Top Trade Ideas - May 6th

FOMC and major earnings are done. The market can take a breather.

The last seven days saw the Fed keeps rates unchanged (as figured) and reiterate that inflation was not at their desired level. One positive for markets was that rate cuts are still on the cards for the Fed this year. The sea-saw rate story starts its next chapter. Subsiding volatility after the news, alongside Apple beating low expectations and announcing a $110B share buyback, saw US equities catch a bid and end the week higher. And China is on a roll.

The week in front of us is much quieter.

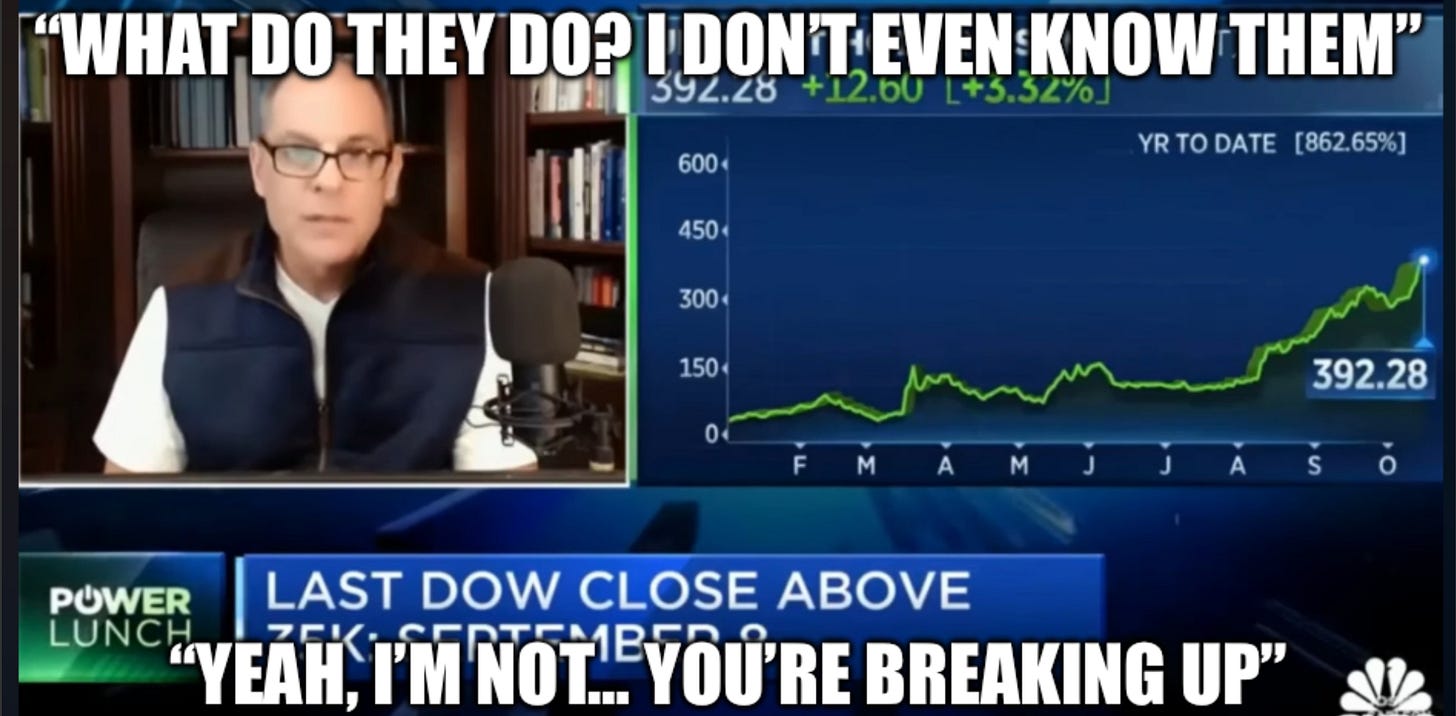

Major earnings have passed us by now, and we just have the bomb that is Nvidia left, but we will have to wait until May 22nd to enjoy that impending vol. Disney is the largest name to report, with other popular stocks such as Uber, ARM, Airbnb, Shopify, Occidental Petroleum and Upstart Holdings (If anyone has figured out what that company does, please let Mark Minervini know).

FX will see a lot of attention on the yentervention story (starting to hate that phrase now) and the USDJPY pair. But there are other areas of the currency market that are presenting opportunities. More on that below.

As usual, the team has been assessing ideas for the days in front of us. We’ve narrowed our focus down to 10 ideas to share with our loyal readers. The trades this week cross US equities, FX pairs and indices. If you are not yet a premium member of the AP team, you can try 7-days here, no cost.

(PS, this free trial will also give you access to our ‘Money Markets’ post from Sunday — a month ahead preview — and the ability to see our April portfolio performance and our current positioning for the new month)

We will see you on Wednesday in our next research post. For those based in the UK, enjoy the bank holiday.

Equities

Our first equity trade this week taps into the e-commerce and China theme. With Amazon’s strong earnings, online retailer names have seen a move higher. On the China front, the CSI 300 and the large-cap ETF (FXI) are both at YTD highs as China continues its rebound. There is some serious potential for this move to continue with momentum as it recovers out of a multi-year decline. Eliant’s Exploits has more thoughts on this in his recent post ‘The Dragon Outperforms’.

With the two themes in mind, we turn to Coupang (NYSE: CPNG) for a long trade. Earnings are scheduled for Tuesday, which is not ideal. So for now, this is a play that we approach with smaller size.

TRADE IDEA - CPNG FITS THE THEME

Entry: 23.00

Stop Loss: 21.25

Take Profit: 25.00

Shippers took the spotlight earlier this year as the middle eastern conflicts spilled over to the Red Sea via Yemen’s Houthis. Although less is said about this now, multiple names in the sector have been trending higher of late.

We look to Teekay Tankers (NYSE: TNK) to trade this move higher. 10-year highs are around $68.

TRADE IDEA - (TNK)ERS TRENDING

Entry: 60.20

Stop Loss: 57.00

Take Profit: 67.20, 68.00