Top Trade Ideas - May 5th

Positioning extremes unwind as resilient data, dovish policy signals, and shifting cross-asset dynamics drive a broad market reset.

Price action this week reflected a reversal of recent positioning extremes, as resilient U.S. data, dovish signals from the BoJ, and shifts in cross-asset sentiment forced a repricing across major markets.

Nonfarm payrolls data on Friday showed no clear evidence of labour market deterioration, driving a sharp move higher in yields, with the 2-year Treasury up 14bps and the 10-year up 11bps. Earlier in the week, a modest uptick in Continuing Claims introduced some noise, but broader labour market trends remained intact. Against this backdrop, consensus trades favouring gold longs, stock shorts, and a broad “Sell America” theme faced sharp reversals, exacerbated by sentiment extremes highlighted across financial media. Look at the latest Barron’s magazine, for example (cover contra).

Meanwhile, the BoJ surprised on the dovish side, cutting its 2026 CPI and GDP forecasts and softening forward guidance. While Governor Ueda did not rule out future rate hikes, market pricing moved to discount a longer pause in policy normalisation, weighing on the yen and reinforcing global liquidity conditions.

Equities extended gains, with the S&P 500 recording a rare nine-day winning streak, the longest since 2004. Mega-cap earnings delivered bifurcated results, with companies less exposed to physical goods outperforming, while tariff-sensitive firms lagged. Importantly, commentary from technology leaders confirmed that AI capital expenditure remains robust, pushing back against concerns of an imminent slowdown and contributing to a reacceleration in sentiment toward the AI complex.

