“If you want a thing done well, do it yourself.”— Napoleon Bonaparte

Welcome to AlphaPicks’ monthly market update, a rundown of global markets for the coming weeks in around ten minutes.

Here’s what you need to know…

If you are not yet a premium subscriber to AlphaPicks, you can manage your account here.

Macro

What a month April turned out to be. To some extent, the anticipation of Liberation Day on April 2nd did cause some to be cautious about what Trump might come up with. But for many, the bar was high for providing something groundbreaking, given his existing forays into using tariffs as a combat tool in February and March.

Such thinking proved to be misguided, as his global tariff imposition sparked a sharp risk-off mood in financial markets. Notable casualties over the space of the next week ranged from oil to the US dollar, from the S&P 500 to US Treasury yields:

At a global macro level, we believe that tariffs are a zero-sum game. The global efficiency loss (otherwise known as the deadweight loss for all those Econ 101 junkies out there) makes the world economy smaller, not bigger.

Yet it’s also true that the country imposing the import tariffs often mean that domestic consumer pay higher prices. It also opens up the country to retaliation risks. The latter already happened, with it likely to take some time to see if the former will play out.

The market volatility incurred saw the VIX spike to 60, with an almost daily barrage of headline risk relating to either the stepping up of trade tensions or some form of relief with exemptions or more constructive dialogue.

In all of this craziness, it was a great time to be a trader, where volatility provided opportunity.

As we enter May, the landscape regarding global trade is more settled. Late in the trading week, headlines from the Chinese Commerce Ministry essentially added up to saying they were open to starting dialogue with the U.S. We feel that over the course of the coming couple of months, some form of trade deal will be struck between the two sides.

We also start the month on the back of an 11% rally in the S&P 500 from the 52-week lows, albeit notching the worst first-100-day performance under a new administration since Richard Nixon’s second term in 1973.

However, if the equity markets are giving mixed signals from a macro perspective, the rate space is equally unhelpful. At one point in April, erratic price action indicated five 25bps cuts were fully priced in for the Fed this year. This has now eased to just over three cuts, with the FOMC meeting next week being a really good barometer for investors to mark against when it comes to the policy stance and outlook from Powell and Co.

A cut next week is very unlikely, but it’ll be good to see if inflation is still perceived to be transitory, even with the tariff uncertainty. If it is, and the Fed believe that they can use rate cuts as a tool to stimulate economic growth, then the market might take any dovish pivot rather well.

Whilst we’re on the topic of central banks, it was impossible to ignore the public displeasure with which Trump has for Chair Powell. During the month, there were several outbursts (often in the form of posts via Truth Social) that criticised his ability to do his job, aggressively pushing for rates to be lowered.

We thought this had been resolved and put to bed, but earlier this week, during a rally in Michigan on Tuesday, he was at it again. Trump commented, “I have a Fed person who is not really doing a good job. You’re not supposed to criticise the Fed, you’re supposed to let him do his own thing, but I know much more than he does about interest rates.”

In our musings on this in Drawing The Line of Independence, we drew some parallels to Turkey in terms of how an escalation of tensions could end up from here. This might sound farfetched to some, but with Trump, you really can’t rule anything out.

It appears Trump doesn’t realise that Powell is part of a committee, and that it’s not his call alone on policy decisions. We feel this isn’t a story that has run its course, so we are observing this as we progress in May.

The corporate earnings season is in full swing, and although we’ll leave more of that chat for the equities section, there was a clear distinction of winners and losers from those reporting so far.

From a macro perspective, one of the main takeaways was the impact of tariff uncertainty on businesses. Even if no tariffs from this point forward get imposed and existing ones are rolled back, damage has already been done. Trying to beat the rush of potentially higher prices has seen supply chains disrupted, with expensive changes to move production onshore or away from Asia beginning.

