Top Trade Ideas - May 26th

Tariffs hit the headlines again as the administration lets the economy run hot.

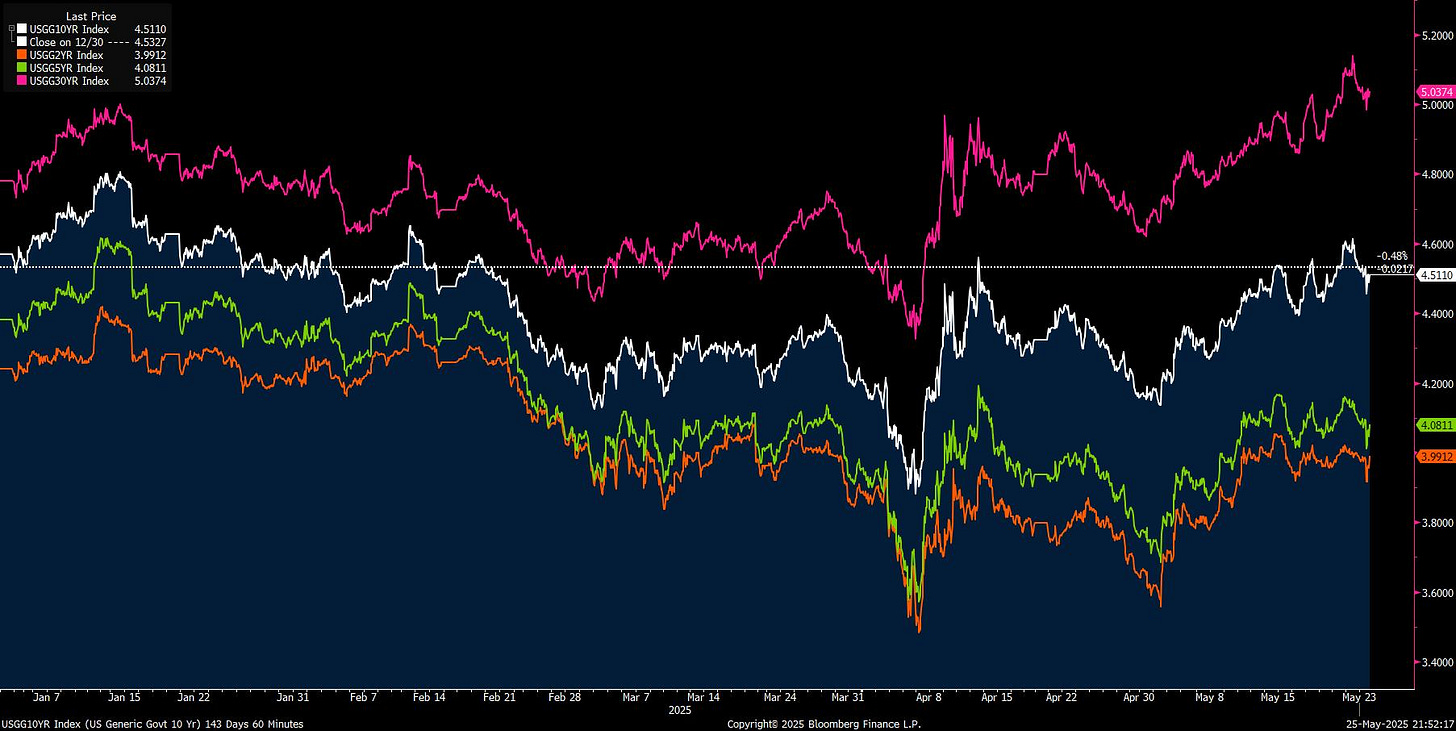

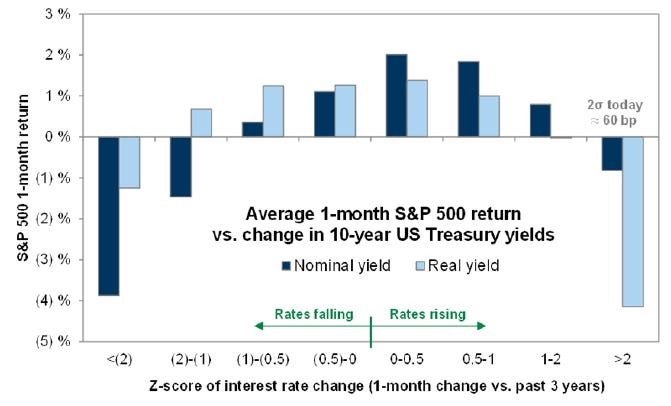

US equity markets declined last week as the Moody’s downgrade set the tone for a broad risk-off move. Initial attempts to shrug off the downgrade faded amid a series of negative catalysts. A weak 20-year Treasury auction on Wednesday pushed long-end yields above 5%, reigniting fears that higher rates could weigh further on valuations. Goldman Sachs flagged 4.7% as a pain threshold (on the 10-year) for equities, which markets are now dangerously close to breaching.

Fiscal concerns resurfaced as the Senate signalled changes to Trump’s tax and spending package that could bump up against the debt ceiling again. Bessent also stated last week that they plan to grow the economy faster than debt to stabilise the debt-to-GDP ratio. Scrap the “detox”, kick the can down the road, and run the economy hot. It’s a slight U-turn on their earlier statements.

On Friday, Trump escalated trade tensions, threatening 25% tariffs on Apple (later expanded to all phone makers) and a sweeping 50% tariff on EU goods from July 9th (extended over the weekend) following the breakdown in trade talks.