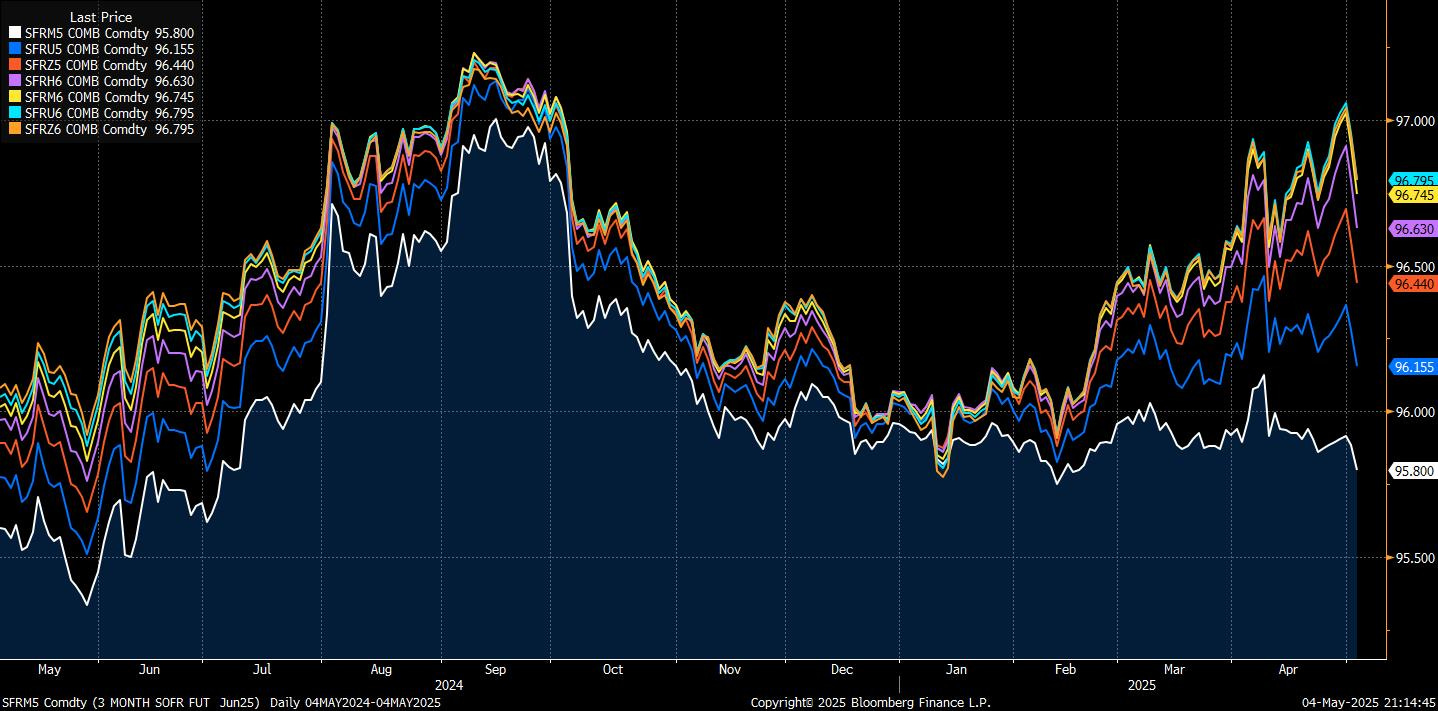

In rate markets, cut expectations unwound into the end of the week. Foreign selling of Treasuries reemerged, alongside public commentary from Japanese officials suggesting the possibility of reduced Treasury holdings in response to U.S. trade policy—a notable shift in tone from one of America’s historically closest allies. Inflation signals remained mixed, with falling crude prices alleviating some near-term concerns, even as tariff-related price pressures continued to surface in corporate communications.