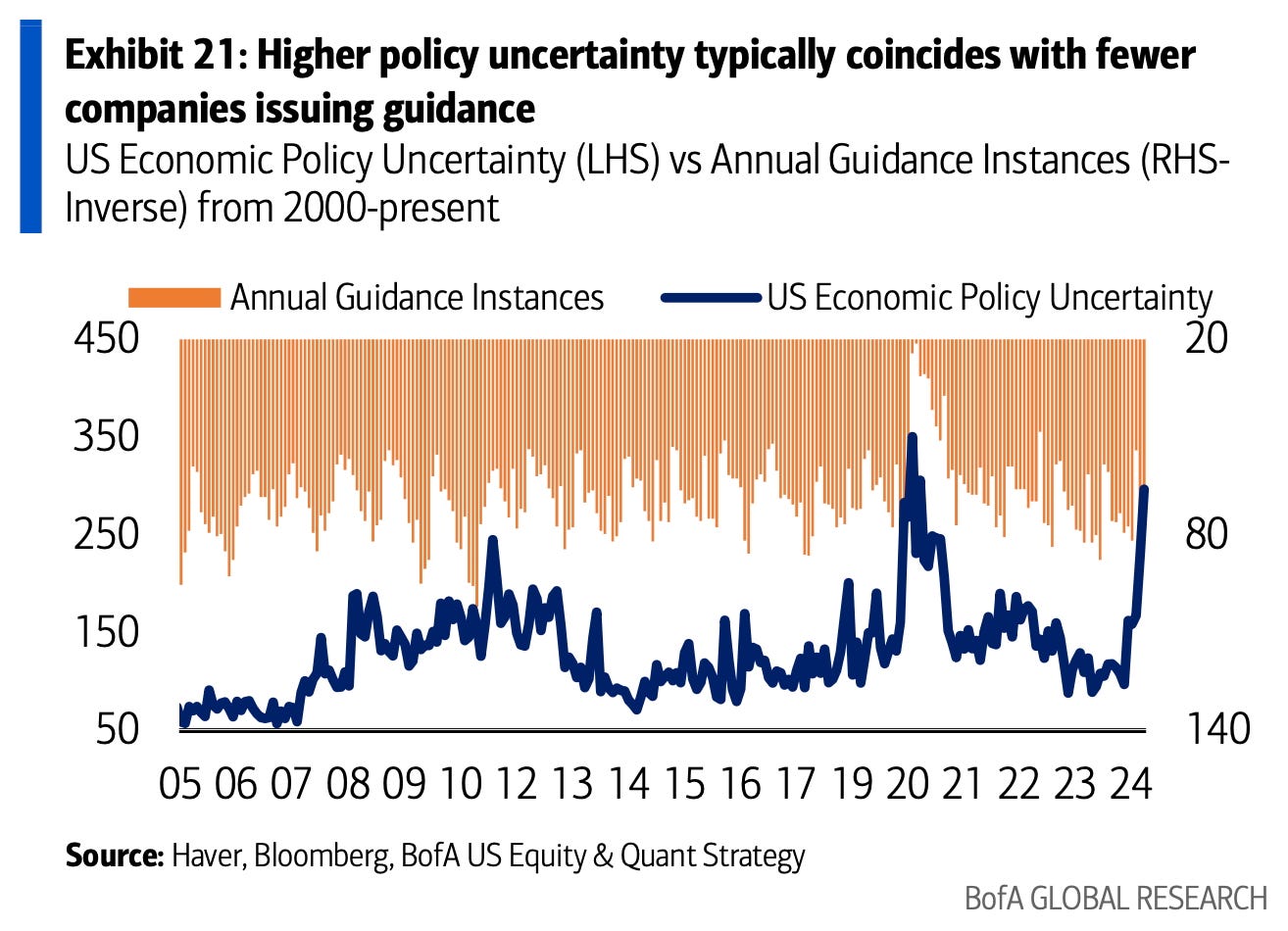

The removal of financial guidance by some reporting companies was another notable point. We wrote about this in more detail here, looking at how policy uncertainty has historically led to fewer companies issuing guidance:

A great point that was made from the article was that:

“This is why guidance matters. It isn’t perfect. It compresses analyst dispersion, incentivises short-termism, and occasionally manipulates expectations. But in an environment where the fog isn’t lifting, it’s one of the last remaining signals from the bridge.

As earnings season unfolds, investors aren’t just watching EPS. They’re watching how many captains are still willing to chart a course.”