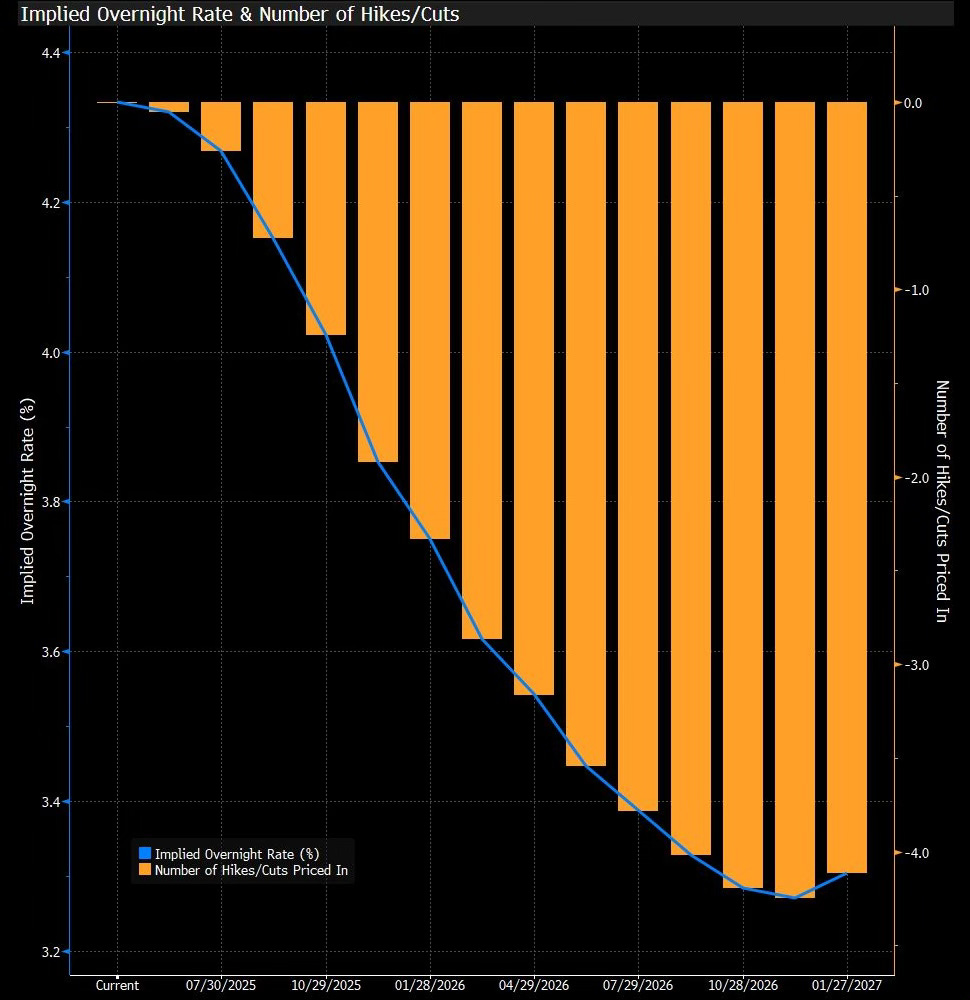

The USD continued to slide, with the Bloomberg Dollar Spot Index hitting a new year-to-date low. Treasury markets were rattled by the poor auction, steepening curves and weakening of the long end. Fed speakers pushed back on near-term cuts despite better-than-expected PMI data, and OIS markets trimmed pricing to 47bps of cuts by year-end.

ICYMI, our latest primer on repo markets was released yesterday. You can read it here.

(To get full access to all research and notes posted, consider becoming a premium reader here.)

The Economic Week Ahead

Markets head into the week with renewed focus on US trade policy after President Trump’s threats to Europe raised fears of a broader trade war, adding to inflation concerns already roiling bond markets. Investors will be watching US PCE inflation data, consumer confidence, and Fed minutes closely for signs of how the central bank plans to navigate rising price pressures alongside slowing growth. Long-dated Treasury yields have surged in recent days, driven by concerns over deficit expansion following the House’s passage of Trump’s tax-and-spend bill and Moody’s downgrade of US sovereign credit.

In the eurozone, the data calendar is heavy with inflation prints from Germany, France, Spain, and Italy, which are key for gauging whether euro-area price pressures are moderating quickly enough to support the ECB’s easing bias. German consumer sentiment and unemployment data will provide insight into the domestic demand backdrop. At the same time, the EU’s confidence surveys and retail sales will help assess the spillover effects from the trade shock. The threat of US tariffs has raised the prospect of retaliation from the European Union. It could have a disproportionate impact on the GDP of Germany and Ireland, particularly if the pharmaceutical and automotive sectors are targeted.

The UK enters a quiet week data-wise following a Bank Holiday, with attention turning to house price data and green gilt issuance. BoE commentary will remain key as the central bank attempts to guide markets through a divided rate-setting committee and a still-muddled economic outlook.