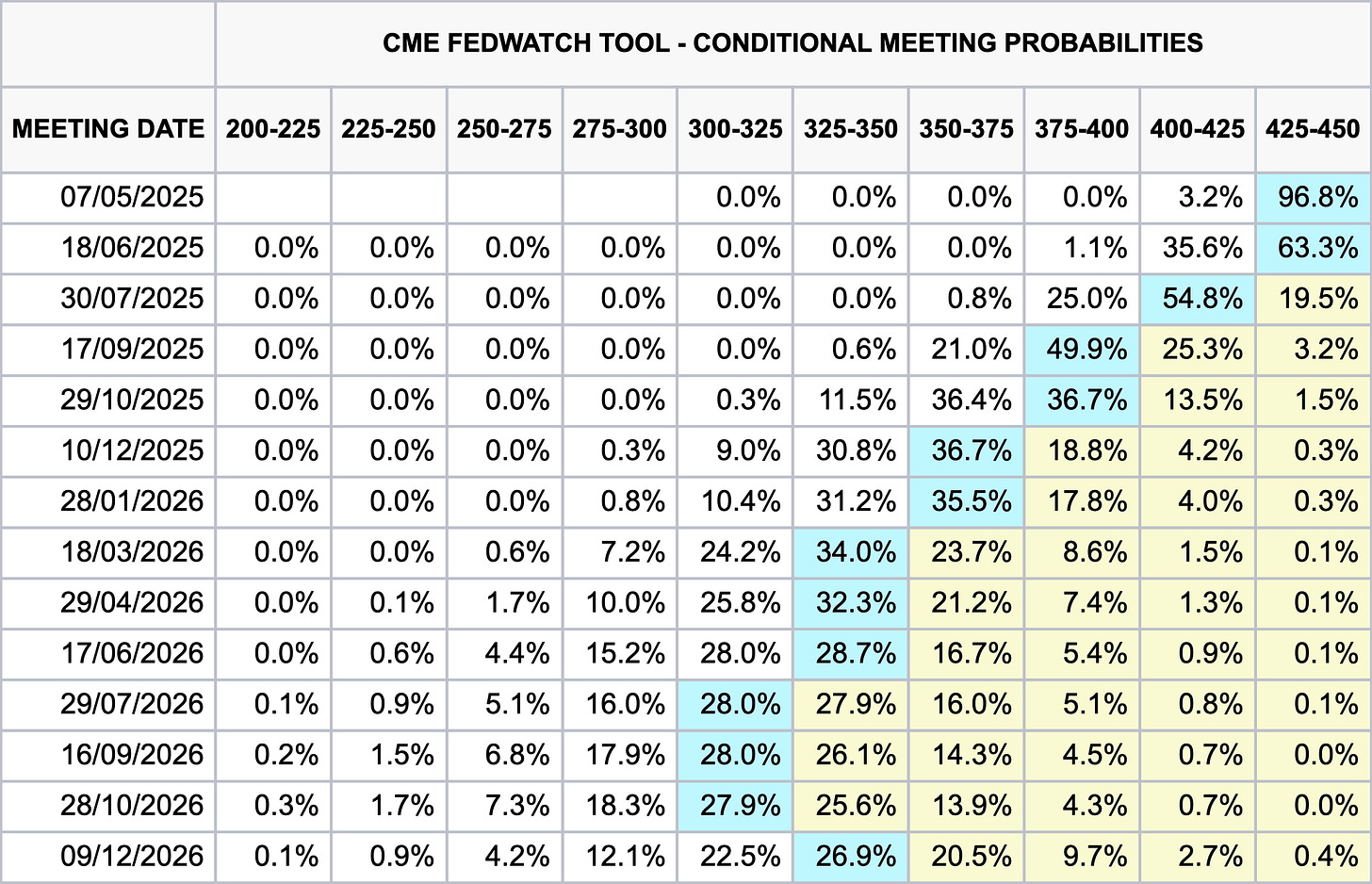

One thought ahead of the FOMC meeting… a shift from the Fed focusing on standing pat to discussing cuts isn’t outright bullish for the market. If slowing growth concerns drive the pivot, it could weigh on the SPX, signalling deeper risks. However, if the Fed transitions away from inflation concerns and views inflation as transitory, a retest of 6,000 on SPX isn’t off the table, in our opinion.

Reasons > Pathing/Timing

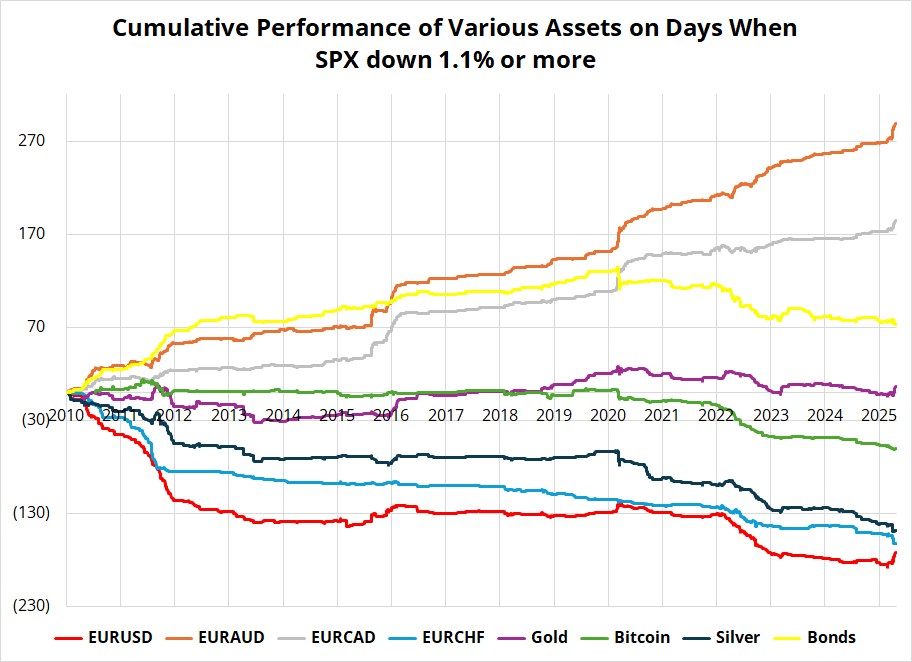

In FX, recent stress events have highlighted a notable behavioural shift, with EURUSD beginning to trade more like a defensive asset during periods of equity weakness. Historical analysis suggests that while EUR historically functioned as a low-beta risk asset, current dynamics are positioning it closer to a safe-haven status, reflecting broader concerns around U.S. fiscal credibility (red line below).

