Top Trade Ideas - May 20th

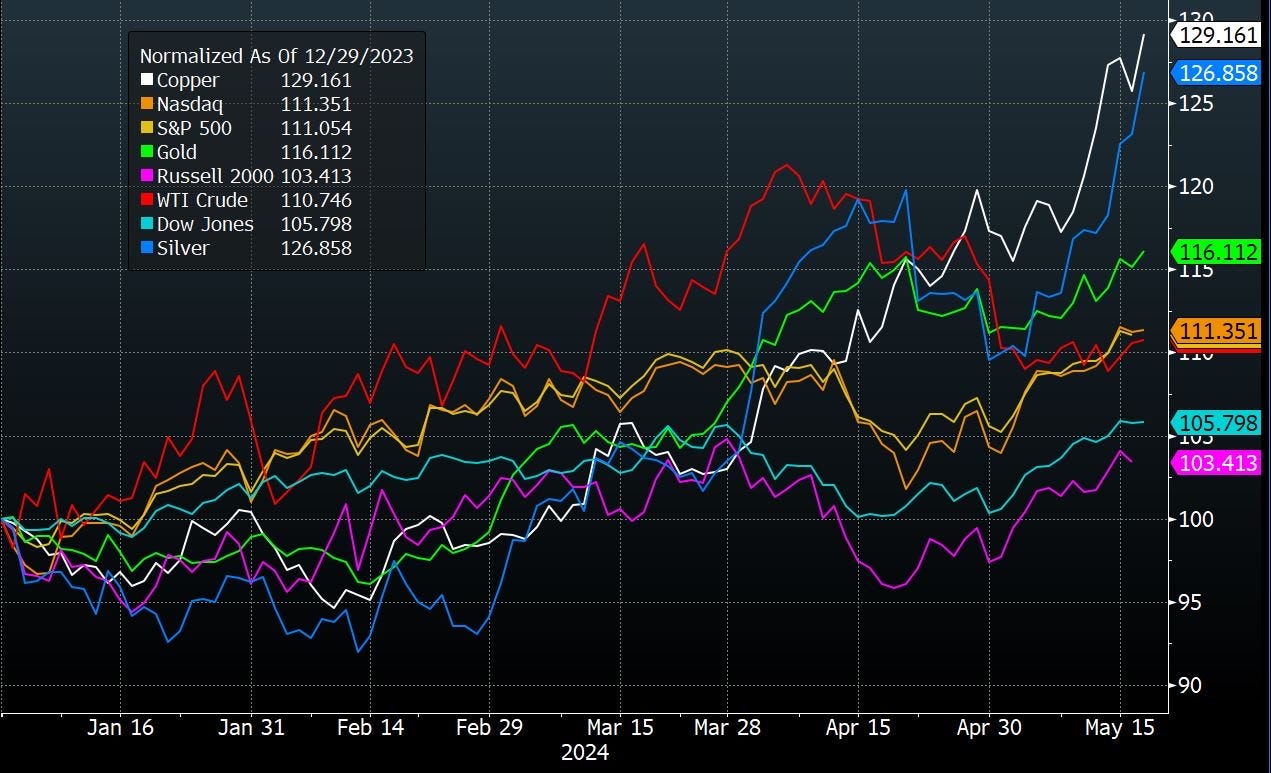

Equities at highs, precious metals surging, FX swings. There's a lot to talk about.

Equity markets seemed back to their usual self last week, with the S&P 500, Nasdaq 100, Dow Jones, FTSE 100, and Stoxx 600 all reaching new highs.

Precious metals were also on a tear on Friday, with silver surging to an 11-year high and gold rallying back toward an all-time peak reached in April. Strong gains in copper are spilling over to silver as the metal is also considered an industrial commodity given its usage.

Three things impact a commodity: supply, demand, and price momentum. Silver and copper have all three of those right now

In G10 FX, the DXY index fell as investors took the as-expected CPI inflation print as a positive affirmation that the Fed will be leaning towards cutting sooner.

FX

We have barely traded EUR/USD so far this year, given the incredible lack of vol and directional break out. Following the CPI print last week, we finally feel a trade is on the cards here.

On Wednesday, the pair broke and held above the 100 DMA and the descending trendline, which has been in place since the start of the year. We feel this opens up a move back to test 1.1000, with an extension target of the December highs above 1.1100.

Fundamentally, even though the ECB will start cutting ahead of the Fed, the pair will trade more around the interest rate differentials. We feel the ECB pricing is now fairly spot on, whereas there’s room for more cuts to be priced in for the Fed. This should act to push the pair higher.

TRADE IDEA - RIDE THE WAVE ON EUR/USD

Entry: 1.0867

Take Profit: 1.1000

Stop Loss: 1.0820

Early Wednesday, we get the latest RBNZ meeting. Given that inflation in the first quarter came in at 5.8% versus the RBNZ forecast of 5.3%, we think there’s scope for further hawkish chatter, which should cause the circa two rate cuts for this year to be priced further out.

We like to pair this up against the USD again, given our tactical bearish view as mentioned above. However, given that we’re dealing with a central bank meeting, we want to avoid being stopped out by any sharp swings.

Therefore, we turn to the options space and look to purchase a one month Call spread, buying a 0.62 strike and selling the 0.63 strike.

TRADE IDEA - POSITION FOR A HAWKISH RBNZ

Buy a one-month NZDUSD call spread option at 0.6200/0.6300 and pay 0.43%. Targeting a 3:1 risk/reward at 0.6300

As usual, we continue the ideas below, covering our thoughts on currency, equity, rates and commodity markets. If you have not tried our premium content before, you should give it a go. There is a lot of value in a small price of £10/month. A free trial can be accessed here.

Onto the rest of the alpha.