Japan will report Tokyo CPI, industrial production, and retail sales on Friday, with inflation expected to edge higher as energy subsidies roll off. The BoJ’s 40-year JGB auction midweek comes under scrutiny following weak demand at a recent 20-year sale, amid concerns that rising yields could trigger renewed volatility in the long end. BoJ bond-buying operations later in the week may attempt to restore calm to the curve. Meanwhile, Governor Ueda’s remarks at the central bank’s policy conference will be parsed for hints on the timing of the next hike, with October now seen as the earliest likely move.

In Canada, Friday’s GDP data will offer a check on economic momentum and help shape expectations around the timing of the Bank of Canada’s return to easing, which markets increasingly expect in the second half of the year.

With global long-end bond markets flashing fiscal concerns, the key challenge for policymakers around the world this week will be striking the right tone—not too dovish to stoke inflation fears, and not too hawkish to overlook the growth risks arising from Washington’s tariff brinkmanship.

Moving to the team’s thoughts for the week ahead:

FX

With Trump’s latest tariff spook with the EU and the weak 20-year Treasury auction, the DXY ended the week sharply lower. Although we have been sitting on the sidelines regarding the next move for the greenback, the close from last week sets the stage for various other G10 currencies to take advantage, with EUR/USD at the forefront.

From a technical perspective, the pair has held the 50dma and appears poised to rise towards the top of the trend channel, suggesting that 1.1600+ (and fresh multi-year highs) could be on the horizon.

We still prefer EUR as the best among the G10 currencies right now and remain bullish on long EUR/GBP as a medium-term trade.

TRADE IDEA - PLAYING USD WEAKNESS

Entry: 1.1362

Take Profit: 1.1600

Stop Loss: 1.1240

The CHF/JPY pair has attempted multiple times over the past couple of months to break and hold above 176.00. It has failed to do so, and the risk-off mood at the end of the week didn’t translate to a sharp appreciation in CHF (as it did back in early April).