Crypto markets, which had shown tentative signs of decoupling from equities, reverted to their prior high-beta correlation structure. In commodities, attention turned to the OPEC meeting, as oil prices have collapsed and positioning screens are at extreme levels. Sentiment is skewed heavily to the downside.

The Week Ahead

The Federal Reserve is expected to hold rates steady this week, but markets will focus on whether growing tariff pressures and softer data push the Fed closer to easing. While inflation remains sticky, money markets continue to price in significant cuts by year-end. Alongside the Fed decision, ISM services data and trade figures will offer the latest read on how tariffs are weighing on U.S. growth.

In Europe, the BoE is set to cut rates by 25 basis points, with investors watching for signals on the pace of further easing. German industrial data will also be key as Europe’s largest economy faces renewed pressure from U.S. trade policy.

China’s April trade report will provide a critical gauge of how tariffs are hitting global flows, with markets braced for a sharp contraction in exports. Any signs of deeper weakness could prompt faster stimulus out of Beijing. Inflation figures, due over the weekend, are unlikely to ease deflation concerns.

Japan’s household spending data is expected to show modest improvement, but ongoing trade uncertainty has pushed expectations for the next BoJ rate hike toward October.

In emerging markets, Brazil’s central bank is likely to deliver another rate hike before shifting to a more neutral stance. Meanwhile, New Zealand’s employment data, Scandinavian central bank meetings, and fresh inflation readings across Asia will add context to how much monetary space remains if global conditions deteriorate further.

Amid intensifying trade disruptions, the focus will stay firmly on how quickly major central banks pivot toward protecting growth.

Before we move into our asset ideas, be sure to check our latest Money Markets for the month ahead, if you have not already.

Let’s start the week in FX this time.

FX

The BoJ late last week didn’t inspire confidence as a central bank that can be counted on to tighten monetary policy from here. Ueda and Co. spoke about the heightened uncertainty in the market right now, mixed in with an expected hit to exports and reduced growth forecasts.

As a result, rate expectations were repriced, and from our perspective we firmly believe the BoJ are now on pause mode for quite a while. We feel JPY will likely move lower from here, especially if this risk-on mood continues in the equity space.

Although we’re not convinced that the USD’s medium-term viability is assured, tactically, the DXY looks like it’s bouncing, so we’re happy to play this on USDJPY.

TRADE IDEA - PLAYING YEN WEAKNESS

Entry: 144.95

Take Profit: 147.95

Stop Loss: 143.95

EUR/CHF has settled down after the sharp bid in CHF with safe haven inflows. Given the higher benchmark now set for market participants to be spooked on trade headlines, we think it’s unlikely for the same size of a CHF move to be replicated in the near term, likely capping any potential for it to break below 0.9220 support.

On the other hand, EUR has already seen a decent boost YTD against other peers, and the latest ECB meeting didn’t really inspire us that another leg higher in the next few weeks is brewing.

On that basis, we think current levels setup nicely to sell a strangle structure, allowing us to pick up the remainder of slightly elevated implied vol against a backdrop where the pair could remain rangebound for coming weeks.

TRADE IDEA - PLAY FOR A RANGE ON EUR/CHF

Sell a one-month strangle, 0.9220 put and 0.9450 call strikes, receiving a 0.61% premium.

Despite annual core inflation slowing to a three-year low in Australia, AUD pairs managed to hold their ground last week, even posting gains against some peers. Even though the RBA might now look at a 50bps cut instead of just 25bps at their next meeting, the bid from AUD can partly be noted with somewhat of a thaw on China/US tensions and the high-beta nature of the currency to risk appetite.