Equities

The critical dynamic to monitor in the coming weeks is straightforward: risk assets are front-running an easing in trade tensions. The deals must ultimately be delivered.

Markets do not bottom on resolution—they bottom on diminished fear. Even if the damage to global relationships proves lasting, a de-escalation of tariffs paired with incremental trade agreements offers a substantially better backdrop than continued escalation and isolationism.

The primary catalyst for equities in the near term remains further normalisation with China. Current levels already price significant progress, and there is room for extension, but not without risk. The principal challenge for the tape lies not abroad, but at home: the U.S. growth trajectory and earnings resilience are the emerging headwinds.

European equity markets are navigating a complex macroeconomic environment defined by both emerging opportunities and persistent structural challenges. After a sharp drawdown earlier this year, the index has retraced more than half of its losses, supported by signs of easing trade tensions and renewed fiscal initiatives across the continent.

The European Central Bank’s increasingly accommodative posture, especially in contrast to the Federal Reserve’s tighter stance, provides a favourable backdrop for equities. With rate cuts likely to continue through the year, monetary divergence is reinforcing relative valuation support and creating an attractive environment for risk assets.

Fiscal expansion is also becoming a material driver. Germany’s infrastructure and defence spending packages are channelling significant capital into the economy, with positive spillover effects expected across the broader Eurozone.

Valuations further bolster the investment case. European equities remain notably cheaper than their U.S. counterparts, with the STOXX 600’s forward price-to-earnings ratio trading at a discount to the S&P 500. As global investors increasingly search for value, this relative mispricing has the potential to act as a catalyst for further inflows.

That said, headwinds remain. Earnings expectations have been revised lower, and forecasts now imply a contraction in EPS across European corporates, reflecting still-cautious sentiment around growth prospects. Currency strength presents an additional challenge; the euro’s appreciation threatens to erode the competitiveness of European exports at a delicate moment for global trade.

Finally, while progress on the China–U.S. trade front is encouraging, the broader landscape remains fraught with uncertainty. Ongoing negotiations and the spectre of renewed tariffs continue to inject volatility into the outlook, leaving European markets susceptible to external shocks even as domestic conditions stabilise.

Emerging markets are regaining prominence in 2025, offering differentiated opportunities across regions such as India, South Africa, and Brazil. Structural shifts in global supply chains, improving domestic fundamentals, and renewed investor confidence are converging to create a more compelling backdrop for selective emerging market exposure.

In India, the acceleration of the “China Plus One” strategy is materially shifting the investment landscape. Global manufacturers are increasingly diversifying production away from China, with India emerging as a primary beneficiary. Apple’s significant expansion of iPhone production through new facilities led by Tata Electronics and Foxconn is emblematic of a broader trend. Policy support remains robust, with production-linked incentives underpinning this manufacturing renaissance. While regulatory complexity and infrastructure bottlenecks remain headwinds, India’s scale, demographics, and policy orientation continue to reinforce its positioning as a structural winner in global manufacturing realignment.

South Africa has also quietly staged an impressive recovery. The Johannesburg Stock Exchange has reached new highs, with the main index advancing 13% year-to-date, buoyed by strength across mining, financials, and domestic-facing sectors. The suspension of several global tariff initiatives has provided a further tailwind, supporting South Africa’s export competitiveness at a critical juncture. After years of structural stagnation, the market is beginning to reflect a more balanced risk-reward profile, though political risk remains an embedded factor.

In Brazil, the story is increasingly one of diversification and sustainability. The economy expanded by 3.4% in 2024, and although growth is expected to moderate to 2.2% this year, the foundations are shifting in important ways. Brazil’s leadership in renewable energy, particularly in hydropower and emerging solar infrastructure, is attracting investment into adjacent sectors such as AI and data centres, where energy stability is a strategic advantage. A transition toward a more diversified and resilient economic model is underway, providing a medium-term anchor for investors willing to look through near-term volatility.

FX

On a normal month, it’s hard not to talk about the USD, but April’s price action makes it impossible not to start by delving into what turned out to be the biggest percentage loss for the greenback in three years, something visualised well below.