish moving average structure. It’s a technically clean setup in a sector that’s been anything but easy to chase.

The fundamentals are lining up. Q1 results came in strong across revenue and EPS, with upbeat guidance and growing conviction around multi-year earnings growth. Leonardo’s diversified platform, from helicopters to electronics, positions it as a core supplier in Europe’s rearmament push.

European defense spending is structurally rising after decades of underinvestment, and Leonardo is well aligned to capture that capital. The chart gives you timing; the macro gives you duration.

For those still on the sidelines, LDO may be the cleanest way back into a powerful theme.

Looking for a breakout above 50

Our focus will remain on Europe for the next few days, looking to find some more equity names that we can add to our portfolio to increase exposure in the mid-term. In the US, some shorter-term vol will create opportunities for tactical trades. We will try to highlight these in the Substack chat or on X over the next few days as they present themselves. Keep an eye out for those.

As always, trade safe.

AP